Apply for personal injury benefits

Personal injury benefits can be income support payments, medical expenses and/or vocational rehabilitation programs while you recover.

These types of benefits can also be referred to as 'statutory benefits'. You can read more about how statutory benefits are defined under the Motor Accident Injuries Act 2017.

Before you read below, open this personal injury benefits diagram.

Income support payments

Did you know? For the first 52 weeks it doesn't matter who caused the accident.

If you are injured in a motor accident and as a result you have a loss of earnings, you may be entitled to income support payments.

Regular income support payments compensate you for some of the income you have lost because of your injury. If you're off work these payments will help pay the bills, so you can focus on getting better.

These payments will be a percentage of your pre-accident earnings:

- for the first 13 weeks the maximum is 95 per cent

- after 14 weeks the maximum is 85 per cent (depending on whether you have total or partial loss of earning capacity)

Most people recover within one year. After one year your income support payments will end if:

- you were at fault / most at fault or

- your injuries are assessed as 'threshold' (as defined in the legislation).

To continue to receive income payments after two years, you must have an ongoing loss of earning capacity and have lodged a claim for damages.

Make your claim as soon as possible

To receive back pay following your crash, the insurer needs to receive the claim within 28 days. If the claim is made on the insurer after 28 days, then you will need to give an explanation for your delay to be considered eligible to receive weekly payments of statutory benefits from the day after the date of the accident. Otherwise, weekly payments of statutory benefits may only begin from the date the claim is made. You can still submit a claim up to three months after the crash, but it’s best to submit a claim as soon as possible.

By the way, back pay can only be paid from the day after the crash because weekly benefits cannot be claimed for the date of the accident.

Medical expenses

Did you know? You might not need to lodge a claim to receive early treatment. Once you notify the relevant insurer, they can approve a GP visit and two treatment sessions such as for physiotherapy without further documents. Use the online accident notification system CTP Connect to get in touch with the right insurer. Contact CTP Assist on 1300 656 919 or [email protected] for more information.

If you need (or think you'll need) more than two treatment sessions, it's important to submit a claim for personal injury benefits.

The insurer may pay for all reasonable and necessary expenses for injury resulting from the accident. This includes:

- medical, dental and pharmaceutical expenses

- rehabilitation and treatment expenses (like physiotherapy)

- the cost of travelling to and from appointments

- in some cases support services (like personal care and help around the home).

Who can apply?

Anyone who is injured in a motor vehicle accident in NSW can apply. This includes:

- drivers and passengers

- riders and pillion passengers

- pedestrians

- cyclists.

The injury can be physical or psychological.

If the injury is a result of a motor accident that is also a work-related accident, you will also need to make a workers compensation claim against your employer's workers compensation insurer. See claiming workers compensation for more information.

You cannot claim these benefits if you are charged with a serious driving offence in connection with the accident, or were the at-fault driver of an uninsured vehicle.

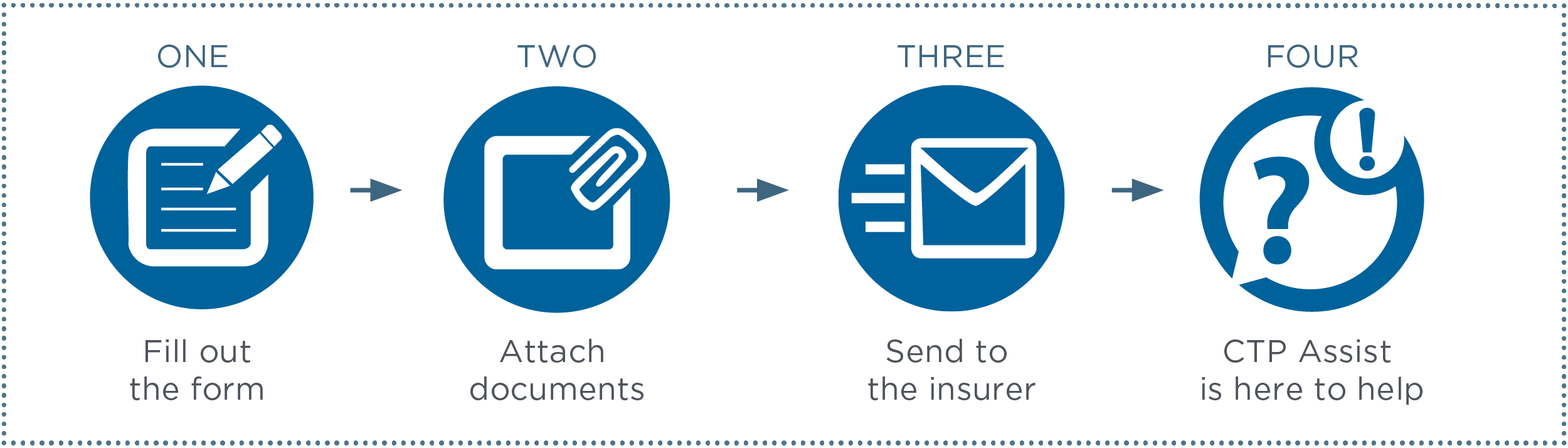

How to apply

Things to know before you start:

- To receive back pay from the date of the crash, the insurer needs to receive the claim within 28 days. You can still submit a claim up to three months after the crash, but it’s best to submit a claim as soon as possible.

- Before you apply, get the details of the other vehicle and report the crash to police. While you have 28 days to do this, you should do it as soon as possible. This is an important way of proving that the accident happened. Read more.

- You can still make a claim if you don't have all these details yet. Submit the application and the insurer will be in touch about any other information they need.

- If you're unable to make the claim yourself (eg you're in hospital), family members, friends or other representatives can submit the claim on your behalf.

Claiming personal injury benefits online

You can lodge a CTP claim for personal injury benefits online. To support your claim, you will need:

- The police event number.

- Details of your injuries, medical treatment received and receipts for medical expenses.

- Your certificate of fitness or medical certificate.

- Proof of earnings, such as pay slips, from before and after the accident.

New applicants

For new applicants applying for personal injury benefits, you need to:

- Create your new MyServiceNSW Account or log in with your current MyServiceNSW Account using the link below. Then under ‘My Services’, add the ‘Motor accident injury claims (CTP insurance) service’.

- Follow the prompts.

- Complete the application for personal injury benefits.

- Upload the documents to support your claim.

Returning users

- If you've previously used SIRA’s ‘Motor accident injury claims (CTP insurance) service portal’, you can log in directly with your MyServiceNSW Account.

Note: By logging in, you consent to sharing your name and email address in your MyServiceNSW Account with SIRA.

Apply by email or post

Did you know? We can find out for you which insurer you need to claim with. See who do I claim with?

- Fill out the form: You need to complete the application for personal injury benefits form. Provide as many details about the accident as you can, including the police event number, details of your injuries and what medical treatment you've already received.

- Attach documents: Any documents or information that helps the insurer to assess the claim can be included. This should include your certificate of fitness and receipts from your medical expenses, as well as proof of earnings, such as your pay slips (photos are ok).

- Send to the insurer: By email or by post (registered post will help you track the day the claim form was delivered to the insurer).

- CTP Assist is here to help: Contact us between 8.30 am and 5 pm on 1300 656 919 or [email protected]. If you leave a voice message or email after hours, we will call you back the next business day.

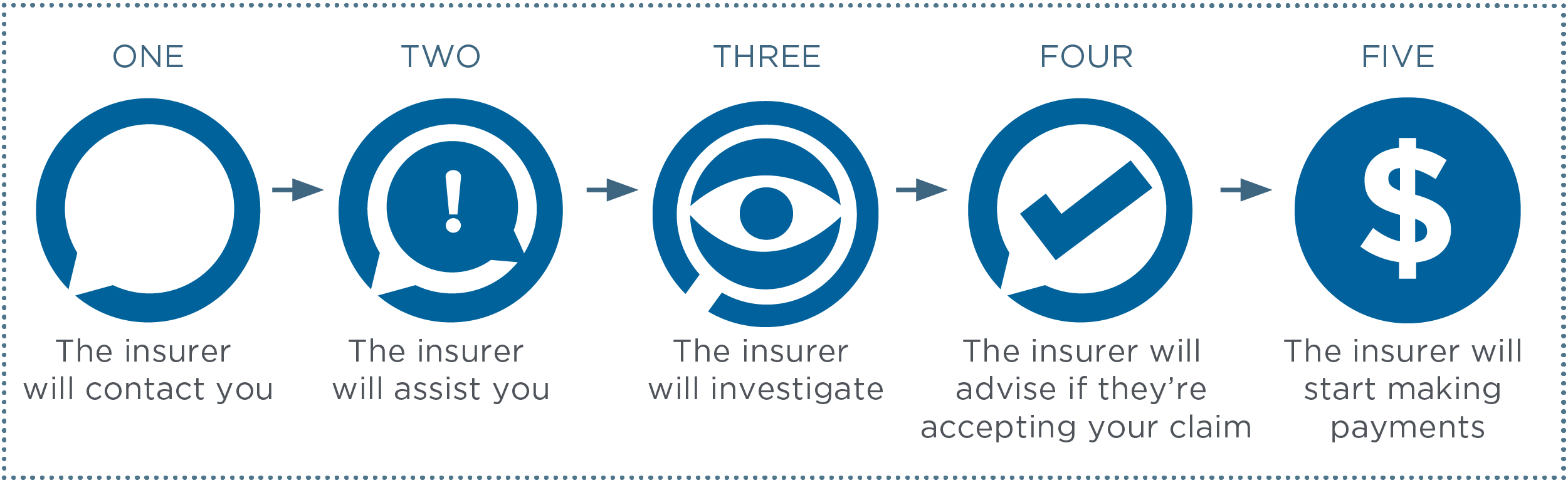

What happens next?

- Contact you: The insurer will contact you within three days after you lodge a claim. They will confirm they have received your application and will outline the next steps in the process. They should also provide a claim number and their contact details. If you need immediate medical treatment ask the insurer to explain what you should do next (including how you can be reimbursed for your medical expenses so far). Also see our pages in the Injury Advice Centre for information to help you recover from certain types of injuries.

- Investigate: The insurer will investigate your claim including reviewing the police report and other evidence such as medical reports from your treating doctor / health professional. The insurer may ask you to see other medical specialists.

- Make a decision: The insurer must tell you within four weeks of the claim being made if they're accepting or denying the claim. If the insurer denies liability they need to give a full explanation of their reasons. This must include the consequences of their decision (including the effects on your entitlements and when it will take effect), copies of the information they used in making the decisions, how you can seek a review the decision, and where to go for further help in understanding what to do next.

- Payments: The insurer will start making payments to you within 14 days if they accept your claim. Most people will also need to start a recovery plan. A recovery plan is designed to return you to full pre-accident activities as soon as possible. It is prepared in consultation with you, your doctor and any relevant treating practitioners. Talk to the insurer for more information.

Please see our disputes section to see which matters can be examined by the Personal Injury Commission.

What if I disagree with the insurer?

Your first step is to request an internal review by the insurer. This is where another person within the insurer (who was not involved in the original decision or action) is asked to review your claim and make a new decision and provide a response.

You only have 28 days to request an internal review by the insurer.

If you are not satisfied with the outcome you may make an application to the Personal Injury Commission for an independent review or get in touch with our CTP Legal Advisory Service through CTP Assist.

CTP Assist is here to help. Contact us between 8.30 am and 5 pm on 1300 656 919 or [email protected]. If you leave a voice message or email after hours, we will call you back the next business day. You can also visit disputes.

If you would like to make a claims complaint about an insurer (not relating to a decision), please get in touch with the Independent Review Office (IRO) on 13 94 76 (Monday to Friday, 8:30am-5:30pm).