Print PDF

Green Slip scheme quarterly insights - December 2017

Download the PDF (1,352KB)

Executive Director’s message

The end of 2017 was an exciting time to commence as Executive Director, Motor Accidents Insurance Regulation (MAIR), State Insurance Regulatory Authority (SIRA).

The ‘2017 scheme’ was launched, along with our new service team, CTP Assist, and our Legal Assist pilot, in mid-December. Average premium rates were reduced and enhanced data analytics are in the final stages of development. Once developed, SIRA will be able to more effectively monitor the scheme and support our regulatory and compliance role.

The 2017 scheme brings a contemporary approach to deliver the optimal recovery of the injured road user, through early support, treatment and care, and rehabilitation. Providing timely financial support for injured earners while off work is also key to this. To facilitate early recovery, insurers are already providing limited treatment to injured people who have notified of an injury but not yet lodged a claim. More resources are being dedicated to seriously injured people.

Compliance is a significant activity for SIRA and we continue to work successfully with the NSW Police through Operation Strike Force Ravens, to address syndicated fraud. Arrests have been made and 161 charges laid.

In taking the new scheme forward we will have a strong focus on supporting the policy holders of NSW and injured road users. As a risk-based regulator we must adequately monitor and influence insurers to maintain a culture of early liability determinations, and treatment and care for people injured on NSW roads.

It is early days for the 2017 scheme and we will be engaging with stakeholders, and monitoring data and the injured person’s experience, to ensure that we achieve scheme goals.

Putting injured people first

Motor vehicle owners, and people injured on NSW roads and their families, benefit from the Government’s reformed Compulsory Third Party Green Slip insurance scheme.

At SIRA we are proud that our reform has delivered in real terms to the people of NSW. The new 2017 scheme, introduced 1 December 2017, has already succeeded in significantly reducing the average premium for NSW vehicle owners.

Injured people are receiving treatment and care promptly by scheme insurers. Support is available for families who have lost loved ones in a motor vehicle accident. Our CTP Assist service, delivering support to injured people, has been well received and much appreciated.

Features of the 1999 scheme

The previous CTP Green Slip scheme, under the Motor Accidents Compensation Act 1999, had been in place for 18 years and was no longer serving road users and policy holders as well as it could.

Under the 1999 scheme, not-at-fault injured road users negotiated a lump sum settlement once injuries stabilised. It was not uncommon for settlement to be reached three or more years after a claim was made, often causing financial and other stressors.

Minor injuries, such as whiplash and soft tissue injuries, were skyrocketing, disadvantaging the more seriously injured. Fraudulent claims were also increasing and there was significant pressure on premiums.

- On average, 47% of every green slip dollar went to the injured person1

- Around 60% of all claims were low-severity claims (such as whiplash and soft tissue injuries) and rising2

- On average, insurer profits were 19%1

- 0.06% of injured people negotiated early medical treatment ($5,000 maximum)

Without reform:

- 6% of benefits paid in the first year

- 16% paid in the second year

- 78% paid after the second year

- 10% to 20% premium increases in the pipeline

- 16% of scheme costs: Legal and investigation expenses1

Benefits of the new 2017 scheme

Actuarial forecasts indicate that each year 7,000 additional road users (at fault) will receive benefits for up to six months.

The Government listened carefully to stakeholders and service providers and the 2017 scheme under the Motor Accidents Injuries Act 2017 introduced:

- new benefits for injured people, including a six- month period of defined benefits for all road users regardless of fault and for those with minor injuries

- more CTP dollars to injured people, particularly the more seriously injured

- access to damages (lump sum) for the more seriously injured (not at fault)

- a faster claims process

- more help and support

- a focus on early treatment and rehabilitation (and return to work for earners)

- a reduced cost of green slip premiums

- a user-friendly Dispute Resolution Service

- reduced opportunities for claims fraud and exaggeration

- stronger regulation of insurer profit margins

- reduced opportunities for legal costs.

The reforms delivered substantial savings in premiums, including a decrease of thousands of dollars on the average premium price for taxis. SIRA is progressively implementing distance- based CTP insurer premium setting for the point to point industry.

18% Reduction: A statewide average premium price reduction from $642 to around $528.

26% Reduction: An average premium price reduction for Sydney passenger vehicle owners from $710 to around $525.

10% Reduction: For country passenger vehicles, the average premium price reduced from $480 to around $430.

Scheme insurers

The green slip market is privately underwritten3 by six licensed insurers operated by four organisations: Suncorp (AAMI and GIO), Allianz Australia (Allianz and CIC Allianz), NRMA and QBE. Zurich ceased issuing Green Slip policies to the public on 1 March 2016 under the 1999 Scheme. SIRA regulates the CTP schemes.

NRMA, GIO, AAMI and Allianz are in the retail market, while QBE is in both retail and non-retail and CIC Allianz predominantly covers fleet.

Insurers ceased selling policies under the 1999 scheme to vehicle owners on 30 November 2017 and started selling policies on 1 December 2017 under the 2017 Scheme. The 1999 scheme will continue operating for several years until licensed insurers finalise claims for accidents happening before 1 December.

Consequently, SIRA is regulating two schemes for a period: the 2017 scheme and claims that have yet to be finalised under the 1999 scheme.

Note 3: Underwriting is a term used by insurers to describe the process of assessing risk and ensuring the cost and conditions of the cover are proportionate to the risks faced by the individual concerned.

Key statistics 2017 scheme

This report covers a four-week period, 1 December to 31 December 2017. Further analysis will be provided as the scheme progresses. Insurers have 28 days from the date of the accident within which to determine a claim for benefits for the first 26 weeks. There was a total of 127 claims in the reporting period.

Claims

| Early notifications (38%) | 76 |

| Full claims (62%) With legal representation Claims lodged where fault is not yet determined | 127 5 122 |

| Claims lodged where fault is not yet determined | 112 |

| Not at fault claims lodged | 14 |

| At fault claim lodged | 1 |

| Total number of claims lodged | 127 |

Injury types

| Total number of soft tissue injuries (including neck and back strain) | 28 |

Claims by gender

| Male | 70 |

| Female | 57 |

Disputes

| Internal insurer reviews | 0 |

| Dispute Resolution Service (DRS) disputes | 0 |

Insurer internal reviews are not anticipated until the injured person’s journey in the 2017 scheme progresses. Similarly SIRA’s Dispute Resolution Service does not anticipate the lodgment of many disputes under the 2017 scheme until the scheme matures and reaches decision points.

Claims by age

| Age group | No. of claims | % of total by age |

|---|---|---|

| 0-16 yrs | 5 | 4% |

| 17-24 yrs | 23 | 18% |

| 25-39 yrs | 49 | 39% |

| 40-49 yrs | 15 | 12% |

| 50-64 yrs | 23 | 18% |

| 65-79 yrs | 6 | 5% |

| 80+ yrs | 5 | 4% |

| Unknown | 1 | 1% |

| Total | 127 | 100%4 |

Claims by insurer

| Insurer | No of claims | % of total by insurer |

|---|---|---|

| AAMI | 12 | 9% |

| Allianz | 17 | 13% |

| CIC Allianz | 6 | 5% |

| GIO | 26 | 20% |

| NRMA | 51 | 40% |

| QBE | 15 | 12% |

| Total | 127 | 100%4 |

Claims by occupation

| Occupation | No of claims | % of total by occupation |

|---|---|---|

| Clerical and administrative workers | 4 | 3% |

| Community and personal service workers | 3 | 2% |

| Labourers | 6 | 5% |

| Managers | 2 | 2% |

| Professionals | 2 | 2% |

| Sales workers | 1 | 1% |

| Technicians and trades workers | 1 | 1% |

| Non-earners5 | 20 | 16% |

| Yet to be advised6 | 88 | 69% |

| Total | 127 | 100%4 |

Note 4: Note rounding error

Note 5: This could also include children, retirees and those not working

Note 6: It can take up to four weeks to determine occupation

Claims for damages: future economic loss and pain and suffering

No claims for damages for economic loss or pain and suffering were lodged in the quarter.

People more seriously injured in a motor vehicle accident can make a claim for:

- economic loss (loss of earnings) (predominantly future earnings)

- non-economic loss (pain and suffering).

In the 2017 scheme such claims are only for people who:

- have more than minor injuries

- were not at fault in the accident. If partially at fault damages may be reduced.

Future medical costs cannot be claimed as medical treatment and care are provided under statutory benefits (personal injury benefits) on an ongoing basis, for life if necessary.

Premiums

New premium filings for the 2017 scheme were accepted by SIRA during the September quarter. These filings7 resulted in the scheme estimated average premium reductions reported earlier in the report. Average premiums will be impacted by the seasonality of registrations and premium written over the year.

Note 7: A filing is a document that shows proof of financial responsibility in determining premium price.

Best prices by insurer

A comparison of Sydney best prices for passenger motor vehicles under the previous and new scheme. Prices are for drivers aged 30 to 54.

| Insurer | 30.11.17 (1999 scheme) | From 1.12.17 (2017 scheme) | Best price change |

|---|---|---|---|

| NRMA | $594 | $468 | $126 (21% reduction) |

| GIO | $583 | $475 | $108 (19% reduction) |

| AAMI | $595 | $475 | $120 (20% reduction) |

| Allianz | $604 | $488 | $116 (19% reduction) |

| QBE | $587 | $470 | $117 (20% reduction) |

| CIC Allianz | $585 | $454 | $131 (22% reduction) |

Market share

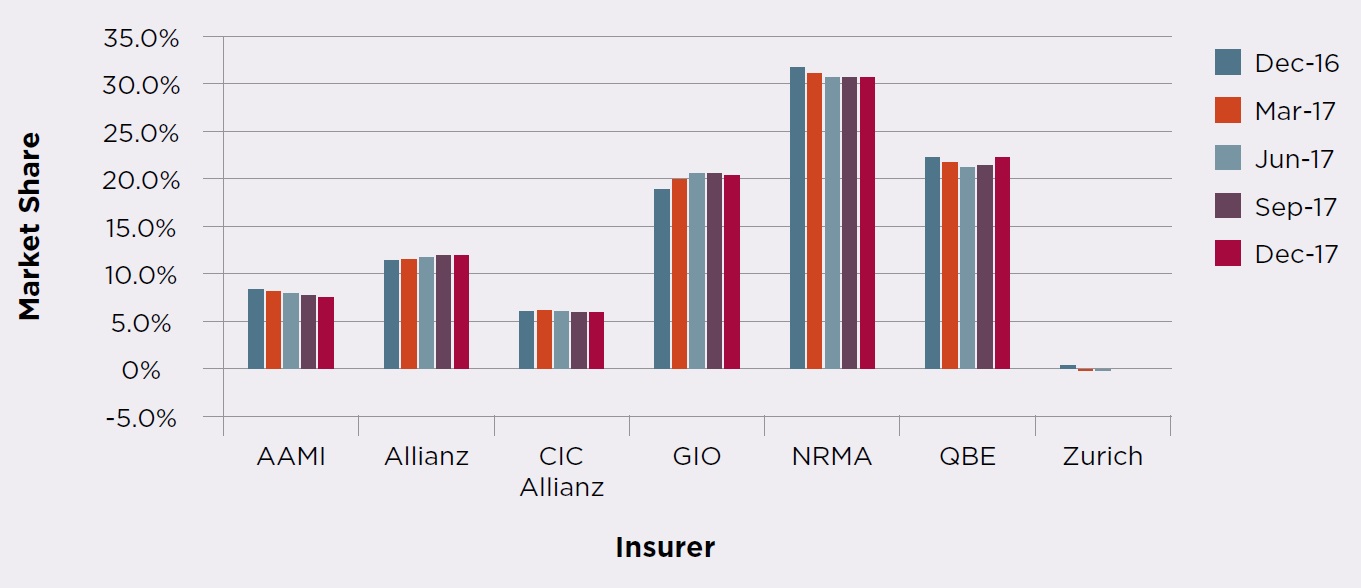

Graph 1 shows the proportion of premiums collected by insurer from the December 2016 quarter to the December 2017 quarter and includes the 2017 scheme. This graph is based on a rolling 12-month period and shows smoother trends in market share as it compensates for seasonal renewals of large fleets of vehicles. NRMA retains the largest market share8 with 30.4%, followed by QBE with 23.6% and GIO with 19.2%.

Note 8: Financial year to date share.

Graph 1: Premium market share (rolling 12-month) comparison

Green Slip Check

Our new and improved Green Slip Check (replacing the Green Slip Calculator) went live in late October and will save motorists time when shopping around for the best deal on a green slip.

It is a fast, user-friendly, comparison tool which will also enable us to make improvements to our services to assist motorists. Improved data collection of the new tool also empowers us to advance our regulatory capability and encourage greater competition among insurers.

People who entered vehicle information to the Green Slip Check

| November 20179 | 284,198 |

| December 20179 | 229,325 |

Note 9: People entered vehicle information to the Green Slip Price Check and received premium information

Help for the injured and their families

CTP Assist

Our injured people support service, CTP Assist, answered telephone and digital inquiries from injured people in both the 1999 scheme and the 2017 scheme; connecting them with their insurer, providing information about their entitlements and supporting self-represented injured people through the Dispute Resolution Service.

The team will continue to improve the journey for people injured in motor vehicle accidents and will address the queries of other service providers working in the scheme.

In December 2017:

2,775 injured people were assisted by phone and digital channel10

162 injured people were connected with an insurer10

1,031 outbound calls10

Note 10: Refers to both 1999 and 2017 schemes

Net Promoter Score

We will commence reporting a Net Promoter Score for CTP Assist services in 2018 and will use this to inform service improvements. The Net Promoter Score is a measure used to identify how easy it is for injured people to deal with us and will assist in improving service delivery.

CTP Legal Advisory Service

A CTP Legal Advisory Service pilot was launched by SIRA mid-December. The service will provide free phone-based legal advice to injured people for services not covered by the Motor Accident Injuries Regulation 2017. Referrals are not anticipated until the June 2018 quarter.

Early treatment and care

Initial liability is being determined promptly.

Findings of a December SIRA review of insurer practice under the 2017 scheme indicates that insurers are being proactive.

Initial GP and physiotherapy consultations are being approved before a claim is formally lodged; pre-populated claim forms are being sent to most injured people who notify (including a blank Certificate of Fitness); and tax file declarations are being emailed to injured people who may be an earner.

Internal insurer review

Nil insurer internal reviews were lodged in the quarter.

For the first time, an injured person can request an internal insurer review which is independent of the original decision maker, allowing the injured person and insurer to resolve the dispute before it reaches SIRA’s Dispute Resolution Service (DRS). This will reduce the number of disputes that DRS must consider and provide a quicker outcome for injured people.

SIRA’s new Dispute Resolution Service

The new DRS and the online portal help support the Premier’s priority to improve government services and the NSW State Priority to deliver better government digital services.

SIRA’s Dispute Resolution Services Division, led by Executive Director Cameron Player, launched the new Dispute Resolution Service (DRS) and new portal, which is accessible via the SIRA website, in December 2017. No applications to DRS were lodged in the quarter.

The new DRS is an accessible and impartial service with independent decision-makers, clear legislative objects and a strong focus on making it easier for injured people, insurers and representatives to have any 2017 Scheme dispute resolved.

The service has been designed to be customer focused and user friendly. People can now lodge any dispute using just one application form. A dedicated Dispute Resolution Officer is assigned to each individual case, and a new Concierge Team has been established to assist injured people through their dispute process.

Keeping the scheme sustainable

We continue to work in strong collaboration with the NSW Police to deter, detect and prosecute fraudulent claims.

In addition, Strike Force Ravens has investigated fraudulent activities of service providers in the CTP scheme. Legal practitioners and health care practitioners have been arrested with one service provider being referred to the Health Care Complaints Commission (HCCC) for unethical conduct.

The introduction of defined benefits through the 2017 scheme, with lump sum options for the more seriously injured, should reduce the opportunity and incentives for people and industry providers to abuse the scheme. This will have a direct positive effect on Green Slip costs for all motor vehicle owners. Under the new legislation, SIRA has also been given increased powers for fraud investigation and prosecution.

March-December 2017 statistics

| Arrests | 18 |

| Fraud related charges which represent $13M in fraud | 161 |

Key statistics 1999 scheme

While the 1999 scheme ceased selling CTP policies on 30 November 2017, people injured up to that date can submit a claim for up to six months after the accident. Consequently, this scheme will be in operation for many years as their injuries, claims, and any disputes which may arise, are resolved.

Claims - 1999 scheme

| New claims lodged in this reporting period11 | 3,771 |

| Not-at-fault Accident Notification Form (ANF) | 1,030 |

| At fault ANF | 197 |

| Full claim direct | 2,216 |

| Full claim converted from an ANF | 328 |

Note 11: Data captured as at 31 December 2017

Graph 2: Reported claims by lodgement quarter from December 2012

Of the claims lodged in the December 2017 quarter, 1,863 are for accidents that occurred in that quarter. This was down 2,207 claims (54.2%) compared to claims for accidents occurring during the December 2016 quarter.

This is partly due to a negative trend and is exaggerated by accidents from 1 December 2017 being reported under the 2017 Scheme. Further claims will likely be submitted until the June 2018 quarter as injured people can submit a claim within six months after an accident.

December 2017:

$384.2m total gross paid in December quarter

$3.25b outstanding estimate by insurers as at 31 December 2017

Total claims by insurer

| Insurer | No of claims | % of total by insurer |

|---|---|---|

| Zurich | 8 | <1% |

| AAMI | 320 | 8% |

| Allianz | 465 | 12% |

| CIC Allianz | 209 | 6% |

| GIO | 873 | 23% |

| NRMA | 1,174 | 31% |

| QBE | 722 | 19% |

| Total | 3,771 | 100% |

Total claims with legal representation

| Claims reported | |

|---|---|

| No representation reported | 1,654 |

| Legally represented | 2,117 |

| Total | 3,771 |

Open or active claims

As of 31 December 2017, there were 28,967 open/active claims under the 1999 Scheme.

The time frame to settlement may be impacted by the time it takes for an injury to stabilise, enabling assessment of the whole person impairment for non-economic loss damages, and resolution of any dispute. It is not uncommon for claims to take three to five years to be resolved.

Medical Assessment Service (MAS)

MAS, provided by SIRA’s Dispute Resolution Services Division, determines medical disputes that arise under the 1999 scheme. Disputes are determined by independent medical experts (MAS Medical Assessors).

MAS lodgments included:

- 104 treatment dispute applications

- 936 permanent impairment dispute applications

- 92 further medical assessment applications

- 276 review panel applications

There were 1,408 new applications lodged with MAS compared to the 1,466 applications in the previous quarter.

There were 1,461 applications finalised by MAS, compared to 1,455 applications in the previous quarter. There were 4% more applications finalised in this quarter than were lodged.

The predominant medical disputes determined by MAS relate to permanent impairment. In the December quarter, 839 permanent impairment disputes were finalised 18% of which were assessed as having a greater than 10% permanent impairment which is consistent with prior periods.

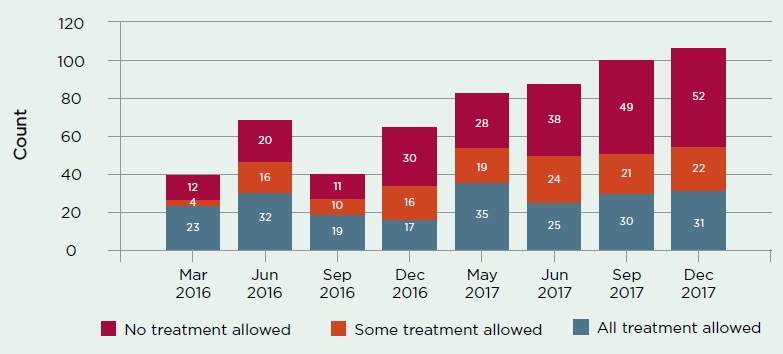

Graph 3 shows that treatment dispute outcomes were consistent with the previous quarter, with no treatment allowed in 50% of finalised disputes, all treatment allowed in 30% of finalised disputes, and some treatment allowed in 21% of finalised disputes (note: rounding error).

Graph 3: Medical assessment outcomes by type

Claims Assessment and Resolution Service (CARS)

CARS determines procedural claims disputes and assesses liability and damages (lump sums) under the Motor Accidents Compensation Act 1999. Disputes are determined by independent claims experts (CARS Claims Assessors).

There were 947 new applications lodged with CARS, down slightly compared to the 1,071 applications in the previous quarter.

The lodgments included:

- 40 Procedural claims dispute applications

- 489 Claims assessment applications

- 418 Applications seeking exemption from claims assessment

There were 978 applications finalised by CARS, down slightly compared to the previous quarter. There were also 495 claims assessment applications finalised, with 75% resolved without a claims assessment. Early resolution rates at CARS have remained relatively stable for many years.

A precondition for commencing court proceedings concerning a claim is that it has been referred to CARS, and, either a certificate exempting the claim from assessment has been provided, or the results of an assessment have been issued.

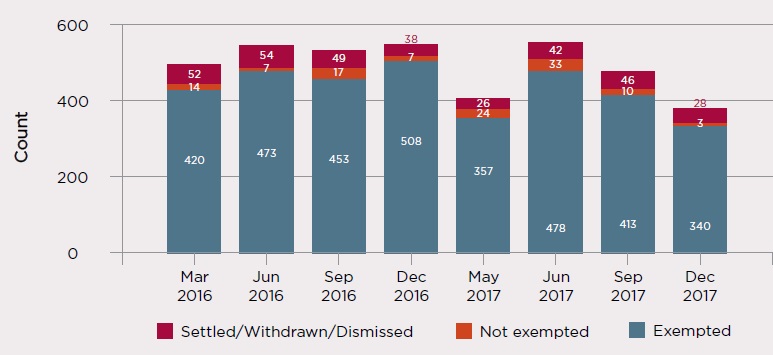

Of the 371 applications for exemption considered, 340 were exempted, three were not and 28 were settled, withdrawn or dismissed.

Challenges to decisions

Decisions made by medical assessors and claims assessors are potentially subject to administrative law judicial review. In the December quarter there were ten decisions made by the Supreme Court and one by the High Court. For the seven challenges to the MAS assessors’ decisions: three were upheld12 and three set aside13 in the Supreme Court. One was upheld in the High Court. For the four challenges to the CARS assessors’ decisions: one was upheld and three were set aside.

Note 12: Upheld means confirmed or supported the Assessor’s decision.

Note 13: Set aside, in this context, usually means that the Court remits the case to CARS or MAS for a new determination.

Graph 4: CARS exemption outcomes for eight quarters ending December 2017

Complaints and compliments

MAIR will be regularly reporting on complaints and compliments under the 2017 scheme. Complaints will be used to improve service delivery and identify any unwelcome emerging trends in the scheme.

Reviews by the Compliance, Enforcement and Investigations team

There were 17 complaints against insurers that have been reviewed, or are presently under review, by SIRA’s Compliance, Enforcement and Investigations team, for the 1999 scheme. Of the 17 complaints:

- Eight were resolved in favour of the insurer

- Five were resolved in favour of the injured person

- Four complaints are not closed

- 11 were for an alleged breach of the Claims Handling Guidelines

- One was for an alleged breach of the Treatment Rehabilitation and Care Guidelines

- One related to the alleged inappropriate or non-payment of legal costs

- Three related to an allegation of inappropriate insurer behaviour or conduct

- One related to an allegation that the insurer was not just and expeditious in resolving a claim.

Letters to the Minister

There were 34 letters of complaint to the Minister for Finance, Services and Property.

Complaints to the Minister by topic

| Topic | No of representations |

|---|---|

| Prices | 24 |

| Claims | 3 |

| Refunds | 2 |

| Legal costs | 2 |

| Other | 3 |

| Total | 34 |

Conclusion

It is early days in the new 2017 scheme and MAIR will be monitoring performance closely to ensure that the Government’s objectives are achieved: an affordable scheme, that provides an increased proportion of benefits to the more seriously injured and reduces the time it takes to resolve a claim.

We will be monitoring the 1999 scheme to ensure that injured people are treated fairly in accordance with the legislation and Guidelines, and are assisted through the claims process.

As the 2017 scheme matures we will be providing more insights on scheme performance, building on this report. Feedback on how we can improve the report is appreciated and can be sent to: [email protected]

Mary Maini