CTP insurer claims experience and customer feedback comparison - December 19

A PDF version of this report is available.

1 December 2017 to 31 December 2019

Why does SIRA publish insurer data?

As part of its regulatory oversight, SIRA monitors insurers’ performance through data-gathering and analysis. SIRA helps to hold insurers accountable by being transparent with this data, enabling scheme stakeholders and the wider public to have informed discussions about the performance of the industry.

Additionally, access to insurers’ data will help customers make meaningful comparisons between insurers when purchasing CTP insurance. People injured in motor accidents may also benefit from knowing what to expect from the insurer managing their claim.

In this report, SIRA compares six key indicators of customer experience across the five CTP insurers in NSW: AAMI, Allianz, GIO, NRMA and QBE.

The following evidence-based indicators measure insurer performance over the course of a claim journey:

- the number of statutory benefits claims accepted by insurers

- how quickly insurers pay statutory benefits

- the outcome of claim decisions reviewed by insurers through the insurer’s internal review unit

- the number and outcome of claims referred to the Dispute Resolution Service

- the number and type of compliments and complaints received by SIRA about insurers

- the number and type of issues escalated to SIRA’s Compliance, Enforcement and Investigations team.

This issue of the report presents data for the first 3 measures above, over two time periods: 1 Jan - 31 Dec 2018 and 1 Jan - 31 Dec 2019. The other measures are presented as per the periods described in the respective sections of the report.

The CTP Insurer Claims Experience and Customer Feedback Comparison results are published each quarter. Future publications will benefit as SIRA continues to improve and expand its data collection and reporting capability.

How many claims* did insurers accept?

Insurers accepted most claims from injured people and their families. Over 98% of claims were accepted in both 2018 and 2019. More detail on the rejected claims is provided on the following page.

| Insurer | Percentage of claims accepted | Total claims accepted | ||

|---|---|---|---|---|

| 2019 | 2018 | 2019 | 2018 | |

| AAMI | 98.1% | 100.0% | 939 | 856 |

| Allianz | 98.0% | 99.1% | 2,153 | 1,998 |

| GIO | 98.1% | 99.9% | 2,003 | 2,143 |

| NRMA | 98.0% | 96.1% | 3,595 | 3,322 |

| QBE | 99.2% | 99.7% | 2,569 | 2,192 |

| Total | 98.3% | 98.5% | 11,259 | 10,511 |

*Statutory benefits claims

Why were claims declined?

Insurers decline claims in certain circumstances under NSW legislation.

The most common reasons for claim denial included:

- late claim lodgement (more than 90 days after their accident),

- insufficient information provided to the insurer,

- the claim did not involve a motor vehicle accident.

1.7% of claims were declined by insurers in 2019, compared to 1.5% in 2018. There were 11,259 total claims accepted in 2019, up from 10,511 in 2018.

Reasons why claims* were declined

Year ending Dec 2019

| Insurer | Late claim (lodged >90 days after accident) | Insufficient information provided to insurer | Claim did not involve a motor vehicle accident | Claim involved an uninsured, unregistered or unidentified vehicle | Claim related to a serious driving offence | Other** | Total |

|---|---|---|---|---|---|---|---|

| AAMI | 9 | 9 | 0 | 0 | 0 | 0 | 18 |

| Allianz | 7 | 0 | 28 | 4 | 1 | 3 | 43 |

| GIO | 20 | 11 | 4 | 0 | 0 | 3 | 38 |

| NRMA | 35 | 7 | 4 | 10 | 8 | 8 | 72 |

| QBE | 9 | 0 | 2 | 4 | 0 | 7 | 22 |

* Excludes claims which were declined because customers were covered by other scheme/insurer.

**Includes: injury non-existent, or not covered under the legislation.

Year ending Dec 2018

| Insurer | Late claim (lodged >90 days after accident) | Insufficient information provided to insurer | Claim did not involve a motor vehicle accident | Claim involved an uninsured, unregistered or unidentified vehicle | Claim related to a serious driving offence | Other** | Total |

|---|---|---|---|---|---|---|---|

| AAMI | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Allianz | 8 | 0 | 4 | 3 | 3 | 0 | 18 |

| GIO | 2 | 0 | 0 | 1 | 0 | 0 | 3 |

| NRMA | 41 | 44 | 16 | 17 | 15 | 2 | 135 |

| QBE | 2 | 0 | 0 | 1 | 0 | 3 | 6 |

**Includes: injury non-existent, or not covered under the legislation.

Totals 2019 vs 2018

| Late claim (lodged >90 days after accident) | Insufficient information provided to insurer | Claim did not involve a motor vehicle accident | Claim involved an uninsured, unregistered or unidentified vehicle | Claim related to a serious driving offence | Other** | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2018 | 2019 | 2018 | 2019 | 2019 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 |

| 80 | 53 | 27 | 44 | 38 | 20 | 18 | 22 | 9 | 18 | 21 | 5 |

* Excludes claims which were declined because customers were covered by other scheme/insurer.

** Includes: injury non-existent, or not covered under the legislation.

How long did it take to receive treatment and care benefits?

Receiving treatment immediately after an accident is critical for making a full recovery. That is why insurers cover initial medical expenses for most people before they lodge a formal claim. This is when customers access treatment and care services after notifying the insurer, but before lodging a formal claim.

74% of injured people received ‘pre-claim support’ in 2019, with a further 20% accessing treatment and care services within the first month after lodging a claim. This result is an improvement on 2018, where 69% of customers accessed treatment and care benefits prior to formally lodging a claim.

Time it take to receive treatment and care benefits (in weeks)

| Insurer | Before lodgement | 0-4 weeks | 5-13 weeks | 14-26 weeks | Claims* | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | |

| AAMI | 63% | 57% | 29% | 31% | 6% | 10% | 2% | 2% | 782 | 643 |

| Allianz | 79% | 78% | 17% | 17% | 3% | 4% | 1% | 1% | 1,769 | 1,601 |

| GIO | 66% | 57% | 26% | 32% | 7% | 9% | 1% | 2% | 1,618 | 1,644 |

| NRMA | 78% | 73% | 17% | 20% | 5% | 6% | 0% | 1% | 3,012 | 2,441 |

| QBE | 73% | 69% | 22% | 23% | 4% | 7% | 1% | 1% | 1,998 | 1,651 |

| Total | 74% | 69% | 20% | 23% | 5% | 7% | 1% | 1% | 9,179 | 7,980 |

Some insurers cover expenses faster than others. Among the five insurers, Allianz and NRMA had the highest proportion of pre-claim treatment and care support. All insurers improved the proportion of pre-claim support in 2019.

*Of the total 11,259 accepted statutory benefits claims in 2019, 9,179 had treatment and care services. For 2018, of the total 10,511 accepted statutory benefits claims, 7,980 had treatment and care services.

How quickly did insurers pay income support to customers after motor accidents?

Some people need to take time off work after an accident. That is why it’s important for insurers to provide income support in the form of weekly payments to people while they are away from work. Half of customers entitled to income support payments received it within the first month of lodging a claim, with the vast majority receiving the income support payments within 13 weeks.

The sooner the insurer receives the relevant information from the customer, the sooner the insurer can begin to pay income support payments.

Time if take to receive income support (in weeks)

| Insurer | 0-4 weeks | 5-13 weeks | 14-26 weeks | 27-52 weeks | Claims* | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | |

| AAMI | 50 | 39 | 41 | 48 | 7 | 13 | 2 | 0 | 308 | 258 |

| Allianz | 67 | 37 | 27 | 53 | 5 | 8 | 1 | 2 | 764 | 603 |

| GIO | 45 | 45 | 47 | 45 | 7 | 9 | 1 | 1 | 682 | 726 |

| NRMA | 45 | 39 | 45 | 49 | 9 | 10 | 1 | 1 | 1,205 | 901 |

| QBE | 45 | 31 | 43 | 53 | 10 | 14 | 2 | 2 | 781 | 677 |

| Total | 50 | 38 | 41 | 50 | 8 | 10 | 1 | 2 | 3,740 | 3,165 |

Some insurers begin paying income support faster than others. Among the five insurers, Allianz had the highest proportion of customers who received income support within the first month of lodging a claim.

Overall, the rate of claims paid within the first month has improved significantly by 12% from 2018 to 2019.

*Of the total 11,259 accepted statutory benefits claims in 2019, 3,740 had payments for loss of income. For 2018, of the total 10,511 accepted statutory benefits claims, 3,165 had payments for loss of income.

What happened when customers disagreed with the insurer’s decision?

Customers who disagree with the insurer’s decision can ask for a review. The decision will be reconsidered by the insurer’s internal review team, who did not take part in making the original decision. Insurers accepted most applications for internal reviews. However, some applications were declined because:

- the request was submitted late and the customer did not respond to requests for reasons why it was submitted late, or

- the insurer determined it did not have the jurisdiction to conduct an internal review of that decision.

Customers sometimes also withdraw their application for an internal review.

Internal reviews by insurers and status (%)

| Number of internal reviews | Withdrawn internal reviews | Determined internal reviews | In progress internal reviews | Declined internal reviews | Internal reviews per 100,000 Green Slips* | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | |

| AAMI | 247 | 137 | 10% | 4% | 56% | 66% | 32% | 23% | 2% | 7% | 53 | 32 |

| Allianz | 392 | 317 | 2% | 1% | 79% | 90% | 18% | 6% | 1% | 3% | 40 | 35 |

| GIO | 535 | 327 | 8% | 10% | 56% | 68% | 34% | 19% | 2% | 3% | 55 | 33 |

| NRMA | 505 | 470 | 6% | 1% | 88% | 79% | 5% | 4% | 1% | 16% | 27 | 24 |

| QBE | 412 | 272 | 16% | 18% | 66% | 72% | 11% | 5% | 7% | 5% | 28 | 19 |

| Total | 2091 | 1523 | 8% | 6% | 70% | 77% | 19% | 9% | 3% | 8% | 36 | 27 |

Internal reviews to accepted claims ratios

| Insurer | 2019 | 2018 |

|---|---|---|

| AAMI | 26% | 16% |

| Allianz | 18% | 16% |

| GIO | 27% | 15% |

| NRMA | 14% | 14% |

| QBE | 16% | 12% |

| Total | 19% | 14% |

*The number of internal review requests received by insurers depends on how many customers they have. Insurers with more customers are more likely to receive a greater number of internal review requests. By measuring insurer internal reviews per 100,000 Green Slips sold, the regulator can compare insurers’ performance regardless of how many customers they have.

Outcomes of Resolved Internal Reviews

Of the total 1465 resolved internal reviews in 2019, 73% had the initial claim decision upheld. In 2018, 76% resolved internal reviews had the decision upheld.

Outcomes of resolved internal reviews

| Type of internal review | Decision overturned - in favour of claimant | Decision overturned - in favour of insurer | Decision upheld | Internal Reviews | ||||

|---|---|---|---|---|---|---|---|---|

| 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | |

| Amount of weekly payments | 46% | 54% | 9% | 9% | 45% | 37% | 115 | 93 |

| Is the injured person mostly at fault? | 26% | 20% | 0% | 0% | 74% | 80% | 140 | 96 |

| Minor injury | 15% | 13% | 0% | 0% | 85% | 87% | 684 | 634 |

| Other review types | 37% | 36% | 1% | 0% | 62% | 64% | 184 | 173 |

| Treatment and care reasonable & necessary | 38% | 30% | 1% | 1% | 61% | 69% | 342 | 169 |

| Total | 26% | 23% | 1% | 1% | 73% | 76% | 1,465 | 1,165 |

The majority of internal reviews result in the original decision being upheld, although there was a decrease (-3%) in this ratio from 2018 to 2019.

What if customers still disagreed with the reviewed decision by the insurer?

If the customer continues to disagree with the insurer about their claim after the insurer internal review, customers may apply to the Dispute Resolution Service (DRS) for an independent determination of the dispute. Most applications require an internal review by the insurer prior to applying to DRS.

DRS can assist in resolving disputes in one of two ways:

- Facilitate the formal resolution of issues in dispute between insurer and customer.

- Arrange an independent and binding decision by an expert decision-maker.

Sometimes DRS applications can be:

- Declined by DRS if they are submitted outside the timeframes set by the legislation or the matter is

outside the jurisdiction of DRS, - Withdrawn by the customer, or

- Settled between the customer and insurer outside the DRS formal process.

Dispute resolution cases by insurer and status (%)*

| Insurer | Number of DRS reviews | DRS reviews in progress | Settled/withdrawn DRS reviews | Declined DRS reviews | Determined DRS reviews | Other** | DRS disputes per 100,000 Green Slips*** |

|---|---|---|---|---|---|---|---|

| AAMI | 265 | 34% | 9% | 3% | 49% | 5% | 28 |

| Allianz | 599 | 29% | 10% | 5% | 50% | 6% | 30 |

| GIO | 625 | 37% | 11% | 4% | 44% | 4% | 31 |

| NRMA | 879 | 24% | 13% | 6% | 54% | 3% | 22 |

| QBE | 492 | 38% | 10% | 3% | 47% | 2% | 16 |

| Total | 2,860 | 31% | 11% | 5% | 49% | 4% | 24 |

*Data from 1 Dec 2017 to 31 Dec 2019

** Open in error, invalid or dismissed disputes.

*** The number of dispute resolution cases received by DRS depends on how many customers individual insurers have. Insurers with more customers are more likely to receive a greater number of dispute resolution applications. By measuring dispute resolution cases per 100,000 Green Slips sold, the regulator can compare insurers’ performance regardless of how many customers they have.

Outcomes of resolved DRS reviews*

| Type of internal review | Insurer decision overturned - in favour of claimant | Insurer decision overturned - in favour of insurer | Insurer decision upheld | Other |

|---|---|---|---|---|

| Minor injury | 33% | 0% | 67% | 0% |

| Treatment and care R&N | 44% | 0% | 56% | 0% |

| Is injured person mostly at fault | 71% | 0% | 29% | 0% |

| Amount of weekly payments | 46% | 0% | 54% | 0% |

| All other dispute types | 41% | 1% | 53% | 5% |

| Total | 38% | 0% | 61% | 1% |

*Data from 1 Dec 2017 to 31 Dec 2019

Compliments and complaints

SIRA closely monitors the compliments and complaints it receives about insurers. Compliments help identify best practice in how insurers manage claims, while complaints may highlight problems with insurers’ conduct which could require further investigation.

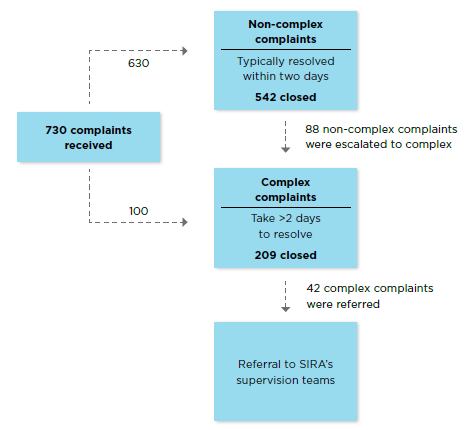

How SIRA handles complaints

Customers can lodge complaints through any of SIRA’s channels. Non-complex complaints are handled by SIRA’s CTP Assist service and usually take less than two working days to close*. Complex complaints are referred to SIRA’s complaints handling experts and take on average 21 working days to close, depending on their complexity. Potential cases of insurer misconduct are escalated to SIRA’s Compliance, Enforcement and Investigation team for further investigation and possible regulatory action.

Customers who are unhappy with the outcome of SIRA’s review can resubmit their complaint for further consideration. If customers disagree with how SIRA handled their complaint, they can contact the Ombudsman of NSW for assistance.

Snapshot of resolved complaints process

Customers are encouraged to talk to their insurer in the first instance; insurers have their own complaints handling process.

Any customers dissatisfied with SIRA’s handling of their complaint can contact the NSW Ombudsman.

This information was collected from 1 January 2019 to 31 December 2019.

* Where SIRA reviews a complaint and provides an outcome.

How many compliments and complaints about insurers did SIRA receive?

Compliments and Complaints (Jan - Dec 2019)

Compliments

| Insurer | Compliments | Compliments per 100,000 Green Slips* |

|---|---|---|

| Total | 162 | 3 |

| AAMI | 15 | 3 |

| Allianz | 32 | 3 |

| GIO | 27 | 3 |

| NRMA | 61 | 3 |

| QBE | 27 | 2 |

Complaints

| Insurer | Complaints | Complaints per 100,000 Green Slips* |

|---|---|---|

| Total | 730 | 13 |

| AAMI | 75 | 16 |

| Allianz | 60 | 6 |

| GIO | 143 | 16 |

| NRMA | 286 | 15 |

| QBE | 166 | 11 |

Totals

| Totals | Total number |

|---|---|

| Compliments | 162 |

| Complaints | 730 |

| Referrals | 40 |

Who made the complaint

| Who made the complaint | Number of complaints |

|---|---|

| Person injured | 344 |

| Lawyer | 306 |

| Green Slip holder | 24 |

| Health provider | 47 |

| Other** | 9 |

This information was collected from 1 January 2019 to 31 December 2019.

* The number of compliments and complaints insurers receive depends on how many customers they have. Insurers with more customers are more likely to receive a higher number of compliments and complaints. By measuring compliments and complaints per 100,000 Green Slips sold, the regulator can compare insurers’ performance regardless of how many customers they have.

**The “Other” category are complaints predominantly by SIRA staff for calls to insurers which for various reasons take an unnecessary long

time to action.

What were the complaints about?

| Complaint type | AAMI | Allianz | GIO | NRMA | QBE | All insurer related complaints |

|---|---|---|---|---|---|---|

| Claims - Decisions | 31% | 37% | 36% | 30% | 20% | 30% |

| Claims - Delays | 19% | 15% | 20% | 34% | 30% | 26% |

| Claims - Management | 15% | 15% | 13% | 11% | 10% | 12% |

| Claims - Service | 23% | 25% | 23% | 22% | 31% | 25% |

| Claims - Other | 0% | 3% | 4% | 2% | 4% | 3% |

| Policy - Purchasing | 12% | 5% | 4% | 1% | 5% | 4% |

This information was collected from 1 January 2019 to 31 December 2019.

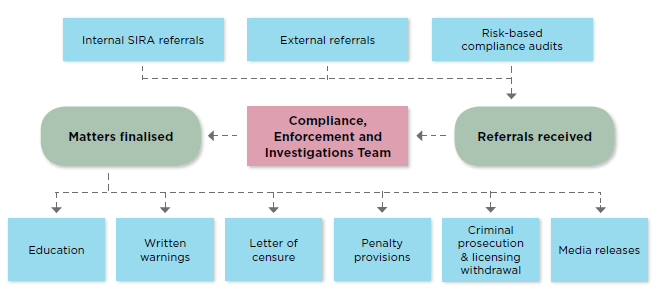

Compliance, Enforcement & Investigations (CE&I)

SIRA has continued to improve its strategies in detecting and responding to breaches of the Motor Accident legislation and guidelines. SIRA works closely with law enforcement agencies and other regulatory bodies to ensure appropriate strategies are in place to minimise risks to the CTP scheme. The CE&I team undertakes a risk-based approach to its investigations by considering the risk and harm to the scheme, claimants and policy holders and carries out appropriate regulatory enforcement action on a case by case basis.

High level approach is summarised as follows:

For more information about how SIRA approaches its compliance and enforcement activities, please refer to SIRA’s Compliance and Enforcement Policy.

During January to December 2019, 42 matters were referred to the CE&I team for investigation into alleged insurer breaches of their obligations under the legislation and guidelines. A total of 40 matters were finalised during this period, which includes matters received prior to January 2019.

| Insurer | Completed investigations | Regulatory Action |

|---|---|---|

| Allianz | 6 | 1 Letter of censure |

| GIO | 5 | - |

| NRMA | 24 | 9 Notice of non-compliance |

| QBE | 5 | 1 Letter of censure 2 Notice of non-compliance |

| Total | 40 | 13 |

Of those matters where an insurer breach was substantiated, the following issues were identified, and insurers subsequently notified:

- Failure to determine or late determination of liability in accordance with timeframes prescribed by the Act and Guidelines;

- Failure to respond or late response to a treatment, rehabilitation and care request by the claimant or their representative;

- Inappropriate management of CTP claims.

The other matters finalised during this period were determined to be insurer practice issues of a minor nature and they have been referred to SIRA’s insurer supervision unit for education and continued monitoring.

Glossary

| Accepted claims | The total number of statutory benefit claims where liability was not declined during the first 26 weeks of the benefit entitlement period. |

| Acceptance rate | The percentage of statutory benefit claims where liability was not declined during the first 26 weeks of the benefit entitlement period. It is the total count of statutory benefit claims lodged, less declined claims, divided by total statutory benefit claims. |

| Claim | A claim for treatment and care or loss of income regardless of fault under the Act. It excludes early notifications (before a full claim is lodged), as well as interstate, workers compensation and compensation to relatives claims. |

| Complaint | An expression of dissatisfaction made to or about an organisation and related to its products, services, staff or the handling of a complaint, where a response or resolution is explicitly or implicitly expected or legally required. |

| Complaints received | The number of complaints that have been received in the time period. |

| Compliment | An expression of praise. |

| Declined claims | The total number of statutory benefit claims where the liability is rejected during the first 26 weeks of the benefit entitlement period. |

| Determined DRS dispute | A dispute which has been through the DRS process and of which a decision has been made. |

| Dispute Resolution Service (DRS) | A service established under Division 7 of the Act to provide a timely, independent, fair and cost effective system for the resolution of disputes. |

| Income support payments | Weekly payments to an earner who is injured as a result of a motor accident, and sustains a total or partial loss of earnings as a result of the injury. |

| Insurer | An insurer holding an in-force licence granted under Division 9.1 of the Act. |

| Internal review | When requested by a person, the insurer conducts an internal review of decisions made and notifies the person of the result of the review, usually within 14 days of the request. |

| Internal review types |

|

| Internal reviews to accepted claims ratio | the proportion of internal reviews to accepted statutory benefit claims. This will remove the influence of the insurer market share and give a comparable view across insurers. |

| Payments | Payment types may include income support payments, treatment, care, home/vehicle modifications or rehabilitation. |

| Referrals to Compliance, Enforcement and Investigation (CE&I) | Where a potential breach of guidelines or legislation is detected through the management of a complaint in accordance with the SIRA compliance and enforcement policy. |

| Service start date | The date when treatment or care services are accessed for the first time. |

| Total number of policies | This figure represents the total (annual) number of policies written under the new CTP scheme with a commencement date during the reporting period. The measure represents the count of all policies, across all regions in NSW. |

About the data in this publication

Claims data is primarily sourced from the Universal Claims Database (UCD) which contains information on all claims received under the NSW Motor Accidents CTP scheme, which commenced on 1 December 2017, as provided by individual licensed insurers.

SIRA uses validated data for reporting purposes. Differences to insurers’ own systems can be caused by:

- a delay between claim records being captured in insurer system and data being submitted and processed in the UCD

- claim records submitted by the insurer being blocked by data validation rules in the UCD because of data quality issues.

All CTP compliments and complaints data from 1 January 2019 to 31 December 2019 was collected through SIRA’s complaints and operational systems. Compliments and complaints received directly by the insurers were not included.

For more information about the statistics in this publication, contact [email protected]