Making a claim

Making a claim

Workers compensation claims must be made in writing, and in accordance with the requirements set out in Part 3 of the Workers compensation guidelines (the Guidelines).

The worker must provide sufficient information to support their claim, and allow the insurer to make a liability determination (decision).

Information required for claims

The information provided should demonstrate that the person making the claim:

- is a worker

- received an injury from or during employment

- lost income, requires medical treatment or incurred other expenses because of the injury.

Workers can provide this information to the insurer by supplying:

- a claim form (where required, see below)

- a completed certificate of capacity issued by a medical practitioner (required for weekly payments only)

- wage information such as payslips, and

- any other information that the worker believes would support their claim.

The worker is also required to provide the insurer with a signed authority form authorising treatment and/or service providers to share information with the insurer about treatment/services provided to the worker for the injury. SIRA has a standard consent form insurers may use for this purpose.

Claim form

Part 3 of the Guidelines specify that, as a minimum, a claim for compensation must provide the insurer with:

- name and contact details of the worker

- name and contact details of the employer (individual or organisation)

- name and contact details of the worker’s medical practitioner

- name and contact details of any witnesses or witness statements (if applicable)

- description of the injury and how it happened

- information to support the medical expenses and other losses the worker is claiming.

Workers are able to complete and submit a claim form to an insurer at any time, subject to specified time limits (see below Timeframe for lodging a claim). SIRA has a standard worker’s injury claim form for this purpose.

The Guidelines permit the insurer to waive the requirement for a claim form if they have enough information to make a liability determination. If the insurer chooses to waive the requirement for a claim form, they should confirm this with the worker.

However, an insurer must require a worker to complete a claim form where:

- a reasonable excuse notice has been issued and the excuse continues to exist, or

- compensation is likely to be claimed beyond provisional payments and the insurer determines that there is insufficient information to determine ongoing liability.

Timeframe for lodging a claim

A claim should be lodged within six months of the date of injury or death (or becoming aware of the injury or death).

In some cases, the time limit may be extended. Insurers can choose to accept a claim made after six months, but only up to three years from the date of injury or death.

Claims made after three years from the date of injury or death may be accepted with approval from SIRA. Insurers cannot accept such claims without SIRA’s approval.

If a worker dies from an injury that had already been claimed for, time limits do not apply to that death claim.

Two or more liable parties

Where there are two or more parties liable to pay compensation for the same or different injuries that a worker has sustained, the making of a claim on any one of the liable parties is considered to have been made on all liable parties.

How is the date of claim calculated?

The date of claim (when a claim is taken to have been made) is taken from the date the specified claim information requirements have been met.

If a worker makes a claim directly to the insurer, the date that the required information was forwarded to the insurer is taken to be the date the claim was made.

If a worker makes a claim to the employer (who forwards the claim on to the insurer), the date that the required information was provided to the employer is taken to be the date the claim was made.

Employer obligations after receiving a claim

An employer (other than a self-insurer) who receives a claim or any other documentation relating to a claim, must forward it to their insurer within seven days.

The employer must also respond to insurer requests for further information about the claim within seven days.

Insurer obligations after receiving a claim

After receiving a claim for compensation, insurers should check that the claim complies with the information requirements set out in Part 3 of the Guidelines.

If an incomplete claim is received, the insurer should contact the person who submitted the claim to obtain the missing information.

Once a complete claim has been received, the insurer has 21 days to make a liability determination, unless the insurer has already accepted provisional liability.

Accepting the claim provisionally allows the insurer more time to investigate a claim before making a formal liability determination (see 'Provisional liability').

If a completed claim for compensation is lodged on a claim that has previously been reasonably excused (see Part 2 of the Guidelines), the claim can still be provisionally accepted.

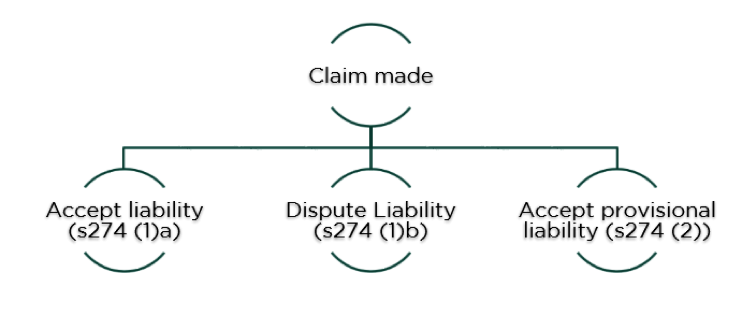

This diagram illustrates the pathways (and supporting legislation) a claim can take after initial notification.

Phone 13 10 50

Email [email protected]