SIRA quarterly regulatory update (ending 30 June 2022)

SIRA’s compliance and enforcement activities target the areas of highest risk. The actions taken are commensurate to the level of real or potential harm, the scope of non-compliance, the severity of wrongdoing and the need for deterrence. These activities are complemented by education and support initiatives to drive better outcomes for the people who make claims and hold policies in SIRA-regulated schemes.

A summary of regulatory activity in the motor accidents, workers compensation and home building compensation schemes for the period 1 April 2022 to 30 June 2022 is provided below and published on the SIRA website.

Regulation of motor accidents insurers

SIRA regulates six licenced insurers in the NSW CTP Scheme: Allianz, NRMA Insurance, Suncorp (brands: AAMI and GIO), QBE, and Youi.

Letter of censure

In the quarter, SIRA issued a letter of censure to QBE Insurance (Australia) Limited under section 9.10(1) of the Motor Accidents Injuries Act 2017. The censure was a response to QBE’s ongoing delays in providing motor accident injury coding data.

Regulatory notices

SIRA issued four regulatory notices to NRMA, AAMI, Youi, and Suncorp (AAMI and GIO) in the quarter. The nature of these matters is below.

Insurer | Date | Matter | Regulatory action |

|---|---|---|---|

NRMA | 12/04/2022 | Claims management principles | SIRA issued a regulatory notice |

AAMI | 9/05/2022 | Failure to provide notice of significant matter within required the timeframes | SIRA issued a regulatory notice |

Youi | 27/06/2022 | Failure to transmit an eGreenslip to Transport for NSW within the required timeframe | SIRA issued a regulatory notice |

Suncorp (AAMI and GIO) | 28/06/2022 | Overcharging of customer CTP premiums | SIRA issued a regulatory notice and a remediation plan is to be established |

Remediation plans

As at 30 June 2022, there were nine ongoing remediation plans. Two of these plans were opened during the reporting period and seven had commenced before. Six plans were closed during the reporting period.

The nature of the nine matters is below.

Insurer | Date commenced | Matter |

|---|---|---|

Suncorp (AAMI & GIO) | 31/08/2021 | Communication of entitlements |

QBE | 31/08/2021 | Communication of entitlements |

QBE | 18/10/2021 | Treatment and care decision timeframes |

NRMA | 1/12/2021 | Treatment and care decision timeframes |

NRMA | 2/12/2021 | Liability decision timeframes |

NRMA | 10/12/2021 | Weekly payments of statutory benefits |

QBE | 28/02/2022 | Treatment and care invoice payment timeframes |

NRMA | 22/03/2022 | Procedural fairness in earning capacity decisions |

GIO | 28/03/2022 | Inconsistent medical certificate data |

Independent Review Office matters

A total of eight matters relating to motor accidents were referred to SIRA from the Independent Review Office (IRO) in line with the SIRA & IRO Memorandum of Understanding during the quarter. Three related to the NRMA for failure to adhere to the Customer Service Conduct Principles, one related to QBE for timeliness of statutory weekly benefit payments, two were for AAMI in relation to delays in assessment of Whole Person Impairment and the timeliness of statutory weekly benefit payment, and two related to GIO for statutory weekly benefit payments.

Insurer Claims and Conduct Assurance Program (ICCAP)

Entitlement to Damages

SIRA conducted an ICCAP activity to ensure that people injured in a motor accident are provided information about damages entitlements. Specifically, the activity reviewed claims of people injured in 2019 whose statutory benefits had been accepted as not at fault and non-minor injury. The review identified 94 per cent of injured persons within this cohort had been provided information about damages entitlements.

SIRA has written to all insurers to confirm its expectations that the communication of entitlements to damages must be evident on all relevant claim files. This includes retrospective remediation where insurers did not demonstrate 100 per cent compliance.

SIRA is continuing to engage with insurers and monitor compliance to this requirement. Compliance to this requirement will be included in the 2022/23 insurer self-assessment and SIRA will conduct a further ICCAP activity to ensure ongoing compliance in 2023/24.

Treatment and care decisions

In June 2022, SIRA commenced an ICCAP activity to ensure insurers were meeting their obligations under the Motor Accidents Injuries Act 2017, Motor Accident Guidelines, and licence conditions as it relates to treatment and care decisions. This activity continued into the next quarter and the outcome will be reported in the next quarterly regulatory update.

Regulation of workers compensation insurers

SIRA regulates four different types of workers compensation insurers: the Nominal Insurer managed by icare, self-insurers, specialised insurers, and government self-insurers (the Treasury Managed Fund) managed by icare.

This quarter, SIRA undertook a review of insurer return to work practices. The fieldwork component comprised of:

- surveying all insurers on their progress towards implementation of the new Standard of Practice 34: Return to work – Early intervention

- interviewing selected insurers around early intervention practices

- reviewing selected insurer claim files with a focus on claims management activity over the first four weeks of a claim.

IRO significant matters

In the quarter, there were 13 workers compensation referrals to SIRA from the IRO. Four of these referrals related to the risk of physical, mental health or financial harm to an injured person, five related to a contravention of the legislation, and four related to breaches of the Customer Service Conduct Principles, Guidelines or Standards of Practice.

Nominal Insurer

This quarter, SIRA continues to closely monitor the Nominal Insurer’s financial position and icare’s enterprise and improvement plans.

SIRA reviewed the Nominal Insurer Improvement Plan in June 2022. SIRA provided feedback to icare in the Tripartite meeting, attended by SIRA, icare and Promontory, requesting icare to provide clarity on their return to work performance stream and respective measures.

SIRA issued one letter of concern to the Nominal Insurer and resolved the following matters.

Date | Issue | SIRA actions |

|---|---|---|

20/04/2022 | Delays with providing documents to Medicare/Centrelink, delaying payment of settlement monies | Expectations raised with icare and icare provided education to relevant staff |

16/05/2022 | Release of 2022/23 premium rates before SIRA approval | Issued letter of concern |

19/05/2022 | Policy related data submission errors | Remediation expectations set. icare committed to resolving by August 2022. |

20/05/2022 | Workers claims information privacy breach | Sought information about privacy breach impact and remediation activities |

The Nominal Insurer submitted its 2022/23 premium filing in March 2022. SIRA assessed this filing against the Market Practice and Premium Guidelines and on 27 May 2022 confirmed that the filing was not rejected.

Specialised insurers

In accordance with the Specialised Insurers Supervision Framework, SIRA completed seven performance meetings.

SIRA assessed specialised insurer 2022/23 premium filings and none were rejected during this reporting quarter. The filings were received from Catholic Church Insurance, Guild Insurance Limited, Hospitality Employers Mutual, and StateCover Mutual Limited.

SIRA commenced assessing the Racing NSW 2022/23 filing during this quarter.

Racing NSW

Date | Issue | SIRA actions |

|---|---|---|

22/04/2022 | Claims management performance |

Self-insurers

A series of reviews were held this quarter in accordance with the Self-Insurers Supervision Framework. Specifically, SIRA:

- Received five annual reviews which included the assessment of the insurer annual business plans to ensure that insurers’ strategies align with the objectives of the workers compensation legislation.

- Received 17 insurers’ claims management self-audits.

- Completed 14 security reviews, which entails an assessment of insurers current valuation of their current liability. These reviews resulted in six insurers increasing the security held, two insurers reducing the security held and one remaining the same.

- Received and assessed seven new licence applications.

- Renewed Woolworths, Estia and BOC licences for a further five years.

The Star Entertainment Group Limited

Date | Issue | SIRA actions |

|---|---|---|

June 2022 | Workers compensation claims management | Issued an Improvement Notice to The Star Entertainment Group Limited for failing to establish a compliant workplace return to work program. Issued a Letter of Direction relating to claims management issues. |

Regulation of employers

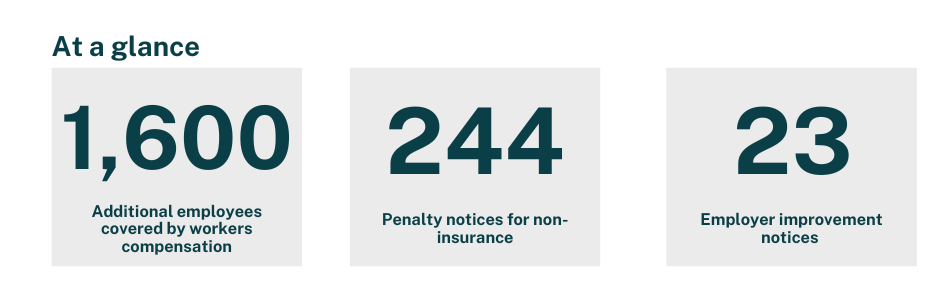

As a result of SIRA’s investigations into non-insurance this quarter, 374 businesses purchased a workers compensation insurance policy. Approximately 1,600 additional employees are now covered by a policy.

SIRA issued 244 penalty notices for non-insurance and made 222 referrals to Revenue NSW to commence recovery action for approximately $6.4 million in double avoided premiums.

SIRA contacted a further 1,024 employers to purchase a policy, received 60 uninsured liability matters, 10 non-insurance matters, 46 under insurance matters for investigation, and issued 50 section 161 notices for employers to produce a policy.

In establishing compliance with employer workplace injury obligations, SIRA issued 23 employer improvement notices for failure to establish a return to work program, failure to appoint a return to work coordinator, failure to notify the insurer within 48 hours, or failure to provide suitable employment. SIRA inspectors made 79 visits and SIRA sent 780 letters to employers with injured workers at risk of not returning to work.

SIRA’s apps and online support saw 941 visits to the Have you been injured at work app and 526 visits to the Small business assist app. The online return to work coordinators training had 793 new registrations, with 538 (67 per cent) of those being employers.

The SIRA Assist Team received 54 complaints that related to employers’ behaviour and alleged non-compliance, with 41 per cent alleging non-compliance with their return to work and suitable employment legislative obligations, and 44 per cent relating to employer behaviour and engagement.

Workplace injury management – building compliance

Action | Quarter | Calendar year to date |

|---|---|---|

Visits to SIRA’s Have you been injured at work app | 941 | 1,693 |

Visits to SIRA’s Small business assist app | 526 | 979 |

New registrations for SIRA’s online RTW (Return to Work) Coordinator training | 793 (67% employers) | 1,547 (69% employers) |

SIRA’s monthly RTW Insider newsletter | 3 issues | 5 issues |

Visits to SIRA’s Worker Status Tool | 2,637 | 4,997 |

Regulation of the home building compensation scheme

icare Home Building Compensation Fund submitted its 2022/23 premium filing to SIRA and it was not rejected. icare will introduce sustainable home building compensation fund premium prices from October 2022.

Healthcare providers

On 1 July 2022, changes made by SIRA to correct high surgeon and orthopaedic surgeon fees in the NSW workers compensation scheme came into effect. The changes brought surgeon and orthopaedic surgeon fees in the NSW workers compensation scheme back into line with AMA rates.

Workplace rehabilitation providers

As at 30 June 2022, there were 95 workplace rehabilitation providers approved to work in the workers compensation scheme. These providers had been assessed against the new Workers Compensation Workplace Rehabilitation Provider Approval Framework which came into effect on 1 January 2022.

Allied Health Practitioners

As at 30 June 2022, there were 15,280 allied health practitioners approved to provide services in the workers compensation scheme. In this quarter SIRA has approved a further 275 allied health practitioners.

Hearing Service Providers

As at 30 June 2022, there were 232 hearing service providers approved to deliver services in the workers compensation scheme. In this quarter SIRA has approved a further 13 hearing service providers.

During the quarter SIRA introduced new Workers Compensation Guidelines for the Approval of Hearing Service Providers. The guidelines strengthen the requirements for approved hearing service providers by adding extra conditions of approval and introducing a requirement for providers to renew their approval every three years. All currently approved hearing service providers will need to reapply for approval before 26 October 2022.

Authorised Health Practitioners

As at 30 June 2022, there were 458 active authorised health practitioners in the motor accidents scheme.

In the quarter, SIRA appointed five new authorised healthcare practitioners. One applicant was not approved as they did not meet the eligibility requirements.

1 April to 30 June 2022 | Motor accidents scheme | Workers compensation scheme | |||

|---|---|---|---|---|---|

Authorised Health Practitioner | Allied Health Practitioners | Injury Management Consultants | Workplace Rehabilitation Providers | Hearing Service Providers | |

SIRA approved | 5 | 275 | 0 | 4 | 13 |

Applied but not approved | 1 | 0 | 0 | 0 | 0 |

Practitioner initiated cessation | 0 | 455 | 0 | 0 | 10 |

SIRA initiated cessation | 0 | 0 | 0 | 0 | 0 |

Total number of active practitioners at end of period | 458 | 15,280 | 86 | 95 | 232 |