SIRA quarterly regulatory update (ending 31 December 2022)

This report is a summary of the regulatory activity undertaken by the NSW State Insurance Regulatory Authority (SIRA) in the motor accidents, workers compensation and home building compensation schemes for the period 1 October 2022 to 31 December 2022.

SIRA’s compliance and enforcement activities target the areas of highest risk. The actions taken are commensurate to the level of real or potential harm, non-compliance, or the severity of wrongdoing and the need for deterrence.

These activities are complemented by SIRA’s education and support initiatives to drive better outcomes for anyone who makes a claim and hold policies in the regulated schemes.

Regulation of motor accidents insurers

SIRA regulates six licenced insurers in the NSW compulsory third party (CTP) scheme: Allianz, NRMA Insurance, Suncorp (brands: AAMI and GIO) QBE, and Youi.

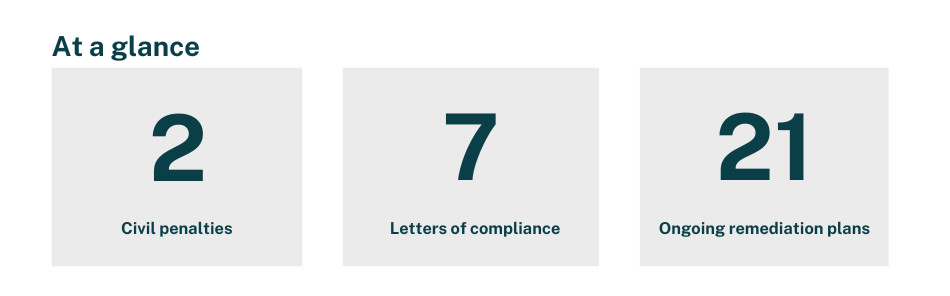

Civil penalties

SIRA imposed two civil penalties (monetary fines) on Suncorp (AAMI for $50,000 and GIO for $50,000) on 15 December 2022. The penalties were imposed for failure to comply with the timeframes to conduct internal reviews in accordance with their obligations under the Motor Accident Guidelines, under the Motor Accident Injuries Act 2017 (MAIA) and accordingly with the standard licence conditions during the period April 2018 to August 2020.

Letters of compliance

SIRA issued a total of seven letters of compliance during the period 1 October 2022 to 31 December 2022 alerting the entity to an identified risk or issue, and the potential consequences of inaction.

Insurer | Date | Matter | Regulatory action |

|---|---|---|---|

AAMI | 17/10/2022 | Referral for medical examination | SIRA issued a Letter of Compliance. |

ALLIANZ | 17/10/2022 | eGreenSlip transmission delays | SIRA issued a Letter of Compliance. |

ALLIANZ | 26/10/2022 | Delays in Sending Correspondence to Claimants’ Legal Representatives | SIRA issued a Letter of Compliance. |

NRMA | 1/12/2022 | Delay in treatment and care decision | SIRA issued a Letter of Compliance. |

QBE | 10/10/2022 | Injury coding requirements | SIRA issued a Letter of Compliance. |

QBE | 14/11/2022 | Incorrect application of indexation to weekly statutory benefit payments | SIRA issued a Letter of Compliance. |

QBE | 10/10/2022 | Failure to adhere to recovery plan requirements | SIRA issued a Letter of Compliance. |

Remediation plans

As at 31 December 2022, there were a total of 21 ongoing remediation plans in place for CTP insurers:

The nature of the ongoing remediation plans are presented in the table below.

Remediation plans ongoing 1 October 2022 – 31 December 2022

Insurer | Date commenced | Matter |

|---|---|---|

AAMI | 7/07/2022 | Overcharged CTP Premiums |

AAMI & GIO | 4/04/2022 | Incorrect Medical Certificate Data |

AAMI & GIO | 29/07/2022 | Delay to Weekly Benefit payment |

AAMI & GIO | 3/09/2022 | Treatment and Care – Insurance Conduct and Claims Assurance Program (ICCAP ) |

ALLIANZ | 4/07/2022 | Treatment and Care – ICCAP |

ALLIANZ | 1/11/2022 | Delayed transmission of eGreenSlip |

ALLIANZ | 9/11/2022 | Claims management – communication |

ALLIANZ | 15/12/2022 | MAIA Self Assessment Tool (SAT) |

GIO | 15/09/2022 | Incorrect CTP Premium Calculations |

NRMA | 10/12/2021 | Weekly benefits - decision making |

NRMA | 5/09/2022 | Incorrect data provided to the U niversal Claims Database (UCD) |

NRMA | 30/09/2022 | Treatment and Care – ICCAP |

NRMA | 16/12/2022 | MAIA SAT |

QBE | 30/09/2022 | Treatment and Care – ICCAP |

QBE | 24/10/2022 | Injury Coding |

QBE | 25/11/2022 | Incorrect application of indexation to weekly benefits after the second entitlement period. |

YOUI | 5/09/2022 | Treatment and Care – ICCAP |

YOUI | 15/12/2022 | MAIA SAT |

Insurer Claims and Conduct Assurance Program

Recovery Plans

SIRA completed an Insurer Claims and Conduct Assurance Program (ICCAP) activity in December 2022 to ensure insurers are meeting their obligations under the Motor Accident Injuries Act 2017, Motor Accident Guidelines and licence conditions as it relates to recovery plans.

The activity identified a range of issues with compliance performance and the implementation of recovery planning. As a result, each insurer is required to submit a plan for remediation to ensure systematic compliance in relation to recovery plans. SIRA will also be running a series of education sessions in 2023 with the insurers to translate the research available for effective recovery planning.

SIRA will undertake a further file review of all insurers in late 2023 to ensure that the remediation activities have resulted in systematic compliance.

The scheme Recovery Plan report outlines more detailed findings on the ICCAP activity.

Independent Review Office matters

A total of 10 significant matters relating to motor accidents were referred to SIRA from the Independent Review Office (IRO) for further investigation in line with the SIRA & IRO Memorandum of Understanding during the quarter.

- Four referrals related to NRMA, of which two were related to weekly benefit payment timeframes, one was related to calculation of entitlements, and one was in relation to treatment and care decision timeframes.

- Two referrals related to QBE for claims management communication.

- Two referrals related to GIO, of which one was related to weekly benefits payment timeframes and one related to whole person impairment.

- One referral related to AAMI for weekly benefits payment timeframes

- One referral related to Gordian for communication of entitlements

Gordian RunOff Limited

In December 2022 SIRA undertook a claim file audit to ensure that Gordian RunOff Limited (Gordian) is meeting the requirements of the Motor Accident Guidelines Claims in response to treatment adherence and claim settlement adherence.

In a sample of Gordian claims selected by SIRA Gordian demonstrated the below compliance levels:

Overall audit score: | 96% |

TRAC requirements | 93% |

Settlement requirements | 100% |

Based on the findings of the review, SIRA will maintain its current supervision approach of Gordian.

Gordian manage run off claims that were acquired when Zurich Australian Insurance Ltd (Zurich) ceased underwriting NSW CTP Green Slips under the Motor Accidents Compensation Act 1999. On 31 December 2018, Zurich’s NSW CTP insurance portfolio was transferred to Gordian an Enstar Group Ltd subsidiary, by way of a Scheme sanctioned by the Federal Court of Australia pursuant to Part III, Division 3A of the Insurance Act 1973, after Gordian was granted a licence under the 1999 Act by SIRA. Gordian is therefore the licensed insurer for the Zurich NSW CTP claims arising from the transferred portfolio, Gordian has appointed Enstar Australia Limited, a related entity, to be their claims manager.

Gordian is required to comply with the 1999 Act, regulations and Guidelines made under the Act as a condition of their licence. SIRA has a statutory function to monitor the operation of the motor accidents scheme under the 1999 Act, including the handling of claims.

Regulation of workers compensation insurers

SIRA regulates four different types of workers compensation insurers: Nominal Insurer (NI) managed by icare, self-insurers (employers approved by SIRA to manage their own workers compensation claims, e.g., BOC Limited), specialised insurers (specialised industry, e.g., Racing NSW), and government self-insurers (the Treasury Managed Fund) managed by icare.

Special licence conditions

SIRA issued special licence conditions to two self-insurers over the period of October to December 2022 to clearly establish what is required of the licenced insurer to maintain their licence.

Insurer | Date of imposed special licence conditions |

|---|---|

Catholic Churches Insurance | 31/10/2022 |

31/10/2022 |

Letters of compliance

SIRA issued two letters of compliance during the period to the nominal insurer, alerting the entity to an identified risk or issue, and the potential consequences of inaction.

SIRA’s regulatory actions and the nature of these matters are presented in the table below.

Insurer | Date | Matter | Regulatory action |

|---|---|---|---|

icare | 19/10/2022 | COVID-19 disaster payments for Pre-injury Average Weekly Earnings (PIAWE) calculations. | Monitoring and review of actions taken by icare to ensure correct application of PIAWE calculations where impacted by COVID-19 payments. |

Icare | 20/12/2022 | Wage Price Index (WPI) settlements |

Audits of nominal Insurer

In the period 1 October 2022 to 31 December 2022, SIRA undertook two audits of the nominal insurer in accordance with powers provided in section 202A of the Workers Compensation Act 1987.

- Investigative audit into the historical failure to index workers weekly benefit in line with the legislative requirements.

- Quarterly audit of 50 claims to assess the management of these in the first four weeks.

Insurer self-audit activities

Licensed insurers are required to undertake a claims management self-audit and lodge the report with SIRA each financial year. During this period, 13 insurers had self-audit remediation plans underway. SIRA actively monitors these improvement activities and takes regulatory action as needed.

SIRA quarterly supervision priorities

SIRA monitors the compliance and performance of licensed insurers through its insurer supervision framework, setting out clear supervision priorities for each financial year. The first of the workers compensation supervision priorities set out for the 2022/2023 financial year, was response to notification of injury and as of 31 December 2022 21 self-insurers are now compliant, and a further 15 insurers providing information for validation by SIRA. 41 insurers were required to review their practices and develop a remediation plan to ensure accurate reporting of injury. SIRA will continue to monitor these improvement activities and take regulatory action as needed.

Remediation plans

Six remediation plans were commenced or continued across the period 1 October 2022 to 31 December 2022 for insurers with a focus on claims management and return to work programs.

Independent Review Office matters

A total of 21 matters relating to workers compensation were referred to SIRA from the Independent Review Office (IRO) for further investigation in line with the SIRA & IRO Memorandum of Understanding during the quarter.

18 out of the 21 matters required review with insurers from SIRA. The reasons for notification include:

- Delays in decisions and payments relating to medical entitlements

- Claims management

- Calculation and delays with weekly payments of compensation

- Dispute processes

Review of the Treasury Managed Fund

The Treasury Managed Fund (TMF) provides workers compensation coverage to government agencies. It is administered by the State Insurance Corporation (SICorp) and managed by icare.

In December 2022, SIRA completed the review of 100 claim files as part of the Corrective Services NSW review and provided the draft report to stakeholders for feedback prior to publication. The Corrective Services review is the first component of the broader TMF review.

The TMF review will involve the review of approximately 1,000 claim files as part of a holistic review. The primary objectives of the review are to determine whether workers compensation activities within TMF agencies are being conducted in accordance with legislation and best practice. A further objective is to evaluate the interplay between TMF agencies, claims managers and SI Corp/icare in the conduct and administration of workers compensation claims.

Licensing

Within the reporting period the following insurer licences were renewed:

Insurer | Date of renewal |

|---|---|

Catholic Churches Insurance | 31/10/2022 |

Randstad Holdings | 31/10/2022 |

Northern Beaches Council | 30/11/2022 |

Commonwealth Steel Company | 31/12/2022 |

The following insurer submitted a request for extension of licence:

Insurer | Month of request |

|---|---|

Hospitality Employers Mutual | December 2022 |

The following licence applications are under assessment/review include:

Applicant | Comment |

|---|---|

Adecco Holdings Pty Ltd | Approved to commence 28/02/2023 |

Hays Recruitment (Australia) Pty Ltd | Approved to commence 31/03/2023 |

Endeavour Group Limited | Approved to commence 03/04/2023 |

The following licence applications were received and commenced assessment/review:

Applicant | Month complete application received |

|---|---|

| October 2022 |

| November 2022 |

Insurer Guarantee Fund

The Insurer Guarantee Fund (IGF) was established under the Workplace Injury Management and Workers Compensation Act 1998 and relates to workers’ compensation liabilities arising from companies that have placed into administration and have been brought into the IGF through specific legislation.

The transition of historic policy details and claims records from WRL (previous claims provider) to EML (current claims provider) was finalised on 31 December 2022.

Former self-insurers

Pasminco Australia Limited finalised the transition of the ongoing liability portfolio to icare for ongoing claims administration.

Regulation of employers

In establishing compliance with employer workplace injury obligations, SIRA issued 53 employer improvement notices for non-compliance with workplace rehabilitation obligations and issued eight notices for production of information related to possible contraventions. SIRA inspectors completed 94 employer engagements and SIRA sent 692 letters to employers with injured workers at risk of not returning to work.

SIRA’s apps and online support saw 945 visits to the ‘Have you been injured at work’ app and 692 visits to the Small Business Assist app. The training had 541 new registrations, with 393 (73per cent) of those being employers.

The SIRA Assist Team received 12 complaints that related to employers’ behaviour and alleged non-compliance, with 25 per cent alleging non-compliance with their return to work and suitable employment legislative obligations, and 75 per cent relating to employer behaviour and engagement.

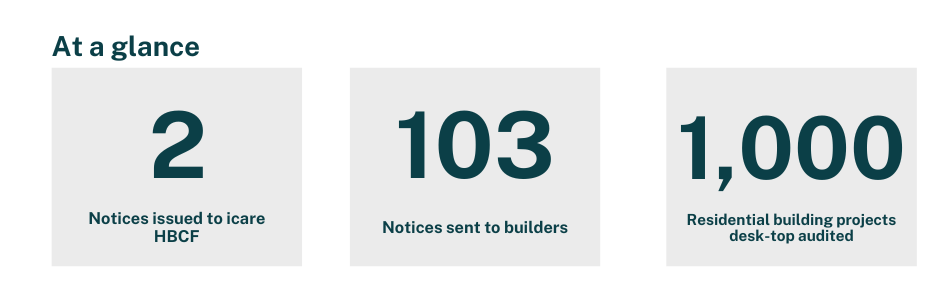

Regulation of the home building compensation scheme

SIRA supervises and monitors the home building compensation scheme and its performance. In collaboration with Fair Trading, SIRA investigates and enforces non-compliance by building businesses.

During the period 1 October to 31 December 2022, SIRA determined and granted one exemption application under section 97 of the Home Building Act 1989.

As part of the review of insurer eligibility practices in the home building compensation scheme, on 11 November 2022 a notice was issued upon icare under section 127 of the Home Building Act 1989 , to provide all securities and financials utilised in icare's eligibility modelling of 10 selected builders.

During the this period, SIRA conducted a desk-top audit of approximately 1,000 residential building projects where data indicated potential non-compliance with home building insurance requirements. Notices were sent to 103 builders to produce documents for compliance review. Most projects are compliant, however some matters were referred to NSW Fair Trading for further scrutiny.

In a separate review, SIRA has identified data quality issues where the certificate unit numbers for multiple dwellings that share the same street address had been incorrectly reported to SIRA. On 2 December 2022, SIRA issued a notice to icare under section 105X of the Home Building Act 1989. The notice required icare to submit to SIRA by 16 December 2022, corrected address details for some contracts of insurance involving work on multi-dwelling buildings for which inaccurate addresses had been recorded. On 14 December 2022, icare confirmed in writing to SIRA the actions it had taken to comply with the notice, including validating and correcting 4,725 addresses.

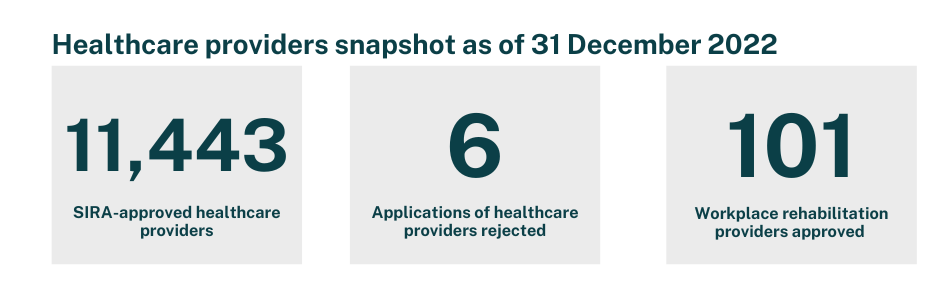

Healthcare providers

SIRA is committed to ensuring that health providers delivering services within the compulsory compensation schemes are in line with the legislation and conditions of the relevant approval framework.

Data Security

In response to increased cyber-attacks in Australia, SIRA emailed all SIRA approved allied health and workplace rehabilitation providers to raise awareness of the potential threat.

To mitigate this occurring in the Workers compensation or CTP Scheme, SIRA clarified for providers their obligations under privacy legislation and the requirement to inform SIRA of a breach or alleged breach of privacy.

SIRA also instructed all workplace rehabilitation providers to submit a report to SIRA setting out how the provider is complying with their obligations under the privacy legislation and how they are complying with their conditions of approval.

Hearing Service Providers

As at 31 December 2022, there were 190 Hearing Service Providers (HSPs) approved to deliver services in the workers compensation scheme.

Revocation of Hearing Service Provider from the SIRA scheme

In December 2022, two HSPs were revoked from delivering services in the NSW workers compensation system as they no longer met the requirements set out in the Workers compensation guideline for the approval of HSPs.

Workplace rehabilitation providers

As at 31 December 2022, there were 101 workplace rehabilitation providers approved to work in the workers compensation scheme.

A SIRA approved workplace rehabilitation provider was issued with a limited period of certificate of approval throughout 2022 outlining conditions required to be met in line with the workplace rehabilitation provider approval framework.

Allied Health Practitioners in the workers compensation scheme

As of 31 December 2022, there were 10,739 allied health practitioners approved to provide services in the workers compensation scheme. In the period 1 October to 31 December 2022 SIRA has approved 415 allied health practitioners.

SIRA revoked its approval of four allied health practitioners from delivering services in the NSW workers compensation scheme as it was determined the conditions imposed on their Australian Health Practitioner Regulation Agency registration was because of a disciplinary process.

Authorised Health Practitioners in the motor accidents scheme

As of 31 December 2022, there were 463active authorised health practitioners in the motor accidents scheme.

In the quarter, SIRA appointed sevennew authorised healthcare practitioners.