Print PDF

Training program guidance material

Introduction

There is strong evidence that work promotes recovery and reduces the risk of long term disability and work loss. The focus of the NSW workers compensation system is supporting workers to recover at, or return to work following a work-related injury.

Section 53 of the Workplace Injury Management and Workers Compensation Act 1998 (1998 Act) allows the State Insurance Regulatory Authority (SIRA) to develop, administer and coordinate vocational rehabilitation schemes for workers.

If a worker meets SIRA's eligibility criteria and program requirements, the worker's use of the program will be accepted and the insurer will administer the program costs.

The SIRA training program provides funding to assist a worker to develop new skills and/or obtain qualifications to remain at work with their pre-injury employer or to commence work with a new employer.

Eligibility

A worker is eligible if:

- at the time of program commencement, they are receiving, or are entitled to receive weekly payments under the Workers Compensation Act 1987 (1987 Act)

- a commutation or work injury damages settlement has not been accepted.

Principles

The application for training must include a detailed description of how the training addresses the following principles:

- the worker cannot return to their pre-injury duties

- the worker has insufficient marketable and transferable skills for durable employment

- the recover at/return to work goal is realistic and appropriate to the worker’s skills, aptitude, interests, preferences, motivation, current and/or anticipated functional and work capacity

- training will assist the worker to return to a position reasonably comparable to pre-injury employment in terms of salary and status and will result in a cessation or substantial reduction in weekly payments

- training will enhance the worker’s employment prospects towards securing durable employment that is considered likely to be the most direct path back to work.

Courses

Training courses selected should:

- be provided by a registered training organisation or higher education provider

- result in formal qualifications recognised by the Australian Quality Training Framework or provide an industry-recognised licence or certificate

- be the best match to the worker’s circumstances in relation to:

- proximity of the course venue to the worker’s residence and any travel requirements

- timeliness and availability of the training (e.g. commencement date, study load and duration)

- the most suitable method of delivery for the worker’s circumstance (e.g. face to face, distance education, online learning).

Training expenses

The training expenses below will be considered for approval.

Course fees

Expenses relating to compulsory course fees will be considered for approval.

Textbook and stationery expenses

If not included in course fees, textbook and stationery expenses will be considered. Payments can be made in advance, every six months. The textbook and stationery allowance is:

- full-time study for one year $500

- part-time study for one year $275

- training less than one year – determine a pro rata allowance.

If the allowance is insufficient, an outline of actual textbook and stationery expenses must be submitted as part of the application.

Travel

Workers should use public transport where available and appropriate.

If it is necessary to use a private vehicle, the vehicle must have third-party property insurance1 as a minimum. Private transport costs are reimbursed at 55 cents per kilometre2.

Accommodation

If a training course involves a necessary period of external study, reasonable accommodation expenses (excluding meals) will be considered. Expenses are reimbursed to the worker or paid to the accommodation provider.

Essential course equipment

Essential equipment is equipment the training provider requires all students to use, or equipment the worker particularly requires to mitigate the effects of their injury.

During training, workers are expected to use the facilities available from the training provider and from community services, such as libraries. Where this is not possible, the option of hiring essential equipment should be explored before considering the need to purchase it.

Application process

Preparing an application

A worker or the worker's return to work coordinator, insurer or approved workplace rehabilitation provider (provider) may prepare an application.

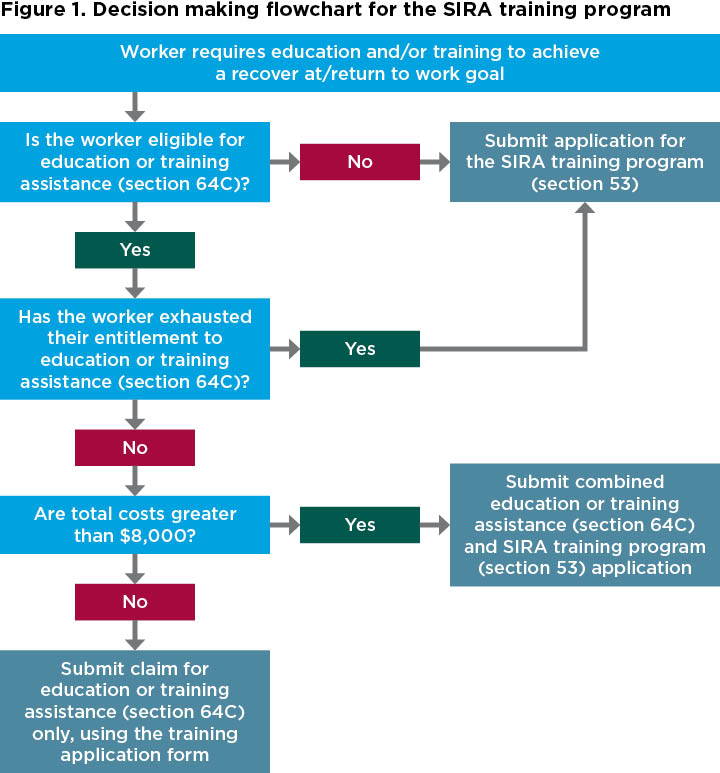

The person developing the application must check whether a worker has an entitlement to education or training assistance (under section 64C of the 1987 Act - note this does not apply to exempt workers)3. This should be confirmed with the insurer. Where the worker is entitled to claim such assistance, this entitlement must be exhausted before accessing funding under the SIRA training program.

A worker who has an entitlement to education or training assistance may be eligible for funding under the SIRA training program where:

- they have exhausted their entitlement to education or training assistance (this includes where the cost of training exceeds $8,000), or

- the insurer disputes liability for education or training assistance (including where the insurer does not notify the worker of a decision within the required time period).

A combined education or training assistance and SIRA training application may be developed where costs required exceed $8,000. In this instance, it is necessary to demonstrate that the application meets the requirements for both an education or training assistance claim and the SIRA training program.

Figure 1 below aims to guide decision making concerning the development of an application.

An application for the SIRA training program is prepared using the training application form. The application must include:

- evidence of appropriate assessment to identify suitable vocational options and the need for training

- evidence that the training aligns with the agreed recovery at/return to work goal in the worker’s injury management plan

- information to demonstrate the training principles have been addressed (and, if any principles cannot be met, justification as to why training is the strategy most likely to assist the worker to remain at or return to work)

- information relating to the choice of course with reference to the training provider, qualifications and the worker’s circumstances

- the total cost of training including all compulsory course fees and associated costs

- evidence regarding the worker’s capacity and ability to complete the proposed training

- for longer or more complex training, a proposed strategy to support the worker for the duration of the training.

Submitting an application

The completed training application form together with supporting information must be submitted to the insurer.

Applications should be submitted before training commences to ensure:

- the worker has access to support and assistance in selecting the most appropriate course, and

- the worker meets the necessary requirements for the SIRA training program.

Retrospective applications for the SIRA training program will only be considered under exceptional circumstances. A retrospective application is where enrolment and costs for training have been incurred prior to obtaining approval from the insurer or SIRA.

Exceptional circumstances are circumstances that are out of the ordinary, unusual, special or uncommon. Not knowing about the requirement to lodge an application prior to course enrolment or incurring training costs, is not an exceptional circumstance.

Assessing an application

Applications $500 or less

Workplace rehabilitation provider

A provider can assess applications that are $500 or less where the insurer has approved the recover at/return to work plan that incorporates training. The provider must follow their service provision and internal quality assurance processes to confirm the application meets the SIRA training requirements and relevant principles.

The provider can arrange for training to commence without seeking formal approval from the insurer. However, the provider must inform the insurer in writing of the specific costs relating to the application.

Applications above $500

Nominal Insurer scheme agent

When the claim is with a Nominal Insurer scheme agent, the agent will assess applications that are above $500.

The agent will write to the worker and the person submitting the application, advising their decision to approve or decline the request, along with the reason for their decision within 14 days (or within 21 days for a combined education or training assistance and SIRA training application).

If the application is not approved, the agent must advise the worker of the SIRA appeal process.

Agent for icare Insurance for NSW, self-insurer or specialised insurer

When the worker’s claim is with an agent for icare Insurance for NSW4, the agent will assess applications that are more than $500, but less than $10,000.

Self and specialised insurers5 will assess applications for funding that are more than $500 but less than $2,000.

The agent/insurer will write to the worker and the person submitting the application, advising their decision to approve or decline the request, along with the reason for their decision within 14 days (or within 21 days for a combined education or training assistance and SIRA training application).

If the application is not approved, the agent/insurer must advise the worker of the SIRA appeal process.

SIRA

If the application exceeds the cost an agent for icare Insurance for NSW, or self or specialised insurer may approve, the application must be sent via email to SIRA at [email protected] within 14 days (or within 21 days for a combined education or training assistance and SIRA training application).

The application must include the insurer’s opinion on whether they support the training application with reference to the training principles.

If the application includes retrospective costs, please outline:

- what these costs are

- how the proposal aligns with the workers injury management plan and recover at work goal

- an explanation of the reasons why the application was not submitted prior to enrolment and or prior to costs being incurred and

- outline the exceptional circumstances for SIRA to consider.

SIRA will then assess the application for funding in light of the insurer’s recommendation. The insurer will be advised of the outcome of the assessment in writing within 10 working days of receiving a complete application. The insurer will advise the worker of the outcome of the assessment, and the SIRA appeal process if the application is not approved.

Payment

Payments should be made in line with the amount(s) approved. Payment should only be made where there is evidence of cost/expenditure (e.g. purchase order, tax invoice, receipts or record of travel such as a travel log or fares).

The insurer / agent must have controls in place to prevent duplicate payments being made and claimed.

A completed vocational program – claim for payment form and relevant invoices or receipts must be submitted to facilitate payment.

Up to $300 may be paid in advance (where appropriate) for travel. Claims for travel expenses should be supported by a travel log which includes dates of travel, cost of fares/kilometres and destinations.

Nominal Insurer scheme agent

When the claim is with a Nominal Insurer scheme agent, the agent is responsible for administering payment of vocational program expenses.

Agent for icare Insurance for NSW

When the claim is with an agent for icare Insurance for NSW, the agent is responsible for administering payment of vocational program expenses less than $10,000.

Self-insurer or specialised insurer

When the claim is with a self or specialised insurer, the insurer is responsible for administering payment of vocational program expenses less than $2,000.

SIRA

When the claim is with an agent for icare Insurance for NSW insurance agent, self-insurer or specialised insurer and the costs exceed the amounts above, SIRA will make payments.

These payments will be processed when a vocational program – claim for payment form, copy of the vocational program - details form, and relevant invoices or receipts are received at [email protected].

NOTE: A minimum of 10 working days is required to enable processing and payment of approved costs.

Insurer / agent reimbursement

Insurers and agents can request reimbursement from SIRA for program costs. Insurers and agents are to ensure that all claims for reimbursement can be substantiated. Substantiated means programs are approved and supported by appropriate evidence of the expenses.

Self and specialised insurers

Reimbursements from SIRA can be claimed within six months of the costs being incurred by submitting a claim for payment, evidence of payment and relevant receipts.

Nominal insurer and agent for icare Insurance for NSW

Reimbursements from SIRA can be claimed by a tax invoice. The invoice should be accompanied by an itemised breakdown by claim and program type of the costs incurred.

For more information about making a claim for reimbursement contact [email protected].

Payment of fees for extended periods of training

Payment of approved training/course fees should be made in advance for each term or semester. Payment of fees will continue to be made upon successful completion of the previous period of training.

For university fees, payments must be made in a timely manner before the start of each term to prevent incurring a HELP6 debt. Indexation costs7 that occur due to late payment of fees are generally not covered.

Refund of fees for withdrawal or non-attendance

It is the responsibility of the person submitting the application to find out the withdrawal/cancellation policy of the training provider. In the event a worker withdraws from a subject and/or course, steps should be taken to follow the training provider’s procedures to enable recovery of fees.

Following approval

Monitoring training

The insurer is responsible for determining who will monitor the training. A provider, insurer or return to work coordinator must proactively manage all aspects of the training to maximise the worker’s outcome and ensure the training goal is achieved. Monitoring should include:

- predicting and identifying barriers or issues

- using a collaborative problem-solving approach to implement solutions

- ensuring necessary equipment for training is available to the worker on commencement and is used effectively

- ensuring the worker attends training and is completes studies successfully

- communicating progress and outcomes of training as agreed with the insurer and worker

- attending to refunds for withdrawal/non-attendance where applicable

- reviewing the outcome of the training upon completion and reporting appropriately to all parties.

Change in circumstances

Eligibility should continue to be assessed throughout the duration of the training.

If a worker already engaged in an approved SIRA training program becomes eligible for the section 64C education or training assistance benefit during the course of the training program, the worker should continue the training. Any future amendments to the worker’s training must be assessed under education or training assistance.

Training extensions/amendments

Any extension or amendment to the training must support the recover at/return to work goals.

The relevant section of the training application form (reason for extension/amendment request) must be completed and sent to the insurer a minimum of five working days before the requested change is implemented. The insurer will review the application and advise of the decision in line with this guidance material.

Extensions or amendments to the training may not be funded in cases where prior endorsement/approval was not obtained.

Notification of injury

If a new injury or re-injury occurs that significantly impacts upon the proposed training:

- the worker must promptly notify the provider/return to work coordinator or insurer

- the worker or training provider must notify the provider/return to work coordinator, or insurer within 24 hours of the injury

- the provider/return to work coordinator or worker must notify the insurer and SIRA within 48 hours of receiving notification (by phone and/or email)

- the insurer is responsible for facilitating completion of the aggravation/new injury notification and claims management requirements.

Review process

If there is disagreement about eligibility or use of the training program, the worker should try to resolve the matter with the insurer in the first instance.

For information on what to do when a request to use a SIRA funded program has not been approved, find out how to request a review of a program decision.

Further information

Vocational rehabilitation programs resources are available:

- Training application form

- Vocational program - claim for payment form

- Vocational program - closure report form

- Work trial guidance material

- Transition to work guidance material

- JobCover placement program guidance material

Other references:

- Workplace Injury Management and Workers Compensation Act 1998, section 53 – vocational rehabilitation programs

- Workers Compensation Act 1987, section 64C – new employment assistance

- Workers Compensation Amendment (Return to Work Assistance) Regulation 2016

- Guidelines for claiming workers compensation

Footnotes

- Third party property insurance is different to third party personal (CTP ‘green slip’) insurance, which does not meet the minimum insurance requirement.

- These rates are correct at time of publication. Please refer to the current Workers compensation benefits guide for the current rate for car travel expenses.

- Refer to the Guidelines for claiming workers compensation – B4.1 Return to work assistance (education or training assistance).

- An agent for icare Insurance for NSW provides workers compensation insurance to most public sector employers except those who are self-insurers. icare Insurance for NSW contracts insurance agents to manage policies and claims on its behalf.

- Self-insurers are employers approved by SIRA to manage their own workers compensation claims. Specialised insurers hold a restricted licence to provide workers compensation insurance for a specific industry or class of business or employers.

- HELP – Higher Education Loan Program, In 2005, the Higher Education Loan Program (HELP) replaced HECS. HELP is comprised of four main loan programs: HECS-HELP, FEE-HELP, OS-HELP and VET FEE-HELP.

- Accumulated HELP debt is subject to indexation. This is applied on 1 June each year to maintain its real value by adjusting it in line with changes in the cost of living (as measured by the Consumer Price Index). For more information, see the ATO website.