Self-insurers

If you are a self-insurer, you can manage and administer your own workers compensation claims instead of obtaining a workers compensation policy from icare.

On this page

- Eligibility

- How to apply

- List of insurers

- Self-insurer licence applications

- Notifying SIRA about a significant matter

A self-insurer is responsible for:

- the direct ownership and management of workplace and workers compensation risks

- the experience and outcomes for injured workers

- workforce relationships

- meeting additional operational conditions.

You need to obtain a self-insurer licence from us to become a self-insurer.

We may grant:

- a single self-insurer licence to an employer

- a group self-insurer licence to a holding company and all wholly-owned subsidiaries of the company that are employers in NSW

We can grant a licence for up to eight years. A licence can be renewed thereafter.

Eligibility

Self-insurer licence applicants must first meet certain requirements to ensure they will conduct themselves in accordance with the legislation, be financially viable and maintain high standards of injury management and case management throughout the term of the licence.

You can read more about:

- licensing requirements in the self-insurer licencing framework

- our tiered supervisory model.

Licensing requirements include:

Conduct

Self-insurers must conduct themselves in accordance with legislation and demonstrate reporting of a standard acceptable to us.

As a self-insurer, you must:

- undertake risk management practices to support your strategic direction and submit a business plan reporting such practices and direction

- secure workplace safety by complying with the Work Health and Safety Act 2011

- provide accurate business intelligence reporting within our time frames and to our standards. This includes reporting claims data, changes to ownership and corporate structure, and notification of significant matters.

Claims management

Self-insurers must perform claims management in accordance with legislation and demonstrate injury and claims management of a standard acceptable to us.

You must invest in the appropriate resources, develop expert capabilities, and manage claims to meet our claims management principles and standards.

Outsourcing claims management is permitted however it does not remove your responsibility to meet our expectations.

You are required to undertake a claims management self-audit and lodge the report with us. Further information is available in the the Insurer claims management audit guide.

Other resources

Financial ability

Self-insurers must demonstrate ongoing financial ability and strength to meet their workers compensation obligations for licence continuity.

They need to have sufficient resources to cover their past and future financial obligations, and be of sufficient size to provide the necessary security and obtain and maintain reinsurance policy to mitigate the risk of insolvency.

Self-insurers must prepare and lodge a copy of their annual report (including audited financial statements) each financial year.

Security

Unless you are an exempt employer (such as a government employer), you must provide financial security to ensure your workers are covered and other employers in NSW are not forced to meet the cost of claims should you be unable to meet workers compensation liabilities under your licence.

Security is determined by referencing the annual actuarial report provided to SIRA in accordance with our self-insurer requirements.

Reinsurance

You must obtain and maintain unlimited reinsurance cover to restrict liabilities to a maximum amount for any one event.

Supervision

We will regularly monitor and assess self-insurer performance against our standards for conduct, claims management and financial ability.

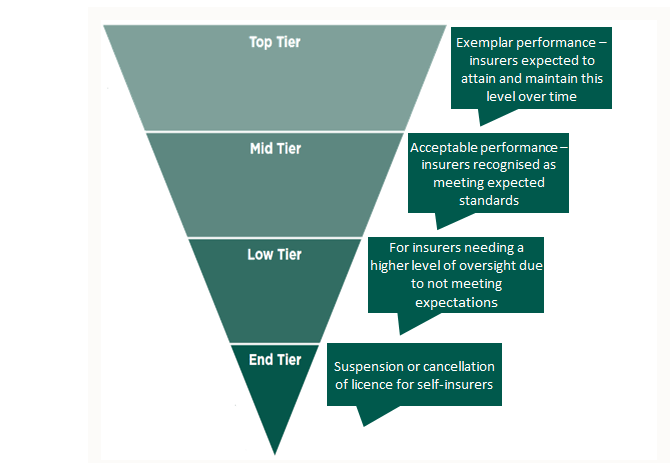

We employ a tiered supervisory model to formally acknowledge expected performance and define our risk-based regulatory oversight of insurers.

We will provide formal performance assessment and tier placement on an annual basis and as required.

Claims run-off

Should you no longer hold a self-insurer licence, you will still be held responsible for the management of the tail of claims incurred while licensed.

We will continue to hold security until we're satisfied that all claims have been discharged or adequately provided for.

Renewals

We grant licences for up to eight years.

Generally, new applicant licences are granted for a period of up to three years.

After your licence expires you will need to reapply in accordance with the licensing requirements.

How to apply

- Complete a self-insurer application form and provide the information outlined in the 'requirements for a licence application' section of the self-insurer information requirements document.

- An application fee of $40,000 is payable at the time you lodge your application. The application fee for a group self-insurer licence is $45,000. The fee is non-refundable regardless of the outcome of your application.

For more information email [email protected]

Also see the NSW Workers Compensation Self-Insurers Association (SIA) website. The SIA provides advice to prospective self-insurers and organises education forums about issues that affect self-insurers. The SIA also liaises with SIRA on behalf of self-insurers.

List of insurers

For a list of single self-insurers or group self-insurers see the How to get workers compensation insurance page of our website.

Self-insurer licence applications

Stakeholders are invited to submit feedback on pending licence applications submitted to SIRA.

Veolia Holdings Australia Pty Ltd applies for a group self-insurer licence

Veolia Holdings Australia Pty Ltd (VEOLIA) has applied to the State Insurance Regulatory Authority for a group self-insurer licence covering the following wholly owned employing subsidiaries:

| Company Name |

|---|

| Veolia Environmental Services (Australia) Pty Ltd |

| Veolia Recycling & Recovery Pty Ltd |

| Veolia Recycling & Recovery (No. 1) Pty Ltd |

| Veolia Recycling & Recovery ANZ Pty Ltd |

| Veolia Water Operations Pty Ltd |

| Veolia Water Utilities Pty Ltd |

| Veolia Energy Technical Services Pty Ltd |

| Veolia Energy Solutions Pty Ltd |

| EarthPower Technologies Sydney Pty Ltd |

Veolia Holdings Australia Pty Ltd’s principal activities within NSW consists of energy efficiency services, including the design, engineering, product selections, assembly, installation and maintenance of large scale commercial and industrial ventilation and air conditioning systems. The group also carries out activities relating to the provision of liquid waste collection and treatment services.

Submissions are invited from interested stakeholders regarding VEOLIA’s self-insurer licence application. Submissions are due by close of business, 6 May 2024.

Please email your submission to [email protected].

Notifying SIRA about a significant matter

SIRA is the independent regulator of the workers compensation system in NSW.

To fulfil its objectives and functions under the State Insurance and Care Governance Act 2015 and relevant scheme legislation, SIRA requires the timely and transparent notification of significant matters from licensed insurers and providers. These notifications enable SIRA to respond to significant matters related to policies of insurance, claims and other related matters under the scheme legislation.

For more information, please see the Notification of significant matters page.

Further information

SIRA is currently reviewing and updating the self and specialised insurer licencing framework which will include reviewing and updating the below documents. Some content may be amended as a result of this review.

Applicants and insurers are encouraged to contact SIRA via [email protected] for clarification of specific requirements.

For more information you can see the below documents.

- Security policy for self and specialised insurers

- Group self-insurer standard licence conditions

- Single self-insurer standard licence conditions

- Self-insurer licensing policy

- Self-insurer s189 business information requirements

- Endorse or delete a subsidiary

- Renew a self-insurer licence

- Self-insurer licence application

- Self-insurer tiering model

- Self-insurer tiering: panel and internal review process

- Self-insurer information requirements document (includes application form)