SIRA quarterly regulatory update (ending 30 September 2022)

SIRA’s compliance and enforcement activities target the areas of highest risk. The actions taken are commensurate to the level of real or potential harm, the scope of non-compliance, the severity of wrongdoing and the need for deterrence. These activities are complemented by education and support initiatives to drive better outcomes for the people who make claims and hold policies in SIRA-regulated schemes.

A summary of regulatory activity in the motor accidents, workers compensation and home building compensation schemes for the period 1 July 2022 to 30 September 2022 is provided below.

Regulation of motor accidents insurers

SIRA regulates six licenced insurers in the NSW CTP Scheme: Allianz, NRMA Insurance, Suncorp (brands: AAMI and GIO) QBE, and Youi.

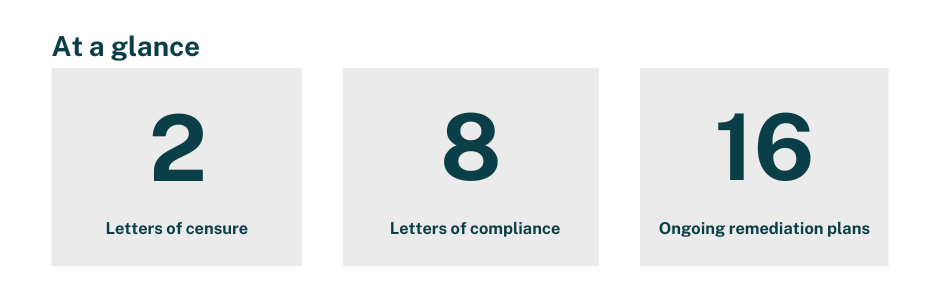

Letters of censure

SIRA issued a letter of censure to QBE Insurance (Australia) Limited on 18 July 2022 under section 3.32 of the Motor Accidents Injuries Act 2017. The breach related to the incorrect application of indexation to weekly statutory benefits.

SIRA issued a letter of censure to AAMI on 24 August 2022 under 9.5(4) of the Motor Accidents Injuries Act 2017. The breach was in relation to Suncorp’s obligations to report a significant matter to the Authority in accordance with the standard licence conditions.

Letters of compliance

SIRA issued a total of eight letters of compliance during the period 1 July to 30 September 2022 consisting of:

- two matters for AAMI

- one matter for Allianz

- two matters for GIO

- two matters for NRMA

- one matter for QBE.

SIRA’s regulatory actions and the nature of these matters are presented in the table below.

Insurer | Date | Matter | Regulatory action |

|---|---|---|---|

QBE | 5 July 2022 | Delay in the payment of the interim rate for weekly benefits | SIRA issued a Letter of compliance. |

GIO | 7 July 2022 | Incorrect CTP premium calculations | SIRA issued a Letter of compliance Remediation plan established and ongoing |

AAMI | 18 July 2022 | Claims Management Principles | SIRA issued a Letter of compliance |

AAMI | 1 August 2022 | Delay to weekly benefit and interim rate payments | SIRA issued a Letter of compliance Remediation plan established and ongoing |

GIO | 1 August 2022 | Delay to weekly benefit and interim rate payments | SIRA issued a Letter of compliance Remediation plan established and ongoing |

Allianz | 9 August 2022 | Failure to transmit eGreenslip to Transport for NSW within the required timeframe | SIRA issued a Letter of compliance Remediation plan established and completed |

NRMA | 22 August 2022 | Delay to weekly benefits payments and incorrect data provided to the Universal Claims Database | SIRA issued a Letter of compliance Remediation plan established and ongoing |

NRMA | 2 September 2022 | Claims Management Principles | SIRA issued a Letter of compliance |

Remediation plans

As at 30 September 2022, there were a total of 16 ongoing remediation plans in place for CTP insurers:

- four remediation plans for AAMI

- one remediation plan for Allianz

- four remediation plans for GIO

- four remediation plans for NRMA

- one remediation plan for Youi and

- two remediation plans for QBE.

The nature of the ongoing remediation plans are outlined below.

Remediation plans ongoing during the period

Insurer | Date commenced | Matter |

|---|---|---|

QBE | 31 August 2021 | Communication of entitlements |

NRMA | 2 December 2021 | Liability decision timeframes |

NRMA | 10 December 2021 | Weekly payments of statutory benefits |

AAMI | 4 April 2022 | Incorrect Medical Certificate data |

GIO | 4 April 2022 | Incorrect Medical Certificate data |

Allianz | 4 July 2022 | Treatment and care decisions |

AAMI | 7 July 2022 | Overcharged CTP premiums |

AAMI | 29 July 2022 | Delay to weekly benefit and interim rate payments |

GIO | 29 July 2022 | Delay to weekly benefit and interim rate payments |

AAMI | 3 September 2022 | Treatment and care decisions |

GIO | 3 September 2022 | Treatment and care decisions |

NRMA | 5 September 2022 | Delays to weekly benefits payments and incorrect data provided to the Universal Claims Database |

YOUI | 5 September 2022 | Treatment and care decisions |

GIO | 15 September 2022 | Incorrect CTP premium calculations |

QBE | 30 September 2022 | Treatment and care decisions |

NRMA | 30 September 2022 | Treatment and care decisions |

Independent Review Office matters

A total of eight matters relating to motor accidents were referred to SIRA from the Independent Review Office in line with the SIRA and IRO Memorandum of Understanding during the quarter. Five referrals related to NRMA, of which two were related to claims management principles, one was related to weekly benefit payment timeframes, one was related to whole person impairment and one was related to investigations. One referral related to QBE for treatment and care decision making, one related to GIO for claims management communication, and another referral related to AAMI for whole person impairment.

Insurer Claims and Conduct Assurance Program

Treatment and care decisions

In June 2022, SIRA commenced an Insurer Claims and Conduct Assurance Program (ICCAP) activity to ensure insurers are meeting their obligations under the Motor Accidents Injuries Act 2017, Motor Accident Guidelines, and licence conditions as it relates to treatment and care decisions.

The activity identified ongoing issues with both NRMA Insurance and QBE’s claims management in relation to delivering on their treatment and care decision obligations. As a result, SIRA imposed special licence conditions on Insurance Australia Limited (trading as NRMA Insurance) and QBE Insurance (Australia). This is the first time that special licence conditions have been imposed on insurers in the NSW motor accidents scheme.

SIRA will undertake a further file review of all insurers in early 2023 to ensure that the remediation activities have resulted in systemic compliance.

The summary Treatment and Care Decisions report outlines more detailed findings on the ICCAP activity.

Injury Coding Audit

In this quarter, SIRA contracted an independent audit of CTP insurer’s injury coding. The purpose of this review was to assess each insurer’s accuracy of injury coding and, where necessary, provide guidance and assistance. Under section 3.32 of the Motor Accident Guidelines, each insurer is required to provide up-to-date, accurate and complete injury coding data for every claim they manage.

The review found an industry average of 92 per cent compliance.

Individual insurer results were as follows:

Allianz | 95% |

NRMA | 93% |

Suncorp | 96% |

QBE | 86% |

Youi is a new entrant to the scheme, and this was the first year its compliance was reviewed. A cohort of injury codes were not able to be obtained which would allow a direct comparison with the other Insurers.

As part of the review, the independent auditor also provided guidance and recommendations to each of the insurers to assist them in strengthening their injury coding processes and procedures.

SIRA will continue to supervise and work with the insurers to ensure compliance with injury coding guidelines and standards.

Regulation of workers compensation insurers

SIRA regulates four different types of workers compensation insurers: Nominal Insurer (NI) managed by icare, self-insurers, specialised insurers, and government self-insurers (the Treasury Managed Fund) managed by icare.

Nominal Insurer

SIRA has issued regulatory letters to icare on the following issues:

Date | Issue | SIRA actions |

|---|---|---|

8 August 2022 | Privacy breach – Cost of claims reports sent to incorrect recipients | Letter issued to icare requesting further information on the data breach. |

30 September 2022 | Privacy breach – Cost of claims reports sent to incorrect recipients |

In August 2022, SIRA advised icare that it would undertake a performance audit of 50 claims from October 2022.

Self-Insurers and Specialised Insurers

This quarter, SIRA:

- Completed two licence renewals (Veolia and Ventia).

- Granted two group self- insurer licences (Food Investments Pty Ltd and Thomas Foods International Consolidated Pty Ltd).

- Special licence conditions imposed on Coca Cola Europacific Partners API Pty Ltd in response to poor compliance and claims management practices.

Insurer self-audit activity

Licensed insurers are required to undertake a claims management self-audit and lodge the report with SIRA. During this period, 23 insurers had self-audit improvement plans underway. SIRA actively monitors these improvement activities and takes regulatory action as needed.

Treasury Managed Fund

Over the quarter, SIRA updated the terms of reference for the Corrective Services NSW review. This review of 100 claims is the first in the round of rolling reviews that comprise the broader TMF review.

Independent Review Office matters

In this quarter, SIRA received 22 matters from the IRO regarding potential breaches against legislation and poor compliance with Standards of Practice. The escalations related to issues such as claims management, dispute process, liability delays, weekly payment delays and pre-injury average weekly earnings.

SIRA quarterly supervision priorities

Notification of injury

In the first of its workers compensation insurance supervision priorities for 2022/2023, SIRA addressed the requirement for insurers to record and report all notifications of injury regardless of whether the worker subsequently made a claim for the injury.Self-insurers who were not already compliant were requested to provide their reasonable excuse letter for review by SIRA to ensure compliance with relevant legislative instruments, and an implementation plan on how and when the self-insurers were going to meet reporting requirements compliance. SIRA will continue to monitor all insurers adherence to injury reporting obligations.

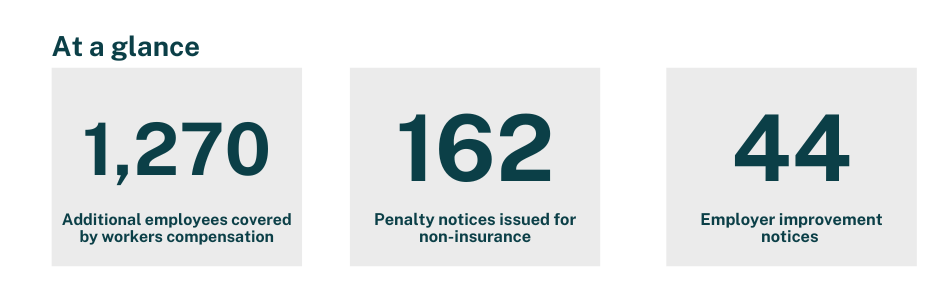

Regulation of employers

As a result of SIRA’s investigations into non-insurance this quarter, 35 businesses purchased a workers compensation policy. This means an additional 1,270 employees are now covered by workers compensation.

SIRA also issued 162 penalty notices for non-insurance and made 145 referrals to Revenue NSW to commence recovery action for $3,793,632 of double avoided premiums.

In the management of workplace injury obligations, SIRA issued 44 employer improvement notices for failure to establish a return to work program, failure to appoint a return to work coordinator, and one penalty notice for failure to comply with an employer improvement notice.

Inspectors made 111 visits to employers with injured workers at high risk of not returning to work or who were potentially non-compliant with their return to work and injury management obligations. SIRA issued 605 letters to employers with injured workers at moderate risk of not returning to work

SIRA’s apps and online support saw 1058 visits to the ‘Have you been injured at work’ app and 528 visits to the ‘Small business assist’ app. The online return to work coordinators training saw 1006 new registrations, with 793 of those being employers.

The SIRA Assist Team received 39 complaints that related to employers’ behaviour and alleged non-compliance, with 25 per cent alleging non-compliance with their return to work and suitable employment legislative obligations and 75 per cent related to employer behaviour and engagement.

Regulation of the home building compensation scheme

In the home building compensation scheme, SIRA undertook an audit of 30 claims made for home building compensation insurance with icare HBCF). This audit found compliance with guideline requirements.

Oracle Building Corporation Pty Ltd (‘Oracle’) became insolvent during this quarter. Oracle had been issued 699 certificates of insurance for residential building work projects since 2012-13, of which most were for new dwelling construction in the Hunter and Central Coast regions. SIRA maintained a high level of supervisory oversight to ensure that impacted homeowners were made aware of their entitlements and icare HBCF was providing timely and supportive claims management.

During the September 2022 quarter, SIRA determined three exemption applications under section 97 of the Home Building Act 1989, of which SIRA granted two exemptions and refused one.

In September 2022, SIRA announced a review of insuer eligability practices in the home building compensation scheme. The review will examine icare HBCF’s compliance with approved eligibility criteria when granting insurance policies. It will be undertaken by forensic accountants, McGrathNicol. The review is expected to be finalised by early 2023.

Regulation of healthcare providers

Changes made by SIRA to correct high surgeon and orthopaedic surgeon fees in the NSW workers compensation scheme came into effect on 1 July 2022.

Workplace rehabilitation providers

As at 30 September 2022, there were 101 workplace rehabilitation providers (WRPs) approved to operate in the workers compensation scheme as assessed against the new Workers Compensation workplace rehabilitation provider approval framework which came into effect on 1 January 2022.

SIRA assessed eight new applications, of which six were approved and two were not granted approval to deliver services.

SIRA assessed 27 workplace rehabilitation providers specialised job seeking service stream applications. Ten were approved, eight withdrew their submission and nine were not granted approval to deliver services.

SIRA continues to supervise 18 workplace rehabilitation providers who are currently on corrective action plans and is reviewing their return to work performance.

Allied health practitioners

As at 30 September 2022, there were 10,387 allied health practitioners approved to deliver services in the workers compensation scheme. In this quarter, SIRA approved a further 391 allied health practitioners to operate in the workers compensation scheme.

Commencing in 2001, practitioners who were approved under the previous guidelines had no requirement to renew and therefore practitioners had ongoing approval. SIRA introduced new workers compensation guidelines for the approval of treating allied health practitioners on 16 July 2021. The Guidelines strengthen the requirements for approved allied health practitioners by adding extra conditions of approval and introducing a requirement for providers to renew their approval every three years.

All approved allied health practitioners, as at 16 July 2021, were provided with a 12 month transition period to apply for SIRA approval to continue to deliver services. As a result of the implementation of the new Guidelines, SIRA saw a substantial correction in the scheme, with 2,944 practitioners not submitting a renewal application to deliver ongoing services and a further 198 practitioners confirming their withdrawal from the scheme.

SIRA also conducted a comprehensive review of all allied health practitioners with limitations and conditions imposed on their Australian Health Practitioner Regulatory Agency (AHPRA) registration to ensure the safety of customers within the NSW workers compensation scheme. SIRA did not approve seven allied health practitioners as conditions on their registration were imposed due to a disciplinary process; four physiotherapists and three psychologists.

SIRA approval was revoked for one physiotherapist due to suspension of their AHPRA registration.

Hearing service providers

As at 30 September 2022, there were 236 hearing service providers approved to deliver services in the workers compensation scheme. In this quarter SIRA approved a further three hearing service providers to work in the workers compensation scheme.

SIRA introduced new Workers Compensation Guidelines for the Approval of Hearing Service Providers. The guidelines strengthen the requirements for approved hearing service providers by adding extra conditions of approval and introducing a requirement for providers to renew their approval every three years. From 16 November 2022, only providers that have been approved under the new guidelines can continue to deliver services in the workers compensation scheme.

Authorised Health Practitioners

As at 30 September 2022, there were 456 active authorised health practitioners on SIRA’s published list. In this quarter, SIRA appointed a further four authorised health practitioners to operate in the 2017 motor accidents scheme and there was one practitioner-initiated cessation.

1 July to 30 September 2022 | Motor accidents scheme | Workers compensation scheme | |||

|---|---|---|---|---|---|

Authorised Health Practitioners | Allied Health Practitioners | Injury Management Consultants | Workplace Rehabilitation Providers | Hearing Service Providers | |

SIRA approved | 4 | 391 | 2 | 6 | 13 |

Applied but not approved | 0 | 7 | 1 - pending | 2 | 0 |

Practitioner initiated cessation | 1 | 198 withdrew 2,944 renewal not submitted | 0 | 0 | 10 |

SIRA initiated cessation | 0 | 1 | 0 | 0 | 0 |

Total number of active practitioners at end of period | 456 | 10,387 | 88 | 101 | 236 |

Supervision activity - accredited exercise physiologists

SIRA focuses on a specific allied health practitioner discipline each quarter.

SIRA aims to build practitioner capability in financial administration practices to improve compliance and reduce inappropriate provider behaviour. A number of verification processes are undertaken with insurers and practitioners to identify where inappropriate outlier behaviour exists. SIRA endeavours to provide practitioners a fair and reasonable process to review our findings and improve compliance with SIRA Fees Orders. SIRA will initiate regulatory action where behaviour identified is outside of the fee orders, guidelines or legislative requirements.

This quarter, SIRA focused on the outlier behaviour of accredited exercise physiologists. This involved the supervision of accredited exercise physiologists. Financial leakage for the providers targeted was an accumulation of charges of over eight hours of work per day and/or travel charges of over 400 kms per day. This target group accounted for 67 per cent ($952,799) of total leakage identified ($1,430,338).

Notice of Compliance letters were forwarded to the targeted accredited exercise physiologists requesting rationale be provided to the excessive billing findings of the SIRA review.

SIRA has approached relevant insurers to verify the findings of the review.

Fluoroscopy

SIRA identified instances of billing for fluoroscopy services in association with surgical or interventional procedures by medical practitioners who do not hold the required radiation user licence. SIRA distributed correspondence to 56 unlicenced medical practitioners. Billing for two of the medical practitioners was found to have been issued by a hospital rather than the practitioner. As a result, SIRA will be investigating the fluoroscopy billing conducted by the hospitals concerned.