SIRA quarterly regulatory update (ending 31 March 2023)

This report is a summary of the regulatory activity undertaken by the NSW State Insurance Regulatory Authority (SIRA) in the motor accidents, workers compensation and home building compensation schemes for the period 1 January 2023 to 31 March 2023.

SIRA’s compliance and enforcement activities target the areas of highest risk. The actions taken are commensurate to the level of real or potential harm, the scope of non-compliance, the severity of wrongdoing and the need for deterrence.

These activities are complemented by education and support initiatives to drive better outcomes for the people who make claims and hold policies in SIRA-regulated schemes.

Regulation of motor accidents insurers

SIRA regulates six licenced insurers in the NSW Compulsory Third Party (CTP) Scheme: Allianz, NRMA Insurance (NRMAI), Suncorp (brands: AAMI and GIO), QBE, and Youi.

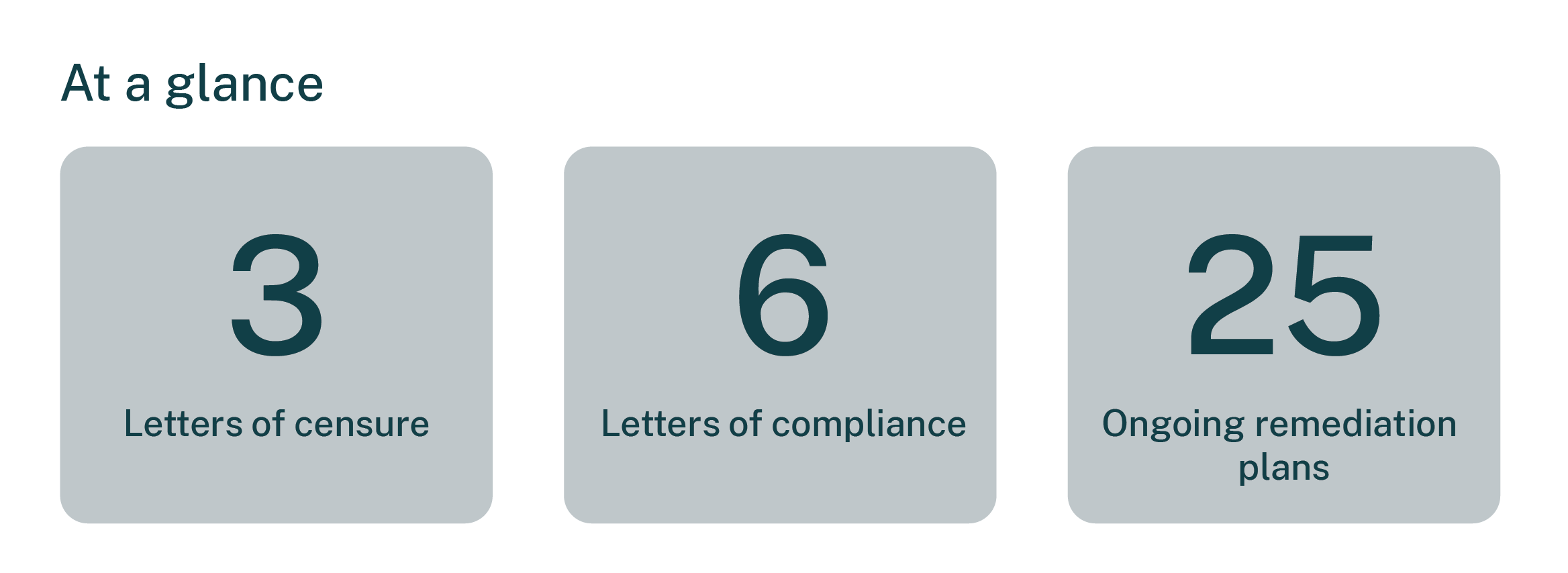

Letters of censure

SIRA issued three letters of censure to NRMAI in the quarter for breaches of the Motor Accident Injuries Act 2017. The breaches included incorrect calculation of pre-accident weekly earnings, delays in responding to treatment and care requests and delay in payment of weekly benefits.

Read more:

- Insurance Australia Limited trading as NRMA Insurance censured for incorrect calculation of weekly benefits

- NRMA Insurance censured for multiple delays in the CTP scheme

- NRMA Insurance censured for delays in payment of weekly benefits

Letters of compliance

SIRA issued a total of six letters of compliance during the period 1 January – 31 March 2023, alerting the entity to an identified risk or issue and the potential consequences of inaction.

| Insurer | Date | Matter |

|---|---|---|

| NRMAI | 11/01/2023 | Delay to payments of weekly benefits |

| NRMAI | 20/02/2023 | Delay to payments of weekly benefits |

| NRMAI | 20/02/2023 | Delay to payment of weekly benefits and procedural fairness not afforded to claimant |

| NRMAI | 07/03/2023 | Liability decision delays – New information relevant to a liability decision |

| AAMI | 01/03/2023 | Delays to weekly benefit interim payments |

| GIO | 01/03/2023 | Delays in assessing pre-accident weekly earnings and processing weekly benefits |

Remediation plans

As at 31 March 2023, there were a total of 21 ongoing remediation plans in place for CTP insurers. Insurers are required to implement a remediation plan where non-compliance with their obligations has been self-reported or determined by SIRA.

| Insurer | Date commenced | Matter |

|---|---|---|

| AAMI | 07/07/2022 | Overcharged CTP Premiums |

| AAMI & GIO | 29/07/2022 | Delay to weekly benefit payment |

| AAMI & GIO | 03/09/2022 | Non-compliance with treatment and care obligations |

| AAMI & GIO | 20/01/2023 | Insurer obligations self-assessment 2022 |

| AAMI & GIO | 23/01/2023 | Non-compliance with recovery planning obligations |

| Allianz | 04/07/2022 | Non-compliance with treatment and care obligations |

| Allianz | 01/11/2022 | Delayed transmission of eGreenSlip |

| Allianz | 15/12/2022 | Insurer obligations self-assessment 2022 |

| Allianz | 10/02/2023 | Non-compliance with recovery planning obligations |

| NRMAI | 10/12/2021 | Non-compliance with weekly payment obligations |

| NRMAI | 30/09/2022 | Non-compliance with treatment and care obligations |

| NRMAI | 16/12/2022 | Insurer obligations self-assessment 2022 |

| NRMAI | 10/02/2023 | Non-compliance with recovery planning obligations |

| QBE | 30/09/2022 | Non-compliance with treatment and care obligations |

| QBE | 24/10/2022 | Injury coding data quality issues |

| QBE | 25/11/2022 | Non-compliance with weekly payment obligations. |

| QBE | 31/01/2023 | Insurer obligations self-assessment 2022 |

| QBE | 27/02/2023 | Non-compliance with recovery planning obligations |

| Youi | 15/12/2022 | Insurer obligations self-assessment 2022 |

| Youi | 24/02/2023 | Non-compliance with recovery planning obligations |

| Youi | 05/09/2022 | Non-compliance with treatment and care obligations |

Insurer Claims and Conduct Assurance Program

Treatment and Care Re-audit

SIRA completed an Insurer Claim and Conduct Assurance Program (ICCAP) activity in February 2023. The purpose was to review the effectiveness of the insurer’s treatment and care remediation plans and confirm compliance with the requirements as set out in the Motor Accident Injuries Act 2017, Motor Accident Guidelines and licence conditions.

The activity noted there was significant improvement with insurer’s compliance in their treatment and care obligations. All insurers were able to demonstrate the effectiveness of their remediation plans and improvements in compliance to the requirements.

Based on the findings of the re-audit, SIRA will take a tailored regulatory approach with each insurer to ensure substantial, sustained compliance is achieved across all requirements.

Regulation of workers compensation insurers

SIRA regulates four different types of workers compensation insurers: the Nominal Insurer managed by icare, self-insurers (employers approved by SIRA to manage their own workers compensation), specialised insurers (insurers operating in a specialised industry), and government self-insurers (the Treasury Managed Fund) managed by icare.

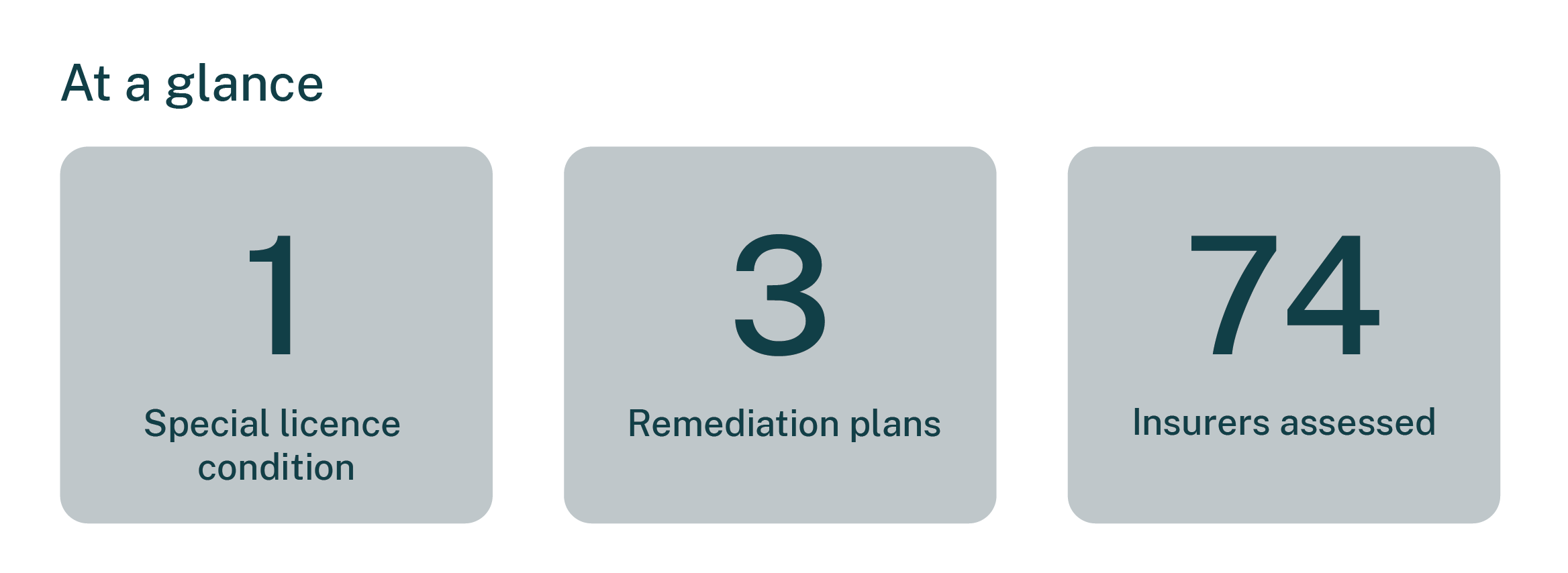

Special licence conditions

SIRA issued special licence conditions to one self-insurer in the quarter to clearly establish what is required of the licenced insurer to maintain their licence.

| Insurer | Date of imposed special licence conditions | Reason for imposed licence conditions |

|---|---|---|

| Aldi Stores – A Limited Partnership | 24 February 2023 | Poor compliance and claims management practices |

Read more: Special conditions imposed on Aldi Stores workers compensation licence

Remediation plans

Three remediation plans were commenced in this period.

| Insurer | Date plan commenced | Details |

|---|---|---|

| Sydney Trains | 1 January 2023 | Remediation plan implemented in response to self audit in 2022 |

| NSW Trains | 1 January 2023 | Remediation plan implemented in response to self audit in 2022 |

| Boral Limited | 20 March 2023 | Remediation plan associated with self-audit |

Insurers assessed

Seventy-four insurers were assessed against ‘notification of injury’ reporting and as a result, five self-insurers were found to require improvement.

Other regulatory actions

SIRA’s regulatory actions are listed in the table below.

| Insurer | Date | Matter | Regulatory action |

|---|---|---|---|

| icare | 28 February 2023 | Delays in payment of lump sum benefits to injured workers | Letter of compliance |

Audit of the Nominal Insurer

In March 2023, SIRA undertook its second quarterly audit of the Nominal Insurer in accordance with powers provided in section 202A of the Workers Compensation Act 1987 (the 1987 Act). The focus of this audit was the process to determine, update and communicate a worker’s weekly benefit entitlement. The report outlining the findings can be found here.

SIRA audits of self and specialised insurers

SIRA undertook self and specialised insurer audits under Section 202A of the Workers Compensation Act 1987.

| Insurer | Date commenced | Reason |

|---|---|---|

| Ventia Australia Pty Ltd | 27 March 2023 | Scheduled audit program |

| Healius Ltd | 28 March 2023 | Scheduled audit program |

| Life Without Barriers | 30 March 2023 | Scheduled audit program |

Licensing

The following insurer licences were renewed:

| Insurer | Date of renewal |

|---|---|

| Wesfarmers Limited | 31 January for 5 years |

| Unilever Australia (Holdings) Pty Ltd | 31 January for 5 years |

| Toll Holdings Limited | 28 February for 1 year |

| Aldi Stores - A Limited Partnership | 28 February for 3 years |

| Adecco Holdings Pty Ltd | 28 February for 3 years |

| Hays Recruitment (Australia) Pty Ltd | 31 March for 3 years |

The following licence application was received and is under assessment/review:

| Applicant | Comment |

|---|---|

| Qantas (moving from single to group insurer) | February 2023 |

The following licence applications were granted and commenced:

| Applicant | Commenced |

|---|---|

| Adecco Holdings Pty Ltd | 28 February 2023 |

| Hays Recruitment (Australia) Pty Ltd | 31 March 2023 |

Fraud on the workers compensation scheme

A total of 102 investigations were received in this quarter and 66 matters completed.

One criminal matter, prosecuted under the NSW Crimes Act 1900, was concluded in this quarter.

Read more: Man sentenced for workers compensation fraud.

A total of 40 coercive notices were sent to employers (3) and workers (37) during the quarter.

Independent Review Office matters

During the quarter, a total of 12 matters relating to workers compensation were referred to SIRA from the IRO in line with the SIRA & IRO Memorandum of Understanding.

The reasons for referral included:

- potential legislative breaches

- concerns regarding insurer behaviours and decision making.

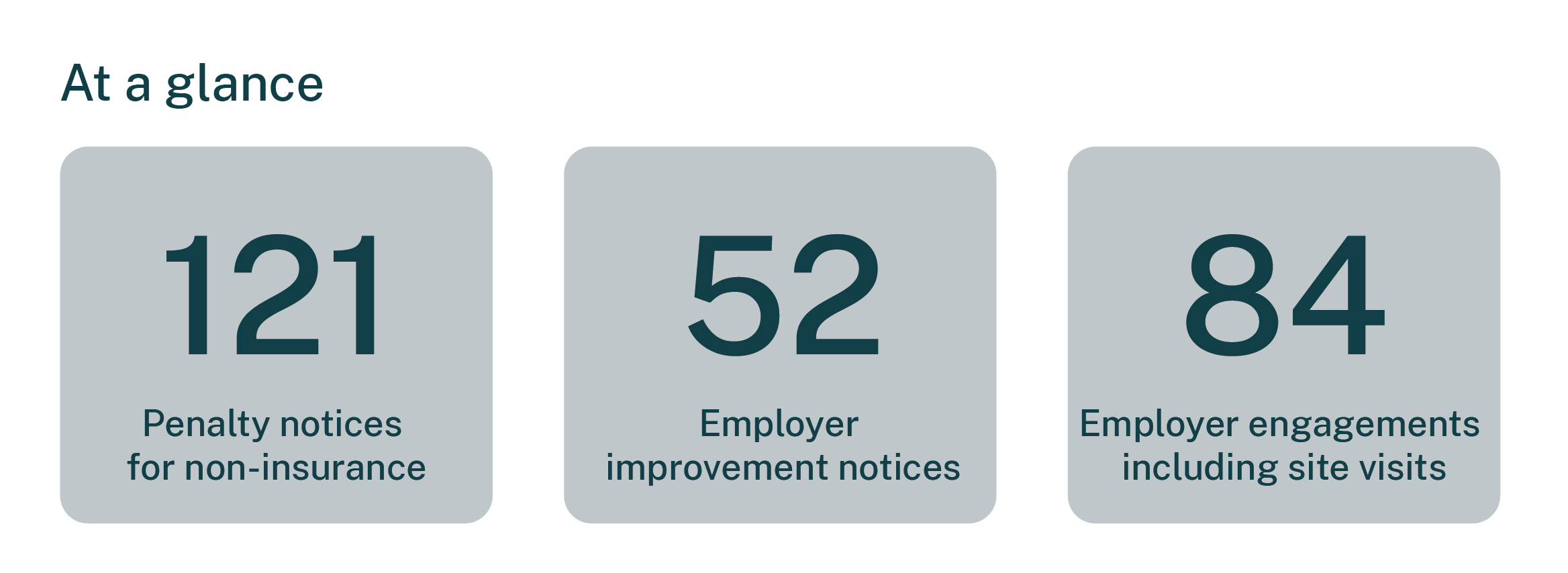

Regulation of employers

SIRA regulates employers to ensure they comply with their workers compensation responsibilities, including holding a policy.

As a result of SIRA’s investigations into employers who had not taken out appropriate workers compensation insurance this quarter, a further 185 businesses have now purchased a workers compensation insurance policy. This equates to 758 additional employees now covered by a policy.

SIRA issued 121 penalty notices for non-insurance and made 16 referrals to Revenue NSW to commence recovery action for approximately $276,098 in double avoided premiums.

SIRA received 92 uninsured liability matters from icare, 19 non-insurance matters, 71 under insurance matters from SafeWork NSW for investigation, and issued 94 notices for employers to produce a current policy.

In establishing compliance with employer workplace injury obligations, SIRA issued 52 employer improvement notices, five notices for production of information and two penalty notices.

SIRA inspectors completed 84 employer engagements (which may include site visits, issuing of notices, and working with the employer until full compliance is achieved). SIRA also sent 608 letters to employers with injured workers at risk of not returning to work.

Regulation of the home building compensation scheme

SIRA supervises and monitors the home building compensation scheme. In collaboration with NSW Fair Trading and the Office of the Building Commissioner, SIRA investigates and enforces non-compliance by building businesses.

During the quarter, the review of insurer eligibility practices in the home building compensation scheme assessed documents that were received from icare in December 2022 in response to a notice under s127 of the Home Building Act 1989. During the quarter SIRA requested that icare provide additional information.

SIRA determined four insurance exemption applications under section 97 of the Home Building Act 1989, of which one was granted and three were refused.

SIRA issued 36 notices under section 127 of the Home Building Act 1989 to builders in relation to compliance with insurance obligations. SIRA sought eligibility and insurance advice from icare for several matters during this period. SIRA also assisted NSW Fair Trading by providing advice and intelligence on home building insurance for three investigations.

SIRA received a premium filing from icare HBCF on the 28 February 2023 and commenced assessment of the filing.

On 18 January 2023, SIRA consulted icare about new proposed insurance guidelines, in satisfaction of subsection 103ED(3) of the Home Building Act 1989. The guidelines were published for public consultation from 19 January 2023 to 31 March 2023.

Healthcare and rehabilitation providers

SIRA is committed to ensuring that health and rehabilitation providers delivering services within the compulsory compensation schemes are in line with the legislation and conditions of the relevant approval framework.

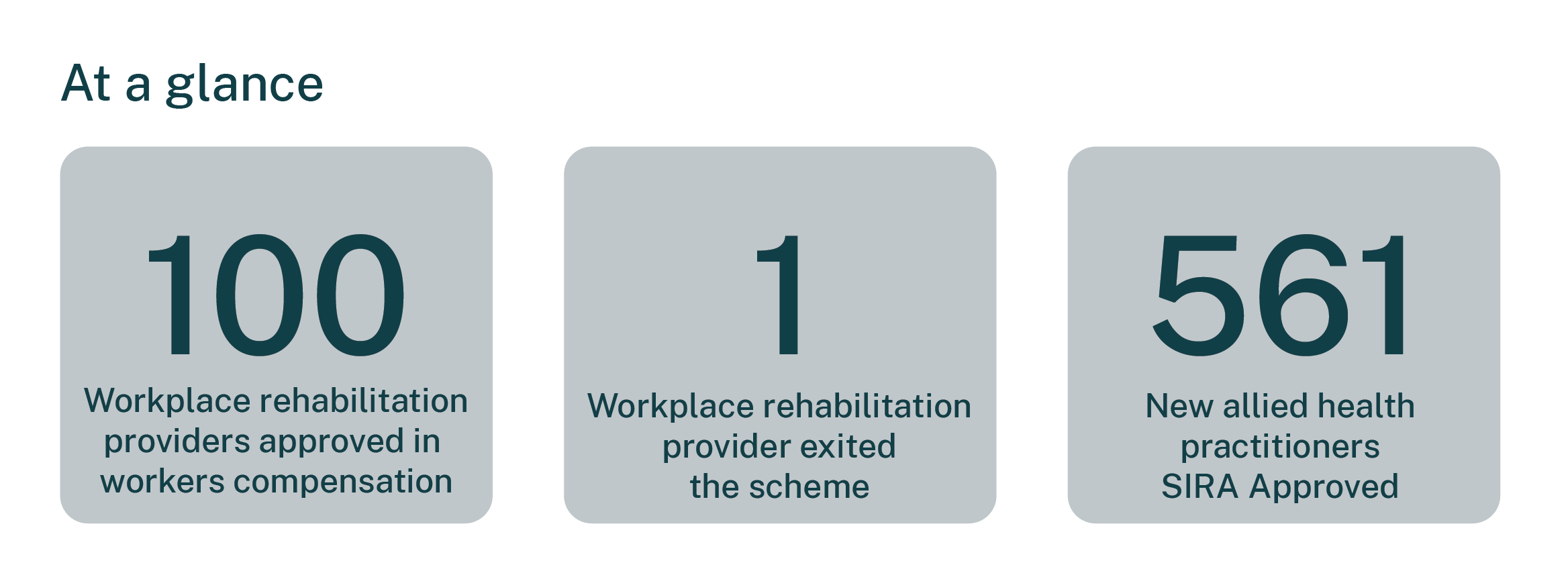

Workplace rehabilitation providers

As at 31 March 2023, there were 100 Workplace Rehabilitation Providers (WRP’s) approved to operate in the workers compensation scheme.

Remediation plans

There are two open remediation plans with a reduced twelve-month period of approval in place. Three remediation plans were closed in the quarter with one WRP no longer approved to operate in the workers compensation scheme.

There were 11 new applications received and currently undergoing assessment.

Hearing Service Providers

As at 31 March 2023, there were 196 hearing service providers approved to deliver services in the workers compensation scheme. In this quarter, SIRA has approved five hearing service providers. Two were revoked as they no longer met conditions of approval.

Allied Health Practitioners in the workers compensation scheme

As at 31 March 2023, there were 11,101 allied health practitioners approved to provide services in the workers compensation scheme. In this quarter SIRA has approved 561 allied health practitioners. SIRA also revoked approval for 69 allied health practitioners who did not have general registration with AHPRA.

Authorised Health Practitioners authorised to give evidence in the motor accident scheme

As at 31 March 2023 there were 477 health practitioners authorised to give evidence ( HPA’s) in the motor accidents scheme.

In this quarter, SIRA appointed 15 new HPAs. One applicant’s authorisation was revoked as they no longer met the eligibility requirements.