Print PDF

Part 1 of the Motor Accident Guidelines: Premium determination

Determination of insurance premiums for third-party policies

Introduction

1.1 These Guidelines provide mechanisms for the regulation of insurance premiums matters under Part 2, Division 2.3 and clause 2 of Schedule 4 of the Motor Accident Injuries Act 2017 (NSW) (the Act). They are issued by the State Insurance Regulatory Authority (the Authority).

Commencement and revocation of previous Guidelines

1.2 This Part of the Guidelines is effective for policies that come into effect on or after 15 January 2024. For policies that come into effect from 15 January 2023 to 14 January 2024, Part 1 of the Motor Accident Guidelines v 9.1 continue to apply.

Definitions

1.3 In this Part of the Guidelines, bonus malus refers to a percentage decrease or increase in the insurer’s base premium using approved risk-rating factors. Bonus has the same meaning as discount and malus has the same meaning as loading in this Part.

Guiding principles

1.4 The primary objects under section 1.3 of the Act relating to a premium framework are to:

(a) promote competition and innovation in the setting of premiums

(b) ensure the sustainability and affordability of the scheme and fair market practices

(c) keep premiums affordable by ensuring that the profits realised by insurers do not exceed the amount that is sufficient to underwrite the relevant risk.

1.5 To promote competition and innovation by insurers, the Authority allows risk-based pricing, but this must be done within limits in order to keep premiums affordable. The premium framework recognises that this liability scheme, which is compulsory and privately underwritten, blends risk-based and community-rated approaches to assist with the object of affordability.

1.6 Filed premiums must be adequate and not excessive (under section 2.22(1)(a) of the Act). The Authority will closely scrutinise filed premiums against the objects of the Act and against any range of premiums for transitional policies it has determined under clause 2(3)(c) of Schedule 4 of the Act.

1.7 In aligning with the competition and innovation objects, the Authority recognises that insurers will pursue their own particular business objectives that will be reflected as an integral part of each insurer’s pricing strategy. On this basis, technical (actuarial) pricing will not be considered in isolation and an explanation by insurers is encouraged for non-technical pricing considerations, including:

(a) business plans and short, medium and long-term growth strategies

(b) response to pricing by competitors

(c) market segmentation and distribution strategies

(d) innovation and efficiencies in their business model.

1.8 The Authority will take into account the objects of the Act by considering both qualitative and quantitative explanations when reviewing insurer filings.

Premium filing process

Filing requirements

1.9 A premium filing under Division 2.3 of the Act must be provided in soft copy and must include:

(a) covering letter

(b) filing report

(c) the Authority’s motor accident filing template

(d) any other additional information reasonably required by the Authority.

Covering letter

1.10 The premium filing covering letter must be signed by the NSW CTP product executive or equivalent office holder of the licenced insurer and include:

(a) the proposed commencement date for the premium and the period nominated by the insurer for the Authority to reject the premium (cannot be less than six weeks)

(b) an executive summary of the filing

(c) the overall average premium

(d) any significant changes to the most recent business plan approved by the Authority impacting competitive strategies or market positioning

(e) any significant rating factor changes

(f) any changes in bonus malus levels

(g) implementation plan detailing how the insurer will meet the proposed commencement date

(h) an outline of the policyholder impact analysis.

Filing report

1.11 Every filing report must include:

(a) a summary of the changes proposed and any changes in business strategy

(b) explanation of each filing assumption change made since the previous filing

(c) completed motor accident filing template commentary and analysis of the estimated effects on the portfolio composition as described in ‘Portfolio analysis’ section below

(d) an analysis of the change in average premium and base premium against the previous filing

(e) signed endorsement of the filing from the NSW CTP Product Executive or equivalent office holder

(f) any other information requested by the Authority.

1.12 Nothing further is required to be included in the filing report if all the following conditions are met:

(a) the expiry date of the filing lodged is within 12 months from the commencement date of the most recent filing approved by the Authority

(b) the change in average premium excluding GST and the Fund levy reported in Schedule 1C of the Authority’s motor accident filing template is less than 4% when compared to the most recent filing approved by the Authority

(c) the change in Base Premium Rate (Class 1 Metro) excluding GST, Fund levy reported in Schedule 1C of the Authority’s motor accident filing template is less than 4% when compared to the most recent filing approved by the Authority.

1.13 If any of the above conditions are not met, the filing report must also include:

(a) how the proposed insurance premiums (excluding the Fund levy and GST, and assuming no policyholders are entitled to any input tax credit (ITC)) were determined by the insurer

(b) the factors and assumptions considered in determining the premiums, how those factors were derived, and any variation relative to the Authority's independent actuary’s costing assumptions (Schedule 1E, provided by insurers in the form specified in Table 1.3), taking into account the insurer’s business mix by class and region and other (claims experience related) factors against those of the industry

(c) an explanation of the non-technical pricing factors where applicable

(d) how the insurer assessed projected future frequency of:

- claims for the industry (inclusive of nominal defendant claims, and by subdivision as set out in Schedule 1E)

- claims for the insurer (by subdivision as set out in Schedule 1E and disclosing the treatment of shared claims and nominal defendant claims).

(e) how the insurer assessed projected future average claim size of:

- claims for the industry (inclusive of nominal defendant claims, and by subdivision as set out in Schedule 1E)

- claims for the insurer (by subdivision as set out in Schedule 1E and including the estimated net effects of shared and nominal defendant claims).

(f) a summary of claim frequency and average claim size (in current values), and resulting cost per policy, by claim component (including nominal defendant), allowing for sharing and net of ITCs, should be included in the filing report. This should reconcile to item 1c in Schedule 1C for claim frequency and indicate the adjustment to claim sizes required to reconcile to item 2b in Schedule 1C.

(g) economic and investment assumptions, including:

- assumed future rates of wage and price inflation

- full yield curve adopted and the single equivalent rate of discount

- assumed future claim payment pattern for the underwriting period covered by the filing specifying whether the basis is current values, inflated or discounted.

(h) superimposed inflation (SI) assumption, including:

- assumed future rates of SI

- disclosure of the single equivalent rate of SI where different rates have been used for different claim segments and/or different rates of SI have been adopted in future years

- an explanation of the approach taken in setting the SI assumptions.

(i) insurer expenses, including average past actual and expected future rates and amounts of:

- acquisition and policy-handling expenses (excluding commission or other remuneration) associated with third-party policies with appropriate explanation provided and a description of the methodology used to allocate overhead expenses

- commission or other remuneration expenses (for the purpose of determination of insurance premium the filed percentage per policy cannot exceed 5% of the proposed insurance premium)

- claims-handling expenses, including an explanation of what is included in this item, and a description of the methodology used to allocate overhead expenses

- net cost of reinsurance.

(j) disclosure of the above past and expected future expenses on a total pool basis as well as on a cost per policy basis for acquisition and policy expenses, and on a per claim basis for claims-handling expenses (for clarity, claims-handling cost per claim expected to arise during the period covered by the filing)

(k) the expense assumptions used and an explanation of how they relate to the above information

(l) proposed profit margin: the percentage of gross insurance premiums intended to be retained as profit, before tax

(m) adjustments to insurer premium to obtain the class 1 metro base premium by disclosing a full explanation of the calculation of the:

- ratio of the class 1 metro premium to the average premium

- average bonus malus factor: commentary should be included where the filed average bonus malus factor varies from the average implied by the expected future number and mix of insured vehicles by vehicle class and rating region at each bonus malus level (as provided in the portfolio analysis)

(n) details of how the percentage loading applied to the nil ITC premium rates to obtain the ITC premium rates was determined

(o) details of how the short-term loading parameters A, B, X and Y were determined

(p) a comparison with the previous filing of the filed average premium and the actual average premium received by the insurer, together with an explanation of the allowance made for non-annual policies in calculating these average amounts, including:

- how the assumptions regarding future experience in the current premium filing differ from the corresponding assumptions in the previous filing by the insurer

- the changes in assumptions and the effect of those changes on the proposed premiums, including reconciliation between the previous and proposed new base premium for a Sydney passenger vehicle for which the policyholder is not entitled to any ITC.

(q) Insurers must undertake sensitivity analysis on key assumptions that are subject to significant uncertainty to quantitatively illustrate the impact of uncertainty on proposed premiums. Such sensitivity analysis includes the use of scenarios to test the impact of multiple assumptions simultaneously.

- The extent of the variation assumed on key assumptions for sensitivity testing should reflect an alternate reasonable and plausible situation. Insurers must document the results of the sensitivity analysis in the filing report.

- The Authority may provide guidance on the specific assumptions or scenarios to be tested and included in a filing before its submission.

(r) any other matter the insurer considered in determining premiums.

1.14 The Authority may request additional information or amendments to the premium filing.

Rejection of premiums by the Authority

1.15 The Authority may reject a premium filed under Division 2.3, section 2.22 of the Act if it is of the opinion that the premium:

(a) is excessive or inadequate in relation to actuarial advice and to other relevant financial information available to the Authority

(b) does not conform to the relevant provisions of these Guidelines, or

(c) will not fall within the range of premiums determined by the Authority under clause 2(3)(c) of Schedule 4 of the Act, ‘Savings, transitional and other provisions’.

1.16 The Authority will conduct a review of all filings lodged in accordance with Division 2.3 of the Act and these Guidelines. The Authority may also obtain actuarial advice or other relevant financial advice.

1.17 The Authority’s review will consider:

(a) whether a filing is considered incomplete. The Authority will determine completeness by reviewing the documentation, schedules and motor accident filing template required by these Guidelines. The Authority must be satisfied that there is materially sufficient explanation of the assumptions and filed premiums to enable a review of the quantitative and qualitative elements of the filing, and

- if classified as incomplete, the Authority may request further information from the insurer in accordance with section 2.20(7) of the Act, which will mean that time does not run in relation to the period allowed for rejecting the premium until the insurer complies with the Authority’s request, or

- the Authority may request its withdrawal and, if not withdrawn, will exercise its discretion to reject the filing.

(b) whether the premium has been determined in accordance with the process set out in these Guidelines. This will include the requirement to provide additional information regarding the premiums filed and to justify premiums that have been filed.

Special provisions for premiums during the transitional period

1.18 In determining the Authority’s opinion on whether the premium is adequate and not excessive under section 2.22(1)(a) of the Act, the Authority will consider the comparison between its assumptions (in Schedule 1E) and those filed by the insurer.

Premium components and factors

Motor accident schedule of premium relativities

1.19 As part of the motor accident filing template, the Authority will provide a Motor Accident Schedule of Premium Relativities. Insurers must classify vehicles based on this Schedule.

1.20 Insurers must apply the relevant premium relativities that are applicable to the vehicle class and region.

Base premium

1.21 The base premium for each vehicle classification and region must be:

(a) calculated as the class 1 metro vehicle base premium for which the policyholder is not entitled to any input tax credit (ITC)

(b) multiplied by the relativity for the particular vehicle class and region published in the motor accident schedule of insurer premium relativities current at the date the third-party policy begins

(c) divided by 100.

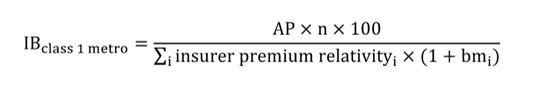

1.22 The nominated base premium is used to define the allowable range of premiums in terms of the limits for bonus malus, the relative premiums for vehicle classifications and regions, and the loading that allows for policyholder entitlement to an ITC. It is equal to:

Where:

- IBclass1metro = The insurer’s base premium for class 1 metro including GST but excluding the Fund levy, calculated as if no policyholders are entitled to any ITC. The Fund levy is the combined total of the Motor Accidents Operational (MAF) Fund levy, Lifetime Care & Support (LTCS) Fund levy and Motor Accident Injuries Treatment & Care (MAITC) Fund levy

- AP = The insurer’s average premium including GST but excluding the Fund levy, calculated as if no policyholders are entitled to any ITC, as shown in the filing assumptions summary sheet (Table 1.2, Schedule 1C)

- insurer premium relativityi = The premium relativity applicable to the i-th policy, as anticipated to be underwritten over the period of the premium filing based on the motor accident schedule of insurer premium relativities

- bmi = The bonus malus rate (%) applicable to the i-th policy, as anticipated to be underwritten over the period of the premium filing

- n = The number of policies anticipated to be underwritten over the period of the premium filing.

Ratio of insurer’s average premium to class 1 metro (item 13 in Table 1.2)

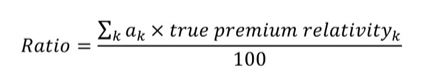

1.23 This factor expresses the ratio of the insurer’s average premium based on the insurer’s projected portfolio mix (annual policy equivalent, taking into account the insurer’s vehicle class and region mix of business), relative to the base premium of a class 1 metro vehicle. This is calculated by:

(a) determining the percentage of the insurer’s projected portfolio (based on the number of vehicles) that will be written in each vehicle class and region

(b) multiplying each of the above proportions by the motor accident schedule of premium relativities published by the Authority for the corresponding vehicle class and region

(c) adding up all of the values calculated in (b) above

(d) dividing (c) above by 100.

1.24 The formula for the calculation is:

Where:

- αk = The proportion (as a %) of the insurer’s projected portfolio (based on vehicle count) for the k-th vehicle class and region

- true premium relativityk = The premium relativity for the k-th vehicle class and region in the motor accident schedule of insurer premium relativities published by the Authority.

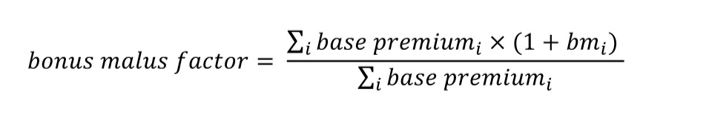

Bonus malus factor (item 14 in Table 1.2)

1.25 This factor expresses the average bonus malus applied by an insurer to its projected annual policy equivalent portfolio (after taking into account the insurer’s vehicle class and region mix of business). This is calculated by:

(a) determining the total portfolio premium (before GST and levies) to be collected, inclusive of the bonus malus rates to be applied, for the portfolio of risks projected to be written by the insurer. This portfolio of risks should take into account the insurer’s mix of business by vehicle class, region and rating factors

(b) determining the total portfolio premium (before GST and levies) to be collected, before the application of any bonus malus rates, for the portfolio of risks projected to be written by the insurer

(c) dividing (a) by (b).

1.26 The formula for the calculation is:

Where:

- base premiumi = The applicable base premium ($) for the i-th policy based on its vehicle class and rating region

- bmi = The bonus malus rate (%) applicable to the i-th policy given the rating factors and bonus malus structure adopted by the insurer.

Bonus malus limits, rating structure and risk rating factors

1.27 Each risk rating factor proposed by an insurer must be objective and evidence-based. A risk rating factor must not be used unless approved by the Authority. Insurers can apply to use objective risk rating factors except race, policy duration, ITC entitlement and postcode.

1.28 Insurers can apply to use objective risk rating factors except race, policy duration, ITC entitlement and postcode.

1.29 Insurers may apply separately to the Authority for approval to use any proposed new objective risk rating factor.

1.30 The Authority encourages insurers to apply to use innovative rating factors that differentiate risk with quantifiable data, including telematics. Alternative pricing mechanisms, including initial premium payments combined with premium refund or extra premium options, are possible for all vehicle classes. Insurers may refund part of the premium paid for a third-party policy during or after the period for which the policy is issued, by reference to digital information recorded about the safe driving of the insured vehicle during that period, or other factors including the distance travelled. If insurers wish to apply these refund provisions to any vehicle class, the basis and methodology must be approved by the Authority.

1.31 Where there is a significant change to an insurer’s bonus malus structure or change in the bonus malus applied to a group of policyholders (more than 10% change in the bonus malus percentage applied compared to the current rating structure in force, in absolute terms), an insurer must include in their filing:

(a) analysis showing the technical relativity (or cost) for each group of policyholders within the rating factor for which bonus malus changes are proposed

(b) a comparison of the technical relativity (or cost) against the actual premium relativity or bonus malus percentage (or cost) proposed.

1.32 Where an insurer proposes a rating structure that is significantly different from the technical basis, reasons for the difference must be discussed in the filing report.

1.33 The various levels of the bonus malus filed by a licensed insurer for each vehicle class and rating region must be supported by experience-based evidence or a reasoned assessment of risk and/or strategic commercial reasons, except where an absolute bonus malus has been mandated by the Authority. An insurer must not charge the maximum malus for all vehicles in a particular vehicle classification unless this is supported by such evidence or assessment.

Malus limits

1.34 The maximum malus percentage may be calculated exactly or rounded to the nearest one tenth of 1%. For example, a multiple calculated as 51.2657% may be applied without rounding or rounded to 51.3%.

1.35 Premiums charged by an insurer must be no greater than the multiple shown in of the insurer’s base premium, excluding GST, for the vehicle classification and each region.

Table 1.1: Multiple of the insurer’s base premium, excluding GST

Vehicle classes | Maximum malus |

|---|---|

1, 3c, 3d, 3e, 5, 6a, 6b, 6c, 8, 9a, 9d, 9e, 9f, 11, 12a, 13 and 18a | (145% x RB + (IB – RB) x 30%)/IB |

7 | Not more than 140% of the insurer’s base premium excluding GST |

10d, 10e, 10f, 10g and 10h | (130% x RB + (IB – RB) x 30%)/IB |

6d, 6e, 12b, 14, 15a, 15c, 17, 18b, 18c and 21 | Not more than 110% of the insurer’s base premium excluding GST |

Where:

- IB = The insurer’s filed base premium for a class 1 metro vehicle for which the policyholder is not entitled to any ITC

- RB = The reference base rate at the time of filing.

Bonus limits

1.36 For premiums charged by an insurer for specific vehicle classifications by region:

(a) If the vehicle is a new non-fleet class 1 vehicle, premiums may be restricted to 80% of the base premium, excluding GST, for each region. If a bonus limit is applied under this provision, then the bonus malus limits in clauses 1.35 and 1.37 do not apply.

- New = Original (establish) registration for current year and including plus or minus one year.

- Non-fleet = A fleet of fewer than 5,000 class 1 or class 3c (or both) vehicles.

1.37 Otherwise for class 1 vehicles and class 3c vehicles that are not part of a fleet, if the youngest driver is aged:

(a) under 55, the minimum premium is no less than 80% of the insurer's base premium, excluding GST, for these vehicle classes by region

(b) 55 or over, the minimum premium is no less than 75% of the insurer's base premium, excluding GST, for these vehicle classes by region.

1.38 Otherwise for fleet vehicles, if the:

(a) fleet comprises 5,000 or more class 1 or class 3c vehicles (or both) owned by a single entity or registered operator, or a group of related entities or registered operators, that proposes to insure third-party policies with one or more licensed insurers, the minimum premium is no less than 60% of the insurer's base premium, excluding GST, for these vehicle classes by rating region.

1.39 Premiums charged by an insurer for vehicle classes 10d, 10e, 10f, 10g and 10h must be no less than 80% of the insurer's base premium, excluding GST, for the vehicle classes by region.

1.40 Premiums charged by an insurer for vehicle classes 3d, 3e, 5, 6a, 6b, 6c, 8, 9a, 9d, 9e, 9f, 11, 12a, 13 and 18a must be no less than 70% of the insurer's base premium, excluding GST, for the vehicle classes by region.

1.41 Premiums charged by an insurer for vehicle classes 6d, 6e, 12b, 14, 15a, 15c, 17, 18b, 18c and 21 must be no less than 90% of the insurer's base premium, excluding GST, for each of these vehicle classes by region.

1.42 Premiums charged by an insurer for vehicle class 7 must be no less than 80% of the insurer's base premium, excluding GST.

Premiums where entitlement to an ITC is applicable

1.43 Specific premiums apply when the vehicle owner is entitled to an input tax credit (ITC) for GST purposes to allow for the tax treatment. The insurer will determine two sets of premium rates:

(a) nil ITC premium rates, which apply to policyholders with no entitlement to any ITC for GST included in the premium

(b) some ITC premium rates, which apply to policyholders entitled to claim an ITC for at least some of the GST included in the premium. Some ITC premium rates will be the insurer's corresponding nil ITC premium rates increased by a loading.

1.44 Each insurer will determine the percentage loading it considers appropriate. However, the loading, expressed as a percentage of the corresponding nil ITC premium rates, must be within the range of 6.5% to 7.5%.

1.45 The loading will be determined in relation to the effect of policyholders' entitlement to claim an ITC on the insurer's entitlement to claim decreasing adjustments for claims costs attributable to those policyholders.

1.46 The ITC loading must be the same percentage for each vehicle classification and region. However, threshold variations in the percentage loading attributable only to the calculation of premiums for non-annual policies or to rounding are acceptable.

Loading of premiums for short-term policies

1.47 For quarterly or six-month policies, short-term insurer premiums may include a surcharge (the short-term policy surcharge), excluding GST, LTCS levy and MAF levy, which is calculated as follows:

- Quarterly premium = (annual premium + X) x (100% + Y%) / 4

- Half-yearly premium = (annual premium + A) x (100% + B%) / 2

Where:

Annual premium excludes GST, LTCS levy and MAF levy X, Y, A and B are amounts that each insurer will determine, subject to:

- X (administrative costs loading for quarterly policies) being no more than $15

- Y (a forgone investment income loading for quarterly policies) being no more than 2.2%

- A (administrative costs loading for half-yearly policies) being no more than $5

- B (forgone investment income loading for half-yearly policies) being no more than 1.5%.

1.48 Each licensed insurer must set one proposed rate for each of the factors X, Y, A and B that will be applied consistently across all short-term CTP policies offered by that insurer. The proposed loadings will be included in all filings and must be approved by the Authority. The surcharge does not apply to short-term periods for common due date policies. GST and the pro rata Fund levy for the relevant policy term are then added to calculate the total amount payable by the policyholder for a short-term policy, initially to the nearest one cent.

Justifying third-party premium assumptions

1.49 Insurers must specify how they have determined proposed premiums and explain the proposed premiums to the satisfaction of the Authority. Insurers are required to complete the Authority's motor accident filing template.

1.50 The total estimated claims cost (risk premium) adopted in the filing must:

(a) reflect the expected outcomes of the Act

(b) be on a central estimate basis; that is, an estimate of the mean, which must not be intentionally or knowingly conservative or optimistic.

Basis of estimate

1.51 Expense assumptions adopted in the filing must be set with reference to:

(a) maximum rates of expense assumptions specified by the Authority

(b) excluding expenses not directly relevant to the acquisition, policy administration or claims management of the insurer's third-party insurance business

(c) the suitability of the expense type for inclusion in a compulsory insurance product and the efficiency of the insurer's own administration and claims processes

(d) the insurer's best estimate of expenses, taking into account current internal management budgets and internal strategies to control costs.

Level of explanation

1.52 Filed assumptions for must be explained with sufficient information that an analysis of the filing can lead to a conclusion that the results stated in the filing:

(a) have been determined on a central or best estimate basis where required

(b) meet the adequate test under section 2.22(1)(a) of the Act

(c) represent a genuine effort on the part of the insurer to offer competitive premiums and thereby allow the Authority to form an opinion under section 2.22(1)(a) of the Act that the filed premium is adequate and not excessive.

1.53 The level of detail to be provided will depend on the price impact of the assumptions, the extent of the uncertainty surrounding the assumptions, the nature of the analysis and considerations of materiality as viewed by the Authority.

Actuarial valuation report

1.54 Each licensed insurer must provide the Authority with a copy of its latest full valuation report (when it is completed, including all appendices) relating to its NSW CTP business. If a full valuation of the NSW CTP portfolio is conducted more frequently than annually, the insurer must provide the most recent full valuation report available. A comparison and explanation of any differences between the filed assumptions and the following assumptions from an insurer's NSW CTP portfolio insurance liability valuation report assumptions must be provided in filings:

(a) claim frequency assumed for premium liabilities†

(b) average claim size assumed for premium liabilities†

(c) superimposed inflation

(d) economic assumptions

(e) claim-handling expense assumed for premium liabilities†

(f) policy and administration expense assumed for premium liabilities†.

† If premium liabilities are not estimated at a given balance date, then the insurer should use the latest accident year/underwriting year. Claim frequency and average claim size may be considered in aggregate (for example, as a risk premium) if an insurer's adopted methodology for the full valuation does not enable such a breakdown.

1.55 Insurers must explain any developments in experience since the most recent full valuation as part of this comparison.

CTP business plan and management accounts

1.56 Each licensed insurer must provide the Authority annually with a copy of its current NSW CTP business plan and disclose all relevant business and distribution strategies when significant changes are made. Each licensed insurer must provide the Authority with a copy of its NSW CTP management accounts annually. In addition, the insurer must provide a:

(a) comparison of budgeted expenses and actual expenses for the previous filing period

(b) detailed budget of expenses covering the proposed filing period.

1.57 The above expense analysis should show the following expenses separately (to the extent they have been broken down as such in the management accounts):

(a) commission

(b) acquisition and policy administration expenses

(c) claims-handling expenses

(d) any other expense components itemised in the insurer's own management accounts.

Discount rate assumptions

1.58 Insurers must use rates of discount that are no less than the risk-free rates based on the forward rates implied from market information available at the time of preparing the filing, being applied to the average underwriting date of the period filed.

1.59 Insurers must disclose the single weighted average discount rate calculated by applying the payment pattern or expected weighted mean term for the claim liabilities underlying the policies to be underwritten to the insurer's adopted rates of discount.

Maximum rates of assumptions used in the determination of premiums

1.60 The Authority's intention in setting maximum rates of assumptions is to reflect current market conditions. Alignment to changing market conditions will be considered through periodical reviews. The following assumptions are subject to a maximum rate used in the determination of premiums:

(a) claims-handling expense assumptions must not exceed a rate of 8% of risk premium

(b) acquisition and policy-handling expenses, including commission and other remuneration, are subject to a maximum rate of $43.60 per policy (on average across the policies underwritten by an insurer), indexed with movement in CPI

(c) the superimposed inflation assumption must not exceed a rate of 2.5%

(d) the maximum profit margin for determining premiums is 8% of the proposed average gross premium (excluding levies and GST).

1.61 The Authority will review these maximum rates periodically.

1.62 Under section 2.22(8) of the Act, the Authority is not bound by any of the maximum rates of assumptions if it considers that it would be unreasonable to apply them in the particular circumstances of the case. The Authority may choose not to reject a premium filing that exceeds the maximum rates if the insurer:

(a) has made allowances for innovation and efficiency that are forecast to improve scheme and policyholder outcomes, or

(b) has held its licence for less than three years.

(c) To avoid doubt, the Authority may still reject the insurer's premium filing even if such circumstances exist.

Risk equalisation mechanism (REM)

1.63 In determining proposed premiums, the insurer must consider any risk equalisation arrangements that the Regulation may impose under section 2.24(2) of the Act or in accordance with section 2.24(7) of the Act.

Calculating net REM amount

1.64 Insurers must calculate the net REM amount consistent with the Authority's motor accident filing template and Schedule 1D related to the filing period by:

(a) projecting the number of annualised policies to be issued for the filing period by each REM pool and for the total of other classes and regions that are not part of the REM pools

(b) multiplying the projected number of annualised policies for the filing period above by the REM $ amount for each REM pool prescribed by the Risk Equalisation Mechanism Deed

(c) the sum of all the REM amounts for all REM pools from the above clause divided by the projected number of annualised policies for all classes and regions (including those not in REM pool) for the filing period

(d) This result is the net REM amount per policy that is included in item 12a of Schedule 1C of these Guidelines.

Portfolio analysis

1.65 Insurers must provide a portfolio analysis consistent with the format detailed in the Authority's motor accident filing template. The following information and analysis relating to portfolio mix must be provided:

(a) the expected future number and mix of insured vehicles by vehicle class and rating region at each bonus malus level, including commentary on strategies that are expected to result in any changed mix of business

(b) actual past number and mix of insured vehicles for the previous 12 months (for a period ending no earlier than two months before the rate filing is submitted) by vehicle class and rating region at each bonus malus level that applied for each policy written within that 12-month period

(c) for each REM pool, compare the projected mix of business from the last filing against actual mix, including a detailed explanation of any variation of projected mix from recent experience

(d) the net impact of the REM based on the projected mix

(e) the proposed use of bonus malus, and the basis on which they will be offered to all vehicle owners, including a complete description of the rating structure, each rating factor with relevant qualifying time periods, where applicable, definitions of generic terminology, a summary of the explicit changes in bonus malus since the previous filing and the impact on the insurer's required and expected average premium

(f) for all policyholders to be issued a renewal notice during the proposed filing period (assuming 100% retention), the distribution by numbers of policies experiencing a price increase/decrease (including Fund levy and GST) using incremental bands designated in the Authority's motor accident filing template compared to the actual premium paid for in force policies for each of the following vehicle classes (in Excel format):

- class 1 by rating region

- class 3c by rating region

- class 3d

- class 3e

- class 6a

- class 7 by plate type

- classes 10d, 10e, 10f, 10g and 10h combined

- classes 6d, 6e, 12b, 14, 15a, 15c, 17, 18b, 18c and 21 combined

- all remaining classes combined

- all classes combined in aggregate.

(g) the expected number of policies by underwriting quarter split by vehicle class, region, ITC entitlement, policy duration and at each bonus malus level, with premium income split by insurer premium, MAF levy, LTCS levy, MAITC levy, GST and total payable (in Excel format)

(h) the resulting average bonus malus factor for each vehicle class and rating region (in Excel format).

Motor accident filing template

1.66 The Authority's motor accident filing template must be attached to every filing report and the data format must not vary from the specifications prescribed in the motor accident filing template. The following documents and the Authority's motor accident filing template are to be attached to every filing report.

Schedule 1A

1.67 Insurers must provide the base premium, including GST but excluding Fund levy, for each vehicle classification and region for policyholders who are not entitled to any ITC (PDF version in filing report and Excel version using the Authority's motor accident filing template).

Schedule 1B

1.68 Insurers must provide a full description of the proposed bonus and malus structure and the actual amounts (after applying any rounding) proposed to be charged for each vehicle classification, region and bonus malus rate, subdivided into separate amounts of:

(a) GST

(b) insurance premium excluding GST

(c) Fund levy

(d) total payable by the policyholder.

1.69 Separate schedules are required for nil ITC premium rates and some ITC premium rates respectively, for both annual and short-term policies.

Schedule 1C

1.70 Insurers must provide a summary of the assumptions adopted and base premium filed (PDF version in filing report in the form specified in Table 1.2 and an Excel version using the Authority's motor accident filing template).

Table 1.2: Premium filing summary sheet

Item | Premium factors | Assumption |

|---|---|---|

1a. Assumed frequency | Claims for an industry mix of vehicles (net of sharing and nominal defendant) | % |

1b. | Relativity of the claims frequency for the insurer’s mix of vehicles to the claims frequency for an industry mix of vehicles | |

1c. | Claims for insurer (net of sharing and nominal defendant) | % |

2a. Average claims size, start of underwriting period | Claims in current dollar values for an industry mix of vehicles (gross of reinsurance, net of sharing and nominal defendant)1 | $ |

2b. Average claims size, start of underwriting period | Claims in current dollar values for insurer (gross of reinsurance, net of sharing and nominal defendant)1 | $ |

3a. Average claims size for filing period | Claims for an industry mix of vehicles for filing period (from item 2), fully inflated and discounted to the middle of the period filed1 | $ |

3b. | Relativity of the claims average claim size in current dollar values for the insurer’s mix of vehicles to the claims average claim size in current dollar values for an industry mix of vehicles | |

3c. Average claims size for filing period | Claims for insurer for filing period (from item 2c) fully inflated and discounted to the middle of the period filed1 | $ |

4. | Insurer average risk premium (formula used to combine above assumptions to arrive at average risk premium) (1c x 3c)1,2 | |

5. Average risk premium | Excluding GST calculation (substitute values in formula)1 | $ |

6. Acquisition and policy-handling expenses, including commission | Per cent gross premium excluding GST and Fund levy | $ |

7. Claims-handling expenses | Per cent gross premium excluding GST and Fund levy | % |

8. Net cost of reinsurance loading | Per cent gross premium excluding GST and Fund levy | % |

9. Other assumptions | Specify nature and value of assumption | % |

10. Profit margin | Per cent gross premium excluding GST and Fund levy | % |

11. Average premium | Formula used to arrive at average premium excluding GST and Fund levy) ((5 + 9)/(1 -(6 + 7 + 8 + 9 + 10))2 | |

12. | Excluding GST and Fund levy (substitute values in formula)1 | $ |

12a. | Net overall impact of the REM (net REM $ per policy) (refer to the Authority motor accident filing template D3) | $ |

12b. | Required average premium (item 12 less item 12a) | $ |

13. | Ratio class 1 metro to average premium calculated in accordance with the formula in ‘Ratio of insurer’s average premium to class 1 metro’ section of this Part of the Motor Accident Guidelines | |

14. Bonus malus | Bonus malus factor calculated in accordance with formula in ‘Bonus malus factor’ section of this Part of the Motor Accident Guidelines | |

15. Class 1 metro premium | Nil ITC class 1 metro base premium excluding GST and Fund levy (12b ÷ 13 ÷ 14) | |

16. | Nil ITC class 1 metro base premium including GST but excluding Fund levy | $ |

17. | Minimum nil ITC class 1 metro premium including GST but excluding Fund levy (ignoring premiums calculated using a bonus factor of less than 80%) | $ |

18. | Minimum nil ITC class 1 metro amount payable by policyholder including GST and Fund levy (ignoring amounts calculated using a bonus factor of less than 80%) | $ |

19. | Maximum nil ITC class 1 metro amount payable by policyholder including GST and Fund levy | $ |

20. | Loading applied to nil ITC premium rates to calculate some ITC premium rates (0% ITC premium rates) | % |

21. | MAF levy (class 1 metro) | $ |

22. | Administrative costs loading for quarterly policies (X) | $ |

23. | Forgone investment income loading for quarterly policies (Y) | % |

24. | Administrative costs loading for half-yearly policies (A) | $ |

25. | Forgone investment income loading for half‑yearly policies (B) | % |

26. | Period premiums are proposed to apply |

Notes:

- Estimates of average claim sizes and average premiums must be those applicable to the nil ITC premium rates; that is, calculated as if no policyholders have any entitlement to an ITC, and as if the insurer has an entitlement to decreasing adjustments or ITC for all claims costs directly attributable to specific policies. The loading applied to nil ITC premium rates to calculate the insurer's some ITC premium rates is then shown as item 20.

- Use item number for formula description.

Schedule 1D

1.71 Insurers must provide details of the calculation of the net REM amounts in the form specified in the Authority's motor accident filing template.

Schedule 1E (transition period only)

1.72 Each insurer must use the form specified in Table 1.3 to provide a summary of its filed assumptions compared to the Authority’s costing assumptions for the Scheme.

Table 1.3: Summary of the insurer’s filed assumptions compared to the Authority’s costing assumptions for the Scheme

Assumption description (column A) | Authority’s costing assumptions for the Scheme (column B) | Insurer’s adjusted assumption for the industry (column C) | Relativity of insurer assumption to industry assumption (column D) | Insurer assumption (column E) |

|---|---|---|---|---|

Claims frequency: at‑fault (AF) threshold injury claims | 0.030% | |||

Claims frequency: not at‑fault (NAF) threshold injury claims | 0.086% | |||

Claims frequency: NAF claims WPI >10% | 0.024% | |||

Claims frequency: NAF claims WPI <=10% | 0.035% | |||

Claim frequency - Death, Interstate and Workers’ Compensation (WC) | 0.015% | |||

Claim frequency - Early Notification | 0.006% | |||

Total claims frequency | 0.195% | |||

Average claims size (ACS): AF claims (15/01/24 dollars) | $28,600 | |||

ACS – NAF threshold injury claims (15/01/24 dollars) | $11,400 | |||

ACS: NAF claims WPI >10% (15/01/24 dollars) | $636,200 | |||

ACS: NAF claims WPI <=10% (15/01/24 dollars) | $138,600 | |||

| ACS - Death, Interstate and WC (15/01/24 dollars) | $103,700 | |||

| ACS - Early Notification (15/01/24 dollars) | $200 | |||

Total ACS all claims (15/01/24 dollars) | $119,700 | |||

Total ACS (inflated/discounted and 15/07/24 dollars)† | $126,600 | |||

Weighted average duration of payments (15/01/24 dollars) | 3.65 | |||

Claims inflation: wage inflation (overall weighted average) | 3.56% | |||

Claims inflation: superimposed inflation (overall weighted average) | 2.15% | |||

Discount rate (overall weighed average) | 4.26% | |||

Risk premium: inflated and discounted risk premium for underwriting year beginning 15 January 2024† | $247 | |||

Claims-handling expense (% of risk premium) | 8.00% ($19.73) | |||

Net reinsurance expense | $1.20 | |||

Policy and acquisition expense | $43.60 | |||

Profit margin (% of premium excl. GST and levies) | 8.00% ($27.05) | |||

GST (10%) | $33.82 | |||

| REM Adjustment | $1.13 | |||

Insurer premium (incl. GST) | $373 | |||

| Estimated additional costs | ||||

MAF levy | $14.10 | |||

LTCS levy | $102.43 | |||

MAITC levy | $24.61 | |||

Total premium payable (incl. GST and levies) | $514 |

Uninflated undiscounted average claim size in 15/01/24 dollars.

Totals may not add due to rounding.

† Discounted to the middle of the underwriting year beginning 15 January 2024 (i.e. 15 July 2024).

Description of each column

Column A: describes the type of assumption.

Column B: sets out the Authority's scheme-wide premium parameters for the industry to achieve the overall target average premium.

Column C: insurer industry assumption for an industry mix of business - allows for comparison against the Authority's independent actuary assumptions in column B.

Column D: relativity of insurer assumption to industry assumption to allow for differences in the insurer's portfolio of risks to be better or worse experience than the industry before business mix adjustment (which is based on the mix by class/region from relativities) and any other claims-related differences.

Column E: insurer assumption.

Other notes

- Total claims frequency for column C should be the same figure as in item 1a in Schedule 1C.

- Total claims frequency for column E times the relativity for the insurer's mix of vehicles should be the same figure as in item 1c in Schedule 1C.

- Average claims size (1/04/2023 dollars) for column C should be the same figure as in item 2a in Schedule 1C.

- Average claims size (1/04/23 dollars) for column E times the relativity for the insurer's mix of vehicles should be the same figure as in item 2b in Schedule 1C.

- Average claims size (inflated/discounted dollars) for column E times the relativity for the insurer's mix of vehicles should be the same figure as in item 3c in Schedule 1C.

- Column E for risk premium (fully inflated and discounted to the middle of the period filed) should be the same figure as in item 5 in Schedule 1C.

- For the accident period referenced above, the following is relevant:

- The period represents accidents that occur from 1 April 2023 to 31 March 2024.

- The period represents statutory benefit claims that will be reported from 1 April 2023 to 30 June 2024 allowing for the statutory 3 months reporting period. There will also be claims reported after 30 June 2024 that may also be accepted as valid statutory benefit claims depending on the circumstance of their lodgement (known as late claims). Only after all of the late claims have been reported and accepted will the actual number of statutory benefit claims be known i.e. after 30 June 2024.

- The period represents claims for damages that will be lodged from 1 April 2023 (for claims assessed at greater than 10% whole person impairment) and from 1November 2024 (for claims assessed at equal to or less than 10% whole person impairment) to 31 March 2027. There will also be claims for damages lodged after 15 January 2026 (for accidents on 1 April 2023) and after 31 March 2027 (for accidents on 31 March 2024) that may also be accepted as valid claims.