GN 5.1A Calculating PIAWE

This guidance applies to the calculation of PIAWE for workers injured on or after 21 October 2019. For workers injured prior to 21 October 2019, see GN 5.1 Calculating PIAWE for workers injured before 21 October 2019.

This guidance does not apply to exempt workers or coal miners.

Overview

Workers compensation legislation requires the insurer to commence provisional weekly payments of compensation within seven days after initial notification to the insurer of an injury, unless there is a reasonable excuse for not commencing weekly payments.

In order to commence weekly payments of compensation, the insurer must calculate the worker’s pre-injury average weekly earnings (PIAWE). The calculation of the worker’s PIAWE is a work capacity decision under section 43(1)(d) of the Workers Compensation Act 1987 (1987 Act).

Pay information should be requested from the employer as soon as practicable to meet the legislated timeframe for commencing weekly payments - see sections 267 and 275 of the Workplace Injury Management and Workers Compensation Act 1998 (1998 Act).

Insurers may consider taking proactive steps to gather earnings information for a worker who presents with a certificate of capacity with restrictions, but where there is no loss of earnings.

Workers and employers can reach an agreement as to the amount of a worker’s PIAWE- see Schedule 3, clause 3 to the 1987 Act and Division 4, Part 4 of the Workers Compensation Regulation 2016 (2016 Regulation). For the insurer to commence weekly payments within seven days of initial notification, the agreement is to be reached promptly.

Definition of ‘pre-injury average weekly earnings’

PIAWE is the average of a worker’s gross weekly earnings over the 52 weeks prior to their date of injury. There are some exceptions to this definition which are noted below.

If a worker is employed by more than one employer at the date of injury, the earnings for all jobs are considered when determining PIAWE (see Schedule 3, clause 2 of the 1987 Act).

Refer to the PIAWE Reference Guide for an overview of how to calculate PIAWE.

Earnings and income

Earnings is income received by the worker for work performed in any employment during the relevant earning period. This can include wages, shift and other allowances, overtime amounts, commissions, the value of non-monetary benefits (if a worker no longer has the use of the benefit - see section non-monetary benefits below for further details), salary sacrificed superannuation contributions and piece rates.

Schedule 3, clause 6(2) to the 1987 Act outlines what is not considered income for the purposes of calculating PIAWE:

- compulsory superannuation contributions made by the employer

- a non-monetary benefit if the worker continues to be entitled to the use of the benefit after the injury

- compensation for loss of earnings under an insurance or compensation scheme (this includes workers compensation payments made during the relevant earning period), and

- any discretionary payment made without obligation by the employer (this can include incentive bonus payments).

Allowances

A worker can receive an allowance related to the performance of overtime or shift work (for example, a meal allowance). Other common allowances include allowances for uniforms, tools and equipment, and first aid. However, any allowances which the worker has received or is entitled to receive reimbursement for are not considered as earnings.

Commissions

Workers who receive commission payments are paid based on completion of a task, or by how much they sell. This may or may not be in addition to an hourly rate of pay.

Piece rates

Workers receiving piece rates are paid for each unit of production at a given rate, rather than receiving an hourly rate of pay for their work.

JobKeeper payments

Any additional payment subsidised by the JobKeeper scheme are not considered earnings (that is, any ‘top-up’ component of the JobKeeper scheme payment) for the purposes of calculating PIAWE (see Schedule 3, clause 10 of the 1987 Act). The JobKeeper scheme payments ceased on 31 March 2022.

Non-monetary benefits

Non-monetary or ‘non-cash’ benefits are earned by workers in the place of salary. They can include, for example, education fees, residential accommodation, child care or the use of a motor vehicle.

The 1987 Act and Part 10 of the Workers Compensation Guidelines (Guidelines) state that non-monetary benefits must 'be provided to a worker for the performance of work by the worker' and 'expressly [provide] a personal benefit to the worker'.

A worker is considered to have been provided with a non-monetary benefit if they have use of the non-monetary benefit at the date of injury. The non-monetary benefit may only be included in the worker’s PIAWE from the date that the benefit has been relinquished by the worker or withdrawn by the employer after the injury (see Schedule 3, clause 6(3) of the 1987 Act).

Salary sacrificed items can be considered non-monetary benefits if they are included as part of a salary package. If the value of the item is included in the gross earnings as part of a salary package, the value of the item will need to be separately identified if the non-monetary benefit is retained by the worker. Salary sacrificed superannuation contributions (i.e. the value of any voluntary contribution amounts made from a worker’s pre-tax earnings over and above the minimum amount paid by the employer to meet the employer’s superannuation obligations under federal legislation) forms part of a workers gross earnings for the purposes of calculating PIAWE.

Amending PIAWE to include the value of non-monetary benefits

If a non-monetary benefit is relinquished by the worker, or withdrawn by the employer, after PIAWE has already been determined and applied, the worker’s PIAWE must be amended to include the value of the benefit. The new PIAWE amount is effective from the date the worker is no longer entitled to the non-monetary benefit.

- If the PIAWE amount had originally been determined by the making of a work capacity decision by the insurer, the insurer is to determine the monetary value of the non-monetary benefit and include this value into PIAWE by making a work capacity decision (under section 43(1)(d) of the 1987 Act). A work capacity decision notice is to be sent to the worker and written advice of the new PIAWE amount is to be provided to the employer.

- If the original PIAWE amount had been determined by agreement between the worker and the employer, the worker and employer may agree a value for the non-monetary benefit. In this situation the original agreement may be varied to include this value in the worker’s PIAWE, however it is still subject to the insurer's approval. This new agreed PIAWE becomes the new PIAWE, and the worker and the employer are to be advised in writing of the new PIAWE amount.

- If the original PIAWE amount had been determined by agreement, and the worker and employer cannot agree on the value for the non-monetary benefit, the insurer is to make a work capacity decision regarding PIAWE. A decision notice is to be sent to the worker, and written advice of the new amount is to be provided to the employer. The work capacity decision must include an insurer calculation of PIAWE (rather than simply reflect the amount agreed in the original agreement).

Calculating the value of a non-monetary benefit

There are two ways to calculate the value of a non-monetary benefit, depending whether fringe benefits tax applies (see below).

The value is calculated as an annual amount. This figure is to be divided by 52 weeks to determine a weekly amount. This weekly amount is then multiplied by the number of weeks in the relevant earning period and added into the worker’s gross earnings.

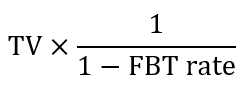

If fringe benefits tax applies

The employer or the Australian Tax Office (ATO) can advise whether fringe benefits tax applies to a non-monetary benefit. The formula provided in Schedule 3, clause 7(2) of the 1987 Act is used to calculate the value of the non-monetary benefit.

Value as a fringe benefit is to be determined in accordance with the formula:

TV is the taxable value of the benefit as a fringe benefit under the Fringe Benefits Tax Assessment Act 1986 of the Commonwealth.

FBT rate is the rate of fringe benefits tax imposed by the Fringe Benefits Tax Assessment Act 1986 of the Commonwealth that applies when the non-monetary benefit was provided to the worker.

The taxable value of the benefit can be obtained from the employer. An employer must lodge a Fringe Benefits Tax (FBT) return if they have a liability during an FBT year (between 1 April to 31 March). The FBT rate is available from the ATO website and is the rate applicable when the non-monetary benefit was provided to the worker.

If the benefit is exempt from fringe benefits tax

If an item is exempt from fringe benefits tax, the amount reasonably payable for that non-monetary benefit must be used. In most cases, this amount can be obtained from the employer, as the employer is required to keep these records for tax reporting purposes.

Part 10.3 of the Guidelines includes the following factors to be considered when determining the monetary value of a non-monetary benefit:

- Pay As You Go (PAYG) summaries provided to the worker, or accounting / tax return information for working directors

- the worker’s contract of employment

- records kept by the employer as to the value of the non-monetary benefit

- any records kept by the worker

Insurers may consider other available information where appropriate to do so.

Where this information cannot be obtained from the employer, the insurer will need to determine the amount with reference to other comparable sources. For example, the Rent and Sales Report produced by the NSW Department of Communities and Justice can be used as a guide for the reasonable rental amount that is payable for residential accommodation that is not subject to fringe benefits tax.

(See Schedule 3, clause 7 of the 1987 Act)

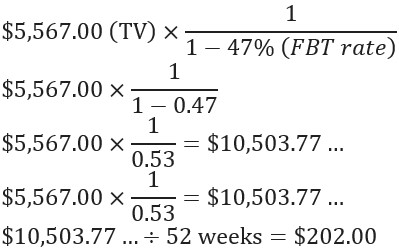

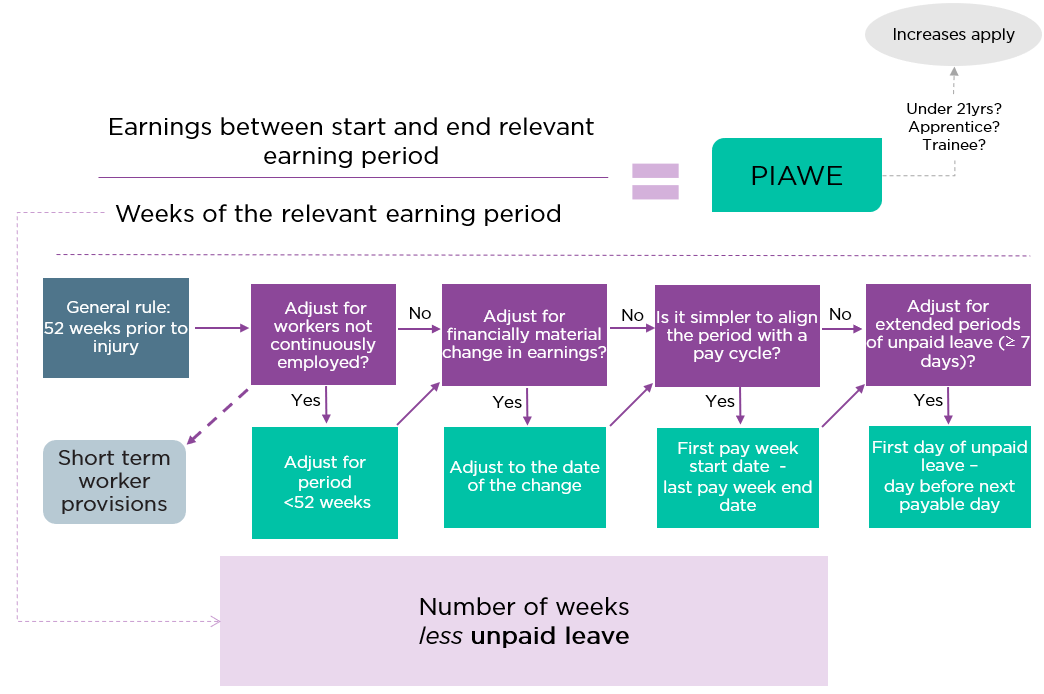

Relevant earning period

The relevant earning period is the 52-week period before the worker's date of injury. The relevant earning period may be adjusted in the following situations, and in the following order:

- to take into account a period of less than 52 weeks of continuous employment with the pre-injury employer

- to take into account any financially material change in the workers earnings circumstances

- to align with any regular interval at which the worker is paid (optional)

- to take into account periods of unpaid leave

- to take into account a financially material reduction in earnings due to the COVID-19 pandemic in the prescribed periods.

Relevant earning period workflow

(See Part 4, Division 2 of the 2016 Regulation)

An alternative method exists for workers continuously employed with the pre-injury employer for less than four weeks (refer to the section on ‘short term workers’ below).

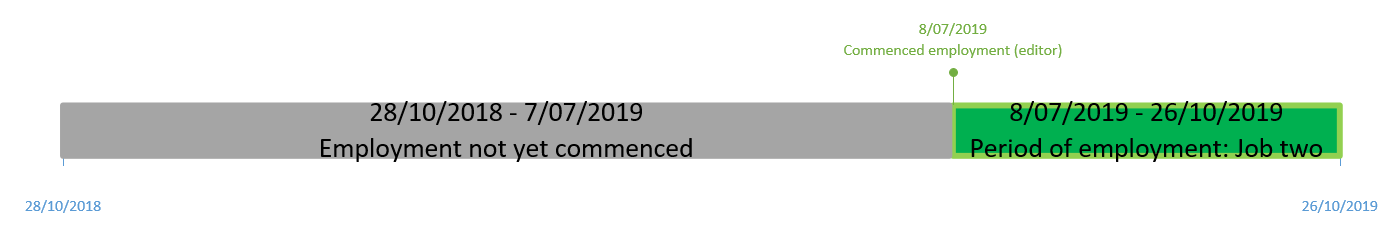

Workers not continuously employed

If a worker has been continuously employed with their pre-injury employer for less than 52 weeks, the relevant earning period is adjusted to exclude the period before their first day of employment.

Financially material change to earnings

If there was an ongoing change to the worker’s employment arrangement resulting in a financially material change to the worker’s earnings during the 52 weeks immediately prior to the injury, the relevant earning period is adjusted to exclude the period before the change (see section 8C of the 2016 Regulation).

Examples include an ongoing (not temporary): change in role, change in duties, change in work hours (such as part time to full time), promotion, demotion or other change in earnings circumstances. A worker’s individual circumstances must be considered when determining if the change is financially material.

Alignment of relevant earning period with the worker’s pay period

An insurer may choose to align the workers relevant earning period with the employers pay period if it will make the determination of PIAWE more straightforward (see section 8D of the 2016 Regulation).

This approach is not to be used if the insurer considers that, by aligning with the pay period, the result would likely decrease the worker’s PIAWE.

The period may be adjusted in any way (shifted, reduced or extended) but may not be adjusted so that it commences on a day before the day on which a material and ongoing change to the worker’s earnings took effect.

This provision makes it easier for insurers to determine a worker’s earnings during the relevant earning period by enabling insurers to adjust the relevant earning period so that:

- the relevant earning period commences on day one of the first full pay period in the 52-week period immediately prior to the date of injury, or

- where there has been a material and ongoing change in the worker’s earnings during the 52 weeks immediately prior to the date of injury, the relevant earning period commences on the first day of the first full pay period after the day on which the change in the worker’s earnings took effect

AND

- the relevant earning period ends on the last day of the last full pay cycle immediately prior to the date of injury.

Unpaid leave

The relevant earning period for a worker is to be adjusted if, during any period of seven or more consecutive calendar days within the relevant earning period the worker did not receive earnings and took a period of unpaid leave. That period of unpaid leave is to be excluded from the relevant earning period for the worker. The excluded period is defined from the first day of unpaid leave and ends on the day before the worker returns to work or to a day of paid leave.

An unpaid maternity leave arrangement may be dealt with in accordance with the unpaid leave provisions, depending on the return to work arrangements after the maternity leave period.

Financially material reduction in earnings due to COVID-19

Changes made to the calculation of PIAWE impacted by the COVID-19 pandemic apply from 23 October 2020.

Clause 8EA of the 2016 Regulation allows for adjustment to the relevant earning period for workers who have had a change in their employment arrangements due to the impact of the COVID-19 pandemic on their employer. The change must result in a financially material reduction in the worker's earnings. This includes earnings reduced to zero. A reduction in earnings may arise from a worker working fewer hours or accepting a lower rate of pay.

There are two prescribed periods which may be excluded from the relevant earning period:

1. First prescribed period

The first prescribed period is 23 March 2020 to 14 June 2020. The whole period is excluded from the relevant earning period if the worker experienced a material reduction in their earnings over the entire prescribed period.

2. Second prescribed period

The second prescribed period commences on 15 June 2020 and ends on the earlier of:

- 27 September 2020 or

- the day before the worker earns in any employment.

The second prescribed period may only be excluded if the worker’s relevant earning period has already been adjusted by the exclusion of the first prescribed period.

If at the end of the first prescribed period, the worker had no earnings for work performed in any employment, the second prescribed period is to be excluded. This means the worker was not performing any work, but may have been receiving the JobKeeper Scheme payment. Note that workers remain continuously employed if they have been temporarily ‘stood down’ during the pandemic but remain employed by the employer.

Casual and seasonal workers

Calculating PIAWE for casual or seasonal workers requires careful consideration of the relevant earning period. Casual and seasonal workers may have long periods not working, or they may work for multiple employers during the unadjusted relevant earning period.

Casual workers do not receive paid leave, but their employer can agree for workers to not work for holidays or for other reasons. Gaps in employment may be due to lack of availability of work, or due to worker choice.

The relevant earning period may be adjusted for these workers as it is for all workers.

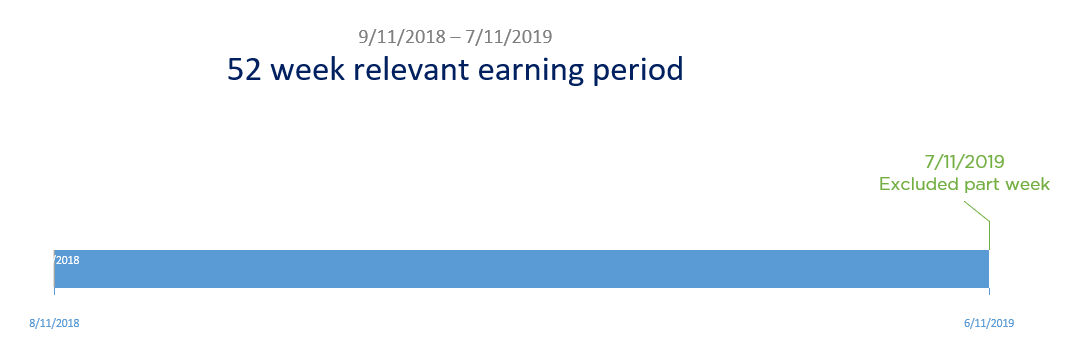

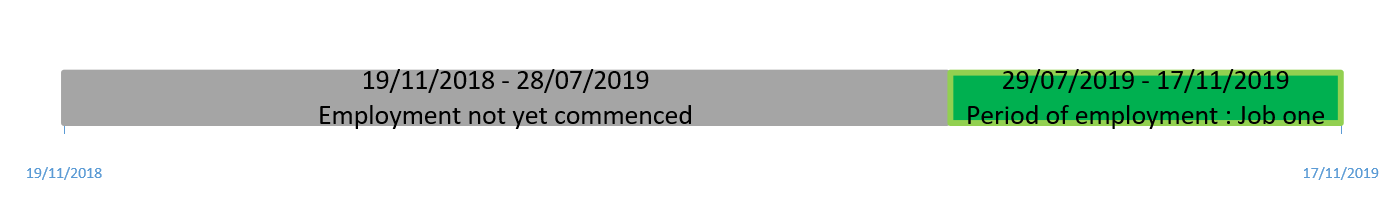

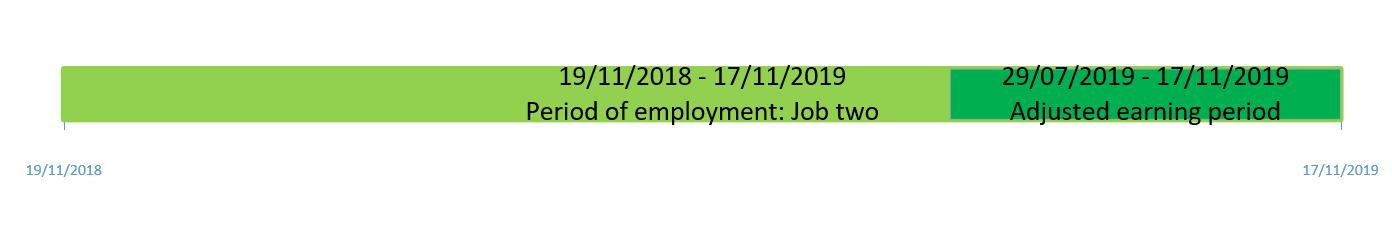

Concurrent employment

If a worker is employed in more than one job at the time they sustain an injury, any jobs other than the job in the course of which the injury arose (“primary job”) are considered secondary employment.

The average weekly earnings are calculated for all secondary employment in the same way as average weekly earnings are calculated for the primary job.

The earnings and earning periods for each of the jobs are determined separately. The average weekly earnings for each employment are then added together to determine PIAWE.

Short term workers

Workers who have been continuously employed by the same employer for less than four weeks before their injury may have their PIAWE calculated by having regard to the weekly earnings they could have expected to earn in that employment in the 52-weeks after the injury (see Schedule 3, clause 4 of the 1987 Act).

When considering prospective earnings, the insurer is to take the following into account:

- any contract of employment (in writing or implied) in place before the date or injury

- any award or enterprise bargaining agreement for the worker

- pre-injury hours worked and earnings received during the 52 weeks prior to the injury.

Should the above points be of limited assistance, regard can be given to the average weekly amount earned by others performing similar work as the worker (whether or not with the same employer), during the 52-weeks before the injury.

A short-term worker may also have their PIAWE calculated using the relevant earning period before their date of injury.

Note: Before considering which option to use for a short-term worker, the insurer should take into consideration which option is the fairest approach for the worker.

See clause 8F of the 2016 Regulation.

Apprentices, trainees and young people

Some workers are entitled to incremental earning increases at certain ages or stages during their employment (see Schedule 3, clause 5 to the 1987 Act).

This includes:

- workers under the age of 21

- apprentices, or

- trainees for the purposes of becoming qualified to carry on an occupation to which the contract of employment relates.

For these workers, PIAWE is to be recalculated at each age or stage in accordance with what they would have been entitled to receive, had they not become injured and continued in that employment.

Insurers are to assess the considerations listed in the table below as outlined in Table 10.1 in Part 10 of the Guidelines.

| Consideration | Detail |

|---|---|

| The relevant Award or Enterprise Bargaining Agreement (EBA) | If the worker is paid in accordance with an Award or EBA then the hourly base rate of pay and any applicable penalty rates and allowances are to be used. |

| A comparable relevant Award or EBA | If the worker is not paid in accordance with an Award or EBA, however there is a similar relevant Award or EBA that could apply to the worker, this may be used. |

| Comparable average earnings | Where no Award or EBA applies to the worker a rate can be determined by reference to the average weekly amount earned by other workers in the same employment for the performance of similar work. The rate determined is to be based on the date the amount is to be applied. |

No applicable rate for a worker who has reached 21 years

If there is no rate applicable to a worker who has reached the age of 21 years, the worker is entitled to receive a rate which is based on a worker who has reached the age of 21 years who performs similar work to the worker in the same employment as the injured worker. If such information is not available, an insurer may determine a rate for these workers based on a rate for a worker who has reached the age of 21 years in a similar but not necessarily in the same employment as the injured worker.

For the purposes of comparison, consideration should be given to the average weekly earnings received by workers performing similar work as the worker during the 52 weeks before they reached the age of 21 years. This rate will be determined based on rates current at the time.

If it is not possible to establish a comparable rate the maximum weekly compensation amount is to be used - see clause 8G of the 2016 Regulation. Note that where the maximum is to be used as PIAWE, the weekly payment formula applies to this rate (that is, taking 95% or 80% of the maximum weekly amount).

The Labour Market Insights website is a useful resource for determining a rate in a similar industry.

Minimum PIAWE

The minimum PIAWE is $155 and is set by clause 8AB of the 2016 Regulation. This amount is not indexed.

If a worker’s PIAWE is calculated to be lower than the minimum PIAWE ($155), then the minimum PIAWE is to be set as the worker’s PIAWE. The minimum PIAWE is not to be used as an interim PIAWE until an insurer has sufficient information to determine PIAWE, unless the insurer has evidence that the worker's PIAWE is likely to be less than $155 per week.

PIAWE Agreement

A worker and employer may reach agreement about the worker's PIAWE. If the insurer is satisfied that such an agreement reasonably reflects the worker's PIAWE and is otherwise fair and reasonable, the insurer must approve and give effect to that agreement. See Part 4, Division 4 of the 2016 Regulation.

If the worker has more than one job when they sustain their injury, the worker and the employer for the job in which the worker was injured may reach agreement about average weekly earnings for multiple jobs.

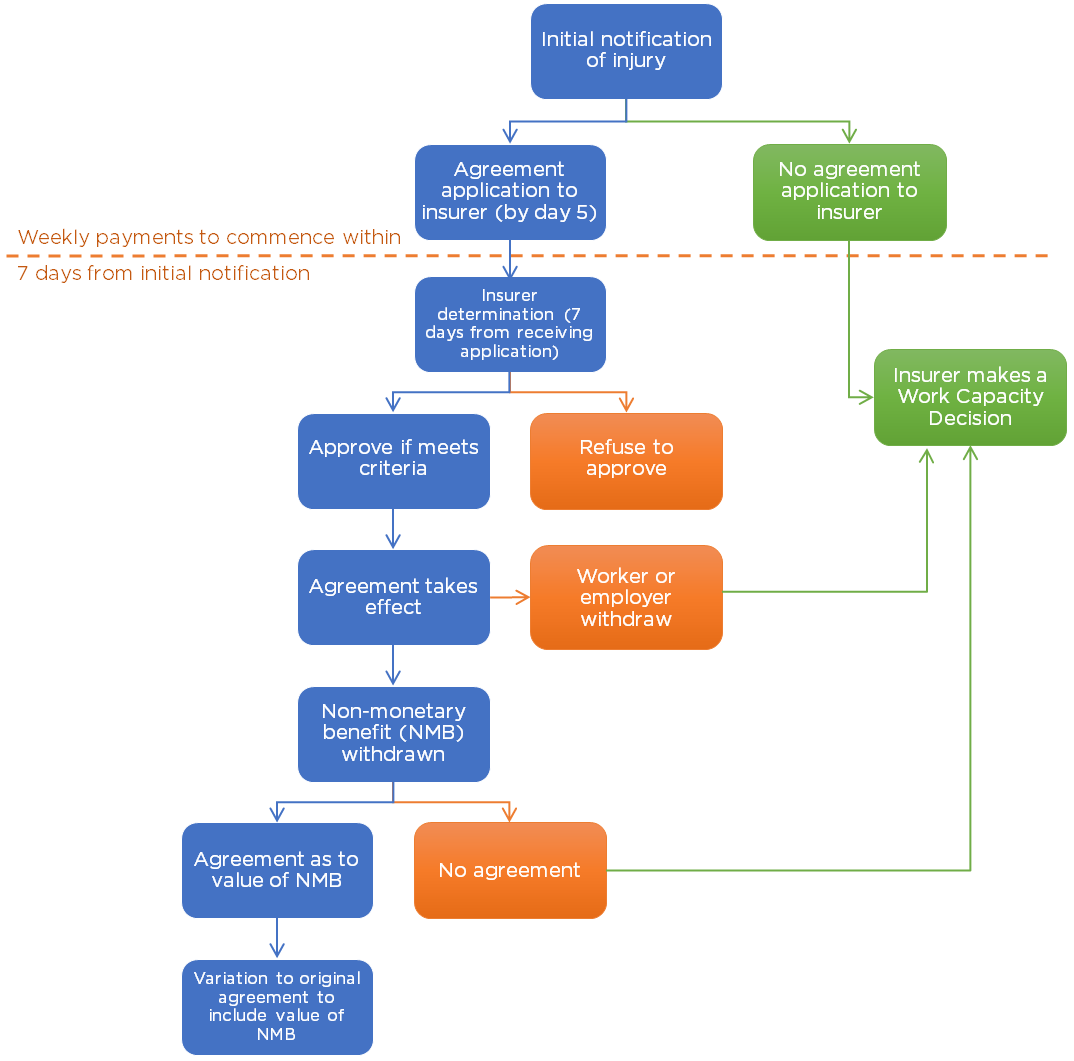

Agreement workflow

Application for approval

A written application for approval is to be made by either the worker or the employer within 5 days of notification of the injury to the insurer (see clause 8J of the 2016 Regulation).

The application must include:

- the agreed PIAWE amount*

- the date of the agreement

- the worker's name, injury date and claim number

- the employer's name

- the name and contact details of the person authorised by the employer to enter into the agreement

- details of any other employment in which the worker is engaged

- any evidence which supports the agreement (e.g recent payslips or contract of employment)

- any other information the employer or worker considers were taken into account in reaching the agreement

- acknowledgement of consent to the agreement

* The agreed PIAWE remains subject to minimum PIAWE.

SIRA has an application for approval of a PIAWE agreement form, which can be used by the worker and employer to meet the above requirements.

The worker's and employer's consent can be provided by a physical signature or electronic signature on a single application document. It may also be provided by email, as long as the insurer is satisfied that both the worker and employer have given their express consent to the agreement (for example, the consent was sent in an unbroken chain of emails together with the information required in clause 8J of the 2016 Regulation).

Approval of the agreement

The insurer is to approve or refuse to approve the agreement within seven days of receiving the application. After the application is determined, the insurer must notify the worker and employer of the outcome of the determination. The approval of the agreement is not a work capacity decision.

The insurer is to approve the agreement if they are satisfied that the agreed amount reasonably reflects the worker’s PIAWE and that the agreement is fair and reasonable.

PIAWE agreements were designed to be less administratively burdensome by easing the requirement for insurers to gather pay, leave and employment-related information to calculate PIAWE. The insurer is to decide what supporting information they require to be satisfied for approval.

If the insurer has disputed liability, they cease to have an obligation to approve or refuse the agreement.

If the insurer has a reasonable excuse for not commencing weekly payments, the insurer has seven days to approve or refuse to approve the agreement after the earlier of:

- ceasing to have a reasonable excuse, or

- the claim being accepted.

If a worker is under legal incapacity, an insurer must not approve a PIAWE agreement (see clause 8K(5) of the 2016 Regulation). A person under legal incapacity includes:

(a) a child under the age of 18 years,

(b) an involuntary patient or forensic patient within the meaning of the Mental Health Act 2007,

(c) a person under guardianship within the meaning of the Guardianship Act 1987,

(d) a protected person within the meaning of the NSW Trustee and Guardian Act 2009, and

(e) an incommunicate person, being a person who has such a physical or mental disability that prevents the person from receiving communications, or expressing their will, in relation to their property or affairs.

The insurer still has the obligation to commence weekly payments within 7 days of initial notification. The agreed amount (not yet approved by the insurer) can be used to make weekly payments until the agreement has been determined. This is an interim payment decision and is not a work capacity decision.

An insurer cannot make a work capacity decision about PIAWE before the application for the agreement is determined, and an insurer cannot approve the application if it was made after a work capacity decision about PIAWE was made.

Variation of the agreement

An agreement about PIAWE may only be made once. However, the agreement may be varied to include the cash value of a non-monetary benefit where it is withdrawn after injury.

Withdrawal of the agreement

The worker or employer can withdraw from the agreement at any time by giving written notice to the other party and to the insurer.

Following this, the insurer is to make a work capacity decision to determine PIAWE within 7 days. They must provide the worker and employer with written notice of the withdrawal from the agreement and advise the amount of the new PIAWE in a work capacity decision notice.

If the new PIAWE amount is higher than the PIAWE amount in the withdrawn agreement, the worker is to be paid the back payment in accordance with the following formula:

X – Y = Z

Where:

X is the amount of weekly compensation the worker should have received (based on the new PIAWE) from the date the worker first became entitled to weekly payments up to the date in which the last weekly payment was made.

Y is the amount of weekly compensation already paid to the worker over the same period.

Z is the amount owed to the worker over the same period (that is, the “adjustment payment”).

All future payments are to be based on the new PIAWE as determined by the insurer.

Interim PIAWE

To enable weekly payments to commence within 7 days of notification, insurers can use an 'interim PIAWE' if there is likely to be a delay in determining a PIAWE agreement or in receiving all the information to determine PIAWE.

Interim payment decision

If an insurer is not able to approve or refuse to approve an application for agreement by day 7 from initial notification of injury, they may give effect to the agreed amount in the application. This is an interim payment decision and allows the insurer to make weekly payments based on the agreed amount of PIAWE until the application for approval of the agreement has been determined.

The same timeframes continue to apply to approval of the agreement. An interim payment decision is not a work capacity decision. If an insurer subsequently refuses to approve the agreement, they are to determine PIAWE by a work capacity decision.

If the calculated PIAWE is higher than the amount in the agreement, the new rate and the outstanding adjustment payment is to be made to the worker within 14 days from the date of the work capacity decision (see clause 8N to the 2016 Regulation).

Work capacity decision

Insurers should request pay information from the employer as soon as possible. The insurer can inform the employer of their obligation under section 264(2) of the 1998 Act, which requires employers to provide information to insurers within seven days of the insurer’s request.

If an insurer determines that there is likely to be a delay in receiving sufficient information to determine PIAWE to enable weekly payments to commence within seven days of notification, they should request supporting information from the worker to inform an interim PIAWE calculation (see Standard of Practice 7: Interim pre-injury average weekly earnings). Insurers can also consider relevant Awards found on the Fair Work website.

The amount of the interim PIAWE and how that amount was determined must be communicated to the worker by way of a work capacity decision (see section 43(1)(d) of the 1987 Act).

The worker should be informed that this PIAWE is an interim amount until sufficient information is provided to enable the correct PIAWE to be determined.

The minimum PIAWE is not to be used as an interim PIAWE unless the insurer is satisfied that a worker's PIAWE will be less than $155 per week.

The insurer should also advise the worker that an adjustment payment may be payable if PIAWE is later determined to be higher than the interim amount. The new rate and the outstanding adjustment payment must be made to the worker within 14 days from the date of the work capacity decision (see clause 8N to the 2016 Regulation).

Note: An insurer is to continue to engage with the employer to obtain the missing information to determine the worker’s correct PIAWE.

Where there is an interim PIAWE, and the employer does not respond to insurer requests for information, the insurer may contact SIRA on 13 10 50 to determine whether further action is required.

Self-employment and working directors

PIAWE for self-employed workers and working directors is calculated as it would be for all eligible workers. However, the types of evidence gathered may be different based on the worker’s earning circumstances. Business activity statements reflect business activity only and are therefore not useful, and payslips are generally not available. Useful information may include:

- pay as you go (PAYG) summaries

- group certificates/tax returns

- bank statements.

Indexation of PIAWE

Indexation of a worker’s PIAWE is considered on 1 April and 1 October each year (see Part 3, Division 6A of the 1987 Act).

Refer to Insurer guidance GN 5.13 Indexation for more information on how indexation is calculated for weekly payments.

Gathering information for the PIAWE calculation

The insurer needs to gather as much information as possible to calculate the correct entitlement for the worker. This may include:

- a completed PIAWE form

- copies of payslips or any available payroll records covering the relevant earning period

- any relevant Fair Work instrument, contract of employment or enterprise bargaining agreement

- leave records

- tax returns

- any other supporting documentation specific to a worker’s employment circumstances, including dates and amounts relating to ongoing changes in earnings during the relevant earning period.

If the worker has more than one job at the time of injury, the above information (where relevant) should be gathered for the worker's employment with all employers.

Phone 13 10 50

Email [email protected]