SIRA quarterly regulatory update (ending 31 March 2022)

SIRA’s compliance and enforcement activities target the areas of highest risk. The actions taken are commensurate to the level of real or potential harm, the scope of non-compliance, the severity of wrongdoing and the need for deterrence. These activities are complemented by education and support initiatives to drive better outcomes for the people who make claims and hold policies in SIRA-regulated schemes.

A summary of regulatory activity in the motor accidents, workers compensation and home building compensation schemes for the period 1 January 2022 to 31 March 2022 is provided below and published on the SIRA website.

Regulation of motor accidents insurers

SIRA regulates six licenced insurers in the NSW CTP Scheme: Allianz, NRMA Insurance, Suncorp (brands: AAMI and GIO), QBE, and Youi.

Claims for damages were the focus for this quarter, which included a review of communication practices to ensure licenced insurers comply with their obligations. Characteristics of claims lodged in 2018 and 2019 were reviewed to identify whether the insurer had taken a proactive approach in making the claimant aware of their entitlement to claim for damages and still decided not to claim.

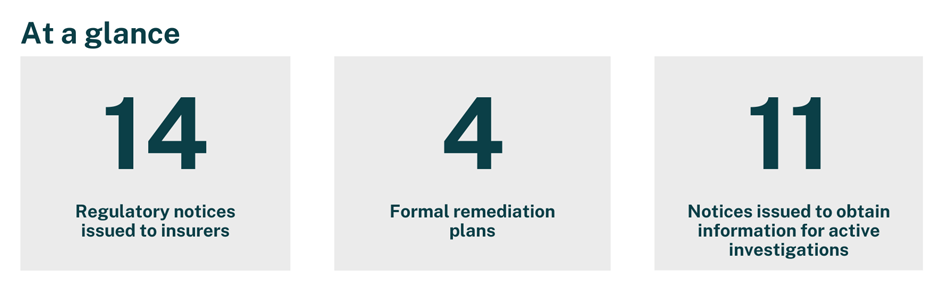

SIRA issued a total of fourteen regulatory notices during the period 1 Jan – 31 March 2022 consisting of:

- two matters for AAMI,

- four matters for GIO,

- five matters for NRMA, and

- three matters for QBE

SIRA’s regulatory actions and the nature of these matters in respect of each of these insurers are presented in the tables below. There were no regulatory notices issued for Allianz and Youi during this period.

In addition, SIRA directed Suncorp (GIO and AAMI), NRMA and QBE to commence a remediation plan during the period.

As at 31 March 2022, there was a total of sixteen ongoing remediation plans. The nature of the ongoing remediation plans are listed below:

- Treatment and care decision timeframes

- Incorrect premiums charged to customers

- Communication of entitlements

- Failure to meet injury coding timeframes

- Compliance issues pertaining to weekly payment of statutory benefits

- Liability decision timeframes

- Procedural fairness in earning capacity decisions

- Inconsistent medical certificate data

- Premium price discrepancies

A total of six referrals from the Independent Review Office (IRO) were sent to SIRA in line with the SIRA & IRO Memorandum of Understanding during the period 1 Jan – 31 March 2022. The issues referred from the IRO were in relation to a non-compliance pertaining to post accident weekly earnings payment, treatment and care decision timeframes and quality of customer service. As a result, SIRA investigated these matters and issued two regulatory notices to NRMA for delays in the reimbursement of treatment invoices, and for failure to provide proactive support and communication with claimant.

Insurer Claims and Conduct Assurance Program

As part of SIRA’s Insurer Claims and Conduct Assurance Program, SIRA conducted a claims file review in February 2022 to ensure that insurers are providing information to injured people about entitlements to damages in line with legislative requirements.

The outcomes of this review will be reported in the June update.

AAMI

Number of AAMI matters | Insurer name | Date | Matter | Regulatory action |

|---|---|---|---|---|

1 | AAMI* | 08/02/2022 | Inconsistent medical certificate data | SIRA issued a regulatory notice and directed AAMI and GIO to prepare a formal remediation plan. |

2 | AAMI | 08/02/2022 | Delay in the payment of legal costs relating to a Merit Review decision | SIRA issued a regulatory notice. |

* indicates one regulatory notice was sent for both AAMI and GIO.

GIO

Number of GIO matters | Insurer name | Date | Matter | Regulatory action |

|---|---|---|---|---|

1 | GIO* | 08/02/2022 | Inconsistent medical certificate data | SIRA issued a regulatory notice and directed AAMI and GIO to prepare a formal remediation plan. |

2 | GIO | 8/03/2022 | Customer Service Conduct Principles - Incorrect cancellation of registration | SIRA issued a regulatory notice. |

3 | GIO | 8/03/2022 | Communication with claimant’s representatives | SIRA issued a regulatory notice. |

4 | GIO | 08/03/2022 | Treatment and care payment timeframes | SIRA issued a regulatory notice. |

* indicates one regulatory notice was sent for both AAMI and GIO.

NRMA

Number of NRMA matters | Insurer name | Date | Matter | Regulatory action |

|---|---|---|---|---|

1 | NRMA | 01/03/2022 | Procedural fairness in earning capacity decisions | SIRA issued a regulatory notice and directed NRMA to prepare a formal remediation plan. |

2 | NRMA | 08/03/2022 | Treatment and care decision timeframes | SIRA issued a regulatory notice. |

3 | NRMA | 08/03/2022 | Delays to Medicare Recovery Payment | SIRA issued a regulatory notice. |

4 | NRMA | 08/03/2022 | Treatment and care decision timeframes | SIRA issued a regulatory notice. |

5 | NRMA | 08/03/2022 | Compliance with damages liability requirements | SIRA issued a regulatory notice. |

QBE

Number of QBE matters | Insurer name | Date | Matter | Regulatory action |

|---|---|---|---|---|

1 | QBE | 01/03/2022 | Treatment and care payment timeframes | SIRA issued a regulatory notice. |

2 | QBE | 08/02/2022 | Treatment and care decision timeframes | SIRA issued a regulatory notice & directed QBE to prepare a formal remediation plan. |

3 | QBE | 08/03/2022 | Incorrect cancellation of a third-party policy | SIRA issued a regulatory notice. |

Regulation of workers compensation insurers

SIRA regulates four different types of workers compensation insurers: Nominal Insurer managed by icare, self-insurers, specialised insurers, and government self-insurers (the Treasury Managed Fund) managed by icare.

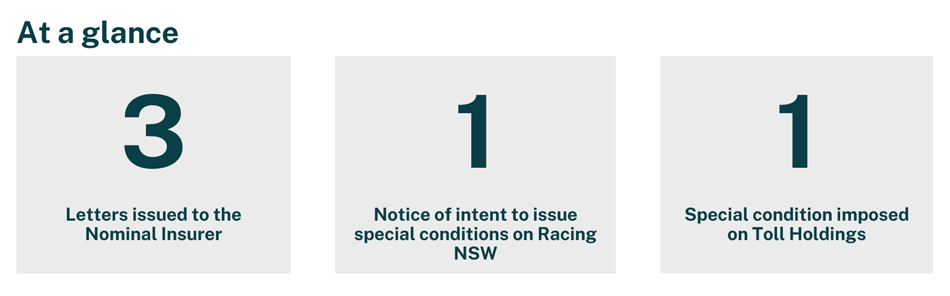

In the quarter, the Independent Review Office (IRO) referred three significant matters to SIRA. One related to a substantial risk of physical, mental or financial harm to a claimant, and two were for a serious breach of Customer Service Conduct Principles, Guidelines or Standards of Practice

Nominal Insurer

This quarter, SIRA continued to closely monitor expenditure from the Workers Compensation Insurance Fund and icare’s enterprise and improvement plans.

SIRA reviewed the Nominal Insurer Business Plan to ensure implementation of Standard of Practice 34: Return to work and early intervention.

SIRA issued a letter of direction, letter of compliance and letter of no further regulatory action to the Nominal Insurer in response to the issues outlined below. During communication with icare in the March 2022 quarter, icare provided SIRA with assurance that system controls are in place to prevent future occurrences of the same issues.

Date | Issue | SIRA action |

|---|---|---|

13/01/2022 | Delay in calculating and paying weekly benefits | Issued letter of direction |

28/02/2022 | Not sending documentation for injury management consultation appointments in timeframe | Issued letter of compliance |

23/03/2022 | Not establishing regular contact with workers and payment of weekly benefits without sufficient evidence | Issued letter of no further regulatory action |

Specialised Insurers

A series of reviews were held this quarter in accordance with the Specialised Insurers Supervision Framework. SIRA also issued a notice of intent to place special conditions on Racing NSW’s workers compensation insurance licence in response to concerns about its claims management performance. Read more here

Racing NSW

Date | Issue | SIRA actions |

|---|---|---|

30/03/ 2022 | Claims management performance | SIRA gave notice of intent to issue special conditions on 30 March |

Self-Insurers

A series of reviews were held this quarter in accordance with the Self-Insurers Supervision Framework. Specifically, SIRA:

- Received five annual reviews which included the assessment of the insurer annual business plans to ensure that insurers’ strategies align with the objectives of the workers compensation legislation.

- Received three claims file reviews which are used to gain insight about how an insurer manages their workers compensation claims and facilitates recovery at work.

- Received six insurers’ claims management self-audits.

- Completed nine security reviews, which entails an assessment of insurers current valuation of their current liability. These reviews resulted in six insurers increasing the security held, two insurers reducing the security held and one remaining the same.

- Seven new licence applications were received and are under review.

Toll Holdings Pty Ltd

Date | Issue | SIRA actions |

|---|---|---|

25/02/2022 | Financial information sought | Special licence condition imposed to gather financial statements and claims actuarial valuation |

Treasury Managed Fund

Preparations for a review of Corrective Services NSW and the Treasury Managed Fund commenced.

Regulation of employers

As a result of SIRA’s investigations into non-insurance this quarter, 429 businesses purchased a workers compensation insurance policy. This means an additional 1,443 employees are now covered by a workers compensation insurance policy.

SIRA also issued 114 penalty notices for non-insurance and made 111 referrals to Revenue NSW to commence recovery action for $3.5M of double avoided premiums.

In the management of workplace injury obligations, SIRA issued 17 employer improvement notices for failure to establish a return-to-work program, failure to appoint a return-to-work coordinator, failure to notify the insurer within 48 hours, or failure to provide suitable employment.

Inspectors made 45 visits to employers with injured workers at risk of not returning to work.

SIRA sent letters to 579 employers with injured workers at risk of not returning to work.

SIRA’s apps and online support saw 752 visits to the ‘Have you been injured at work’ app and 453 visits to the ‘Small business assist’ app. The online return to work coordinators training saw 754 new registrations, with 533 (71%) of those being employers.

The SIRA Assist Team received 39 complaints that related to employers’ behaviour and alleged non-compliance, with 28% alleging non-compliance with their return to work and suitable employment legislative obligations and 54% related to employer behaviour and engagement.

Workplace Injury Management – building compliance

Action | Quarter | Calendar year to date |

|---|---|---|

Visits to SIRA’s Have you been injured at work app | 752 | 1029 |

Visits to SIRA’s Small business assist app | 453 | 582 |

New registrations for SIRA’s online RTW (Return to Work) Coordinator training | 754 | 971 |

SIRA’s monthly RTW Insider newsletter | 2 issues | 3 issues |

Visits to SIRA’s Worker Status Tool | 2360 | 3165 |

Regulation of the home building compensation scheme

SIRA assessed and has not rejected icare HBCF’s revised eligibility model which has been lodged to meet SIRA’s new guidelines which were revised and published in December 2021.

SIRA reviewed and assessed icare HBCF’s reporting on claims and underwriting performance for quarter end December 2021.

SIRA maintained a high level of supervisory oversight to ensure that impacted homeowners were made aware of their entitlements and icare HBCF was providing timely and supportive claims management.

Health providers and practitioners

Workplace rehabilitation providers

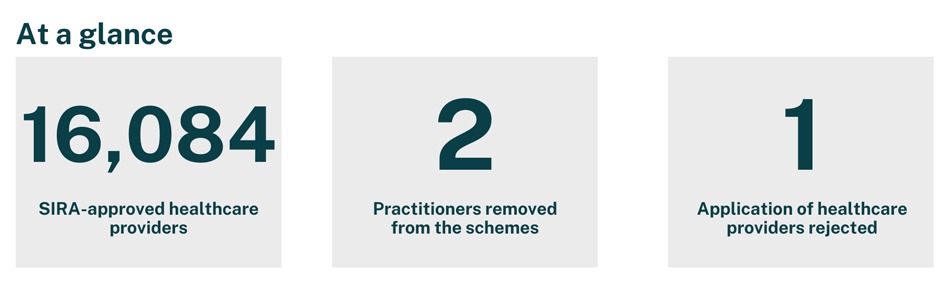

As at 31 March 2022, there are 90 workplace rehabilitation providers (WRPs) approved to operate in the workers compensation scheme as assessed against the new Workers Compensation workplace rehabilitation provider approval framework which came into effect on 1 January 2022.

The following classifications apply:

- 64 providers have full approval status

- 21 providers have approval with additional supervision conditions for minor compliance issues

- Four providers have approval and a more comprehensive supervision and remediation plan requirement to address more significant compliance issues. These providers have been approved to manage clients for reduced approval period whilst SIRA actively, monitors for improvements

- One provider is under formal investigation by SIRA and remains able to provide services, under a reduced approval period.

A further 14 applications are under assessment as at 31 March 2022. There are 26 applications for the new specialist job seeking service stream also under review.

Allied Health Practitioners

As at 31 March 2022, there are 15,457 allied health practitioners approved to provide services in the workers compensation scheme.

In this quarter SIRA has approved a further 418 allied health practitioners to operate in the workers compensation scheme. In addition, SIRA revoked the approval of one allied health practitioner as they no longer met the eligibility requirements.

Authorised Health Practitioners

As at 31 March 2022, there were 452 active authorised health practitioners on SIRA’s published list.

In this quarter, a further 10 authorised health practitioners were appointed to operate in the 2017 motor accidents scheme. SIRA also removed one practitioner from the scheme this quarter as they no longer met the eligibility requirements.

1 January to 31 March 2022 | Motor accidents scheme | Workers compensation scheme | ||

|---|---|---|---|---|

Authorised Health Practitioner | Allied Health Practitioners | Injury Management Consultants | Workplace Rehabilitation Providers | |

SIRA approved | 10 | 418 | 2 | 3 |

Applied but not approved | 1 | 0 | 0 | 0 |

Practitioner initiated cessation | 2 | 12 | 0 | 0 |

SIRA initiated cessation | 1 | 1 | 0 | 0 |

Total number of active practitioners at end of period | 452 | 15457 | 85 | 90 |