Workers compensation system explanatory note December 2020

About this month’s system performance results

Effectiveness

The monthly dashboard reports on the effectiveness of the workers compensation scheme in returning workers to work, measures include ‘return to work’ rate, and ‘maintaining work’ rate. The trends in these measures indicate the scheme’s performance and health.

Research indicates that recovering at work where possible or early return to work after an absence from work can improve worker outcomes. SIRA’s current strategic priorities include improve return to work (RTW) outcomes for people injured at work, and better reporting and measurement of RTW in NSW.

Return to work (RTW) rates (work status code by the date the claim was entered into the system)

The RTW rate is the proportion of injured workers who had returned to work after having time off work following a work-related injury. RTW rate is measured using work status code at time intervals of 4, 13, 26, 52 and 104 weeks. This measure is part of SIRA’s review of the metrics and is likely in the future to be based on date of injury rather than the date the claim was entered into the information system by the insurer.

This month’s RTW rates (December 2020) show a month on month decrease at 4 time intervals (4, 13, 26 and 104 weeks) however the 52 week time interval shows a modest increase of 0.17 percentage points.

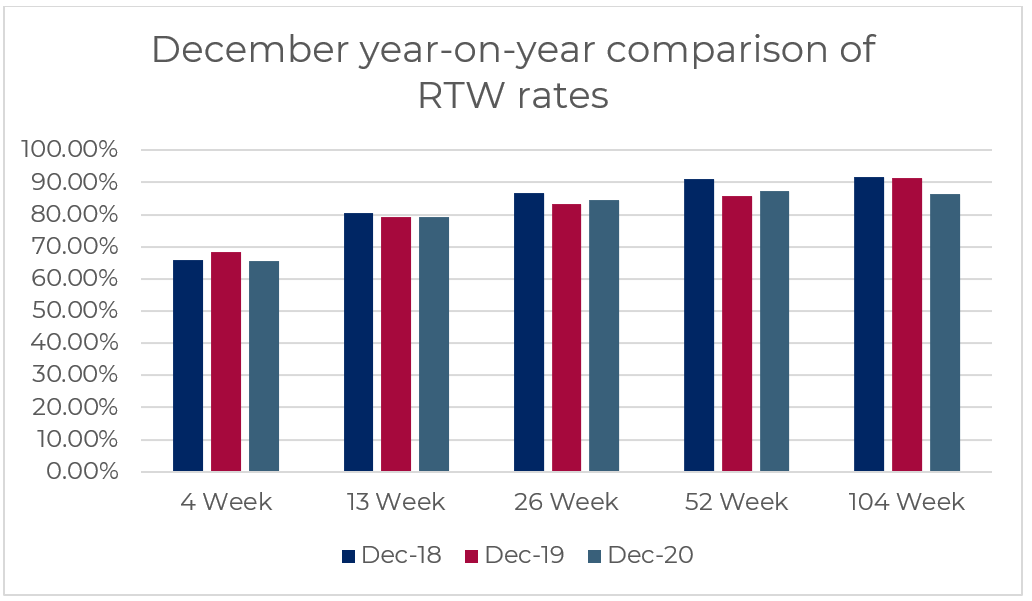

The table below shows the year-on-year changes in RTW rates. The December 2020 RTW rates have slightly decreased at 4 weeks’, 13 weeks’ and 104 weeks’ time intervals, compared with December 2019 RTW rates. The December 2020 RTW rates have increased for 26 weeks’ and 52 weeks’ time intervals.

RTW rates | December 2020 | December 2019 | Percentage points change |

|---|---|---|---|

4 weeks | 65.53% | 68.35% | - 2.82 |

13 weeks | 79.22% | 79.24% | - 0.02 |

26 weeks | 84.48% | 83.43% | + 1.05 |

52 weeks | 87.22% | 85.64% | + 1.58 |

104 weeks | 86.32% | 91.48% | - 5.16 |

While RTW rates have improved for 4, 13 and 26-week time intervals, the RTW rates at all the five time intervals in December 2020 remains lower than the rates in December 2018, as shown in the graph below.

Efficiency

Weekly benefits

Number of workers receiving weekly benefits

The number of workers receiving weekly benefits significantly increased year-on-year representing a risk to the scheme and workers outcomes. There were 37,821 workers receiving weekly benefits in December 2020, compared to 34,421 workers in December 2019. It was an increase of 3,400 workers (9.9% increase).

Weekly payments

Total weekly payments made in the 12 months ending December 2020 increased by $260M (19% increase) compared to the previous 12 months. The percentage changes in total weekly payments made in the 12 months ending December 2020 for each insurer are 21% for NI, 16% for self-insurers, 15% for specialised insurers and 15% for TMF.

Average number of days of weekly benefits paid in the first six months after injury

With the exceptionof self insurers, the average number of days of weekly benefits were paid shows an upward trend. The data for self-insurers showed a significant drop in June 2020, it decreased from 23.5 days in March 2020 to 17.0 days in June 2020.

The data shows a continued increasing number of workers receiving weekly benefits, resulting in higher scheme costs. The duration of the weekly beinfits being paid in the first six months following an injury is also trending upwards and indicates that the scheme’s performance in getting workers back to work is declining.

Viability

Scheme costs continue to increase

Payments have increased in the last 12 months. Total claim payments in December 2020 reached $3.9B, this has increased by $406M compared with December 2019. Key drivers of the increase include

- Increased weekly payments of $260M (19% increase),

- Increased medical payments of $17M (2% increase),

- Increased common law payments of $85M (16% increase), and

- Increased rehabilitation services payments of $26M (17% increase).

For the 12 months ending in December 2020, compared with the 12 months ending in December 2019, NI contributed the most to the increase in total claim payments (13% increase), followed by TMF increased by 9%.

Notable increases in medical payments included allied health expenses, which accounted for 22 % of the total medical payments. Allied health service payments had a 7% increase, in which psychological services payments increased by 19%.

Active claims

Active claims are claims that have received a payment in the preceding three months. The volume of these claims indicates scheme effectiveness and impacts the scheme viability should these volumes not be stable.

Active claim numbers have increased by 0.49 % (502 claims) compared with the same reporting period in 2019 (102,726 claims in December 2020 and 102,224 claims in December 2019). TMF has the greatest percentage change (5.49% increase) compared with NI (1.23% decrease), self-insurers (3.65 % increase) and specialised insurers (0.18% increase).

The continued increases in medical expenses, weekly benefits payments, and number of workers receiving weekly benefits present risks to scheme viability.

Customer experience

Enquiries, complaints and disputes

In December 2020, SIRA and IRO received 1,489 enquiries and 655 complaints. In total, there were 2,144 enquiries and complaints which represents a decrease from the 2,618 in November 2020.

There were 666 disputes received in December 2020, which has decreased from 703 in November 2020. The dispute rate for December 2020 is 0.65% based on 102,726 active claims.

Feedback on these reports

This monthly dashboard includes several enhancements, feedback and comments on the dashboard reports are welcome. Please email us at: [email protected]

About the data in this report

The dashboard reports data from multiple sources to provide insights into the system performance of the NSW workers compensation system. The report is structured on SIRA’s performance framework, reporting on performance measures of effectiveness, efficiency, viability, affordability, customer experience, and equity.

SIRA as the regulator of the NSW workers compensation system monitors the system regularly. From time to time there are discussions and presentations from providers within the workers compensation ecosystem including insurers, medical and therapeutic providers etc about these metrics and in response SIRA continually improves the dashboards.

Methodology, data notes and data sources

The data presented in this report are derived from monthly claims submission data, annual declarations provided to SIRA from NSW workers compensation insurers, the Workers Compensation Commission and the Workers Compensation Independent Review Office and SIRAs complaints and enquiries services.

The financial and cost information in this report is presented in original dollar values with no indexation applied. Costs in the workers compensation scheme are subject to a variety of potential inflationary factors including wage and salary rates, medical fee schedules, statutory benefit indexation and general price inflation. As there is no single index which adjusts for all potential factors, costs have been shown in their original dollar values for simplicity.

The premium value used for the NI in this report is calculated as total premium payable net of GST and levies, such as the dust disease levy and mine safety levy. Premium for self-insurers is deemed premium, calculated as wages covered multiplied by the premium rate applicable for the appropriate industry class. Premium for Government self-insurers (TMF) is the value of the deposit contributions made by each member agency. Premium for specialised insurers is the gross written premium, net of GST and levies, such as the dust disease levy and mine safety levy.

Insurers regularly update claims data based on the progression of a claim. This may result in changing claim details month to month.

Glossary, business terms and data source information

Standard terms | Definitions |

|---|---|

Accident year | An accident year is the year in which the accident giving rise to the claim occurred. |

Active claim | An active claim is a claim that has had any payment activity in the three months as at the end of the same reporting month. |

Affordability | A reflection of the cost of premiums for workers compensation as a percentage of the reported NSW wages bill. The premium value used for the Nominal Insurer is calculated as total premium payable net of GST and levies, such as the dust disease levy and mine safety levy. The premium for self-insurers is deemed premium, calculated as wages covered multiplied by the premium rate applicable for the appropriate industry class. The premium for Government self-insurers (TMF) is the value of the deposit contributions made by each member agency. The premium for specialised insurers is the gross written premium, net of GST and levies, such as the dust disease levy and mine safety levy. Premium information is updated annually. |

Benefits paid directly to workers | Includes weekly payments, common law, s66, death benefits, commutations and miscellaneous payments. |

Benefits paid for services for workers recovery and return to work | Includes medical costs, allied health services e.g. rehabilitation payments to support claimants. |

Bodily location of injury / disease | The bodily location of injury/disease classification is intended to identify the part of the body affected by the most serious injury or disease. Only 1-digit bodily location of injury is used. |

Claim payments types | Claims reported in the reporting month, classified as either 'psychological injuries' for mental disorder claims or 'all non-psychological injuries' for all other claims |

Claim payment development | This chart shows claim payments by accident year. That is, comparing payments of accidents occurring in the 2019/20 financial year with the prior accident period at the same stage of development. This chart allows for like for like comparisons across financial years and is presented in original dollar values with no indexation applied. The financial and cost information in this report is presented in original dollar values with no indexation applied. Costs in the workers compensation scheme are subject to a variety of potential inflationary factors including wage and salary rates, medical fee schedules, statutory benefit indexation and general price inflation. As there is no single index which adjusts for all potential factors, costs have been shown in their original dollar values for simplicity. Note the customer impacted by Section 39 of the act that exited the system up to June 2018 are excluded |

Common Law (WID) payments | Lump sum payments for damages and common law legal expenses incurred by the worker or agent/insurer, pursuant to Part 5 Common Law remedies, Sections 149 to 151AD, Workers Compensation Act 1987 and Section 318H, Workplace Injury Management and Workers Compensation Act 1998. WID stands for ‘Work injury damages’ and this term is used interchangeably with ‘common law’ |

Commutations | The actual gross amount of commutation awarded or agreed upon for the claim. This refers to compensation where a commutation of the claimant's right to compensation has been made by the insurer. The up-front lump sum payment is made to an injured worker in place of continuing weekly compensation award and future medical and hospital expenses, pursuant to Part 3, Division 9 Commutation of compensation, Sections 87D to 87K, Workers Compensation Act 1987. |

Complaint data | Is derived verbatim from reports from customers. Whilst some data cleansing processes are undertaken by SIRA the reporting is verbatim from customers and may from time to time reference an incorrect insurer and/or insurer type. The number of complaints received in the reporting period. |

Complaint types reported to SIRA | Complaints received in the reporting period, split by complaint type. |

Cost to the system for weekly benefits paid per month | This graph shows the costs each month for weekly benefits payments. The financial and cost information in this report is presented in original dollar values with no indexation applied. Costs in the workers compensation system are subject to a variety of potential inflationary factors including wage and salary rates, medical fee schedules, statutory benefits indexation and general price inflation. As there is no single index which adjusts for all potential factors, costs have been shown in the original dollar values for simplicity |

Death payments | Funeral expenses, weekly payments for dependent children and lump sum payments paid to the dependants or estate of the deceased worker, pursuant to the Workers Compensation Act 1987 No. 70 and Workers Compensation (Dust Diseases) Act 1942. |

Development quarter | Development quarter refers to the time elapsed (in quarter) the accident occurred. |

Dispute rate | The number of disputes lodged (internal review, merit review, procedural review and workers compensation commission disputes) in the reporting month divided by the number of active claims as at the end of the same reporting month. |

Disputes lodged/finalised | Disputes lodged/finalised in the reporting period. |

Enquiry | An enquiry is defined as a customer call regarding information or advice that is general in nature. The number of enquiries received in the reporting period. |

Level 1 complaints | A level 1 complaint is defined as a complaint received by frontline staff where an insurer is notified (via email) by the Customer Advisory Service on behalf of the complainant. |

Level 2 complaints | A level 2 complaint is an escalation of an unresolved level 1 complaint. |

Lost time | Monthly average, over the last 12 months, of workers who had lost time. |

Lump sum (S66 and S67) | Section 66 payments are lump sum payments for the permanent loss or impairment of a specified bodily function or limb, or severe facial or bodily disfigurement, including interest, pursuant to Section 66, Workers Compensation Act 1987 and as provided by the Table of Disabilities or whole person impairment (WPI) and Ready-reckoner of Benefits Payable. |

Maintain RTW | This measures the duration workers remained at work in a 12-month period after their first return to work. It uses the work status code to calculate how long the worker remained at work. The cohort selection is based on a consistent sample of injured workers who have returned to work for the first time in financial year 2017/18 after the claims are accepted and entered into the scheme with at least one day time loss (excluding retirees and fatalities). The work status code was monitored for subsequent 12 months since the month injured worker returned to work for the first time. Frequency within the following 12 months development period the injured workers remained at work is then categorised into one of the following groups:

The results are based on the work status as at 30 June 2018 |

Mechanism of incident | Mechanism of incident applies to claims entered into the insurer’s system on or after 1 July 2011 and uses the Type of Occurrence Classification System, 3rd Edition (Revision 1) Australian Safety and Compensation Council, Canberra 2008. |

Merit review | A merit review is undertaken by an independent decision maker at SIRA who conducts a merit review of the insurer’s work capacity decision and outlines findings and recommendations. These reviews are binding on the insurers. |

Nature of injury /disease | The nature of injury/disease classification is intended to identify the type of hurt or harm that occurred to the worker. The hurt or harm could be physical or psychological. |

Number of workers receiving weekly benefits per month | Number of injured workers receiving weekly benefit payments excluding Section 39 claimants that exited the system until June 2018. |

Other payments | Payments for repair to or replacement of artificial limbs and clothing because of the workplace injury, amounts paid to any approved interpreter service for English language assistance to the claimant, transport and maintenance expenses related to travel costs incurred by the worker and shared claim payments. |

Payment data | Payments made are based on the transaction date. Payments with payment date within the reporting period. |

Procedural review | A review by the Workers Compensation Independent Review Office (WIRO) can follow a merit review by SIRA and is a procedural review of the insurer’s work capacity decision. |

Psychological Injury (ies) | The range of psychological conditions for which workers compensation may be paid, including post-traumatic stress disorder, anxiety/stress disorder, clinical depression and short-term shock from exposure to disturbing circumstances. |

Records submitted | All records received from insurers across NSW. This data excludes administration errors. |

Rehabilitation payments | Payments for a single workplace rehabilitation service, a suite of services provided to assist a worker to RTW with the same employer, a suite of services provided to assist a worker to RTW with a different employer or travel costs of the workplace rehabilitation provider in the delivery of rehabilitation services, pursuant to Sections 59, 60 and 63A, Workers Compensation Act 1987. Rehabilitation treatment includes the initial rehabilitation assessment, workplace assessment, advice concerning job modification, and rehabilitation counselling. Rehabilitation treatment does not include medical, hospital, physiotherapy or chiropractic treatment. |

Reportable claims | A reportable claim for workers compensation or work injury damages is a claim that a person has made or is entitled to make under the Workplace Injury Management and Workers Compensation Act 1998. Claims become reportable once they meet certain liability conditions and/or have received payments. For example, the injury or illness may be physical or psychological and employment must be a substantial contributing factor to injury, except for those claims made by police officers, paramedics, fire fighters, volunteer bush fire fighters and emergency and rescue services volunteers for injuries suffered during journeys to and from work or place of volunteering. Reportable claims include claims from workers whose employer is uninsured. Where a split by insurer segment is shown, claims of uninsured employers are included with the Nominal Insurer segment. Exclusions Reportable claims exclude administration error claims, claims closed with zero gross incurred cost, claims shared between two or more workers compensation agents/insurers and the agent/insurer is not responsible for the management of the claims, and claims with payments only for recoveries, vocational programs or invalid payment classification numbers. Reportable claims also exclude claims for:

|

Reportable claims / payments development | The reportable claims development chart shows the development of reportable claims by injury/accident financial year. |

Return to work rate | The Return to work (RTW) rate is the percentage of workers who have been off work as a result of their employment-related injury/disease and have returned to work at different points in time from the date the claim was reported (i.e. 4, 13, 26, 52 and 104 weeks for the SIRA Stats report). RTW rates are calculated monthly for the last 13 months up to the date of data. The cohort for each RTW measure is based on claims reported in a 12-month period, with a lag to allow for claim development (i.e., the lag for the 4-week measure is 28 days; the lag for the 13-week measure is 91 days; the lag for the 26-week measure is 182 days; the lag for the 52-week measure is 364 days; and the lag for the 104-week measure is 728 days). Calculation method for 4-week measure for November 2018 is given below as an example: a) Total number of time lost claimants = Claims reported from November 2017 to October 2018 RTW Rate=b/a multiplied by 100 SIRA identified data quality issues with the accuracy and completeness of data submitted by the Nominal Insurer (NI). The data revealed a significant deterioration in the NI’s RTW performance. To address the data quality and potential performance concerns with the NI, SIRA carried out a Data Quality audit in December 2018 and commenced a Compliance and Performance Review in February 2019 |

RTW including medical only claimants | The percentage of workers at work at 4, 13 and 26 weeks includes medical only claims where the worker did not leave work. The methodology allows a comparison across insurer types of the percentage of workers who were at work at 4, 13 and 26 weeks intervals from the date the claim was entered into the system |

Stayed-at-work rate | The stayed-at-work rate shows the percentage of workers who made a claim and remained working following a work-related injury/disease, that is without losing time at work |

The average number of days weekly benefits are paid to workers for the first six months post injury | Compares the quarters benchmarked across the previous quarters. The chart shows the average number of days of weekly benefits paid to workers in the first 6 months of their claims. This measure uses work hours lost and injury quarter to calculate the average days Note: the data for these measures requires six months to development. |

TMF (emergency) | Government self insurers (TMF) emergency services cover police, fire and ambulance agencies. |

TMF (non-emergency) | Government self-insurers (TMF) non-emergency services cover all agencies under TMF except police, fire and ambulance agencies. |

Weekly benefits paid per month | Weekly benefit payments paid to injured workers for incapacity excluding Section 39 claimants that exited the system until June 2018. |

Weekly payments | Weekly payments paid to an injured worker for incapacity. |

Personal Injuiry Comnission (PIC) previously the Workers compensation commission (WCC) | The PIC or WCC as it was prevous called is an independent statutory tribunal that has jurisdiction to deal with a broad range of disputes. Most of the compensation dispute applications are Applications to Resolve a Dispute (Form 2) and may involve claims for more than one type of compensation benefit, including weekly payments, medical and related treatment, and permanent impairment. |

Data disclaimer

The NSW Government is committed to producing data that is accurate, complete and useful. Notwithstanding its commitment to data quality, the NSW Government gives no warranty as to the fitness of this data for a particular purpose. While every effort is made to ensure data quality, the data is provided “as is”. The burden for fitness of the data rests completely with the user.

The NSW Government shall not be held liable for improper or incorrect use of the data.

Please note, this data is an accurate reflection of the information provided by each insurer, to SIRA, however this data may change due to the progression of data and the application of regular data quality reviews. There are several areas where SIRA is actively working on the methodologies and data sets with the view to improving the measures and the capability to monitor the system.

Would you like additional data?

For more information about this dataset or data source:

There is additional data from the NSW Government on the following sites -

If you need further information please use this link to access information or phone 13 10 50.