Print PDF

Weekly payments of statutory benefits

Insurer Claims and Conduct Assurance Program

August 2023

Introduction

The Motor Accident Injuries Act 2017 (the Act) establishes the NSW Compulsory third party (CTP) insurance scheme. In conjunction with the Act, the Motor Accident Guidelines (the MAGs) support the delivery of the objects of the Act by establishing principles and requirements to ensure timeliness, fairness, transparency and better outcomes and experiences for injured people. The Act and the MAGs set out the requirements for weekly payments of statutory benefits for persons injured as a result of a motor accident in NSW.

The State Insurance Regulatory Authority (SIRA) is the independent regulator of statutory schemes in NSW, including CTP. In line with Division 9.1 of the Act, SIRA has issued licenses to six insurers who operate within the scheme. These licenced insurers are required to adhere to the duties and obligations placed on them under the Act, MAGs and the conditions of their licence. SIRA has a statutory function to monitor the compliance of the licensed insurers and authority to publish information about their level of compliance with the duties and obligations imposed.

In accordance with its statutory functions and pursuant to Section 10.24 of the Act, SIRA undertook an Insurer Claims and Conduct Assurance Program (ICCAP) supervisory activity to ensure that licensed insurers were meeting their obligations as it relates the weekly payment of statutory benefits, including the issuance of liability notices.

The ICCAP activity supports the SIRA2025 Strategy to hold insurers to account and improve the outcomes and experience for claimants within the scheme.

The activity was conducted in three stages:

- Desktop review

- Insurer interviews

- Claims file reviews

This report outlines the findings of the supervisory activity on the information provided by insurers and access to their claims management platform. SIRA notes and appreciates the licensed insurer’s engagement and transparency throughout this supervision activity.

Desktop review

A desktop review was conducted in May 2023 to understand insurers systematic approach to ensuring compliance with their weekly payment obligations.

Insurers were requested to provide relevant documents demonstrating quality assurance (QA) controls (including QA audit questions) measuring compliance against obligations for weekly payments within the first and second entitlement periods and including relevant outcomes demonstrated in the six-month period to February 2023.

Key themes from the desktop review included:

- All insurers had some form of quality assurance process in place to demonstrate a level of monitoring of compliance performance specific to weekly payments.

- Not all insurers quality assurance programs were demonstrating compliance to the requirements being reviewed.

- There are opportunities for some insurers to improve their compliance control measures and quality assurance programs to meet the insurer’s statutory obligations.

Insurer interviews

SIRA met with staff from each insurer for a live claim walk through to demonstrate internal practices, processes and controls that were relied on to support the application of weekly payments in accordance with the Act, the MAGs and licence conditions.

The interviews provided insight into insurer practices in relation to assessment processes, methods of determining if a claimant is an earner, the rationale applied to specific pre-accident average weekly earnings (PAWE) determinations and the insurer’s control measures.

The insurer interview responses were considered against three general themes:

- assess and gather information

- notice period and decisions

- training, operational resources and quality assurance.

Key themes from the interviews included:

- Tools and processes were utilised to determine and calculate PAWE.

- There was misunderstanding demonstrated by some interviewees in respect of the relationship between the earner and liability decisions.

- Case managers utilised the expertise of internal technical specialists where appropriate.

- Generally, most insurers had a formal onboarding or induction program which included information on how to calculate weekly payments and supported by internal staff, however, ongoing training and refresher training appeared to be provided on an ad hoc and informal basis.

- For some insurers, the use of external expertise such as a forensic accountant was not always limited to complex scenarios.

- Decision outcomes for weekly benefit entitlements were communicated to claimants by case managers.

Claims file review

Scope

Insurers |

|

File review date | File reviews were conducted in May 2023. |

|---|---|

Scope | The audit is conducted in accordance with SIRA’s statutory power pursuant to section 10.24 of the Act. The claims file review aims to review insurer’s systems to comply with:

|

Criteria | See appendix 1 |

Review cohorts | Stratified random sample of claims comprised of: Cohort 1 – Claims lodged between October 2022 and February 2023 where interim payments have been paid. Cohort 2 – Claims lodged between July to October 2022 where weekly payments were paid made in the first and second entitlement periods excluding interim payments. Cohort 3 – Claims lodged between August 2022 and January 2023 where a claimant is an earner with no or limited work capacity and no weekly payments made. |

Access to information | Insurers provided SIRA with unrestricted access to their claims records and claims representatives to assist in the completion of the review. The SIRA reviewers engaged with insurer claims representatives throughout the review to highlight potential non-compliances and gather further information to assess and determine compliance. Through this process, insurers were also afforded the opportunity to provide SIRA with their views in relation to the non-compliance. Insurer responses were considered prior to the Lead Auditor making a final determination. |

Results

Scheme

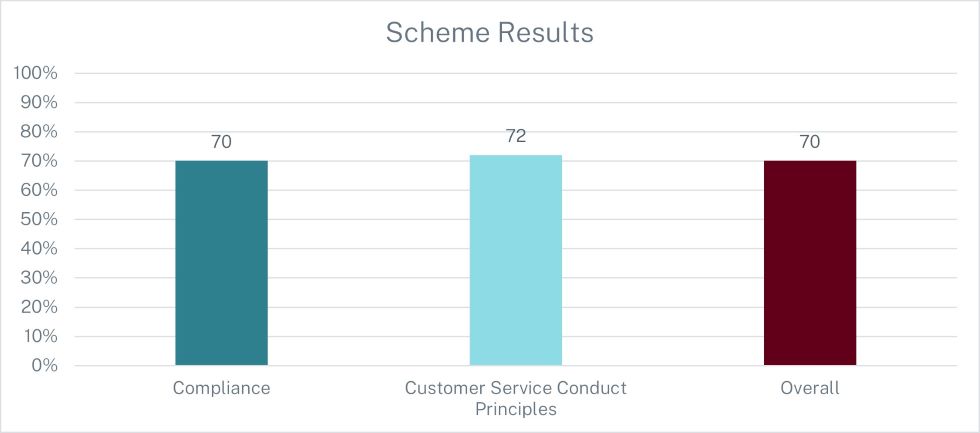

The insurers demonstrated an overall average file review result of 70%. The review criteria comprised two main elements – Compliance and Customer Service Conduct Principles. As a collective, the insurers scored 70% and 72% respectively in these areas.

Overall

Insurers demonstrated the strongest compliance against criteria seven (98%) in applying the correct information and algorithm to calculate weekly payments and criteria eight (96%) with the difference between the interim and PAWE rates being paid promptly.

The lowest area of compliance was demonstrated against the insurers adherence to legislative requirements prior to the suspension of the payment of weekly benefits. In respect of this criteria SIRA acknowledges that there was a small number of files (eight overall) which were relevant for assessment out of the random file sample across all insurers. Further issues were identified in relation to the insurers obligation to provide written notice to the claimant in line with the legislative requirements, including attaching all information relevant to the decision, regardless of whether the information supports the decision.

Insurer

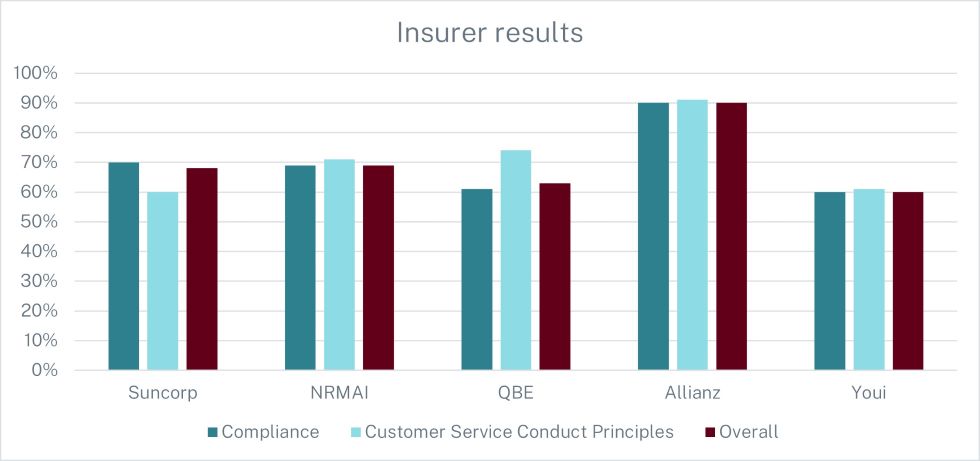

At an insurer level, Allianz received the highest overall score of 90%. Allianz also scored the highest result in relation to compliance (90%) and Customer Service Conduct Principles (91%).

Youi recorded the lowest overall score of 69%. Youi had the lowest score in relation to compliance (60%). Suncorp recorded the lowest score for Customer Service Conduct Principles (60%).

Observations

- Interim payments were generally considered by insurers where information was not available to calculate PAWE.

- In instances where the correct amount of weekly payments was determined as being higher than the interim rate the insurers paid the difference promptly.

- The payment of weekly benefits was generally commenced by insurers within 10 working days of the liability decision and in accordance with the MAGs.

- When weekly payments commenced, payments were made weekly or fortnightly to the claimant.

- Referral for external expertise for some insurers was based on the type of work that the claimant engaged in, rather than the complexity of the circumstances.

- It was identified that insurer notices often lacked written reasons for the PAWE decision including what documentation was relied on to make the PAWE decision. Where an accountant’s report was provided in support of the insurer's PAWE decision, the report was generally provided without the insurers written reasons of how PAWE was calculated and left for the respective claimants to interpret.

- Some instances where the information on the liability notices did not clearly state the insurers determination of the claimant’s statutory benefit entitlements regarding the payment of weekly benefits. Particularly, there were some examples where there was evidence of a disconnect between the liability decision and the determination of earner.

- The insurer liability notices on occasion did not include reasons for the decision with reference to the information relied upon and where information was relevant to the decision this was not always listed on the notice or provided to the claimant.

- Where weekly payments were discontinued, the required process was largely followed in accordance with legislative requirements.

Regulatory response

All insurers were provided with an individual report from the ICCAP activity outlining their results, details of non-conformances and required actions.

Based on the findings of the weekly payments of statutory benefits ICCAP, the following actions will be undertaken:

Action 1

All insurers to develop and implement a remediation plan to ensure systematic compliance is embedded across all areas where substantial compliance was not demonstrated. The development of the remediation plan and associated reporting requirements must be conducted in line with SIRA’s remediation plan expectations.

Action 2

SIRA will monitor the implementation of the remediation plans on a monthly basis. Remediation plan requirements will be monitored until SIRA is satisfied that substantial compliance is being achieved.

Action 3

SIRA will consider further independent assurance activities based on risks presented by each insurer.

Action 4

SIRA will review the Motor Accident Guidelines to determine whether changes are appropriate to clarify expectation and deliver improved outcomes.

Action 5

SIRA will consider further regulatory action in relation to specific insurers who demonstrate ongoing non-compliance to weekly payments obligations.

Appendix 1 – Review criteria

Clause reference | Audit criteria |

|---|---|

Criteria 1 and 3 MAGs: 4.33-4.35(a)-(b)(v8.2) 4.33-4.36 (v9) (compliance) | The insurer provided written notice to the claimant identified as ‘Liability Notice – benefits up to 26 weeks ’and ‘Liability Notice – benefits after 26 weeks’ which included all information required under the MAGs. |

Criteria 2 The Act – s6.3(3)(a)-(d) (compliance) | For the determination of PAWE, the insurer has provided the claimant with: (a) Information about entitlements to statutory benefits (b) All relevant information relied on to make the PAWE decision (c) The written reasons for the decision (d) Any right under the Act to review the PAWE decision |

Criteria 4 MAGs: 4.36(v8.2), 4.37(v9) (compliance) | Where a claimant is legally represented, the insurer must provide the claimant’s legal representative with a copy of the liability notice at the same time notice is provided to the claimant. |

Criteria 5 MAGs: 4.37(v8.2),4.38(v9) (compliance) | If liability was denied, copies of all information provided to the claimant was also provided to the claimant’s legal representative. |

Criteria 6 MAGs: 4.43(v8.2), 4.44(v9) (compliance) | Payment of weekly benefits commenced within 10 working days of the decision to accept liability. |

Criteria 7 The Act – 3.6(1)-(2), 3.7(1)(2) (compliance) | The insurer applied the correct information and algorithm to calculate weekly payments. |

Criteria 8 MAGs: 4.6(b)(v8.2), 4.48(v9) (compliance) | If the correct amount of weekly payments was determined as being higher than the interim rate, the insurer paid any difference owing within 10 business days. |

Criteria 9 The Act – s3.19(1)-(2)(a)-(b), MAGs: 4.60-4.62(v8.2), 4.64, 4.65(f) and (g), 4.66(v9) (compliance) | The insurer provided notice before discontinuing or reducing weekly payments in line with legislative requirements. |

Criteria 10 The Act – s3.14, MAGs: 4.57-4.59(v8.2), 4.61-4.63(v9) (compliance) | Where the insurer suspended (or took steps to suspend) the payment of weekly benefits, the insurer adhered to the legislative requirement prior to suspending payments. |

Criteria 11 Licence condition 2 (Customer Service Conduct Principles) | In the management of the claim, did the insurer conduct itself in line with the Customer Service Conduct Principles? |