Print PDF

Transition to work program guidance material

Introduction

There is strong evidence that work promotes recovery and reduces the risk of long term disability and work loss. The focus of the NSW workers compensation system is to support workers to recover at/return to work following a work-related injury.

Section 53 of the Workplace Injury Management and Workers Compensation Act 1998 (1998 Act) allows the State Insurance Regulatory Authority (SIRA) to develop, administer and coordinate vocational rehabilitation schemes for workers.

If a worker and employer meet SIRA’s eligibility criteria and program requirements, the worker and employer’s use of the program will be accepted and the insurer will administer the program costs.

The transition to work program provides funding to address immediate or short-term barriers or needs that prevent a worker with a work-related injury from obtaining or accepting an offer of employment with a new employer.

There are two payment tiers under the transition to work program:

- Tier 1 – up to $200 to help a worker prepare for job seeking or to commence work. The payment can be used more than once provided the cumulative costs do not exceed $200.

- Tier 2 – up to $5,000 to address an immediate or short-term barrier/s preventing a worker from accepting a new employment offer e.g. travel, transitional child care arrangements, clothing. The payment can be used more than once provided the cumulative costs do not exceed $5,000.

Eligibility

A worker is eligible if:

- they are receiving or are entitled to receive weekly payments under the Workers Compensation Act 1987 (1987 Act) or have recently ceased receipt of weekly payments due to commencing employment

- they are unable to return to work with their pre-injury employer because of the injury, and there is an immediate or short-term barrier or need that prevents the worker obtaining or accepting an offer of employment

- a commutation or work injury damages settlement has not been accepted

- for tier 2 applications – they have a confirmed offer of employment with a new employer that is:

- for a period of three months or more

- for a minimum of 64 paid hours per month, or pre-injury hours if this is less than 64 paid hours per month. Fewer hours may be considered if it can be demonstrated that the worker will progress to meet this requirement within a reasonable time frame.

Principles

The application for the transition to work program must include a detailed description of how an item of service addresses the following principles:

- The item or service must address an immediate or short term barrier or need that prevents a worker from participating in job seeking (Tier 1) or accepting an offer of employment (Tier 2)

- The item or service must be cost effective and demonstrate that other options are less effective in addressing the barrier or need

- The application must demonstrate the worker’s capacity to maintain their financial arrangements independently when the transition to work payment has ceased.

Common strategies

Travel

Workers should use public transport where available and appropriate. If it is necessary to use a private vehicle, the vehicle must have third-party property insurance1 as a minimum. Private transport costs are reimbursed at 55 cents per kilometre2.

Example

John receives a job offer from XYZ Manufacturing however there is no public transport to the factory and his car is unregistered. The provider identifies transport to and from work is the only barrier to John accepting the offer of employment, and that the most suitable strategy to address this barrier is to apply for a transition to work payment to enable John to register his vehicle.

The transition to work application addresses the principles and outlines the need for car registration, insurance and petrol costs until John receives four weeks’ wages.

Relocation and accommodation

Relocation costs will be considered if a job offer becomes available in another location that is well beyond normal commuting distance. Funding for short-term accommodation will also be considered provided there is a sound strategy that will enable the worker to maintain accommodation arrangements independently when the transition to work payments have ceased.

Example

Mary has been unsuccessful in securing a job in retail sales after four months of job seeking due to the limited labour market in her regional area. Mary has received a suitable job offer from an employer in the city however there are concerns she may not be able to sustain the extensive travel involved. Mary has indicated she would relocate to allow her to accept the job. However, she cannot afford removalist costs or the required rental bond.

Mary’s insurer confirms payment to cover the removalist costs, rental bond and the first two weeks' rent meets the principles of transition to work. An application is made and the payment approved.

Transitional child care

Costs for child care with a registered child care provider will be considered, provided the worker can maintain the costs associated with the child care arrangements independently when the transition to work payments have ceased.

Example

Joe has been off work as a result of his injury and has assumed the role of primary carer for his children so that his wife could return to full time work. Joe receives a job offer and there is a vacancy at the local child care centre for his children. However, the family is unable to pay the centre’s bond or initial upfront fees.

Joe’s return to work coordinator submits an application for a transition to work payment to cover the registered child care provider fees including bond until Joe receives his first month’s wage from his new employer.

Clothing and related expenses

Reasonable costs for suitable clothing and personal grooming to support a worker to obtain or commence employment will be considered where the application meets the principles of transition to work. Uniforms or other clothes that are essential for commencing employment will be considered, but not the costs of standard issue uniforms, personal protective equipment and items of clothing that should be provided by the employer as part of their obligations under the Work Health and Safety Act 2011.

Example

Tony has been offered a job at a real estate agency. Tony previously worked as a labourer. The clothing he wore at the interview is not suitable for him to commence work as he is required to wear a business suit. Tony is experiencing significant financial hardship.

The provider submits an application for a transition to work payment to cover the costs of one business suit, two shirts and a pair of shoes to enable Tony to commence work.

Application process

Preparing an application

A worker’s return to work coordinator, insurer or approved workplace rehabilitation provider (provider) may prepare an application.

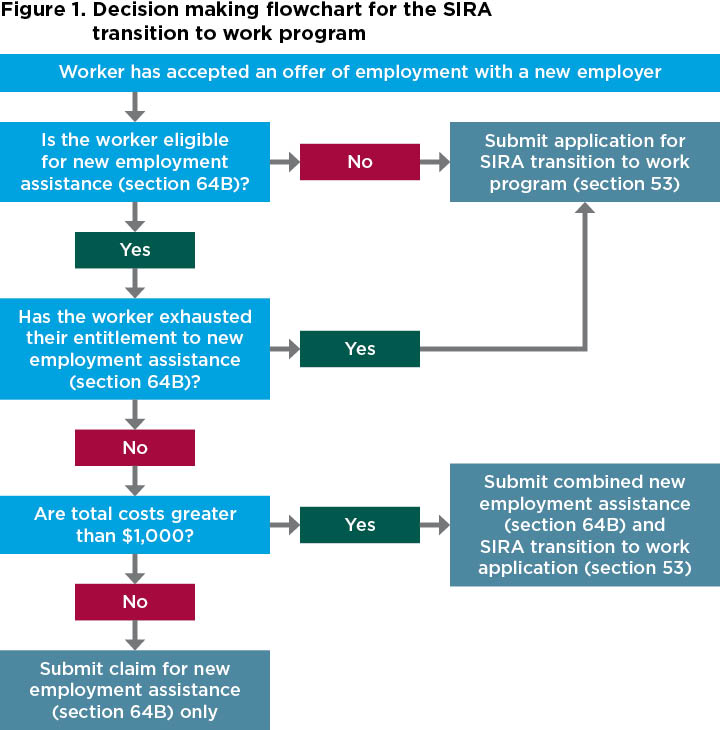

The person developing the application3 must check whether a worker has an entitlement to new employment assistance under section 64B of the 1987 Act . Note: this does not apply to exempt workers. It may be appropriate to confirm this with the insurer. Where the worker is entitled to claim such assistance, this entitlement must be exhausted before accessing funding under the SIRA transition to work program.

A worker who has an entitlement to new employment assistance may be eligible for funding under the SIRA transition to work program where:

- they have exhausted their entitlement to new employment assistance (this includes where an application exceeds $1,000), or

- the insurer disputes liability for the new employment assistance (including where the insurer does not notify the worker of a decision within the required time period).

A combined new employment assistance and transition to work application may be developed where costs required exceed $1,000 up to a maximum of $6,000. In this instance, it will be necessary to demonstrate the application meets the requirements for both a new employment assistance claim and the SIRA transition to work program. If any requirements cannot be met, justification must be provided outlining why the proposal is most likely to assist the worker to return to work.

A SIRA transition to work application is submitted using the vocational program - details form. SIRA does not prescribe an application form for new employment assistance.

Figure 1 below aims to guide decision making concerning the development of an application.

Assessing an application

Tier 1 program costs (costs under $200) do not require prior approval by the insurer. The provider must follow their service provision and internal quality assurance processes to confirm the application meets the SIRA transition to work requirements and relevant principles. The provider must also inform the insurer in writing of the specific costs relating to the application.

Tier 2 program costs must be approved by the insurer before they are incurred. The insurer will advise the worker and the person submitting the application of the assessment decision within 14 days of receiving a complete transition to work application.

If the application is not approved, the insurer must advise the worker of the SIRA appeal process.

Payment

Payments should be made in line with the amount(s) approved. Payment should only be made where there is evidence of cost/expenditure (e.g. purchase order, tax invoice, receipts or record of travel such as a travel log or fares).

The insurer / agent must have controls in place to prevent duplicate payments being made and claimed.

A completed vocational program – claim for payment form and relevant invoices or receipts must be submitted to facilitate payment.

Up to $300 may be paid in advance (where appropriate) for travel.

Nominal Insurer scheme agent

When the claim is with a Nominal Insurer scheme agent, the agent is responsible for administering payment of vocational program expenses.

Agent for icare Insurance for NSW

When the claim is with an agent for icare Insurance for NSW4, the agent is responsible for administering payment of vocational program expenses less than $10,000.

Self-insurer or specialised insurer

When the claim is with a self or specialised insurer5, the insurer is responsible for administering payment of vocational program expenses less than $2,000.

SIRA

When the claim is with an agent for icare Insurance for NSW, self-insurer or specialised insurer and the costs exceed the amounts above, SIRA will make payments.

These payments will be processed when a vocational program – claim for payment form, copy of the vocational program - details form, and relevant invoices or receipts are received at [email protected].

NOTE: A minimum of 10 working days is required to enable processing and payment of approved costs.

Insurer / agent reimbursement

Insurers and agents can request reimbursement from SIRA for program costs. Insurers and agents are to ensure that all claims for reimbursement can be substantiated. Substantiated means programs are approved and supported by appropriate evidence of the expenses.

Self and specialised insurers

Reimbursements from SIRA can be claimed within six months of the costs being incurred by submitting a claim for payment, evidence of payment and relevant receipts.

Nominal insurer and agent for icare Insurance for NSW

Reimbursements from SIRA can be claimed by a tax invoice. The invoice should be accompanied by an itemised breakdown by claim and program type of the costs incurred.

For more information about making a claim for reimbursement contact [email protected].

Review process

If there is disagreement about eligibility or use of the transition to work program, the worker should try to resolve the matter with the insurer in the first instance.

For information on what to do when a request to use a SIRA funded program has not been approved, find out how to request a review of a program decision.

Further information

Vocational rehabilitation programs resources are available:

Other references:

- Workplace Injury Management and Workers Compensation Act 1998 section 53 – vocational rehabilitation programs

- Workers Compensation Act 1987 section 64B – new employment assistance

- Workers Compensation Amendment (Return to Work Assistance) Regulation 2016

- Workers compensation guidelines

Footnotes

- Third party property insurance is different to third party personal (CTP ‘green slip’) insurance, which does not meet the minimum insurance requirement.

- These rates are correct at time of publication. Please refer to the current Workers compensation benefits guide for the current rate for car travel expenses.

- An agent for icare Insurance for NSW provides workers compensation insurance to most public sector employers except those who are self-insurers. icare Insurance for NSW contracts insurance agents to manage policies and claims on its behalf.

- Self-insurers are employers approved by SIRA to manage their own workers compensation claims. Specialised insurers hold a restricted licence to provide workers compensation insurance for a specific industry or class of business or employers.