Print PDF

Point to point Horizon Scanning Issues Paper

This Issues paper was released as part of a SIRA consultation with stakeholders and the community.

About this paper

The purpose of this paper is to consult with point to point stakeholders on future Compulsory Third Party (CTP) insurance arrangements for the industry. The State Insurance Regulatory Authority (SIRA) is seeking submissions on specific issues raised in this paper. Submissions will help inform options for future CTP arrangements for the point to point industry to consider. Although the current point to point CTP arrangements are touched on to provide context, they are not the focus of this paper as discussions on these arrangements are managed through separate processes.

On 18 September 2018, SIRA held a point to point Horizon Scanning Workshop as part of its industry engagement strategy which is discussed further in Part 3. The issues for consideration in Part 4 of this paper are informed by presentations and group discussions held at the workshop.

Introduction

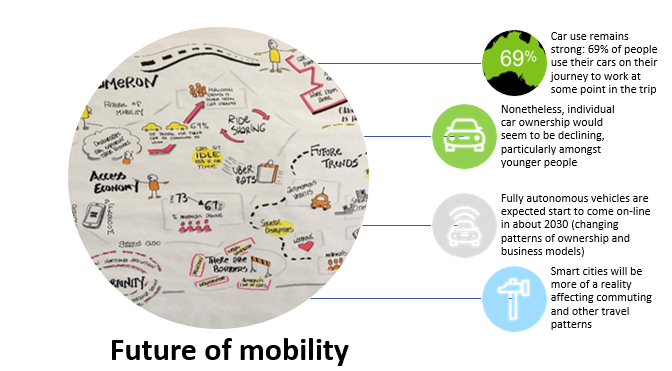

The point to point industry is undergoing significant change which has implications for CTP insurance. CTP arrangements have centred around the more traditional single purpose vehicles falling within distinct vehicle classes; however, vehicle use in the passenger service industry is now more dynamic, multi-faceted and unconfined to convention.

In the point to point industry, conventional taxi and hire car services have been an enduring part of the passenger transport landscape. Taxis and hire cars have been readily identified in terms of shape and usage and - in the main – fell confidently into vehicle class categories. However, the emergence of innovative hire car services in NSW has disrupted the industry, blurred the boundaries between the business and private use of vehicles and challenged current regulatory models. For example, today, the family car can be used for everyday commuting, provide fare paying passenger services or even delivery services. The issue is becoming less about what vehicles were designed primarily to do; rather it is becoming more about what functions vehicles are performing at any one point in time. Moreover, what risks are associated with vehicles performing specific functions and how should this be best managed in terms of appropriate CTP arrangements?

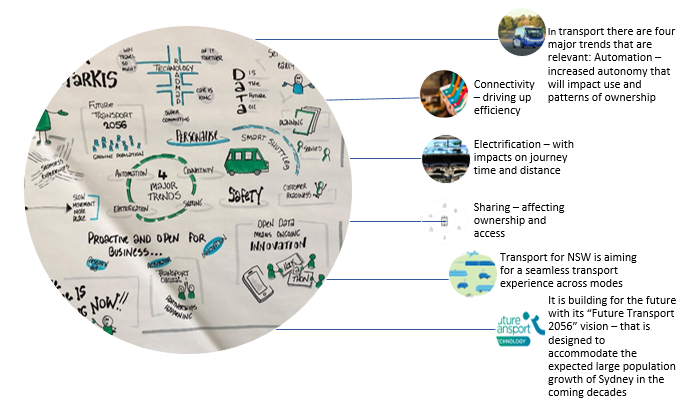

A burgeoning digital economy, consumers seeking convenient and seamless transport options and enabling innovative smart technologies will only continue to drive changes to the point to point market. In this environment, SIRA will be challenged to balance regulatory agility with public good outcomes without impeding market development. SIRA is already working with industry stakeholders and insurers to facilitate change. For example, the adoption of efficient digital booking and trip management systems in the point to point market is providing opportunities to use data to develop more relevant approaches to CTP insurance. However, data and technology are a means to better arrangements, the key task for SIRA is to develop a complete framework that can evolve to meet the needs of modern mobility services and deliver fair outcomes for everyone.

Current CTP arrangements for taxis and hire vehicles under the Motor Accident Injuries Act 2017 (the MAI Act 2017) are transitional arrangements. SIRA will work over the next two years to improve point to point CTP arrangements.

SIRA’s Three Horizon Strategy

SIRA has engaged major industry stakeholders as part of CTP reforms for the point to point industry. Discussions have included options to address the potential emerging imbalance in CTP arrangements in major parts of the industry, because:

- CTP arrangements were not set up for the use of private vehicles for point to point transport,

- CTP insurance was a significant operating cost for the taxi industry,

- rideshare operators were paying premiums on private use and not business use, and

- the risk and exposure profile of rideshare services in NSW is largely unknown.

The MAI Act 2017 commenced on 1 December 2017 and prescribed that similar insurance premiums be paid for taxis and hire vehicles having regard to relevant factors of comparison until at least 1 December 2020. Short-term transitional CTP arrangements were developed that represented the most practical way to address the impact of innovative mobility services alongside traditional passenger services.

Soon after the commencement of the MAI Act 2017, SIRA developed a Three Horizons Strategy to manage CTP arrangements for the point to point industry.

Horizon One

In Horizon One, SIRA worked with industry to implement the usage-based CTP premium for taxis and rideshare operators that includes a cents-per-kilometre (cents/km) component. At the time, taxis and rideshare vehicles use different booking and fare metering platforms and the method for calculating a cents/km usage rate reflects this difference. Under these arrangements, taxis can also choose to simply pay a fixed annual premium. More detail on these arrangements can be found on SIRA’s website at www.sira.nsw.gov.au.

Horizon Two

In Horizon Two, SIRA is working with the taxi industry and insurers as taxi fleets in NSW gradually transition to new booking and fare metering platforms. These platforms are capable of more direct data transfer and will more closely align the method of calculating the usage-based CTP premiums for taxis and rideshare.

Horizon Three

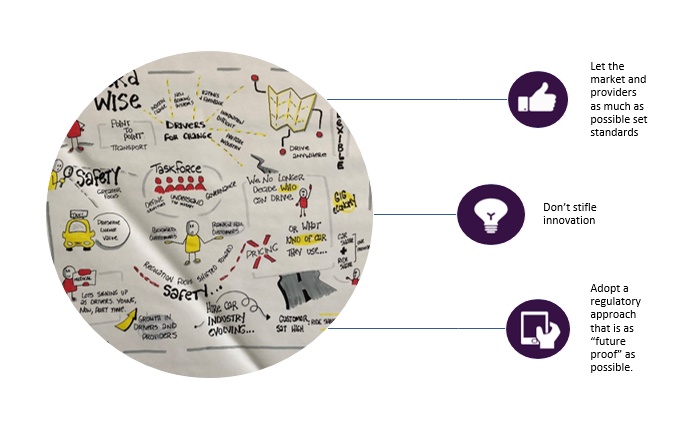

The purpose of Horizon Three is to develop post transitional CTP arrangements that will be – as much as possible – future proof and be flexible in application to manage market innovation and fluidity.

Horizon Three will be a combination of targeted consultations, industry analysis and premium setting design.

Consultation issues will centre on:

- what the future point to point landscape will look like,

- key principles that will characterise and shape more enduring point to point CTP arrangements, and

- the design of premium setting and application mechanisms that ensure future CTP arrangements are fair, affordable, sustainable and reflective of risk.

Consultation and development process

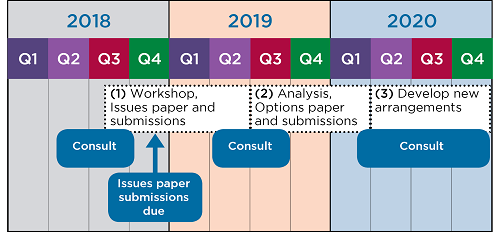

Horizon Three commenced with the Horizon Scanning Workshop on 18 September 2018 representing the first stage of a consultation process that will continue until late 2020. The workshop comprised of presentations from Deloitte, Transport for NSW and the Point to Point Commission and a series of group discussions. Key points from the presentations are at Key presentation messages from Horizon scanning workshop at the end of this issues paper.

Submissions in response to this Issues Paper will be examined alongside industry and actuarial analysis, the findings of which will be presented in an Options Paper to industry in 2019. SIRA will communicate timings for the Options Paper once the extent of consultation and analysis required is clearer. After receiving submissions on the Options Paper, SIRA will begin the development phase of the new CTP arrangements. SIRA will continue to consult during the analysis and development of a set of draft Guidelines for further stakeholder review.

Indicative timings

SIRA anticipates that new CTP insurance arrangements for the point to point industry will be developed during 2020; however, implementation timeframes will be contingent on feedback with industry.

Issues for consideration

The following three issues comprising design principles, key challenges and possible risk factors have been informed through discussions with stakeholders.

Issue 1 – Design principles

SIRA is proposing the following nine principles to guide the development of post transitional arrangements for the point to point industry.

(1) Affordability and sustainability

The CTP scheme in NSW is privately underwritten. Insurers need to be fairly compensated for the risk factors applied to a CTP policy. Further, the scheme needs to be sufficiently funded to ensure that injured persons receive fair compensation and treatment that optimises a return-to-work or normal daily activities. At the same time, premiums for all motorists need to be affordable so that people are not excluded from the social and economic benefits of driving.

(2) Simplicity

Regulation impacts in many ways from industry compliance and administration through to enabling injured persons to access scheme benefits. A ‘good’ scheme should be simple as practicable for all stakeholders and minimise direct and indirect costs. Further, the cost of implementing scheme elements should not be unnecessarily burdensome compared to the overall benefits derived.

(3) Promotes competition

Arrangements should ensure that competition amongst CTP insurers is actively encouraged and maintained. CTP arrangements should allow insurers to innovate in terms of products and ways to price risk. Barriers to new market entrants should be kept low and implementation costs should not exceed the benefits.

(4) Promotes road safety

Driving behaviour has a large impact on the cost of CTP insurance and rewarding improved road safety can empower drivers to effect better CTP outcomes for themselves. Arrangements should promote road safety and not work against it. Incentives incorporated into CTP arrangements should result in fewer accidents and injuries.

(5) Neutrality

Arrangements should not ‘tip’ the passenger transport landscape to advantage one industry segment over the other and should produce competitively neutral outcomes for all point to point stakeholders.

(6) Evidence based

CTP insurance premiums are determined by industry analysis, the insurer’s scheme experience and regulatory requirements. Arrangements and CTP premium determinations should be based on evidence and data.

(7) Privacy

Modern risk-based CTP arrangements will increasingly leverage accurate data sources to dimension risk. Accordingly, privacy issues and legislative requirements will need to be considered when developing a new regulatory framework.

(8) Future proof

The point to point sector will continue to evolve after 2020, with further innovations in technology, usage, and business models. To the extent possible the design of the scheme should be flexible enough to cope with further developments with minimal change so as not constrain those developments.

(9) Fair pricing of risk

Point to point CTP arrangements should be ‘risk-based’. Premiums calculated for a vehicle/driver/owner under the scheme should reflect the risk that is brought onto the road by the vehicle and its use.

Considerations

SIRA would appreciate comments on these guiding principles and welcome suggested edits, amendments or other principles that should shape SIRA’s development of post transitional arrangements.

Issue 2 – Key challenges

The point to point industry is evolving and it is important to understand how and what challenges need to be considered in designing new CTP premiums arrangements. Some of these key challenges are outlined below.

Multiple functions

Industry service providers are utilising their fleets to provide passenger services and other offerings. As such, increasing numbers of vehicles across existing vehicle classes are now being used by operators and drivers to perform different functions, e.g. passenger service, food delivery or other as yet unknown new services.

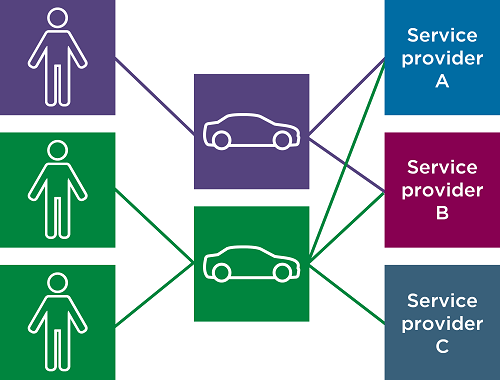

Vehicle, driver and business relationships

Traditionally, passenger service vehicles had a known relationship between driver, vehicle and service providers; however, these relationships have now become more dynamic. An individual driver may drive one of a number of vehicles, or operate a vehicle across one or more service providers for a range of transport services.

Identification

In a sharing economy, many vehicles can start a registration period as a family car. During the registration period, a vehicle can also be operated as a passenger service vehicle. Potentially identifying more transient passenger service vehicles could be problematic for insurers.

Access

The Point to Point Commission licenses businesses as performing booked services or rank and hail work, because of the need for additional safety screening around anonymous work. This distinction may be less relevant when determining CTP insurance arrangements.

Considerations

Please provide feedback on the industry characteristics identified above.

Are there any other significant characteristics of the industry including services, disruptions, business challenges or other existing or emerging issues that should be considered?

Given the increasingly dynamic relationship characteristics described above, will the current approach to issuing and/or administering CTP policies remain appropriate?

In developing post transitional arrangements, are there any approaches to CTP insurance that may cause barriers to market entry or potentially stifle competition and innovation.

Issue 3 – Risk rating factors

Insurers use risk-rating factors to calculate an insurance premium, based on their view of an individual’s risk. In the CTP scheme, risk rating factors can include driving history, vehicle age and garaging location.

A well-designed risk-based scheme will ensure competitive neutrality, fairness and promote responsible behaviour. The following risk rating factors have been proposed to determine risk for the point to point industry as part of post transitional arrangements.

Suggested factor

| Description | Possible unintended consequences or disadvantages |

|---|---|---|

| Kilometres travelled | This is a basic measure of exposure. The higher the number of kilometres travelled, the greater the level of risk. | It could disproportionately affect rural drivers. One way to ensure affordability for high kilometre drivers would be to place a cap on kilometres travelled to keep premiums affordable. However, a cap could lead to further complications and opportunities for “gaming” the system. For example, once a cap is reached, would the fare reduce to reflect that a premium is no longer paid; if not, drivers could choose to operate vehicles that exceeded the cap to collect additional money. |

| Location | Different risk ratings apply to different locations (e.g. rural areas, Sydney CBD). |

This could create economic incentives to not provide services to a location leading to access and equity issues. Limited access to passenger services could push people to make risky decisions such as driving in an impaired condition or choosing higher risk modes of transport. Tracking location could have privacy implications. |

| Time-of-day | Higher loadings could be applied to the day and time of day (late at night, early morning, Friday and Saturday night). |

Increased costs could cause people to drive their own car instead of using a passenger service at high risk times such as Friday and Saturday nights. This factor could result in a shift in traffic loads to other times of the day, which could be positive or negative. |

| Shift durations Rolling shifts | The number of hours a driver spends on the road. |

This may not be the best way to measure driver fatigue as a driver may have finished a full day at another job unrelated to passenger services. To be effective, this may require sharing driver information amongst multiple service providers. |

| Driver condition | Measuring fatigue and driver skill. |

It would be difficult to assess this factor possibly driver feedback, perhaps driver age. Measuring driver condition would require suitable technology in a vehicle – this could be costly, overly burdensome and have privacy implications. |

| Vehicle usage | Is a vehicle transporting passengers, or making deliveries, or both? |

If ratings around usage are too prescriptive, this could stifle innovation. If usage is not clear, this could result in regulatory creep. |

| Vehicle design and features |

Vehicles are rated on number of safety features. Vehicles with greater carrying capacity could be rated as having greater exposure. |

On its own, this would not take vehicle maintenance into account. Overly prescriptive vehicle assessments in terms of features may create unnecessary complexity. |

| Effective corporate safety policies | Reduced loading to a vehicle owner that is operated under a service provider with good safety policies and outcomes. | This rating factor would be complicated to administer if a vehicle operates for more than one service provider. |

Considerations

SIRA welcomes comment and input on the above risk rating factors or suggestions for other risk rating factors.

Any suggestions should be weighed against the guiding principles outlined in Issue 1 in terms of determining unintended consequences.

Submissions

Submissions to this paper are due by 5pm Friday 21 December 2018. For more details visit the consultation page.