Print PDF

Green Slip scheme quarterly insights - June 2018

Download the PDF (3,500KB)

Executive Director’s message

During the quarter, we continued to support injured people through the CTP scheme. Use of SIRA’s new online claim system has increased, simplifying and streamlining the claim process for people injured on NSW roads.

While it is early days, each month we improve customer awareness of the scheme, improve information and support for injured people and increase monitoring and supervision of insurers.

As the scheme regulator, we are particularly focused on liability, minor injury decisions and whether insurers are accurately advising injured people about their entitlements. We continue to identify areas that need clarification, improvement or additional training and are working with insurers to improve this.

A key element is our work with insurers to shift their culture to the new scheme’s focus on supporting the optimal and early recovery for injured people. This includes detailed file reviews to ensure insurers’ decision making is generally robust and evidence-based and that their claims management practices align closely to the objectives and principles of the legislation.

CTP Assist, our multi-channel support and information service, is helping policy holders and proactively contacting injured people to provide information and assist them with their recovery. The service is demonstrating its value with consistently positive feedback.

Our resources for injured people continue to expand. To ensure we are communicating with people in ways that work for them, we’ve added the first in a series of animations to our website. The animation illustrates the claims process using a cast of characters representing everyone involved in the injured person’s recovery journey.

The Young Drivers Telematics Trial, announced in the last Quarterly Insights, progressed significantly this quarter. We chose our telematics technology and research providers, recruited young drivers and started the first group on the trial. We look forward to sharing the results of the trial in 2019.

Working with NSW Police, we continue to fight fraud in the CTP Scheme, with 21 arrests by Strike Force Ravens to date.

CTP refunds continued, with over $75 million returned to NSW vehicle owners during the quarter, bringing the total to over $138 million.

Mary Maini

Executive Director

Motor Accidents Insurance Regulation (SIRA)

The scheme to date

Some key figures for the 2017 CTP scheme for its first seven months: 1 December 2017 to 30 June 2018.

- Over 1.9 million Green Slip checks

- 30,992 people helped by CTP Assist

- 5,137 claims lodged

- Average premium $499, 20% down (NSW average passenger vehicle premium June 2018 vs June 2017)

- Payments $24 million for treatment expenses, weekly payments, care, funeral expenses, insurer costs

- $138 million refunded

Using animation to guide people through their recovery journey

Our community is diverse, and communicates in different ways. Many people prefer to gather information visually or aurally, or have challenges reading English.

As an organisation that recognises diversity, we’ve been developing an online engagement strategy to make sure we are communicating with people in ways that work for them.

A key new resource is web-based animations, with a cast of characters representing everyone involved in both processing a claim and supporting an injured person in their recovery journey.

Our first animation tells the story of Alex, who’s been injured – fortunately not seriously – in a car accident.

In just under three minutes, it tells us what Alex has to do to make a claim and what he should expect, setting out the roles of insurers, health professionals and others in Alex’s return to health.

While there’s a lot of information, it’s all clear and easy to understand.

More animations are planned over the next year to cover various types of claims, how premiums are set, dispute resolution and other common questions about the scheme.

To see Alex’s story yourself, visit our website:

Young drivers telematics pilot: to make our roads safer

To reduce casualties on NSW roads by improving driver behaviour, we are conducting a trial of telematics for young drivers, in partnership with the NSW Centre for Road Safety.

The project is progressing quickly. Since our last Insights report we’ve: selected a telematics system and research firm to conduct the trial; promoted the trial and recruited 1,000 young drivers, aged 17 to 24, from Western Sydney and regional NSW, the higher-risk areas of the state.

The first young drivers have started the trial.

The trial will run during the second half of 2018. Each participant has a telematics system installed in their car, tracking a range of driving parameters – speed, braking, acceleration and cornering forces, distances travelled and time of day.

Data gathered will provide insights into the participants’ driving and help determine whether telematics can moderate risky behaviour and reduce the likelihood of crashes.

There’s more detail on the trial on our website.

Updated Permanent Impairment Guidelines

On 1 June 2018, updated Motor Accident Permanent Impairment Guidelines took effect.

These guidelines are used to establish the degree of permanent impairment caused by a motor vehicle accident. This determines whether damages for non-economic loss can be awarded under the Motor Accidents Compensation Act 1999.

These Guidelines replace those issued on 1 October 2007 and apply to motor accidents that occurred between 5 October 1999 and 30 November 2017.

For accidents on or after 1 December 2017, Part 6 Permanent Impairment, of the Motor Accidents Guidelines (V3 effective from 13 July 2018) apply.

The assessment method is the same for both schemes and there are no technical differences between them.

The Guidelines are available from the SIRA website.

Green Slip Check

The new Green Slip Check has been available for eight months, saving motorists time when shopping around for the best deal on a Green Slip.

More than 250,000 people have visited every month this quarter.

Over 1.9 million checks have been completed since November 2017.

It’s a fast, user-friendly, comparison tool which will also help us improve our services for motorists. Better data collection with the new tool also supports our regulatory role and encourages competition among insurers.

www.greenslips.nsw.gov.au/price-check

People who entered vehicle information to the Green Slip Check

| April 2018 | 259,707 |

| May 2018 | 299,497 |

| June 2018 | 306,944 |

Green Slip refunds

$75.6 million in Green Slip refunds was returned to vehicle owners, businesses and taxis this quarter, as part of the NSW Government’s reforms.

In all, over $138 million has been returned to over two million vehicle owners.

Green Slip prices were reduced for most classes of vehicles* from 1 December 2017 when the new scheme started. So, if people bought or renewed a Green Slip with a start date before 1 December, their premium would be based on the 1999 scheme.

The refund applies to the owner of the vehicle as at midnight 30 November 2017 and is calculated proportionally. That is, the closer the policy start is to 1 December 2017, the larger the refund.

An advertising campaign to encourage people to claim their refund ran across NSW.

1999 and 2017 schemes

Insurers sold their last policies under the 1999 scheme on 30 November 2017 and started selling policies under the 2017 scheme on 1 December 2017.

The 1999 scheme will continue operating for several years until licensed insurers finalise claims for accidents that happened before 1 December.

Consequently, SIRA is regulating two schemes for a period: the 2017 scheme and claims under the 1999 scheme that aren’t yet finalised.

CTP Assist: help for the injured and their families

CTP Assist provides multi-channel, personalised claims support and information for injured people, policy holders and others in the CTP scheme such as doctors and health professionals. Our support officers routinely contact injured people after they have lodged a claim to make sure they get the support they need. The same support officer calls each time to maintain a strong connection.

Net Promoter Score and Customer Effort Score

To measure and continuously improve customer satisfaction with CTP Assist, SIRA has adopted two widely used service quality measurements: the Net Promoter Score (NPS) and Customer Effort Score (CES).

NPS measures how likely a customer is to recommend CTP Assist to others. CES measures how easy it is for a customer to get the help they need.

Together, these let us constantly measure the overall quality of the service and identify opportunities to improve.

Both have been measured since March 2018 and early results indicate high customer satisfaction.

Case studies

Here are some examples of injured people recently helped (please note names and personal details have been changed for privacy):

Empowering advice

Serious fractures had left Alexandra unable to work and she called CTP Assist in considerable distress.

We explained how the insurer can liaise with her employer to consider her options for returning to work. She was also told about counselling options available and the claims process for additional treatment.

The call ended with Alexandra aware of her options and the next steps. Her support officer said she’d call back the following week, after Alexandra’s next GP appointment, to follow up.

For the three months to 30 June 2018, the CTP Assist team handled the following contacts with injured people in both schemes:

- 14,932 injured people were helped by phone and digital channel

- 654 injured people were connected with an insurer

- 10,052 calls to ensure injured people were getting the treatment and support they needed

Support, even if you’re at fault

Stefan had spent some time in hospital as a result of his accident. An occupational therapist had visited his home to see what aids and help he needed to continue his recovery.

Abbey, from CTP Assist, had called him at each of the regular stages to talk about his claim, the process and what he could do. And, of course, reassuring him he could call any time.

Although he was found at fault in the accident, which meant his claim ended after 26 weeks, he was positive about both CTP Assist and his insurer. His Net Promoter Score survey summed it up: ‘You made a bad experience better, reassuring me I was not on my own.’

Overcoming language barriers

Support officer Diana was making a routine call to check all was well with Henry, who’d been injured 10 weeks earlier. Henry asked Diana to speak to his wife Fay, whose English was better than his.

Fay was very distressed when she came to the phone. She explained Henry hadn’t been able to work, they hadn’t received any income payments and were now three weeks behind on their mortgage. She didn’t know what was happening and couldn’t contact the insurer’s case manager.

Diana called the case manager and left a message.

The case manager called back the next day and explained they were waiting for documents from Henry’s employer to complete the claim.

Diana called Fay to pass this on. There was only one problem: the employer was overseas on holidays.

With more phone calls they managed to contact the employer, the documents were arranged and payments started immediately.

A few weeks later, a much calmer Fay called Diana. “If it hadn’t been for you, I don’t know where we’d be. Thank you.”

‘Now we can put the claim behind us and get on with our lives.’

Joe, after receiving support from CTP Assist, got his insurer payments flowing again.

CTP Legal Advisory Service

A CTP Legal Advisory Service pilot was launched by SIRA in mid-December 2017. The service provides legal advice relating to statutory benefits claims, where legal fees are restricted by the Motor Accidents Injuries Act 2017 and supporting Regulations.

To use the service, an injured person can simply call CTP Assist who will help arrange a referral if they are eligible. Advice is personal and confidential. There is no charge to injured people.

In its first months of operation two referrals have been made, with none of the claims involved subsequently being referred to Dispute Resolution Services.

Key statistics 2017 scheme

This report focuses on the three months from 1 April to 30 June 2018, with some data from the scheme’s commencement on 1 December 2017. Further analysis will be provided as the scheme progresses. Insurers have 28 days after an accident to determine liability for benefits for the first 26 weeks. They must determine liability beyond 26 weeks within three months of the accident.

While it is too early for trends to be visible, we are closely monitoring the scheme.

Claims

1 April to 30 June 2018

| Early notifications | 157 |

| Full claims With legal representation | 722 2,234 |

| Claims lodged where fault is not yet determined | 723 |

| Not at fault claims lodged | 1,824 |

| At fault claims lodged | 409 |

| Total number of claims lodged | 2,956 |

Claims by gender

| Male | 1,497 |

| Female | 1,439 |

| Non-specified | 10 |

| Not reported | 10 |

Claim by age

| Age group | No. of claims | % of total by age |

|---|---|---|

| 0-16 years | 126 | 4% |

| 17-24 years | 352 | 12% |

| 25-39 years | 941 | 32% |

| 40-49 years | 553 | 19% |

| 50-64 years | 643 | 22% |

| 65-79 years | 264 | 9% |

| 80+ years | 67 | 2% |

| Total | 2,956 | 100% |

Claims by insurer

| Insurer | No. of claims | % of total by insurer |

|---|---|---|

| AAMI | 215 | 7% |

| Allianz | 412 | 14% |

| CIC | 204 | 7% |

| GIO | 605 | 20% |

| NRMA | 914 | 31% |

| QBE | 606 | 21% |

| Total | 2,956 | 100% |

Claims by occupation

| Occupation | No of claims | % of total by occupation |

|---|---|---|

| Clerical and administrative workers | 178 | 6% |

| Community and personal service workers | 78 | 3% |

| Labourers | 249 | 8% |

| Machine operators and drivers | 109 | 4% |

| Managers | 99 | 3% |

| Professionals | 263 | 9% |

| Sales workers | 76 | 3% |

| Technicians and trades workers | 153 | 5% |

| Non-earners* | 629 | 21% |

| Yet to be advised** | 1,122 | 38% |

| Total | 2,956 | 100% |

Disputes

1 December 2017 to 30 June 2018

| Internal insurer reviews | 315 |

| Valid disputes lodged with Dispute Resolution Service (DRS) | 68 |

Payments

1 December 2017 to 30 June 2018

| Payment type | Amount |

|---|---|

| Weekly payments | 12,014,299 |

| Treatment expenses | 10,267,553 |

| Care | 174,659 |

| Funeral expenses | 666,630 |

| Insurer investigations | 947,125 |

| Insurer medico-legal | 15,236 |

| Insurer legal | 979 |

| Damages | 0 |

| Claimant costs (excluding legal) | 0 |

| Claimant legal | 1,760 |

| Recoveries | -1,543 |

| Total | 24,086,698 |

* This also includes children, retirees and those not working

** It can take up to four weeks to determine occupation

Claims for damages: future economic loss and pain and suffering

In the 2017 scheme, damages claims may be made by people who have an injury that is not a minor injury and were not at fault in the accident. If they’re partially at fault, damages may be reduced. At the time of this report, nine damages claims for future earnings and pain and suffering had been received by insurers.

During the first 20 months after an accident, the person receives lost income, treatment, care and rehabilitation, to promote optimal recovery. After 20 months, those with injuries other than minor injuries may submit a damages claim.

People seriously injured in a motor vehicle accident can make a damages claim immediately after the accident. Seriously injured people are people with injuries that result in a greater than 10 per cent whole person impairment.

Future medical costs don’t need to be claimed, as medical treatment and care are provided under statutory benefits (personal injury benefits). For people with injuries that are not minor injuries, these are available for life if necessary.

If an accident is fatal, the deceased person’s family can make a claim for funeral expenses, which are paid automatically, regardless of who was at fault in the accident.

Scheme insurers

The Green Slip market is privately underwritten1 by six licensed insurers operated by four organisations: Suncorp (AAMI and GIO), Allianz Australia (Allianz and CIC Allianz), NRMA and QBE. Zurich stopped issuing Green Slip policies to the public on 1 March 2016 under the 1999 scheme.

Note 1: Underwriting is the process of assessing risk and ensuring the cost and conditions of the cover are proportionate to the risks faced by the individual concerned.

Best prices by insurer

Below is a comparison of current Sydney best prices for passenger motor vehicles with prices at the end of the previous (March) quarter.

Prices are for drivers aged 30 to 54.

Best prices by insurer

| Insurer | March 2018 | June 2018 | Best price change |

|---|---|---|---|

| NRMA | $468 | $468 | 0% |

| GIO | $475 | $471 | -1% |

| AAMI | $475 | $475 | 0% |

| Allianz | $478 | $478 | 0% |

| QBE | $470 | $470 | 0% |

| CIC Allianz | $467 | $467 | 0% |

Premium

During the June 2018 quarter, new premiums from GIO came into effect from 25 May 2018, reducing their best price by $4 (1%), from $475 to $471.

No insurer submitted a new filing2 during the June 2018 quarter.

Note 2: A filing shows proof of financial responsibility in setting premiums.

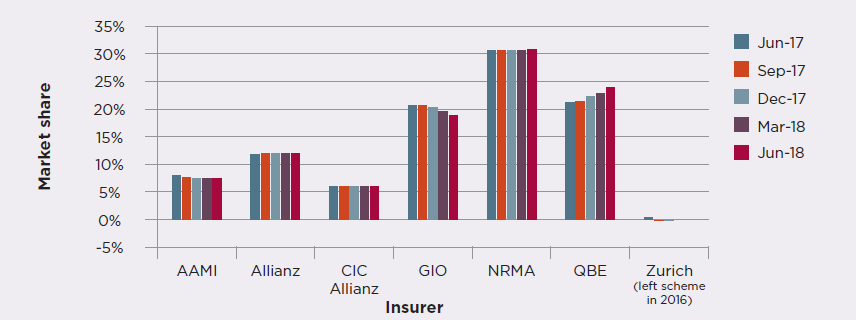

Market share

The graph below shows the proportion of premiums collected by insurers from the June 2017 quarter to the June 2018 quarter and includes the 2017 scheme. It is based on a rolling 12-month period to smooth trends in market share by compensating for seasonal renewals of large fleets of vehicles.

During this quarter, NRMA retained the largest market share with 31 per cent, followed by QBE with 25 per cent and GIO with 17 per cent. QBE and NRMA gained 3.7 and 0.5 per cent market share respectively compared with June 2017. GIO lost 4.3 per cent and CIC Allianz lost 0.1 per cent. AAMI and Allianz market shares remained stable compared to June 2017.

Premium market share (rolling 12-month) comparison

on premiums paid by motorists without adjustment for any refunds as a result of the new scheme. Independent analysis showed the impact of including the refunds was minimal on each insurer’s market share. All insurers agreed with this approach.

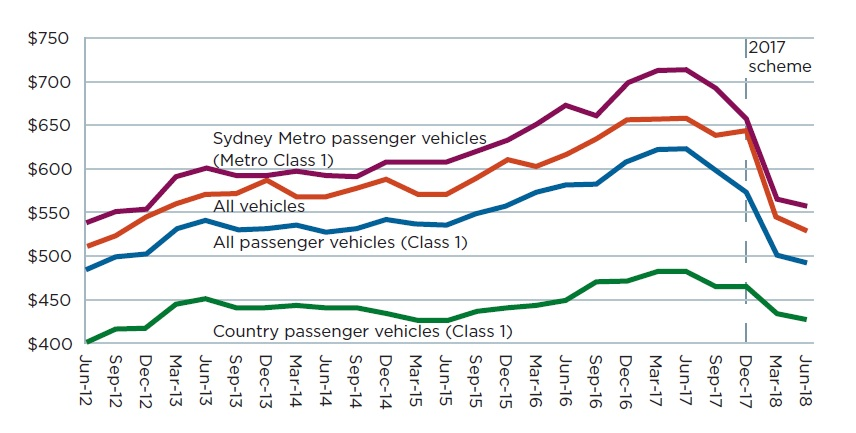

trends

The graph below shows that Green Slip premiums are trending downwards, mainly due to the reform. The reduction in the September 2017 quarter is due to the reduction in claim frequency (the ultimate number of claims divided by the number of vehicles) which insurers factored into their 1 July 2017 premium filings under the 1999 scheme.

The average Green Slip premium paid by all NSW Class 1 passenger vehicle owners was $499, a $127 (20.3 per cent) reduction compared to the June 2017 quarter figure of $626. The reduction is principally due to the reforms and partly due to reductions in claim frequency in recent quarters. NSW Police’s Strike Force Ravens counter fraud activities have also contributed to this reduction.

Average premium trends (includes GST and levies)

Insurer supervision

Our Claims and Customer Outcomes team, through regular supervision visits to insurers, focuses on advice and education. We’re developing training and guidance resources to reinforce high standards in insurer claims handling.

During the June 2018 quarter, our reviews found a range of approaches among insurers to risk screening, finalising claims and communication.

Recovery plans need more attention, with some inconsistency and delays in completing them.

Insurers have taken a variety of approaches and are interested in further training.

Internal reviews are proving effective by giving claimants an avenue for review of decisions when further information is obtained. Insurers are carrying them out promptly and are demonstrating the independence of their review processes. Insurers are using what they learn to continue to improve their decision making.

Overall, the regular visits are proving valuable in guiding insurers to assess and improve their performance and claims practices while giving SIRA additional insights into claims management practices and overall insurer culture.

Insurer internal reviews

285 insurer internal reviews have been lodged this quarter

As the first step in resolving a dispute, an injured person can request an internal review of a decision by an insurer.

This must be independent of the original decision maker, allowing the injured person and insurer to resolve the dispute without SIRA’s Dispute Resolution Service (DRS). This will usually provide a quicker outcome.

An insurer internal review is needed before most disputes can be lodged with DRS.

Internal reviews - 1 December 2017 to 30 June 2018

Internal reviews by decision type

| Internal review type | No. | % |

|---|---|---|

| Is the injury more than a minor injury? | 147 | 47% |

| Amount of weekly benefit payments | 48 | 15% |

| Is treatment and care reasonable and necessary? | 44 | 14% |

| Is the injured person mostly at fault? | 20 | 6% |

| Other | 56 | 18% |

| Total | 315 | 100% |

Internal reviews by outcome

| Internal review outcome | No. | % |

|---|---|---|

| Decision upheld | 141 | 45% |

| Decision overturned | 59 | 19% |

| Withdrawn | 19 | 6% |

| Declined | 17 | 5% |

| In progress | 79 | 25% |

| Total | 315 | 100% |

Disputes and litigation

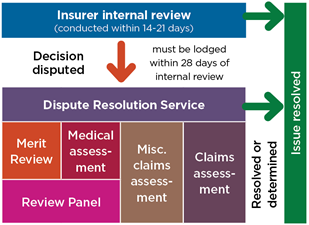

Where an injured person disagrees with an insurer’s decision after an internal review, they can access SIRA’s Dispute Resolution Service (DRS).

Note: some matters can proceed directly to DRS.

Disputes are distinct from complaints about CTP policies, insurer practices, services or conduct.

The first 68 disputes under the 2017 scheme were lodged in the quarter ended June 2018. There has been no litigation under the scheme to date.

Motor Accident Injuries Act 2017 dispute resolution model

Dispute resolution - 2017 scheme - 1 December 2017 to 30 June 2018

| Type | Dispute matter | Decision over-turned | Decision upheld | In progress | Declined | Withdrawn | Total |

|---|---|---|---|---|---|---|---|

| Medical | Minor injury | 38 | 1 | 39 | |||

| Medical | Is treatment and care related to injury caused by accident? | 7 | 7 | ||||

| Medical | Is treatment and care reasonable and necessary? | 1 | 5 | 6 | |||

| Misc claim | Is the injured person mostly at fault? | 2 | 1 | 3 | |||

| Merit | Amount of weekly benefit payments | 1 | 4 | 1 | 6 | ||

| Merit | Is death or injury from a NSW accident? | 1 | 1 | 2 | |||

| Merit | Statutory benefits time limits | 1 | 1 | ||||

| Merit | No benefits if workers compensation payable | 1 | 1 | ||||

| Merit | Variation of weekly payments | 1 | 1 | ||||

| Merit | Gratuitous services | 1 | 1 | ||||

| Unknown | 1 | 1 | |||||

| Total | 1 | 3 | 59 | 2 | 3 | 68 |

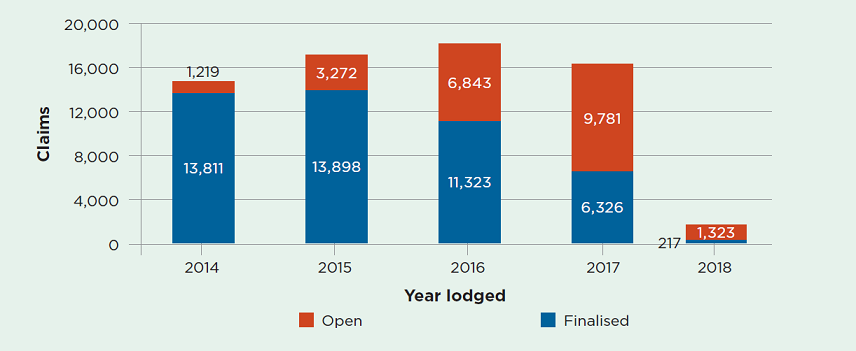

Key statistics 1999 scheme

While the last 1999 scheme CTP policies were sold on 30 November 2017, people injured up to that date can submit a claim for up to six months after the accident.

Any disputes that may arise in those claims in the months and years ahead may still be referred to the Medical Assessment Service (MAS) and the Claims Assessment and Resolution Service (CARS) which continue to operate. Consequently, this scheme will be in operation for many years, as people’s injuries, claims and any disputes which may arise are resolved.

Claims (1 April 2018 to 30 June 2018)

| New claims lodged in this reporting period | 444 |

| Not-at-fault Accident Notification Form (ANF) | 4 |

| At fault ANF | 2 |

| Full claims directly reported | 427 |

| Full claims converted from an ANF | 11 |

Open and closed claims by lodgement year

Open or active claims

As of 30 June 2018, there were 24,135 open claims under the 1999 scheme. This compares with 27,630 as at 31 March 2018.

The time to settle a claim may be affected by the time it takes for an injury to stabilise, enabling the parties to assess whether there may be an entitlement to damages for non-economic loss, and to resolve any disputes. It is not uncommon for claims to take three to five years to be resolved.

As people injured up to 30 November 2017 have up to six months after their accident to submit a claim, lodgement of claims ceased on 31 May 2018, with the exception of a few late claims.

June 2018:

$389 million total gross paid in June quarter

$4.55 billion outstanding estimate by insurers as at 30 June 2018

Total claims by insurer

| Insurer | No of claims | % of total by insurer |

|---|---|---|

| AAMI | 27 | 6% |

| Allianz | 53 | 12% |

| CIC Allianz | 33 | 7% |

| GIO | 83 | 19% |

| NRMA | 140 | 32% |

| QBE | 102 | 23% |

| Zurich | 6 | 1% |

| Total | 444 | 100% |

Injured people with legal representation

| Total new claims | |

|---|---|

| Self-represented | 140 |

| Legally represented | 304 |

| Total | 444 |

Medical Assessment Service

SIRA’s Dispute Resolution Service also delivers the Motor Accidents Medical Assessment Service (MAS), as part of the 1999 scheme, to resolve any medical disputes between injured people and insurers.

Medical disputes are referred to independent expert decision-makers (MAS Medical Assessors) for determination.

Medical assessments, particularly about permanent impairment, are usually referred to MAS about two and a half years after a motor accident, once injuries have stabilised. So we expect to see the volume of disputes continuing at the current rate until about mid-2020, for accidents occurring before the new scheme started on 1 December 2017.

New medical disputes referred to MAS

| Permanent impairment | 950 |

| Treatment and care | 143 |

| Further medical assessment | 90 |

| Medical assessment review | 270 |

| Total for quarter ended 30 June 2018 | 1,453 |

| Total for previous quarter | 1,340 |

Disputes resolved by MAS

There were 1,634 disputes resolved by MAS this quarter, compared with 1,242 in the previous quarter.

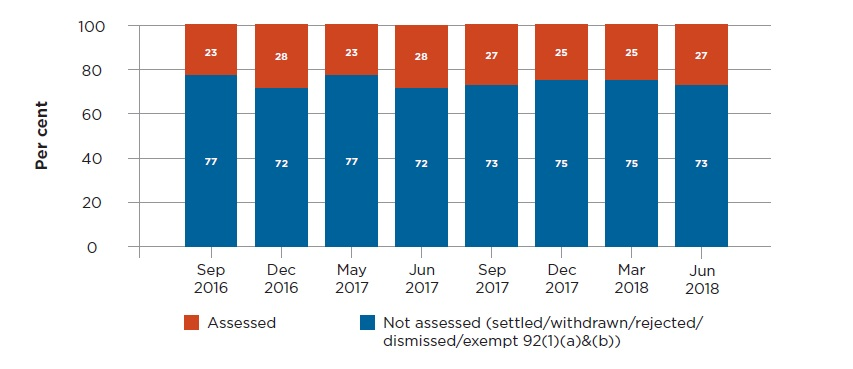

The predominant medical disputes determined by independent MAS Medical Assessors are disputes about permanent impairment, to help parties determine whether an injured person is entitled to claim damages for non-economic loss.

Injured people who have been assessed with permanent impairment of greater than 10 per cent may claim for non-economic loss.

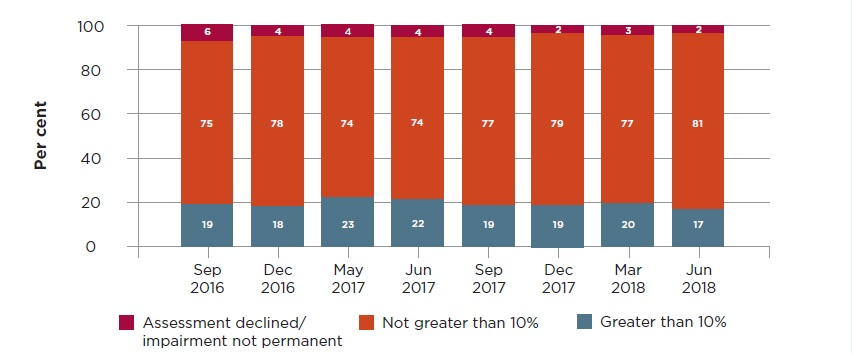

Over 1,100 permanent impairment disputes were resolved in the June quarter. As the graph below shows, 17 per cent of these were assessed as having a permanent impairment greater than 10 per cent, a lower proportion than prior periods.

MAS permanent impairment disputes – assessed outcomes by type

Claims Assessment and Resolution Service

The Dispute Resolution Service also delivers the Motor Accidents Claims Assessment and Resolution Service (CARS), as part of the 1999 scheme, to resolve any claims disputes between people injured in motor accidents and insurers.

Claims disputes are referred to independent expert decision-makers (CARS Claims Assessors), led by the Principal Claims Assessor.

Claims assessments are usually referred to CARS about three years after a motor vehicle accident, once injuries have stabilised and any damages can be assessed and potentially negotiated by the parties. So we expect to see the volume of claims assessments referred to CARS continuing at the current rate until about 2020, three years after the new scheme commenced.

New claims disputes referred to CARS

| General claims assessment | 603 |

| Further general claims assessment | 2 |

| Special assessments of procedural disputes | 34 |

| Applications for exemption from claims assessment | 430 |

| Total for quarter ended 30 June 2018 | 1,069 |

| Total for previous quarter | 1,028 |

Disputes resolved by CARS

This quarter 1,094 disputes were resolved by CARS, compared with 924 disputes resolved in the previous quarter.

General assessments of claims are the predominant dispute referred to CARS. These may include assessments of liability, damages and legal costs. Over 500 general assessment disputes were resolved in the June quarter, most without the need for a decision by a CARS Claims Assessor. This rate is consistent with prior periods.

CARS claims assessments disputes resolved (with and without an assessment)

Administrative law challenges to decisions

Decisions made by statutory administrative decision-makers, including Merit Reviewers, Medical Assessors and Claims Assessors, are all potentially subject to administrative law judicial review in the NSW Supreme Court.

During this quarter there were over 2,700 disputes resolved by the Medical Assessment Service (MAS) and the Claims Assessment and Resolution Service (CARS).

Administrative challenges this quarter included the following for each of these services.

CARS

Two challenges to CARS decisions were commenced, both on behalf of an insurer.

No challenges to CARS decisions were determined by the courts.

Six challenges to CARS decisions are currently before the courts.

MAS

Three challenges to MAS decisions were commenced, two on behalf of an injured person and one on behalf of an insurer.

No challenges to MAS decisions were finalised by the courts.

Fourteen challenges to MAS decisions are currently before the courts.

Keeping the scheme sustainable

Fraudulent claims, with staged accidents, exaggerated injuries and collusion, are a burden for motor accident insurance schemes around the world.

The cost of this is carried by the whole community, specifically in the premiums we pay for our insurance. So reducing fraud benefits everyone.

New laws have strengthened SIRA’s ability to investigate and prosecute people attempting to cheat the system.

Update from Strike Force Ravens

We continue to work with the NSW Police’s Strike Force Ravens to deter, detect and prosecute fraudulent claims.

As at June 2018, Strike Force Ravens has made 21 arrests and laid 164 charges, totalling approximately $13.7 million.

Complaints

MAIR will be reporting regularly on complaints. Complaints will be used to improve service delivery and identify any trends emerging in the scheme.

Better complaints handling

In June 2018, to improve customer experience and increase regulatory insights into all aspects of the CTP Scheme, we began a pilot of a centralised complaints handling function. We will report more information in future Insights reports.

Complaints can arrive by phone, email, post, our website, or through Feedback Assist (see below).

Most complaints are resolved by our front line CTP Assist team. However complaints that are more complex or need specialised knowledge go to the centralised complaints handling function which distributes them to the appropriate teams for action. This includes any regulatory complaints received by the Dispute Resolution Service.

Feedback Assist

In late 2017, SIRA launched Feedback Assist on both the SIRA website and the Green Slip Price Check. A click opens a window to make a complaint or compliment, or to share a suggestion.

This tool is part of a Department of Finance, Services and Innovation initiative to improve complaint handling. During the quarter over 450 policy holders, injured people and other members of our NSW community used this tool. SIRA appreciates people taking the time to provide feedback.

Reviews by the Compliance, Enforcement and Investigations team

In the June quarter 36 complaints were made, as detailed below. These were reviewed or are under review by SIRA’s Compliance, Enforcement and Investigations team.

| Closed/resolved as at 30 June 2018 | 30 |

| Under review | 6 |

| Resolved in favour of the insurer | 7 |

| Resolved in favour of the injured person | 18 |

| Resolved in neither party's favour | 5 |

| Complaint reason | No. |

|---|---|

| Alleged breach of the Claims Handling Guidelines | 14 |

| Alleged breach of the Treatment Rehabilitation and Care (TRAC) guidelines | 5 |

| Alleged inappropriate insurer behaviour or conduct | 3 |

| Alleged insurer was not just and expeditious in resolving a claim | 12 |

| Accuracy of insurer communications to injured people | 1 |

| Out of our jurisdiction | 1 |

Conclusion

Excellent customer service is a key focus for SIRA and a priority for the Premier. We are creating more animations about key aspects of the scheme over the next 12 months to ensure we address the different ways people learn in our diverse community.

To continuously improve, we are measuring customer satisfaction with CTP Assist. Early results are positive.

Insights gained from our regular insurer visits are fed back to insurers for their improvement, backed up with education and review.

We continue to closely monitor the 1999 scheme and injured people with claims under it are being supported by CTP Assist.

Looking to the future, we are contributing to national work on the implications of vehicle automation for road safety and motor accident insurance. This starts from the principle that no one should be worse off financially or procedurally if they’re injured by an automated vehicle.

Feedback on how we can improve this report is appreciated and can be sent to:

[email protected].