Print PDF

Specialised insurer licensing framework discussion paper

Introduction

The State Insurance Regulatory Authority (SIRA) regularly reviews its insurer regulatory frameworks to ensure requirements remain risk-based and focused on achieving customer and system outcomes.

This discussion paper will seek views on the existing licensing framework. SIRA will consider all feedback received during the consultation process and will ensure that changes to the specialised insurance licensing framework are tailored to current and anticipated future risk, regulatory, and economic conditions.

The specialised insurance licensing framework was last reviewed in 2014, before the commencement of the State Insurance and Care Governance Act 2015 which separated the regulator from the Nominal Insurer. The existing arrangements require review to ensure alignment with SIRA’s regulatory framework.

The closing date for submissions is 17 September 2021 1 October 2021.

Purpose

The purpose of this discussion paper is to seek views of stakeholders on opportunities to update the specialised insurer licensing framework by:

- aligning with the licensing frameworks of other SIRA regulated insurers;

- applying the Customer Service Conduct Principles;

- considering the Independent Pricing and Regulatory Tribunal’s (IPART) A best practice approach to designing and reviewing licensing schemes – Guidance material; and

- taking into consideration the outcomes of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

SIRA is seeking feedback on existing arrangements to determine:

- whether the current framework is fit for purpose; and

- where regulatory arrangements can be tailored to account for and address risks to achieving the objectives of the scheme.

We invite you to tell us your views by using our online form or emailing us directly following your consideration of the questions posed in this paper. Questions are posed at the end of each section. Further information about how to make a submission can be found on page 10 of this discussion paper.

SIRA will consider your response, reasoning and evidence for any change in determining licence conditions and changes to the framework.

Objectives

- Review the licensing application process and licensing conditions of specialised insurers to improve outcomes for customers and the workers compensation system.

- Align licence conditions of specialised and self-insurers and Home Building and Compulsory Third Party insurers where appropriate and possible.

- Establish conditions to mitigate insurer risks for specialised insurers taking into consideration the existing regulatory requirements (NSW workers compensation, the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission).

Background

Specialised insurance was established to accommodate mutual insurers which already provided insurance to specific industries before the commencement of the Workers Compensation Act 1926.

Specialised insurers are licensed under Division 3 of the Workers Compensation Act 1987 (the 1987 Act) to underwrite workers compensation liabilities and manage workers compensation claims for employers within a particular industry or class of business or employer.

SIRA has taken steps to strengthen its regulatory approach more generally since the 2015 legislative reforms which allowed for the development of Workers Compensation Market Practice and Premiums Guidelines and Licensed Insurer Business Plan Guidelines and gave power to the Government to make a regulation covering prudential standards for workers compensation insurers. SIRA has also issued Standards of Practice under s192A of the 1987 Act which established SIRA’s overarching principles and requirements for insurers’ management of claims to improve claimants’ experience, outcomes and support.

IPART: Review of licensing schemes

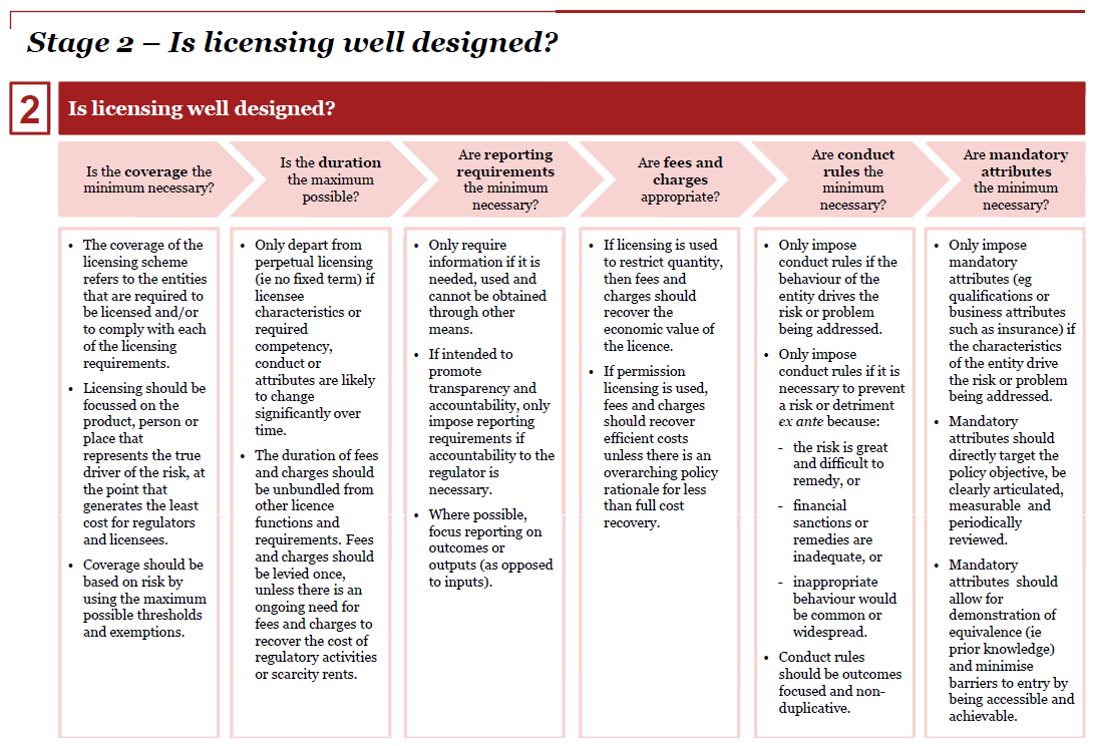

The Best practice approach to reviewing and designing licensing schemes commissioned by IPART in 2013 was developed based on best practice principles. It is intended to be applied as an assessment tool to both existing and proposed licensing schemes. The review of the self-insurer licensing framework will employ the IPART framework as the foundation of the proposed licensing requirements.

The IPART framework considers whether:

- licensing is an appropriate activity;

- the licensing framework is well designed;

- the licensing process is administered effectively and efficiently; and

- the licensing scheme is the best response.

Licensing is considered appropriate if:

- there is an ongoing need for action;

- nothing else addresses the problem;

- there is an ongoing need for a regulatory response; and

- licensing is still required to address the policy objectives.

This paper focuses on the design of the licensing framework. (see table below).

Figure 1 A best practice approach to designing and reviewing licensing schemes: conceptual framework Independent Pricing and Regulatory Tribunal

The key components of SIRA’s current specialised insurer licensing policy are:

- defined industry – properly defining the licence restriction;

- control and ownership – determining the extent of any control and ownership provisions;

- financial viability and security requirements – whether financial viability should be assessed and security is required given APRA’s regulatory regime; and

- case management and Work Health and Safety (WHS) management frameworks –assessment against SIRA’s criteria.

Further details of the current arrangements can be found at https://www.sira.nsw.gov.au/for-service-providers/insurers/workers-compensation/specialised-insurers.

Current state

Part 7, division 3 of the 1987 Act provides for the licensing provisions for licensed insurers. Section 177A of the 1987 Act enables a licence to be endorsed with a specialised insurer licence endorsement under certain conditions.

Unless authorised by specific legislation, a specialised insurer must be authorised under the Insurance Act 1973 (Commonwealth) to carry on general insurance business in Australia at all times during the term of a licence. A specialised insurer must comply with the financial conditions and directions to which its authority under the Insurance Act 1973 relates unless declared exempt by the Commonwealth.

Table 2 Current specialised insurers

Insurer | Type | Industry | Lines of business | APRA regulated | Licence granted |

|---|---|---|---|---|---|

Coal Mines Insurance* | Government monopoly Established under the Coal Industry Act 2001 | Coal Mining | Workers compensation only | No | N/A |

Racing NSW | Government monopoly Established under the Thoroughbred Racing Act 1996 | Racing | Workers compensation only | No | 1998 |

Guild Insurance Limited | National insurer | Pharmacy and Childcare | Diversified insurance products | Yes | 1964 |

Catholic Church Insurance Limited | National insurer | Catholic entities | Diversified insurance products | Yes | 1983 |

StateCover Mutual Limited | State insurer | Councils | Workers compensation only | Yes | 2001 |

HEM Limited | State insurer | Hotels and Clubs | Workers compensation only | Yes | 2008 |

*Section 7A of the 1987 Act and section 9A of the 1998 Act have the effect of establishing Coal Mines Insurance as a licensed specialised insurer. Due to various exemptions in the 1987 Act and the 1998 Act, SIRA’s regulatory oversight of Coal Mines Insurance is limited. As a result, any changes made to the specialised insurer licensing framework will have limited applicability to Coal Mines Insurance, and changes to the existing arrangements are out of scope for this review. SIRA will consult directly with Coal Mines Insurance to develop an appropriate supervision framework given its legislative exemptions.

Review of licensing arrangements

6.1 Licence endorsement

In accordance with section 177A of the 1987 Act, a specialised insurer will be licensed to underwrite policies limited to a particular industry or class of business or employer.

For potential and existing specialised insurers, any request to change the description of the endorsed defined industry or class of business or employer will require the specialised insurer to make an application to SIRA in accordance with SIRA’s requirements.

Preferred outcomes

- Continued alignment with legislative requirement

- Clarification of arrangements of existing specialised insurers

- Promote competition

- Careful balance to ensure industry focus and speciality is not diluted

Questions

- What percentage of an insurer's workers compensation business should the licensee be permitted to conduct outside of those within its defined employer, industry or class of business?

- Is there a better way for SIRA to define a particular industry other than by the Workers Compensation Industry Classification system?

- Are there any other matters SIRA should consider?

6.2 Control and ownership

Under section 177 of the 1987 Act, applications for licences by specialised insurers can be made by any corporation incorporated in New South Wales or any body corporate (subject to the regulations) if the application is conditional on the licence being endorsed with a specialised insurer endorsement.

The application must be supported by the relevant professional, business and other industry bodies involved in the particular industry or class of business or employer concerned, in accordance with section 177A(3)(b) of the 1987 Act. SIRA’s current licensing framework strengthens this section. SIRA requires that a specialised insurer is owned and controlled by a relevant professional, business or other industry body with a substantive, long established peak (and publicly recognised) involvement with the particular industry or class of business that is the subject of the proposed specialised insurance arrangement.

Preferred outcome

- Provide better clarity for new and existing specialised insurers

- Promote competitiveness.

Questions

- What are the benefits or barriers to achieving optimal outcomes for a specialised insurer to be required to be ‘owned and controlled’ by a relevant industry body as opposed to being ‘supported’?

- If you support ‘control and ownership’, should changes be made to the percentage of beneficial ownership and control? If so, why?

- If you don’t support ‘control and ownership’, what are your views on a better model that would drive positive outcomes for the system?

- Are there any other matters SIRA should consider?

6.4 Financial viability

Section 182(1)(c) of the 1987 Act enables SIRA to set conditions in relation to security for the purpose of securing the insurer’s liabilities under the Act. SIRA currently imposes security requirements on specialised insurers in line with its security policy.

Some specialised insurers have expressed concern that the current requirements impose investment constraints, create liquidity concerns and duplicate APRA’s capital requirements.

Preferred outcomes

- SIRA must ensure that all insurer liabilities are able to be paid in full in the event of insolvency.

- Address competitive neutrality concerns i.e. that any actual or potential specialised insurer can compete on even ground with the NSW Government’s Nominal Insurer.

- Improve insurer capacity for investment diversification and liquidity.

- Remove unnecessary potential duplicative regulatory requirements.

Questions

- What is the best way for SIRA to assure that all claims liabilities are funded by the insurer in the event of insolvency?

- Should SIRA require security from APRA regulated specialised insurers? If no, how do we address the risk in the event of insolvency?

- Should there be a review of the calculation methodology by which the security is determined?

- Are there any other matters SIRA should consider?

6.4 Work health and safety

A principal objective of SIRA under section 22 of the Workplace Injury Management and Workers Compensation Act 1998 (the 1998 Act) is to promote the prevention of injuries and diseases at the workplace and the development of healthy and safe workplaces. To facilitate this, SIRA’s current licensing framework requires a specialised insurer to implement a Work Health and Safety Loss Management Program to manage the WHS risks specific to its defined industry.

Preferred outcomes

- To promote the prevention of injury and illness in the workplace.

- Improve cost / benefit outcome of implementing a loss prevention program.

- To promote innovation within insurers in assisting employers to prevent work related injury.

Questions

- What is the best way for a specialised insurer to influence WHS outcomes for its employers?

- Are there any other matters SIRA should consider?

6.5 Conduct

Since its inception, SIRA has introduced expectations in relation to insurer conduct. These include:

While the expectation for an insurer to meet these conduct requirements has been made clear, an insurer’s adherence to the expectations outlined is not currently a condition of its licence.

Preferred outcomes

- Insurers achieve compliance with the legislation and conduct themselves in a manner which provides system participants with positive experiences and outcomes.

- Insurer conduct is in line with community and regulator expectations.

Questions

- How can SIRA best ensure specialised insurers adhere with conduct expectations?

- Should conduct expectations be included in the licence conditions?

- Are there any other matters SIRA should consider?

6.6 Culture and Governance

SIRA currently requires through its licence conditions that the directors of the licensee must collectively have extensive experience and skills in the defined industry, workers compensation insurance and underwriting. This current licence condition seeks to ensure a board is competent to enable the effective governance and oversight of the licence and workers compensation performance.

Preferred outcomes

- Insurer has a robust governance framework in place, providing oversight and understanding of workers compensation outcomes and performance.

- Insurer can demonstrate sound prudential management.

- The board fosters a culture of compliance and risk management.

- Insurer is professional and transparent in its engagement with the regulator.

Questions

- Does the current licence condition address the preferred outcomes?

- Should an additional licence condition be imposed on specialised insurers which requires a self-insurer’s board to demonstrate the required level of expertise and skill in workers compensation and that its workers compensation insurance business is conducted in line with the objectives of the legislation?

- Are there other ways to achieve, demonstrate and assess improved outcomes / governance?

- Are there any other matters SIRA should consider?

6.7 Claims Handling

Currently SIRA requires that an insurer must maintain the necessary infrastructure, systems, processes and resources to perform its obligations and functions (including injury, claims and complaints management) as a licensed insurer in accordance with legislative requirements and to the commercial standards acceptable to SIRA. Additionally, before outsourcing the whole or any part of any key operational functions the licensee must obtain SIRA’s approval.

When a function is outsourced to a third-party, a specialised insurer as the licensed entity remains accountable for the performance of outsourced parties and any instances of non-compliance.

Preferred outcomes

- Ensure appropriate accountability and understanding its obligations by the licensed entity.

- Ensure appropriate capability and capacity of the functions of the insurer to achieve good outcomes for system stakeholders.

Questions

- How can SIRA utilise its licensing frameworks to drive better return to work outcomes for specialised insured employers and their workers?

- How can SIRA best ensure that specialised insurers maintain appropriate oversight of outsourced arrangements, given their continued accountability?

- Should SIRA’s approval be required for outsourcing arrangements?

- Are there any other matters SIRA should consider?

6.8 Licence duration

Section 180 of the 1987 Act provides that a licence granted continues in force until the expiration of the period specified in the licence (if any). The current licensing framework allows a maximum five-year fixed licence term.

Section 183 of the 1987 Act provides for the cancellation or suspension of licences.

IPART recommends perpetual licensing with the intent of minimising the administrative burden on the licensee and the regulator.

Preferred outcomes

- The licence term reflects the ongoing nature of claim liabilities.

- The licensee is authorised to hold a specialised insurer licence without restrictions providing they meet their legislative and regulatory obligations

- The licence term takes into account SIRA’s enhanced supervision activities as an oversight mechanism that replaces some of the historical functions of five-yearly licence renewal.

Questions

- What are the benefits or risks for SIRA to introduce the concept of having an indefinite licence period?

- If an indefinite licence term were to be considered, what licensing restrictions would be appropriate in the case where specific performance risks / issues were identified?

- If an indefinite licence term were to be considered, and SIRA formed the view that the specialised insurer was no longer complying with their legislative and regulatory obligations, what should the process be to give notice to cancel or suspend the licence?

- What are the benefits in restricting an insurer from issuing policies through their licence, rather than cancelling a licence, to ensure the insurer continues to manage their run-off under the regulated licence conditions?

- If an indefinite licence term is not the best option, how should licence term be determined? What should the maximum term be?

- Are there other matters for SIRA to consider?

6.9 Any other comments?

Is there anything that SIRA can implement in its licensing framework to drive improved outcomes for specialised insured employers and their workers?

How to make a submission

SIRA invites individuals and organisations to contribute to share their views, experiences and insights on the specialised insurer licensing framework.

The consultation questions in this paper are not intended to be exhaustive, but rather are provided to assist with focusing feedback on key considerations. While SIRA encourages stakeholders to address the consultation questions within their submission, this is not a requirement and all feedback will be considered.

You are encouraged to attach any evidence that will support your views and provide specific examples where possible.

Your submission can be lodged via:

- the SIRA website www.sira.nsw.gov.au

- email to [email protected]

The closing date for submissions is 17 September 2021 1 October 2021.

Submissions to this consultation may be published on the SIRA website. If you do not wish to have your submission published, please state this clearly on your submission