Print PDF

Corrective Services NSW review

1. Executive summary

In January 2020, SIRA commenced an investigation into the management of three Corrective Services NSW (CSNSW) workers compensation claims for psychological injury. The investigation resulted in an October 2020 report1 which included findings against CSNSW and QBE Insurance (Australia) Limited (QBE), the appointed claims manager and recommendations including a broader review of CSNSW workers compensation claims with a focus on claims for psychological injury.2

In August 2022, SIRA commenced a review of 100 CSNSW claims to assess compliance and conformance of CSNSW and QBE claims and injury management practices against the benchmarks of legislative requirements and regulatory standards. The review also sought to determine whether remedial action taken by CSNSW and QBE had addressed the issues identified by SIRA in 2020.

At the conclusion of the review, SIRA provided a draft report to the principal stakeholders for consideration and feedback. That feedback has been considered in completion of this final report.

The review found CSNSW and QBE work in partnership to develop and deliver sound claims and injury management strategies. The cooperation observed between the organisations is consistent with the formal agreements in place3 and the principles which underpin the workers compensation system objectives.

The review found evidence of early, supportive contact with workers and compliance with legislative requirements around injury management, payment of benefits and the timeliness of liability decisions. Specifically, the review found no evidence to suggest the practices the subject of SIRA’s 2020 investigation were systemic.

The review identified opportunities for further improvement across the following areas of claims and injury management:

- timely communication of injury by CSNSW to QBE

- the application of a ‘reasonable excuse’ to delay fulfilling the requirement to commence weekly payments following notification of injury4

- the use of surveillance, factual investigations and independent medical examinations (IMEs) in the early stages of a claim, particularly for psychological injuries

- the turnover of case managers and the quality and timeliness of consequent handovers

- record keeping.

The review findings highlight challenges faced in managing CSNSW workers compensation claims and will assist in the design and delivery of measures to respond to the changing nature of work and workplace injuries, particularly within the government sector. The findings will inform recommendations to be made following a broader review of Treasury Managed Fund (TMF) Government agencies in June 2023 (TMF review).5

2. Background

2.1 Introduction

Three CSNSW employees alleged psychological injury following a workplace incident on 26 May 2015. SIRA’s 2020 investigation into the handling of the three claims resulted in an October 2020 report which included findings against CSNSW and QBE.

The report recommended a review of CSNSW claims and a broader review of arrangements in claims and injury management handling between TMF government agencies and their appointed claims managers. In response, SIRA has commenced the TMF review. The Terms of Reference for the TMF review are available on the SIRA website and a final report is expected by 30 June 2023.6

2.2 Rationale

The object of the NSW workers compensation system is to secure the health, safety and welfare of workers by preventing work injury; providing necessary treatment, management of work injuries and compensation and promoting return to work within a fair, affordable and sustainable system.7

SIRA’s principal objectives and functions under workers compensation legislation are set out in section 22 of the Workplace Injury Management and Workers Compensation Act 1998 (1998 Act). SIRA’s functions include responsibility for ensuring compliance with workers compensation legislation and day to day workers compensation operational matters.

The review sought to assess the compliance and conformance of CSNSW and QBE claims administration and practices against workers compensation legislation and regulatory standards. A further objective was to confirm whether remedial action taken by CSNSW and QBE had addressed the issues identified in 2020.

2.3 Principal parties

CSNSW is a NSW Government employer within the Department of Communities and Justice (DCJ), the lead agency in the Stronger Communities cluster. It is also a deemed self-insurer pursuant to section 211B of the Workers Compensation Act 1987 (1987 Act).

CSNSW’s workers compensation liability is covered by the TMF, a government managed fund scheme under which state workers compensation liabilities are managed as a self-insurance scheme. The TMF is not an insurer, nor does it provide insurance or risk cover.8

The NSW Self Insurance Corporation Act 2004 established the NSW Self Insurance Corporation (SICorp) to administer the TMF. SICorp has delegated its functions in operating the TMF to Insurance and Care NSW (icare).9 icare appoints claims managers to provide claims management services to its TMF portfolio and has appointed QBE to manage CSNSW claims.

As lead agency, DCJ is responsible for the administration and coordination of CSNSW’s injury management and return to work obligations and acts as liaison between the worker, the worker’s direct manager or supervisor and QBE.

2.4 Considerations

Regulating government entities presents a unique set of challenges. Government agencies conduct some of the most difficult and hazardous work across the state. These challenges have recently been amplified by the ongoing COVID-19 pandemic, natural disasters and the consequent mental health impacts on the community.10 The complex legal framework which supports the operation of government agencies’ workers’ compensation claims presents a new layer of challenges, extending the principal parties beyond worker, employer and insurer.

SIRA is responsible for overseeing both employer and insurer obligations under workers compensation legislation. The review’s primary focus on claims management addresses CSNSW’s deemed self-insurer obligations and those of QBE as the claims manager. CSNSW’s employer obligations, particularly around injury management and return to work, run in tandem to those around claims management and are therefore also addressed.

2.5 SIRA’s 2020 investigation

At the time of their injuries, the three CSNSW workers the subject of SIRA’s 2020 investigation were employed in the Immediate Action Team (IAT) based at the Corrective Services Metropolitan Remand and Reception Centre (MRRC) in Silverwater. The MRRC is a maximum-security correctional facility for male offenders. The events of 26 May 2015 which led to the workers’ psychological injuries occurred in a context of roster changes, proposed changes to the operating arrangements of the IAT and union opposition to those changes. One of the three workers was the union representative for the IAT and the others were union members. The workers’ claims were initially limited to expenses for medical treatment.

SIRA’s 2020 investigation found a concerted approach by CSNSW and QBE to dispute and deny the workers’ claims.11 Each claim was defended on the basis there had been no work injury or, alternatively, on the basis the injury occurred in response to a reasonable decision or action taken by the employer.12

The claims were initially ‘reasonably excused’, subsequently disputed and, ultimately, accepted.

2.6 Recent changes to legislation and regulatory instruments

SIRA has introduced the following standards to its Standards of Practice (Standards), to support, guide and set expectations for insurers in their management of claims:

Standard 32: Managing claims during the COVID-19 pandemic

Commenced 26 June 2020

- To set expectations for insurers around the handling of COVID-19 workers compensation claims and claims handling practices more generally throughout the period of the pandemic.

Standard 33: Managing psychological injury claim

Commenced 1 March 2021

- To promote management of psychological injury claims in accordance with legislative requirements while tailoring services to workers’ needs and focusing on early treatment and return to work. It also assists insurers in identifying claims with an elevated risk of a secondary psychological injury.

Standard 34: Return to work – early intervention

Commenced 4 April 2022

- To address poor return to work performance across the scheme. It requires insurers to actively manage claims in the four weeks following notification of injury, with a focus on individual worker needs and optimising recovery and work outcomes

- There has also been an amendment13 to expand the definition of government employer at section 4 of the 1998 Act to include ‘a person exercising employer functions for the Crown or a government agency in relation to a worker’, such as Secretaries of Departments and certain other heads of public service agencies authorised to exercise the employer functions of the government.14

3. The review

3.1 Scope

One hundred active15 CSNSW claims were selected for review from claims data available to SIRA and current as at July 2022. Data was drawn from claims with a ‘date entered on insurer system’ (DEIS) in the financial years 2019 to 2021 and up to and including January 2022.

In selecting claims for the above cohort, consideration was given to the following matters:

- excluding claims from 2015 to 2018, given the low number of active claims

- including claims from 2019 and 2020 to provide a benchmark of claims management experience against which more recent practice could be compared, and

- greater representation of the most recent claims, to afford review of current practice.

It is important to highlight that claim selection was not random. To ensure a response to the recommendations from SIRA’s 2020 investigation and an adequate review of areas of concern, the claim sample included an over representation of the following:

- psychological injuries

- physical injuries with a payment for psychological treatment

- poor return to work outcomes

- application of reasonable excuse, and

- high medical treatment expenses.

The table below shows the claim sample breakdown between physical and psychological injury across the selected period.

Table 1: Claim sample breakdown by financial year (FY) and injury type

Financial Year | Physical injury claims | Psychological injury claims | Total |

|---|---|---|---|

2018 – 2019 | 2 | 9 | 11 |

2019 – 2020 | 8 | 11 | 19 |

2020 – 2021 | 16 | 14 | 30 |

2021 – 2022 | 21 | 19 | 40 |

Total | 47 | 53 | 100 |

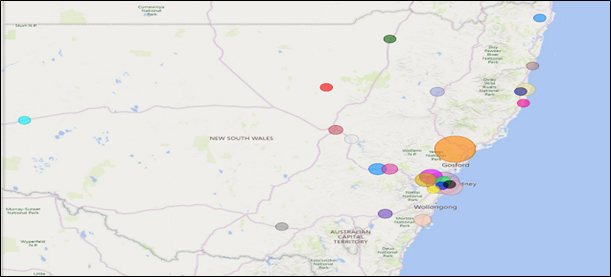

Claims were also selected for representation across statewide demographics including workplace location and worker age, gender and occupation. The sample included ten claims by workers at the MRRC, the worksite the subject of SIRA’s 2020 investigation.

Further detail on the distribution across the state of sampled CSNSW workplaces can be found at Appendix 3.

3.2 Methodology

In August 2022, SIRA wrote to icare and DCJ to confirm it would commence the review using its powers under section 202A of the 1987 Act and included a claim sample listing of 100 claims selected for review.

The review was conducted internally by SIRA reviewers, who were provided online access to QBE’s claims via Guidewire ClaimCenter, a web-based claims system. DCJ’s claims are stored across several different platforms including SafetySuite and TRIM. DCJ’s documents were manually extracted, downloaded and forwarded to SIRA for review.

SIRA did not seek access to DCJ’s files for the 100 sampled claims. As day-to-day claims management sits with QBE, it was expected that any claims management activity undertaken by DCJ and evidenced on DCJ files would be the subject of communication between DCJ and QBE and, therefore, also evidenced on QBE’s files. SIRA sought access to 20 DCJ claim files to test this assumption. Six were initially requested on an ad hoc basis, following review of QBE claim files where it appeared to the reviewer that there may have been undocumented claims management activity. The balance was selected according to the sampling methodology employed to select the 100 claims.

The review approach involved a separation of ‘historical’ and ‘recent’ claims. Claims with a DEIS which pre-dated SIRA’s 2020 investigation (pre-1 November 2020) were considered historical claims, while claims with a DEIS post-dating SIRA’s 2020 investigation were considered recent claims. All claims were reviewed against criteria selected from SIRA’s audit criteria library, currently comprising over 300 criteria. Historical claims were reviewed against seven criteria that allowed a high-level, qualitative review of claims management, providing a focus on the issues arising from SIRA’s 2020 investigation. Recent claims were reviewed against up to 214 criteria, including the seven criteria applied to the historical claims review, covering claims management activity across the life of the claim and testing compliance with legislation (73 criteria) and conformance with other regulatory instruments (141 criteria).

The 214 criteria comprising the audit criteria list applied in this review can be found at Appendix 4.

4. Findings

4.1 DCJ file reviews

SIRA reviewed 20 DCJ claim files via a SharePoint site. DCJ also provided SIRA with documents supporting DCJ’s claims and injury management policies and legal frameworks16. A comprehensive review of DCJ’s documents and files reveals DCJ to have been actively involved in the continuous improvement of its management of workers compensation claims since at least early 2020.

As a self-insurer under section 211B of the 1987 Act, CSNSW and, by extension, DCJ, who manage the claims on CSNSW’s behalf, have a dual role in the workers compensation process, as employer and self-insurer. As an employer, the roles of the injury management officer (IMO) and return to work coordinators (RTWC) are critical to the wellbeing and recovery of injured workers. Those personnel play a vital role in liaising with the claims manager to ensure positive early intervention including a focus on recovery, the offer and provision of suitable duties and development of tailored recovery at work / return to work and injury management plans.

It is evident from the reviews of both DCJ and QBE files that DCJ’s injury management officers and return to work coordinators are actively engaged in the injury management aspects of a claim. There was evidence of clear and comprehensive communication amongst the principal parties. Engagement with workers was generally positive.

The main area of concern identified from the file reviews was around timely communication of injury by DCJ to QBE. Where the employer is a self-insurer or deemed self-insurer, the injury notification date is the date when the employer is first notified of the injury, whether or not there has been time lost from work or medical expenses incurred. For the purposes of meeting legislative compliance, timeframes commence from the date of this first notification and not when the self-insurer’s workers compensation team or claims manager is advised of the injury. There were several instances where DCJ did not inform QBE of a work injury until the worker had sought compensation.

4.2 Historical claims

Across the 43 historical claims reviewed, 27 of which were for psychological injury, there was no evidence of the targeted approach to dispute a claim from the outset as seen in SIRA’s 2020 investigation. Indeed, there was no evidence of overreach or any attempt to unduly influence QBE’s claims management, either by CSNSW or DCJ.

QBE’s claims management practices were assessed as meeting an appropriate standard for claims handling and administration in 95 per cent of cases.

Where complaints or concerns were raised by a worker, these were generally dealt with appropriately and in a timely fashion and communication between claims managers and workers was professional and respectful. There were, however, some instances of workers being subject to undue delays or barriers to accessing benefits to which they were entitled.

Specific examples of poor claims management by QBE included:

- failure to determine a whole person impairment (WPI) claim within timeframes. The WPI claim received in March 2021 was only responded to in August 2021 after the worker’s solicitors had lodged a complaint with the Independent Review Office

- the claim was reasonably excused on the purported basis the injury was not work related, as there was evidence the worker had been under performance management, but there was no evidence the claims manager attempted to resolve the reasonable excuse within the time available; there was also a failure to determine liability within two months of receipt of a claim form

- incorrect PIAWE calculation and delays in paying weekly benefits

- delays in approving treatment requests, including failure to meet legislative timeframes for approvals and failure to issue dispute notices. The delays in access to treatment saw a corresponding decline in the worker’s function and potentially placed them at risk of harm

- extended gaps in communication between claims manager and worker

- workers with psychological injury being required to participate in multiple factual investigations and attend multiple IMEs.

The above examples of poor claims management practice were not widespread but illustrate the range of areas within historical claims management practices with opportunity for improvement.

There were instances of employer behaviour which had the potential to negatively impact workers’ recovery. One worker was referred to as 'damaged-goods' at a return to work meeting. Another worker described her telephone conversations with the RTWC as ‘horrible’. On one claim, the employer refused to provide ergonomic aids that had been deemed necessary for a safe return to work by an ergonomic assessor and supported by the worker’s treating doctor.

There were several claims with clear evidence of employer support and encouragement, and proactive attempts to assist workers’ recovery and return to work.

There was no evidence to suggest any workers within the historical claims cohort were currently awaiting or denied benefits to which they were entitled, or otherwise at risk of harm.

4.3 Claims and injury management practices post-2020

DCJ

DCJ’s new injury management operating model and structure has been in effect since July 2021. IMOs from across the former Departments (now DCJ) were moved into a central team and report centrally under a new supervisory structure.

DCJ commenced a trial of the Complex Case Review process in September 2021, to ensure regular activity and positive communication and decision making on complex claims. It has since been implemented as a formal process and is included in the QBE & DCJ Partnership Plan – 2022. A complex case is defined as a claim where:

- the worker has no work capacity six months post-injury

- the worker currently has no work capacity

- there are complex injuries: multiple injuries or psychological injury

- there are disciplinary or conduct issues

- litigation is anticipated or underway.

There are several other strategies in place to ensure claims management activity accords with best practice expectations, together with regular meetings to discuss performance, process and practice improvements.

QBE

Since at least 2020, QBE has continued to pursue improvements in claims management and to work collaboratively with DCJ to provide proactive and reactive support aimed at preventing injury and reducing the complexity of injuries.

A significant initiative has been a joint investment between icare and QBE in frontline resources, which has seen:

- an increase in the number of teams to support the management and development of frontline teams

- creation of specialist claims teams to manage the more technical and complex claims, including work injury damages, workers with highest needs, whole person impairment > 15 per cent, dust diseases, industrial deafness and recoveries

- creation of a business support team to improve the efficiency of claims administration activities.

A full list of documents evidencing these and other initiatives can be found at Appendix 5.

4.4 Recent claims

4.4.1 Worker consent to release of information

While there was strong evidence that the worker’s informed consent had been sought for CSNSW/QBE to release/request information to/from a third party, there was scant evidence it had been received prior to any information exchange.

It was difficult for reviewers to determine conclusively whether a signed consent form had been received due to the copious documents on many QBE claim files and their poor identification on ClaimCenter.

There was no evidence of worker complaints around lack of consent to the sharing of information.

4.4.2 COVID-19

The review revealed the three workers who had contracted COVID-19 in the workplace had had their claims accepted, either provisionally or outright, and were provided supportive claims management and timely access to entitlements.

COVID-19 has ventilated and/or exacerbated issues regarding access to medical care amongst the general community, especially psychological services and particularly in rural and regional areas. This impact was evident across the claims reviewed.

DCJ reported that throughout 2020 and 2021, QBE and DCJ handled over 1,200 claims in relation to COVID-19 exposure or injury.

4.4.3 Psychological injury

Primary psychological injury

TMF agencies currently account for around 18 percent of all active claims and 46 percent of active psychological injury claims across the scheme. In the 2021 financial year, almost half of the TMF’s psychological injury claims were within the Stronger Communities cluster.

Of the psychological injury claims reviewed, only 13 percent attributed the injury to exposure to a single traumatic incident, such as assault by a co-worker or inmate or other episode of occupational violence. The most common cause of psychological injury was exposure to repeated trauma through interpersonal conflict/work-related pressure/workload issues, which accounted for 49 percent and bullying and harassment, by either a manager or co-worker, accounting for 38 percent. However, it was evident from the accounts provided by several workers that while they attributed their symptoms to complex trauma resulting from workplace issues, they also had a history of exposure to and involvement in multiple, single traumatic incidents.

The table below shows the breakdown of psychological injury claims reviewed according to mechanism of injury.

Table 2: Psychological injury claims - mechanism of injury

Mechanism of injury | Historical claims | Recent claims | Total number of claims |

|---|---|---|---|

Assault by co-worker | 1 | 0 | 1 |

Assault by inmate | 1 | 4 | 5 |

Other occupational violence | 0 | 1 | 1 |

Bullying & harassment (manager) | 7 | 5 | 12 |

Bullying & harassment (co-worker) | 7 | 1 | 8 |

Interpersonal conflict/workloads | 12 | 14 | 26 |

Total number of claims | 28 | 25 | 53 |

Secondary psychological injury

Secondary psychological injury is defined in section 65A(5) of the 1987 Act as a psychological injury arising as a consequence of, or secondary to, a physical injury. Insurers are not required to provide data on secondary psychological injuries. The available data identifies claims for physical injury with payment(s) for psychological treatment.

The review sample included six physical injury claims where the data showed payment for psychological treatment. On review, however, only two such claims were identified (perhaps suggesting data entry errors on the balance). Given the sample size, there are no meaningful insights to be drawn from the review of these claims.

4.4.4 Liability decisions and the application of reasonable excuse

Section 267 of the 1998 Act provides that provisional weekly payments are to commence within seven days of notification of injury unless the insurer has a reasonable excuse for not commencing payments. Section 267(4) provides that the acceptance of liability on a provisional basis does not constitute an admission of liability by the employer or insurer. Where applicable, prior to applying the reasonable excuse, the insurer should attempt to resolve it.

The review revealed that of the six recent claims for physical injury where a reasonable excuse had been applied, all claims had subsequently been accepted outright. Of the eleven recent claims for psychological injury where a reasonable excuse had been applied, seven had subsequently been accepted outright, one had been provisionally accepted, two had been disputed and one remained reasonably excused. The table below shows the liability pathway for recent claims which were reasonably excused at the outset.

Table 3: Liability pathway following reasonable excuse (RE)

This table shows the liability pathway for recent claims which were reasonably excused at the outset.

4.4.5 Factors impacting recovery and return to work

Early intervention

The review revealed strong evidence of early, positive, claims manager contact with workers, employers and treating practitioners. File notes and correspondence typically demonstrated that the claims manager understood the benefits of establishing supportive relationships in the early weeks of a claim. There was evidence of conformance with many of the expectations set out in Standards 33 and 34, even prior to their implementation, suggesting the principles which underpin them are inherent in best practice claims management. The implementation in 2018 of ‘HUG’ (How you going?) calls by the claims manager to a worker is one example.

Investigations

Referrals for surveillance were roughly evenly split between claims for physical and psychological injury, referrals to independent medical examiners and factual investigators were around six times more prevalent in psychological injury claims.

High claims manager turnover

The most common complaint by workers as evidenced in file notes and emails was the high turnover of QBE claims managers. Although workers were typically informed by QBE of forthcoming changes, it was clear on many claims that the replacement claims manager had not received a handover, or adequate handover, prior to their first interaction with the worker. This often necessitated the worker having to provide a history of their injury and claim to the incoming claims manager, and this process was repeated on several claims. There was no evidence of trauma-informed interviewing techniques on the files.

There were several instances of extended and unexplained gaps in communication between the QBE claims manager and worker. Such gaps were particularly evident on claims with several changes in claims managers and claims where workers were required to participate in factual investigations or undergo independent medical examinations.

It was also clear from the files that many workers found the workplace unsupportive. There was evidence of a positive relationship between some workers and their managers, an empathic response to their work injury and a supportive approach to their recovery and return to work. Conversely, there was evidence on a few files of workers describing the workplace as ‘toxic’. Interpersonal issues with co-workers and supervisors were evident among the claims for physical and psychological injury. A perception of the work environment as hostile has the potential to impact workers’ willingness and capacity to recover at and return to work.

4.4.6 Record keeping / document management

QBE

QBE’s online claims system, Guidewire, is easy to navigate at a high level but it is difficult to locate a particular document given the sheer volume and limited naming conventions in use. It is unclear whether this is a system limitation. In any event, it hindered the reviewers’ ability to assure themselves of the existence of certain documents and would likely similarly hinder a new claims manager assigned a particular claim.

As discussed above, the review found a lack of records of formal handover from one claims manager to the next. There was also an absence of evidence demonstrating injury and claims management planning throughout the life of a claim. While injury management plans were generally detailed and tailored in the early stages of a claim, they became repetitive and generic. It was often clear from a file note or medical report that effective management was underway, but it was not accurately recorded.

DCJ

DCJ files are currently stored across SafetySuite and two versions of TRIM, one of which contains the legal files which are managed by a specialised team. The records in SafetySuite do not highlight the existence of a separate legal folder on a claim. SafetySuite is not integrated with ClaimCenter. To capture an email from QBE, an IMO will upload it as an attachment or cut and paste as a file note. DCJ anticipates that a Cloud-based system, which is due for release late 2022/early 2023, should enhance functionality.

4.4.7 Case study

The worker was a prison officer who suffered psychological injury after witnessing two traumatic workplace events in quick succession in early 2021. The initial CoC marked the worker as having no capacity for work for two days.

The initial email from the DCJ RTW co-ordinator to the worker was friendly, supportive and informative. In an early email to the claims manager, the CSNSW HR Advisor supported referral of the worker to a workplace rehabilitation provider (WRP) on the basis the worker had some non-work-related issues and was receptive to rehabilitation. Although a pre-injury duties CoC had recently been issued, the worker had failed to return to pre-injury duties, following an unrelated issue relative to their ongoing role. The HR Advisor acknowledged the worker had been affected by this news coming so soon after his trauma exposure and added: ‘I would really like to review additional support options from how [they] sounded and I’m concerned about whether returning to [workplace] [is] good for [their] health. Of course it’s early days, [they have] only just seen the psychologist this Tuesday and has [their] next appointment [in a fortnight]. Give me a buzz when you have time’.

Following the WRP referral, the provider created a tailored return to work plan, regularly updated CSNSW and QBE about the worker’s capacity for work, and maintained regular, supportive contact with the worker, including accompanying them to case conferences.

The worker returned to pre-injury duties and a closure report was issued in December 2021, with the worker having completed their formal treatment regime, continuing with ‘home based maintenance’.

5. Conclusion

There was no evidence that the practices and behaviour documented in SIRA’s 2020 investigation were systemic. Since the practices the subject of that investigation were brought to light, CSNSW/DCJ and QBE have taken significant steps to improve the administration of the CSNSW portfolio and introduced several risk mitigation strategies. They sought to demonstrate through this review that their remediation efforts in claims and injury management practices since at least 2020 had had measurable positive impacts.

There has clearly been a concerted effort by the principal parties to enhance early injury management intervention, grounded in evidence-based best practice principles. This has been supported by a framework of policies and procedures that highlight the focus on a worker’s wellbeing and recovery and the collaborative, supportive relationships at play.

There is evidence of a commitment by both CSNSW/DCJ and QBE to continuous improvement and this is demonstrated by the high levels of compliance with legislative requirements and conformance with regulatory expectations across the claims reviewed.

CSNSW is clearly a challenging and demanding workplace and it is appropriate to take this into account when assessing the efficacy of claims management processes against recovery and return to work outcomes. Despite being a relatively high-risk workplace, with many workers required to regularly deal with dangerous and violent inmates, psychological injury from exposure to a single traumatic episode was rare. Almost half the claims for psychological injury were caused by interpersonal conflict/work-related pressure/workload issues and almost 40 per cent due to bullying and harassment. To fully understand the workplace environment and its impact on workers’ psychological health would require investigation into the culture around reporting of injuries, particularly those caused by a single, physically violent episode. Analysis of the factors which lead to a worker bringing a claim for psychological injury is outside the scope of this review but consideration needs to be given to the multiple traumatic episodes to which many workers have been exposed during their careers and the consequent complex trauma suffered.

Assigning highly experienced claims and injury managers from day one may see a more considered approach to the initial liability decision. Workers themselves are the biggest drivers of their own recovery. To this end, a more judicious approach to the application of reasonable excuse, as a last resort rather than a default option, would avoid arguably unnecessary delay, dispute and investigation and allow the worker to focus on their health needs. Provisional acceptance of liability signals to the worker that their recovery and return to work is supported. As the legislation is clear that provisional acceptance of liability does not constitute an acceptance of liability by an employer or insurer, it may be that the deterrent to its use is the associated cost. However, as the evidence around positive early intervention is so clear, any money spent on provisional payments is certain to be recouped by the scheme in improved recovery and return to work outcomes.

SIRA will defer providing recommendations until conclusion of the broader TMF review in June 2023. The findings in this review will assist in informing those recommendations.

6. List of tables

7. Appendix 1 - Glossary

Term / short title | Definition / long title |

|---|---|

Additional or consequential medical condition | An additional or consequential medical condition that has resulted from a previous compensable injury. |

Audit criteria library | A library of audit questions and criteria used by SIRA auditors and designed to assess claims management practice, legislative compliance and data quality across the life of a claim. |

Certificate of capacity | A medical certificate completed by the worker’s treating doctor, used in the NSW workers compensation system to describe the nature of a worker’s injury/illness, their capacity for work, and the treatment required for a safe and durable recovery. |

Claim | A claim for compensation or work injury damages a worker has made or is entitled to make. |

Claims management | The management of a worker’s claim by an insurer, self-insurer or claims manager in accordance with legislative and regulatory requirements. |

Claims manager | Provides claims management services for a range of government agencies. |

Cluster | A grouping of NSW Government departments, agencies and organisations |

Common Law | A worker injured in circumstances where his/her employer was negligent may be able to claim work injury damages under the common law remedies laid out in Part 5 of the of the Workers Compensation Act 1987. |

Compliance | This measures insurer activity in relation to the obligations and |

Conformance | The adherence to regulatory standards including guidelines and standards of practice. |

Corrective Services New South Wales (CSNSW) | CSNSW is a government employer and workers compensation self-insurer within the Stronger Communities Cluster, responsible for NSW prisons and programs for managing offenders in the community. |

Dispute | A decision to deny liability for all or part of a claim. |

Early intervention | The active management of a claim in the four weeks following notification to establish effective relationships, identify risks of delayed recovery and work loss and set tailored actions to optimise recovery and work outcomes. |

Employer | An employer can be an individual, a corporation, a firm, an unincorporated body of persons, a government agency or the Crown and can also include the legal personal representative of a deceased employer, or a former employer. |

Entitlement periods | First entitlement period: a claim for compensation in the form of weekly payments made by a worker, means an aggregate period not exceeding 13 weeks (whether or not consecutive) in respect of which a weekly payment has been paid or is payable to the worker. Second entitlement period: a claim for compensation in the form of weekly payments made by a worker, means an aggregate period of 117 weeks (whether or not consecutive) after the expiry of the first entitlement period in respect of which a weekly payment has been paid or is payable to the worker. |

Exempt worker | The amendments introduced in the Workers Compensation Legislation Amendment Act 2012 do not apply to certain categories of workers including police officers, paramedics and firefighters. These workers are referred to as exempt workers. Claims by exempt workers are mainly managed as though the June 2012 amendments never occurred. |

Factual investigation | An investigation by a third-party service provider into the facts of an injury and/or claim; the results of which may inform decision making with respect to liability and other claim entitlements. |

Government agency | Any department, person or body exercising executive or administrative functions on behalf of the Government |

Government employer | The Crown or any government agency |

Government self-insurer | Any NSW Government employer covered by the Government’s managed fund scheme (TMF). |

HUG call | An icare initiative where a telephone call is made to the worker to ask: “How are U Going”. It forms part of the insurer’s regular cycle of reviews and communications with the worker |

Independent medical examination | An assessment conducted by an appropriately qualified and experienced medical practitioner to help resolve an issue in injury or claims management. |

Independent medical examiner | An appropriately qualified and experienced medical practitioner who can help to resolve an issue in injury or claims management. |

Injury | A personal injury arising out of or in the course of employment and includes a disease injury where employment was the main contributing factor to contracting the disease, and includes the aggravation, acceleration, exacerbation or deterioration of any disease, but only if the employment was the main contributing factor to the aggravation, acceleration, exacerbation or deterioration of the disease. |

Insurance and Care NSW (icare) | icare provides workers compensation insurance to public and private sector employers in NSW. Through delegation by SICorp, icare operates and provides claims management services to the TMF. |

Insurer | The various insurers in the NSW workers compensation system, include the Workers Compensation Nominal Insurer, specialised insurers, self-insurers and government self-insurers. |

Nominal Insurer | The Workers Compensation Nominal Insurer established under section 154A of the Workers Compensation Act 1987 Act. icare acts for the Nominal Insurer and exercises the functions of the Nominal Insurer as required by the NSW workers compensation legislation. |

Nominated treating doctor | Where an injury prevents the worker from performing their pre-injury duties for seven days or more, they must nominate a treating doctor (typically, their GP or treating doctor). |

Non-exempt worker | A worker whose claim is not exempt from the amendments introduced in the Workers Compensation Legislation Amendment Act 2012. |

NSW Self Insurance Corporation (SICorp) | SICorp is a statutory body created by the Crown, whose primary function is to manage government managed fund schemes, such as the TMF, for the purposes of paying the self-insurer liabilities incurred by the relevant government employers. SICorp may and has delegated its functions to icare. |

Permanent impairment | A worker who receives an injury that results in a degree of permanent impairment greater than 10% is entitled to receive from the worker’s employer compensation for that permanent impairment. Permanent impairment compensation is in addition to any other compensation. |

Permanent impairment assessment | An assessment obtained by the worker or insurer which certifies the degree of permanent impairment resulting from a work -related injury and is conducted by a registered medical practitioner trained to assess a worker's permanent impairment. |

Personal Injury Commission (PIC) | A single, independent tribunal for injured people claiming against the workers compensation and compulsory third party (CTP) insurance schemes. The PIC replaced the former Workers Compensation Commission (WCC) from 1 March 2021. |

PIAWE | A worker’s pre-injury average weekly earnings, used to calculate their entitlement to weekly payments of compensation. |

Pre-injury duties | The duties a worker performed before they were injured. |

Primary psychological injury | A psychological injury that is not a secondary psychological injury. |

Provisional liability | Provisional weekly payments of compensation by an insurer to a worker, that are to commence within seven days of initial notification of an injury, that ensures early access to treatment and financial assistance is received whilst full liability is being investigated. The acceptance of liability on a provisional basis does not constitute an admission of liability by the employer or insurer. |

Psychological injury | A psychological injury is a personal injury arising out of or in the course of employment that is a psychological or psychiatric disorder and extends to include the physiological effect of the disorder on the nervous system. |

QBE Insurance (Australia) Limited (QBE) | QBE is engaged by icare to provide claims management services to NSW Government employers including CSNSW. |

Reasonable excuse | An excuse not to comply with Workplace Injury Management and Workers Compensation Act 1998 requirement that provisional weekly payments of compensation by an insurer are to commence within seven days of initial notification of an injury to a worker. A list of ‘reasonable excuses’ is included in the Workers Compensation Guidelines. |

Return to work | A return to work (and whether to pre-injury duties or suitable duties) by an injured worker in a timely, safe and durable way, with particular regard to their capacity, pre-injury employment, age, education, skills and work experience. |

Return to work rates | SIRA’s measurements in monitoring return to work performance at different stages of a claim. The return to work (RTW) rate is the percentage of workers who have been off work as a result of their injury/disease and have returned to work at different points in time from the date the claim was reported. The measures are made at four, 13, 26, 52 and 104 weeks. |

Scheme agent | Persons appointed to act as an agent for the Nominal Insurer in connection with the exercise of any of their functions. |

Secondary psychological injury | A secondary psychiatric or psychological condition which arises as a consequence of, or secondary to, a physical injury. |

Section 40 assessment | An assessment where the insurer gathers information in relation to the workers ability to earn in a labour market or where they have unfulfilled capacity for work. |

Self-insurer | Employers who manage their own workers compensation claims under the arrangements described in the Workers Compensation Acts. |

Suitable duties | The work duties an employer provides to a worker to recover at work and/or return to work by for which the worker is currently suited for. |

Specialised Insurer | Licensed insurer whose licence is endorsed with a specialised insurer endorsement that allows them to underwrite workers compensation liabilities and manage workers compensation claims for employers in a defined industry. |

State Insurance Regulatory Authority (SIRA) | SIRA was established in 2015 to steward and regulate the workers compensation insurance, motor accidents CTP insurance, and home building compensation schemes in NSW. |

Treasury Managed Fund (TMF) | The NSW Government self-insurance scheme, administered by SICorp. SICorp delegates its functions in operating the TMF to icare and icare appoints Claims Service Providers to provide claims management services to the TMF portfolio. |

Work capacity | The worker’s functional ability to return to their pre-injury employment taking the nature, duties, tasks, and hours of work of their pre-injury employment into consideration. |

Work capacity assessment | An assessment of an injured worker’s current work capacity conducted in accordance with the Workers Compensation Guidelines. |

Work capacity decision | A decision by the insurer about the worker's current capacity for work and includes an assessment of what is suitable employment for the worker, what they can earn in suitable employment and whether they can engage in certain employment without risk of further injury. |

Work injury | An injury that occurs in the course of the worker’s employment and for which compensation is or may be payable. |

Work injury damages | If a worker is injured in circumstances where the employer was negligent, the worker may have a right to claim work injury damages. ‘Damages’, in relation to work injuries, are compensatory in that they attempt to measure, in monetary terms, the harm caused to a worker by the negligence of their employer. The claim is limited to damages for past economic loss due to loss of earnings and future economic loss due to the loss or impairment of earning capacity as a result of the work injury only. |

Worker | A person who has entered into, or works under a contract of service or a training contract with an employer whether by way of manual labour, clerical work or otherwise, and whether the contract is expressed or implied, and whether the contract is oral or in writing. |

Workers compensation | Compensation under the Workers Compensation Acts and includes any monetary benefit under those Acts. |

Workers Compensation Acts | The Workers Compensation Act 1987 and the Workplace Injury Management and Workers Compensation Act 1998. |

8. Appendix 2 - Relevant legislation and regulatory instruments

Long title | Short title |

|---|---|

Customer Service Legislation Amendment Act 2021 (NSW) | CSLA Act |

Guidelines for Workplace Return to Work Program | Guidelines for Workplace RTW Program |

Government Sector Employment Act 2013 (NSW) | GSE Act |

Health Records and Information Privacy Act 2002 (NSW) | HRIPA Act |

Interpretation Act 1987 (NSW) | Interpretation Act |

NSW Self Insurance Corporation Act 2004 | SIC Act |

Workers Compensation Guidelines for the Evaluation of Permanent Impairment | WC Guidelines for Evaluation of PI |

Privacy Act 1988 (Cth) | Privacy Act |

Privacy and Personal Information Protection Act 1998 (NSW) | PPIP Act |

SIRA Standards of Practice | Standards |

State Insurance and Care Governance Act 2015 (NSW) | SICG Act |

Workers Compensation Act 1987 (NSW) | 1987 Act |

Workers Compensation Amendment Regulation 2018 (NSW) | WCA Reg |

SIRA Workers Compensation Benefits Guide | WC Benefits Guide |

SIRA Workers Compensation Guidelines | WC Guidelines |

SIRA Workers Compensation Guidelines for the Approval of Treating Allied Health Practitioners | WC Guidelines for Approval of Allied Health Practitioners |

SIRA Workers Compensation Insurer Data Reporting Requirements, May 2019 | WCIDRR |

Workers Compensation Regulation 2016 (NSW) | WC Regulation |

Workplace Injury Management and Workers Compensation Act 1998 (NSW) | 1998 Act |

9. Appendix 3 - State-wide distribution of sampled claims

Map Key | |

|---|---|

Larger facility | Centres within facility (Claims per facility) |

Bankstown Community Corrections Office | Bankstown Community Corrections Office (1) |

Bathurst Correctional Centre | Bathurst Correctional Centre and Parole Unit (4) |

Broken Hill Community Corrections Office | Broken Hill Community Corrections Office (1) |

Brush Farm Corrective Services Academy | Brush Farm Corrective Services Academy (3) |

Campbelltown Community Corrections Office | Campbelltown Community Corrections Office (1) |

Cessnock Correctional Centre |

|

Coffs Harbour Community Corrections Office | Coffs Harbour Community Corrections Office (1) |

Community Corrections City Office | Community Corrections City Office (1) |

Coonamble Community Corrections Office | Coonamble Community Corrections Office (1) |

Dubbo Courthouse | Dubbo Courthouse (2) |

Emu Plains Correctional Centre |

|

Francis Greenway Correctional Complex |

|

Goulburn Correctional Centre | Goulburn Correctional Centre (2) |

Kirkconnell Correctional Centre | Kirkconnell Correctional Centre (3) |

Kempsey Community Corrections Office | Kempsey Community Corrections Office (1) |

Lismore Local Court | Lismore Local Court (1) |

Long Bay Correctional Complex |

|

Mid North Coast Correctional Centre | Mid North Coast Correctional Centre (5) |

Moree Courthouse | Moree Courthouse (1) |

Paramatta Transitional Centre | Paramatta Transitional Centre |

Port Macquarie Community Corrections Office | Port Macquarie Community Corrections Office (1) |

Silverwater Correctional Complex |

|

South Coast Correctional Centre | South Coast Correctional Centre (4) |

Tamworth Community Corrections Office | Tamworth Community Corrections Office (2) |

Unknown (not displayed in map) |

|

Wagga Community Corrections Office | Wagga Community Corrections Office (1) |

Wellington Correctional Centre | Wellington Correctional Centre (2) |

10. Appendix 4 - Audit criteria

Notes:

- For the purposes of this review, a reference in the audit criteria to:

- ‘employer’, is taken to be a reference to the self-insured government employer and/or the lead agency

- ‘insurer’, is taken to be a reference to the government self-insurer (government agency) and/or the claims manager.

- SIRA introduced its Standards of Practice on 1 January 2019. Standards 32, 33 and 34 were introduced subsequently and came into effect on 26 February 2020, 1 March 2020 and 4 April 2022, respectively. Assessment of claims management performance is measured against best-practice expectations and, where relevant, Standards and will account for the date of introduction/implementation of the Standard.

CSNSW review - audit criteria | |

|---|---|

Early claims management | |

A.00 | Did the employer notify the insurer of the injury within 48 hours of becoming aware of the injury? |

A.01 | If the insurer received an incomplete initial notification of injury, did they inform the notifier (and the worker, where possible) within three business days to specify the additional information needed? |

A.14 | Did the insurer contact the worker, employer and treating doctor (if appropriate and reasonably practical) within three business days of being notified of a significant injury? |

A.02 | Was the initial contact with the worker, employer and, if appropriate, the treating doctor, supportive? |

A.02.01 | On identification of a significant psychological injury, did the insurer contact the worker as soon as practicable to offer the necessary support? |

A.02.02 | On identification of a significant psychological injury, did the insurer contact the employer as soon as practicable to offer the necessary support? |

A.08 | Did the insurer seek the worker’s informed consent to release /request information to/from a third party? |

A.08.01 | Did the insurer have the worker’s informed consent before releasing/requesting information to/from a third party? |

A.09 | Did the insurer offer the worker the services of an interpreter/translator? |

A.15 | On identification of a significant injury, did the insurer advise the worker of their injury management plan obligations? |

A.16 | On identification of a significant injury, did the insurer advise the employer of their injury management plan obligations? |

A.03 | Did the insurer gather and analyse information on potential risk factors for delayed recovery? |

A.04 | Did the insurer collaborate with the worker, employer and treatment providers to identify and implement actions matched to identified risks for delayed recovery? |

A.05 | Did the insurer equip and support the worker to maximise their input into their recovery? |

A.06 | Did the insurer support the employer in meeting their workers compensation obligations around early intervention? |

Liability determination | |

A.18 | For COVID-19 claims, did the insurer ascertain whether the worker was in prescribed employment and whether the presumption applies? |

A.19 | Did the insurer inform the worker of the further information required to establish they had contracted COVID-19? |

A.20 | For COVID-19 claims, did the insurer inform the worker and employer of the further information required to determine liability; provisionally accept liability and commence provisional payments without delay? |

B.01 | Did the insurer consult with the worker to obtain information relevant to the liability determination? |

B.02.01 | Did the insurer consult with the employer to obtain information relevant to the liability determination? |

B.02.02 | Is there evidence the employer influenced, or attempted to influence, management of the claim in a manner inconsistent with the information on file or legislative requirements? |

B.03 | Did the insurer start provisional payments/issue a reasonable excuse/determine liability within seven calendar days of notification of injury? |

B.05 | Was there a subsequent liability decision (other than for an additional / consequential injury)? |

Liability accepted | |

B.11 | Was the decision to accept liability consistent with the information on file? |

B.12.01 | Did the insurer provide the worker with written advice on accepting liability? |

B.12.02 | Did the insurer provide the worker with written advice within two business days of the liability decision? |

B.13.02 | Did the insurer’s written advice to the worker on accepting liability provide the details required by Standard 3? |

B.14 | Did the insurer provide the employer with written advice within two business days of the liability decision? |

B.15 | Did the insurer’s written advice to the employer on accepting liability provide the details required by Standard 3? |

B.15.01 | Did the insurer provide the employer with additional information on the liability decision within 10 business days of request? |

Provisional liability | |

B.32 | Was the decision to accept provisional liability consistent with the information on file? |

B.33.01 | Did the insurer provide the worker with written advice of the decision to accept provisional liability? |

B.33.02 | Did the insurer provide the worker with written advice on accepting provisional liability within two business days of the decision? |

B.34.01 | Did the insurer’s written advice to the worker on accepting provisional liability provide the requisite legislative details? |

B.34.02 | Did the insurer’s written advice to the worker on accepting provisional liability provide the details required by Standard 3? |

B.35 | Did the insurer provide the employer with written advice on accepting provisional liability within two business days of the decision? |

B.36 | Did the insurer’s written advice to the employer on accepting provisional liability provide the details as required by Standard 3? |

B.41 | Did the insurer actively investigate the claim during the provisional liability period? |

B.42 | If the insurer required a completed claim form to determine liability, did they proactively request this from the worker and allow sufficient time for the worker to complete and submit the form? |

B.44 | Did the insurer make a prompt liability decision on receipt of required information, during the provisional liability period? |

Reasonable excuse | |

B.65 | Was the decision to issue a reasonable excuse consistent with the information on file and in accordance with the guidelines? |

B.66 | Did the insurer provide the worker with written advice of the reasonable excuse within seven calendar days of notification of injury? |

B.67.01 | Did the insurer’s written advice to the worker of the reasonable excuse provide the requisite legislative details? |

B.67.02 | Did the insurer’s written advice to the worker of a reasonable excuse provide the details required by Standard 3? |

B.68 | Did the insurer provide the employer with written advice of the reasonable excuse within two business days of the decision? |

B.69 | Did the insurer’s written advice to the employer of a reasonable excuse provide the details as required by Standard 3? |

B.70 | Did the insurer determine liability for any claims for medical expenses on a reasonably excused claim within 21 calendar days? |

B.91 | Did the insurer determine provisional liability on a reasonably excused claim within seven calendar days of the reasonable excuse being resolved? |

N.25 | Did the insurer determine liability on a reasonably excused claim within 21 calendar days of the date a claim was made? |

Liability disputed | |

N.20 | Was the decision to dispute liability consistent with the information on file? |

B.23 | Did the insurer review the decision to dispute liability before notifying the worker? |

B.24 | Did the insurer call the worker to discuss the effect of the decision before issuing the dispute notice? |

B.25 | Did the insurer’s written advice to the worker on disputing liability provide the requisite details? |

B.26 | Did the insurer’s written advice to the employer on disputing liability contain the requisite details? |

C.06 | Did the insurer provide the worker with the required notice when ceasing weekly payments? |

C.08 | Did the insurer undertake the requested review under section 287A of the 1998 Act (s287A review)and advise the worker of the outcome within 14 calendar days of the request? |

C.09 | Was the s287A review undertaken by an appropriate person? |

C.09.01 | Did the s287A review consider relevant material submitted by the worker? |

C.10 | Did the insurer’s written advice to the worker on the outcome of the s287A review contain the requisite details? |

Initial injury management plan | |

D.02 | Did the insurer develop an injury management plan no later than 20 business days from the date the injury was identified as significant? |

D.03 | Did the insurer consult the worker when developing the injury management plan? |

D.04 | Did the insurer consult the employer when developing the injury management plan? |

D.05 | Did the insurer consult the treatment provider when developing the injury management plan? |

D.06.01 | Did the injury management plan meet legislative requirements? |

D.06.02 | Did the injury management plan meet the requirements of Standards 12, 33 and 34? |

D.07 | Did the insurer issue the injury management plan to the employer and worker? |

Recovery at work/injury management | |

A.07 | Did the insurer coordinate stakeholders to achieve worker goals and work outcomes? |

D.08 | Did the insurer regularly review the risks for delayed recovery, tailor actions/interventions as needed and update the injury management plan? |

F.10.01 | Was there adequate contact with the employer? |

F.10 | Did the insurer ensure recovery at work plans were provided to all stakeholders? |

F.07.01 | Did the employer offer/provide suitable work? |

F.10.02 | Where the employer advised they were unable to provide suitable work, did the insurer take appropriate action? |

F.06 | Did the insurer make a referral to a workplace rehabilitation provider when the evidence on file indicated it may be warranted? |

F.25 | Did the insurer determine a request for rehabilitation within 21 days? |

F.27 | Did the insurer ensure services provided by the workplace rehabilitation provider were consistent with the Workers compensation workplace rehabilitation provider approval framework? |

F.28 | Did the insurer ensure the workplace rehabilitation provider’s attendance at a case conference accorded with the requirements of Standard 16? |

F.29 | Did the insurer maintain responsibility for management of the claim? |

F.30 | Did the insurer respond to and action the worker’s request for a change in workplace rehabilitation provider? |

Injury management consultant | |

F.12 | Did the insurer consider a referral to an injury management consultant when indicated by the evidence on file? |

F.33 | Did the insurer have a valid reason for making a referral to an injury management consultant? |

F.34 | Did the insurer contact the worker to discuss the referral to the injury management consultant? |

F.35 | Did the insurer contact the nominated treating doctor to discuss the referral to the injury management consultant? |

F.36 | Did the insurer give the worker 10 business days’ notice of the injury management consultant assessment or gain the worker’s agreement to a shorter timeframe? |

F.37 | Did the insurer’s written advice to the worker provide all relevant details? |

F.38 | Did the insurer provide sufficient referral information to the injury management consultant? |

F.39 | Did the insurer ensure the worker and nominated treating doctor received a copy of the injury management consultant report? |

F.40 | Did the insurer action the recommendations of the injury management consultant? |

F.41 | When making subsequent injury management consultant appointments, did the insurer use the same injury management consultant or have a valid reason not? |

Mediation and case conference | |

O.01 | Was there evidence of a breakdown in the relationship between the employer and worker? |

O.02 | Did the insurer address the breakdown in the relationship between the worker and employer with the employer? |

O.03 | Did the insurer propose mediation (directly or through the workplace rehabilitation provider) if indicated by evidence on file? |

F.21 | Did the insurer arrange a case conference if indicated by evidence on file? |

F.22 | Did the insurer obtain the worker’s agreement to a case conference, provide the relevant advice and schedule an appropriate appointment? |

F.23 | Did the insurer implement actions arising from the case conference? |

Secondary psychological injury | |

F.07.02 | Did the worker develop a secondary psychological injury? |

F.07.03 | Did the insurer screen for biopsychosocial factors to identify whether the worker was at an elevated risk of developing a secondary psychological injury? |

F.07.04 | If the insurer identified the worker as at risk of developing a secondary psychological injury, did the insurer develop a tailored strategy to facilitate support? |

F.07.05 | Did the insurer determine any treatment request related to the secondary psychological injury at the earliest possible opportunity? |

B.02.03 | Is there evidence to suggest the injury/claims management actions of the agency or claims manager caused or contributed to the worker’s psychological distress, injury or impairment? |

Additional/consequential injury | |

E.03 | Did the insurer contact the worker and/or nominated treating doctor within five business days of receipt of the certificate of capacity or other form of notification of an additional or consequential medical condition? |

E.04 | Did the insurer determine the claim for an additional or consequential medical condition within 21 calendar days of receipt of the certificate of capacity or other form of notification? |

E.06 | Was the decision to accept liability for the additional or consequential condition consistent with the information on file? |

E.11 | Was the decision to dispute liability for an additional or consequential medical condition consistent with the information on file? |

E.12 | Did the insurer review the decision to dispute liability for an additional or consequential medical condition before notifying the worker? |

E.13 | Did the insurer call the worker to discuss the decision to dispute liability for an additional or consequential medical condition prior to issuing the dispute notice? |

E.14 | Did the insurer’s written advice to the worker on disputing liability for an additional or consequential medical condition provide the requisite details? |

E.15 | Did the insurer’s written advice to the employer on disputing liability for an additional or consequential medical condition contain the requisite details? |

Investigations | |

Factual investigation | |

G.02 | Did the insurer have a valid reason for making a referral for a factual investigation? |

G.03 | Did the insurer provide written advice to the worker about the referral for the factual investigation? |

G.04 | Did the insurer ensure the worker received a copy of their statement following the factual investigation? |

Independent medical investigation | |

G.11 | Did the insurer have a valid reason for making a referral to an independent medical examiner? |

G.12 | Did the insurer select an appropriately qualified independent medical examiner with expertise relevant to the worker’s injury? |

G.13 | Did the insurer select an independent medical examiner appropriate to the worker's needs? |

G.14 | Did the insurer give the worker 10 business days’ notice of the independent medical examination, or obtain agreement to a shorter timeframe? |

G.15 | Did the insurer’s written notification to the worker of the independent medical examination provide the requisite details? |

G.16 | Did the insurer consider the worker’s objection to attend an independent medical examination and provide an appropriate response? |

G.17 | Did the insurer discuss with the worker the action being taken following receipt of an independent medical examination report? |

G.18 | Did the insurer have a valid reason for making a subsequent referral to an independent medical examiner? |

G.19 | Did the insurer use the same independent medical examiner for subsequent examinations unless there was a valid reason not to? |

Surveillance | |

G.07 | Did the insurer have a valid reason for making a referral for surveillance? |

G.08 | Did the insurer ensure surveillance was conducted within requirements? |

G.09 | Did the insurer respond appropriately to a worker's enquiry regarding surveillance? |

G.10 | Did the insurer release surveillance information appropriately and with information about relevant obligations? |

Weekly benefits - PIAWE | |

Non-exempt workers | |

J.20 | Did the insurer inform the worker and employer how PIAWE may be determined and what was required from them within three days of notification of injury? |

J.21 | Did the insurer calculate PIAWE correctly based on the available evidence? |

J.22 | Did the insurer’s advice to the worker of the PIAWE decision include the requisite details? |

J.47 | Did the insurer make an interim PIAWE decision if there was insufficient information to make a PIAWE decision? |

J.48 | Did the insurer's advice to the worker of the interim PIAWE decision include the required details? |

J.49 | Did the insurer’s advice to the employer of the interim PIAWE decision include the required details? |

J.25 | Did the insurer calculate weekly benefits correctly in the first entitlement period? |

J.26 | Did the insurer advise the worker of the expected reduction due to the 13-week statutory step-down no less than 15 working days before it took effect? |

J.28 | Did the insurer correctly calculate weekly benefits in the second entitlement period? |

J.29 | Did the insurer conduct a work capacity assessment after 78 weeks to determine the worker's entitlement to weekly payments after 130 weeks? |

J.30 | Did the insurer provide the worker with the continuation of weekly payments after 130 weeks application form after 78 weeks of benefits? |

J.31 | Did the insurer advise the worker of the expected reduction due to the 130-week statutory step-down no less than 15 working days before it took effect? |

Exempt workers | |

J.08 | Did the insurer calculate the average weekly earnings or current weekly wage rate correctly? |

J.10 | Did the insurer calculate weekly benefits correctly for payment in the first 26 weeks? |

J.11 | Did the insurer calculate weekly benefits correctly for payment after the first 26 weeks? |

J.12 | Was a section 40 assessment arranged in accordance with the requirements of the 1987 Act? |

J.13 | Did the insurer calculate weekly benefits correctly for payment under section 40A of the 1987 Act? |

J.14 | Did the insurer provide the worker with six weeks’ written notice before reducing weekly payments under section 40A? |

J.15 | Did the insurer advise the worker of the expected reduction due to the 26-week step-down no less than 15 working days before it took effect? |

Other | |

J.04.01 | Is there evidence the worker was paid incorrectly? |

J.55 | Did the insurer request the worker's tax file number within five business days of the decision to pay the worker directly? |

J.56 | Did the insurer advise the worker in writing within five business days of commencing direct payments? |

Work capacity | |

K.01 | Did the insurer review the worker’s work capacity on receipt of relevant information? |

K.03 | Was a formal assessment of the worker for the purposes of a work capacity decision made in accordance with the guidelines? |

Work capacity decision | |

K.12 | Is the adverse work capacity decision consistent with the information on file? |

K.13 | Was the adverse work capacity decision reviewed by an appropriate person before the worker was notified? |

K.14 | Did the insurer call the worker to discuss the adverse work capacity decision before issuing the written advice? |

K.15 | Did the insurer’s written notification to the worker advising of the adverse work capacity decision provide the requisite details? |

K.18 | If the worker applied to the Personal Injury Commission for review of an adverse work capacity decision did the insurer observe the effect of a stay of the decision? |

Medical management | |

L.10 | Was there evidence of collaboration between treatment providers to ensure a coordinated, goal-directed focus on recovery and return to work? |

L.11 | Did the insurer acknowledge a claim for medical and related treatment within 10 working days? |

L.12 | Did the insurer determine a claim for medical and related treatment within 21 calendar days? |

L.30 | Was the decision to approve liability for medical and related treatment consistent with the information on file? |

L.31 | Did the insurer advise the worker and treatment provider of the decision to approve treatment within two business days of the decision? |

L.32 | Did the insurer discuss expectations around allied health treatment with the worker? |

L.34 | Did the insurer ensure the worker’s nominated treating doctor directed the treatment plan? |

L.35 | Did the insurer appropriately action the worker’s request to change their nominated treating doctor? |

L.36 | Was the decision to dispute liability for medical and related treatment consistent with the information on file? |

L.37 | Did the insurer arrange an internal review of the decision to dispute liability for medical or related treatment before advising the worker? |

L.38 | Did the insurer call the worker to discuss the decision to dispute liability for medical and related treatment prior to issuing written notice? |

L.39 | Did the insurer’s written advice to the worker on disputing liability for medical or related treatment provide the requisite details? |

L15 | Did the insurer refer the worker for a medication review if indicated? |

L17 | Did the insurer action the recommendations from the medication review? |

L.29 | Did the insurer ensure diagnostic services were clinically relevant before approving? |

L18 | Did the insurer ensure all treatment approved was relevant to the compensable injury? |

L.45 | Did the insurer review the appropriateness of the hydrotherapy/gym program before approving? |

L.53 | Did the insurer approve the worker's request to obtain a second opinion before surgery? |

L.54 | Did the insurer contact the worker before or immediately following surgery to ensure they had appropriate support on discharge from hospital? |

Claims management - other | |

H.26 | Did the insurer determine a claim for domestic assistance within 21 calendar days of receipt? |

H.28 | Was the liability decision on the claim for domestic assistance consistent with the information on file? |

H.42 | Did the insurer determine liability on a claim for aids/modifications within 21 calendar days of receipt? |

0.44 | Was the liability decision on a claim for aids/modifications consistent with the information on file? |

H.59 | Did the decision to suspend the worker's benefits reflect the information on file? |

H.60 | Did the insurer give the worker the required notice of suspension of benefits? |

H.61 | Did the insurer's written advice to the worker on suspending benefits contain the requisite details? |

H.70 | Did the insurer make timely contact with the worker, employer and other stakeholders to advise of a change in case manager? |

H.12 | Is there evidence of a complaint by the worker? |

H.13 | Was there evidence of a privacy breach? |

Lump sum payments | |

I.04 | Did the insurer request further particulars of the permanent impairment assessment within 10 working days of the date claim received? |

I.05 | Did the insurer review the permanent impairment assessment report within 10 business days of receipt? |

I.07 | Did the insurer advise the worker an independent medical examination is required, within two weeks of the claim being lodged? |

I.08 | Did the insurer ensure the independent medical examiner was appropriately qualified, relevant to the worker's injury, and a SIRA-approved permanent impairment assessor? |

I.09 | Did the insurer ensure the independent medical examiner was appropriate to the worker's needs? |

I.10 | Did the insurer’s written notice to the worker of the independent medical examination provide 10 business days’ notice of the appointment or reflect an agreed timeframe? |

I.11 | Did the insurer's written advice to the worker of the independent medical examination provide the requisite details? |

I.12 | Did the insurer determine the claim within either one month of the degree of permanent impairment being determined or two months of all relevant particulars being provided, whichever is the later? |

I.13 | Was the insurer’s liability decision on the permanent impairment claim consistent with the information on file? |

1.26.01 | Has a claim for common law damages been made or anticipated? |

L.38.01 | Was there an application for commutation? |

Claim closure | |

Claim closure – return to work | |

M.11 | Did the insurer monitor the worker's return to pre-injury/permanently modified duties for a reasonable period of time? |

M.12 | Did the insurer communicate with the worker prior to claim closure to provide the requisite details? |

M.17 | Did the insurer's written advice to the worker on closing the claim provide the requisite details? |

Claim closure – section 39 of the 1987 Act | |

M.03 | Did the insurer correctly calculate 260 weeks of entitlement? |

M.04 | Did the insurer determine the degree of permanent impairment to allow 13 weeks’ notice of cessation of benefits? |

M.05 | Did the insurer provide the worker with 13 weeks' notice of cessation of benefits? |

M.06 | Did the insurer's written advice to the worker on cessation of benefits include the required details? |

M.07 | Did the insurer advise the worker of the expected reduction due to the section 39 statutory step-down no less than 15 working days before it took effect? |

Claim closure – section 59A of the 1987 Act | |

M.25 | Did the insurer correctly determine the worker's section 59A compensation period? |

M.26 | Did the insurer provide the worker with at least 13 weeks’ written notice of cessation of medical entitlements? |

M.27 | Did the insurer provide the nominated treating doctor with at least 13 weeks’ written notice of cessation of medical entitlements? |

M.28 | Did the insurer's written advice to the worker regarding cessation of medical benefits under section 59A provide the required details? |

M.29 | Did the insurer provide the worker with appropriate assistance to transition off medical entitlements? |

L.52.01 | If secondary surgery was undertaken did the insurer pay the worker weekly compensation if they were so entitled? |

Claim closure - retirement | |