SIRA quarterly regulatory update (ending 31 December 2021)

SIRA has published a summary of regulatory activity in the motor accidents, workers compensation and home building compensation schemes for the period 1 October to31 December 2021.

SIRA’s compliance and enforcement activities target the areas of highest risk. The actions taken are commensurate to the level of real or potential harm, the scope of non-compliance, the severity of wrongdoing and the need for deterrence. These regulatory activities are complemented by education and support initiatives to drive better outcomes for the people who make claims and hold policies in each of the schemes.

Regulation of motor accidents insurers

SIRA regulates six licenced insurers in the NSW CTP Scheme: Allianz, NRMA Insurance, Suncorp (brands: AAMI and GIO), QBE, and Youi.

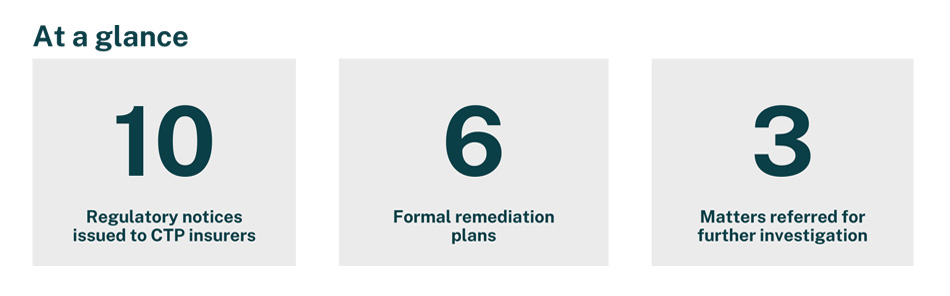

In the quarter ending 31 December 2021, SIRA issued 10 regulatory notices to CTP insurers. Of these notices, six were issued to NRMA, three to GIO and one to QBE.

SIRA directed NRMA to implement three formal remediation plans to oversee improved performance and compliance and referred three matters for further investigation. QBE were directed to implement three formal remediation plans to oversee improved performance and compliance. As of 31 December 2021, across all insurers there were 14 remediation plans open, some of which remain ongoing since before the quarter.

The Independent Review Office (IRO) notified SIRA of 19 significant matters, resulting in eight regulatory notices being issued. SIRA’s memorandum of understanding with the IRO defines ‘significant matters’ as matters that include fraudulent conduct, a risk of substantial physical, mental health or financial harm to an injured person, aserious contravention of the law, or a serious breach of the Customer Service Conduct Principles or Guidelines.

In December 2021, SIRA wrote to all CTP insurers to advise its supervision focus for the next 12-18 months. SIRA requested that insurers consider these priorities in the development of their annual business plans to ensure a high level of compliance and better outcomes for injured people. The areas of SIRA’s supervision focus include:

- Customer service conduct principles

- Return to work/Return to activity and value-based care outcomes for injured people

- Data quality and reporting, including data privacy and protection

- Complaints handling and dispute management practice

- Pricing, underwriting, and market practice

Detailed information on the regulatory notices issued and remediation plans requested in the quarter.

GIO

Date | Issue | Regulatory response |

|---|---|---|

22/10/2021 | Delay in first weekly benefit payment | Issued regulatory notice |

17/12/2021 | Error in Green Slip renewal notices | Issued regulatory notice |

24/12/2021 | Compliance with treatment and care decision timeframes | Issued regulatory notice |

NRMA

Date | Issue | Regulatory response |

|---|---|---|

11/11/2021 | Failure to consider alternate Medicolegal providers closer to the injured person's place of residence | Issued regulatory notice |

11/11/2021 | Compliance issue pertaining to weekly payments of statutory benefits Compliance with correct weekly payments of statutory benefits | Issued regulatory notice Requested remediation plan SIRA investigation is ongoing |

11/12/2021 | Compliance with treatment and care decision timeframes associated with processing reimbursements | Issued regulatory notice Requested remediation plan SIRA investigation is ongoing |

12/11/2021 | Delay in acknowledging and referring an application for internal review | Issued regulatory notice |

12/11/2021 | Failure to meet timeframes for providing liability decisions | Issued regulatory notice Requested remediation plan SIRA investigation is ongoing |

17/12/2021 | Failure to demonstrate a proactive and expeditious approach to the determination of liability on claims for damages | Issued regulatory notice |

QBE

Date | Issue | Regulatory response |

|---|---|---|

07/10/2021 | Delay in determining first liability decision | Requested remediation plan |

07/10/2021 | Premium price discrepancy | Requested remediation plan |

18/10/2021 | Compliance with treatment and care decision timeframes | Requested remediation plan |

20/12/2021 | Failure to demonstrate a proactive and timely approach in determining claims for damages liability | Issued regulatory notice |

Regulation of workers compensation insurers

SIRA regulates four different types of workers compensation insurers: the Nominal Insurer (managed by icare), self-insurers, specialised insurers, and government self-insurers (the Treasury Managed Fund, managed by icare).

This quarter, there was a strong focus on return to work performance. In December 2021, SIRA announced a return to work action plan. As part of the action plan, SIRA required all workers compensation insurers to resubmit their business plans with detail on how they will improve return to work performance and commenced consultation on a new Standard of Practice.

Nominal Insurer

This quarter, SIRA continues to closely monitor the Nominal Insurer’s financial position and icare’s enterprise and improvement plans.

SIRA issued a letter of caution to the Nominal Insurer in response to delays in processing service provider invoicing.

Self and specialised Insurers

A series of reviews and performance meetings were held this quarter in accordance with the Self and Specialised Insurers Supervision Framework. Specifically, SIRA:

- completed 24 annual reviews, which included the assessment of insurer annual business plans to ensure that insurers’ strategies align with the objectives of the workers compensation legislation

- completed 19 security reviews, which entails an assessment of insurers’ current valuation of their current liability. These reviews resulted in 13 insurers increasing the security held, three insurers reducing the security held, and three remaining the same

- completed nine claims file reviews, which are used to gain insight about how an insurer manages their workers compensation claims and facilitates recovery at work

- reviewed nine insurers’ claims management self-audits.

Treasury Managed Fund

In October 2021, SIRA published the Terms of Reference for the Treasury Managed Fund (managed by icare) review. The objective of this review is to assess whether workers compensation activities for government agencies are being conducted effectively, economically, and in compliance with NSW workers compensation legislation. Over the quarter, SIRA commenced gathering data relevant to the scope of the review.

In December 2021, the scope of this review was expanded to include an audit of return to work performance. The expanded scope responds to Action 7 in SIRA’s return to work action plan.

Regulation of employers

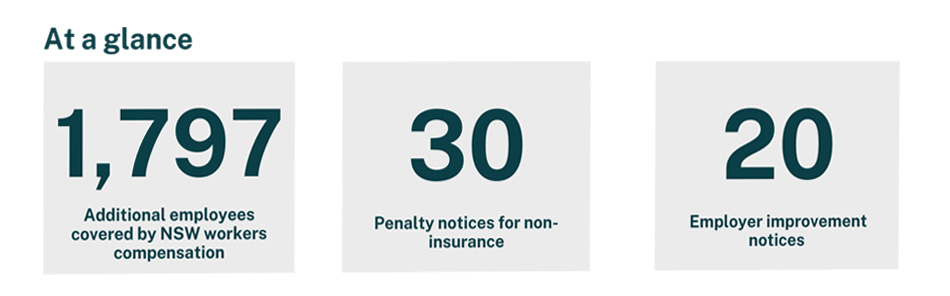

As a result of SIRA’s investigations into non-insurance this quarter, 481 businesses purchased a workers compensation policy. This means an additional 1,797 employees are now covered by workers compensation.

SIRA also issued 30 penalty notices for non-insurance and made 18 referrals to Revenue NSW to commence recovery action for $350,278 of double avoided premiums.

In the management of workplace injury obligations, SIRA issued 20 employer improvement notices for failure to establish a return to work program, failure to appoint a return to work coordinator, and failure to comply with an employer improvement notice.

Inspectors made 60 visits to employers with injured workers at risk of not returning to work.

SIRA’s apps and online support saw 881 visits to the ‘Have you been injured at work’ app and 510 visits to the ‘Small business assist’ app. The online return to work coordinators training saw 709 new registrations, with 479 (68%) of those being employers.

Regulation of the home building compensation scheme

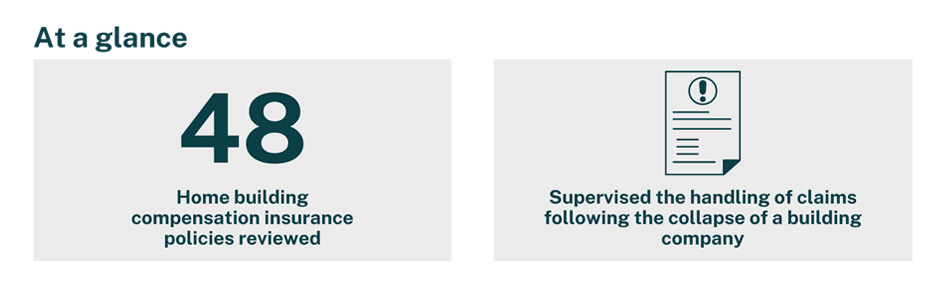

In the home building compensation scheme, SIRA reviewed 48 policies of home building compensation insurance issued by the icare home building compensation fund (HBCF) this quarter. This review reported compliance with guideline requirements.

In November 2021, a major residential building company, Privium Group, went into voluntary administration and surrendered its contractor licence. SIRA maintained a high level of supervisory oversight to ensure that impacted homeowners were made aware of their entitlements and icare HBCF was providing timely and supportive claims management.

Regulation of healthcare providers

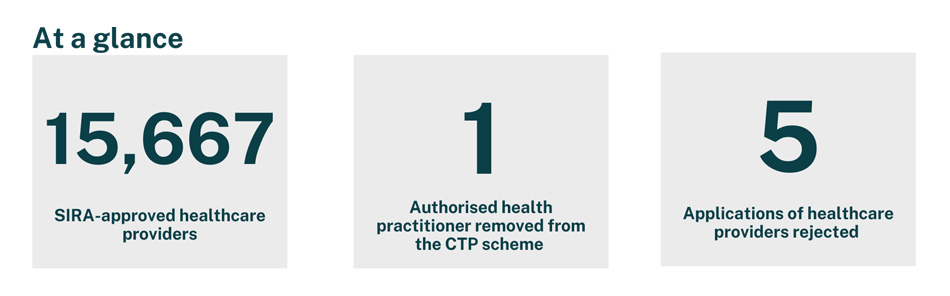

At the end of December 2021, a total of 15,667 practitioners had SIRA approval to act as an authorised health practitioner, allied health practitioner, injury management consultant, or workplace rehabilitation provider in the motor accidents and workers compensation schemes.

SIRA removed one authorised health practitioner in the 2017 motor accidents scheme this quarter as they no longer met the eligibility requirements.

SIRA undertook an assessment of workers compensation workplace rehabilitation providers following the implementation of a new approval framework in September 2021. The new Workers Compensation workplace rehabilitation provider approval framework required all approved providers to renew their approval so that they could continue delivering services beyond 31 December 2021. SIRA did not approve two practitioners to continue delivering services in the NSW workers compensation scheme. Another four providers did not seek renewal of their approval to work in the scheme post 31 December 2021.

1 October 2021 to 31 December 2021 | Motor accidents scheme | Workers compensation scheme | ||

|---|---|---|---|---|

Authorised Health Practitioner | Allied Health Practitioners | Injury Management Consultants | Workplace Rehabilitation Providers | |

SIRA approved | 9 | 156 | 0 | 87 |

Applied but not approved | 2 | 0 | 1 | 2 |

Practitioner initiated cessation | 1 | 5 | 1 | 0 |

SIRA initiated cessation | 1 | 0 | 0 | 0 |

Total number of active practitioners at end of period | 445 | 15,052 | 83 | 87 |